Last editedOct 20236 min read

Direct Debit is not an instant payment method. Payments take at least 3 working days to clear, and no payments are made at weekends or bank holidays.

This guide details the timings for Direct Debit payments, and how you can optimise them. Find out all you need to know about the timescales involved in how long it takes to set up a Direct Debit and how long it takes for the payment to clear.

For businesses that want to collect regular payments via Direct Debit but that also require an immediate initial payment, we’ll show how you can seamlessly pair Direct Debit with Instant Bank Pay to satisfy these requirements.

In this article, you will learn:

How long does it take to set up a Direct Debit?

Once you've established how your business will access the Direct Debit scheme and followed the necessary steps to begin taking payments, you've gone most of the way towards setting up a Direct Debit between yourself and a customer.

It can take a matter of minutes to set up a Direct Debit if you're using the GoCardless dashboard. All that remains is to provide the customer with advance notice and to be aware of the timings involved in the Bacs payment cycle, which are outlined below. Both help to make Direct Debit one of the most trustworthy, secure, and reliable payment methods.

Watch the short video that explains Direct Debit in a nutshell:

End the stress of being paid late by automating your payment collection!

Getting paid on time with GoCardless is simple, affordable and easy to set-up in just a few clicks.

Advance notice

Except for the cases below, you must notify your customer before submitting a payment to be collected by Direct Debit. By default, the amount of advance notice required is 10 working days, although this can be reduced through agreements with your customer and with your bank.

Notable exceptions to this rule are:

Explicitly authorised payments, where a customer authorises a specific payment to be taken immediately. This authorisation can only apply to a single payment at a time.

Fixed payment schedules, where a customer has already been notified of the date and amount of each payment (for example, they were informed that £10 would be collected from them on the 1st of every month).

See our guide to taking payments for more details.

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

With GoCardless, advance notice is just 3 days, giving you more flexibility

GoCardless offers a cost-effective, done-for-you Direct Debit service that takes care of advance notice on your behalf. We ensure you send the right information to the right person at the right time.

Click here to learn more about all the advantages of collecting Direct Debit payments with GoCardless.

Timings after payment submission

Once submitted to the banks, Direct Debit payments are processed using the Bacs three-day cycle. Because of the specifics of how Direct Debit works they can only be considered successful if no failure report is received several days later.

Full details of the optimised collection time is provided below, but in summary:

If a Direct Debit mandate is already in place, payment is collected 2 working days after submission, can be considered 99% confirmed 3 working days after submission, and 100% confirmed after 4 working days.

If a Direct Debit mandate needs to be created, payment is collected 4 working days after submission, can be considered 99% confirmed 5 working days after submission, and 100% confirmed after 6 working days.

The key to understanding both payment timings is the Bacs three-day cycle which we explain below.

How long does it take for Direct Debit payments to clear?

The Bacs three-day cycle

All Direct Debit processes operate using the Bacs three-day cycle. Designed in the 1970s, the cycle specifies the timescales on which banks must respond to input from each other.

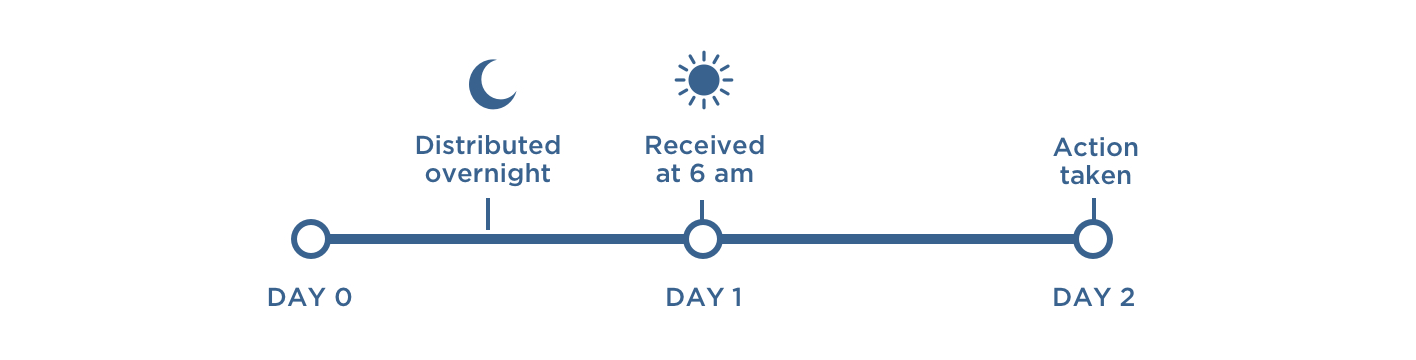

Working day 0 (submission): A message (e.g., a payment request) is submitted to Bacs between 7:00am and 10:30pm. Bacs then distribute this request to the relevant parties overnight.

