Last editedOct 20231 min read

Learn how to design and send compliant UK Direct Debit notifications.

The UK Direct Debit scheme has strict requirements for sending notifications to customers. For you as a merchant, it’s important to understand exactly what kind of notifications you need to send, and how to handle them. Our guide will walk you through the process, helping you design fully compliant customer notifications which your sponsor bank can sign off quickly.

The two types of Direct Debit notifications

Direct Debit notifications fall into two categories, which can be sent together:

Mandate setup confirmation

Payment notifications (also known as ‘advance notice’)

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

1. Mandate setup confirmation

A mandate setup confirmation tells your customer that their Direct Debit mandate has been set up correctly. You must send it within 3 working days of the customer signing up or incorporate it into the customer's first payment notification. You can send the mandate setup confirmation by email or post.

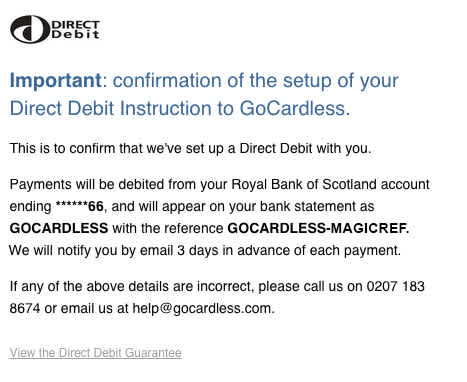

To be compliant, a mandate confirmation must include the following information:

The heading “Important: Confirmation of the setup of your Direct Debit to [Merchant]”, alongside a Direct Debit logo

The payer's redacted bank details, the mandate reference and the name on the SUN

The Direct Debit Guarantee, with a Direct Debit logo, or a link to it

The address and phone number of the merchant

The below image shows an example mandate setup confirmation email, which includes all of the above details:

If you're using GoCardless, also include the phrase "Payments by GoCardless" as part of the notification.

Accept Direct Debit payments for your business with GoCardless

2. Payment notifications

A payment notification tells your customer when they can expect a single payment or stream of regular payments to leave their account. Just like mandate confirmations, payment notifications are mandatory in UK Direct Debit. You can send them by email or post.

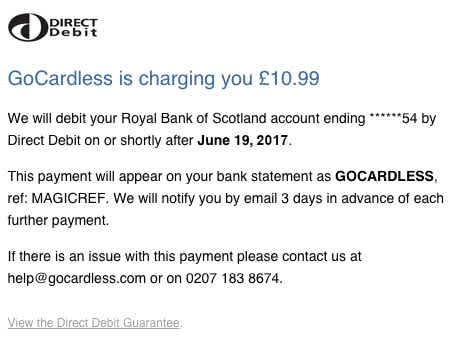

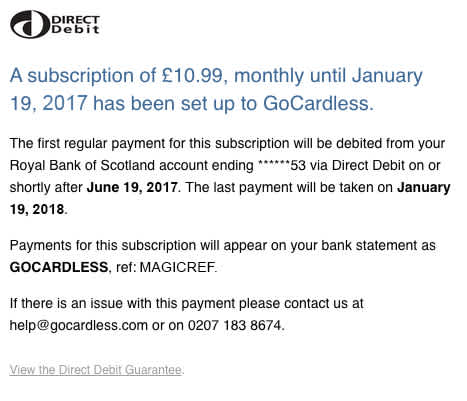

To be compliant, a payment notification must include the following information:

How much notice will be given for future payments (if this is the first notification)

The amount, reference and date of the collection(s)

The address and phone number of the merchant

The below image shows an example payment notification email, which includes all of the above details:

For subscription payments, where the frequency and amount remain the same, you can send a single payment notification email to cover the entire subscription. Here’s an example:

Customer notifications and GoCardless

GoCardless offers fully compliant emails that can be sent on your behalf. Alternatively, if you want to send your own emails, you can do this using GoCardless Pro with our API. Or if you are a partner, you can send specific customer notifications.