Working day 1 (processing): Having received the message at 6:00am, the relevant parties prepare to respond. For example, your customer's bank would prepare to debit their account.

Working day 2 (action): All parties take the action required. For example, your customer's bank would debit their account, whilst your bank would simultaneously credit yours.

The Bacs three-day cycle is used for collecting payment by Direct Debit, setting up new Direct Debit Instructions, and for notifying the merchant of any payment failures. Chaining several three-day cycles together gives the optimal timeline for collecting a payment by Direct Debit.

Need to get paid faster than three days?

Instant Bank Pay offers immediate account-to-account payment - it’s fast, secure and can be seamlessly combined with Direct Debit to collect an initial payment instantly before the first recurring payment is processed.

Collecting payment against an existing mandate

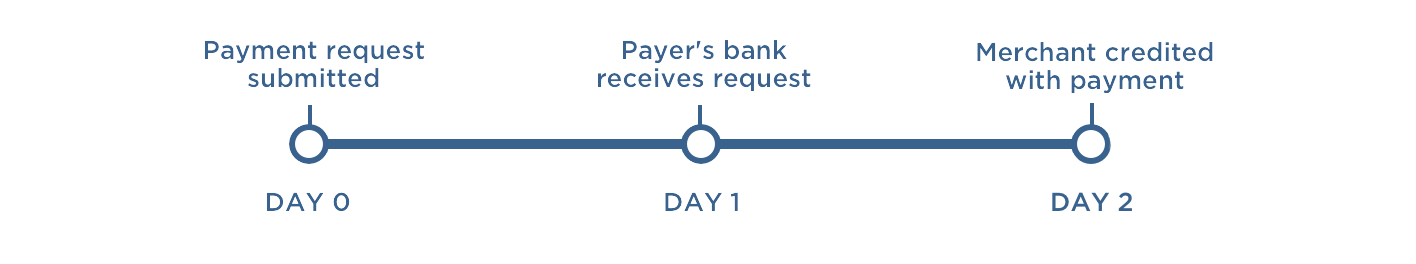

A single Bacs processing cycle is used to collect a payment against an existing Direct Debit Instruction. Collection, therefore, takes two working days:

However, it is important to understand what happens when a payment fails.

Because of the way Direct Debit works, even payments which have failed will be credited to your account on day 2.

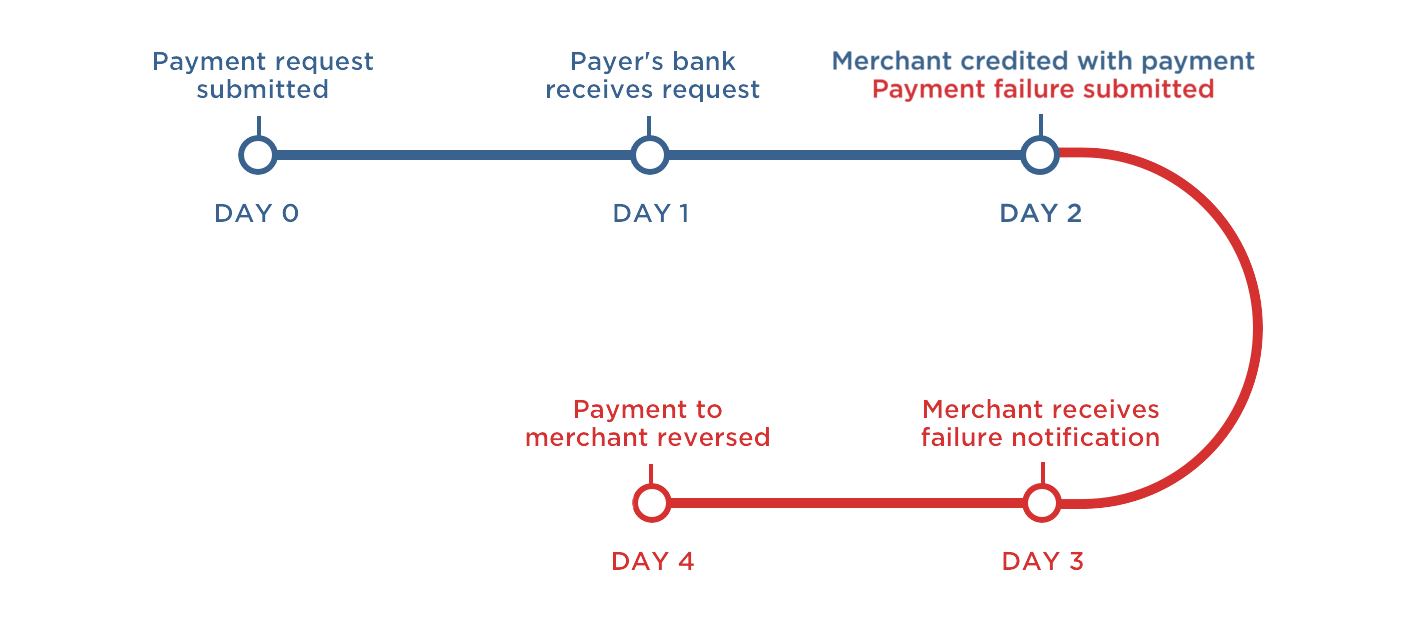

If your customer's bank thinks the payment should not have happened (if the customer's account was overdrawn, for example), they will notify your bank to get the payment reversed.

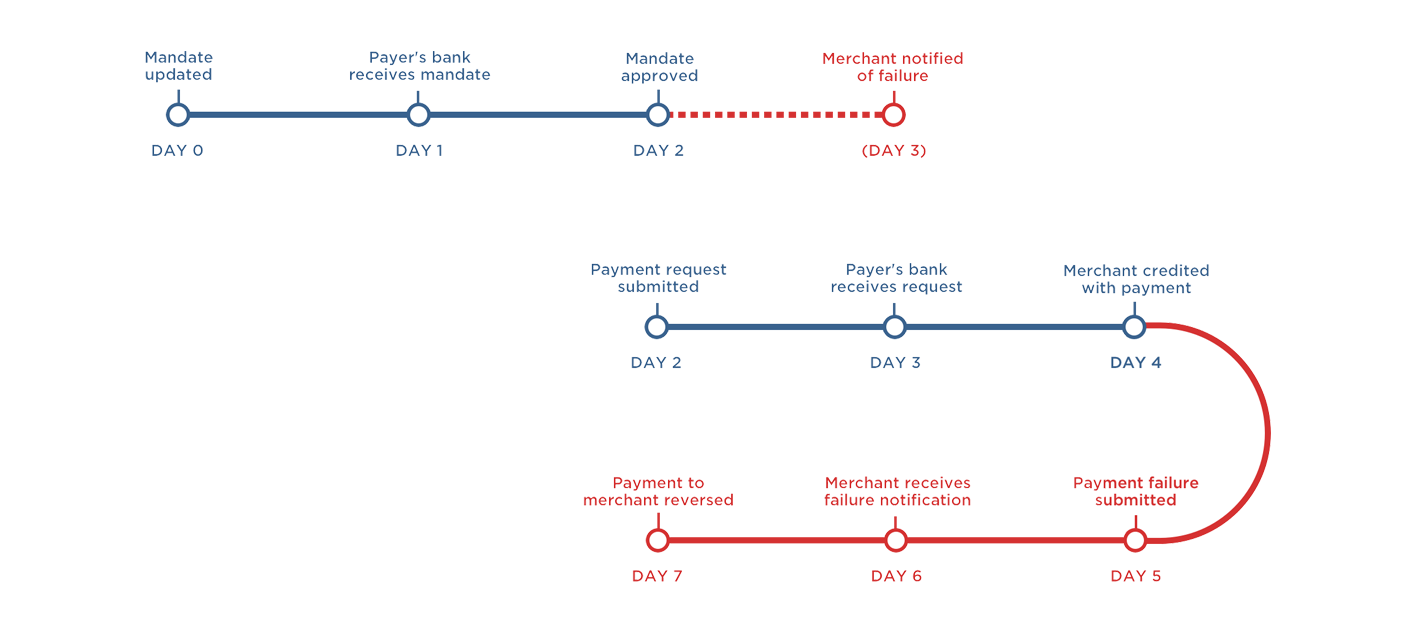

Failure notifications are sent via an additional Bacs three-day cycle, and generally, the customer's bank will submit this notification on working day 2 (the day the payment was due):

However, in around 1% of cases, the notification is only submitted the following day. In this case, it is received by the merchant's bank 4 workings days after payment submission:

If a failure notification is received, the payment will be automatically reversed. As a result, a payment cannot be considered complete until there is no receipt of failure notification on day 4.

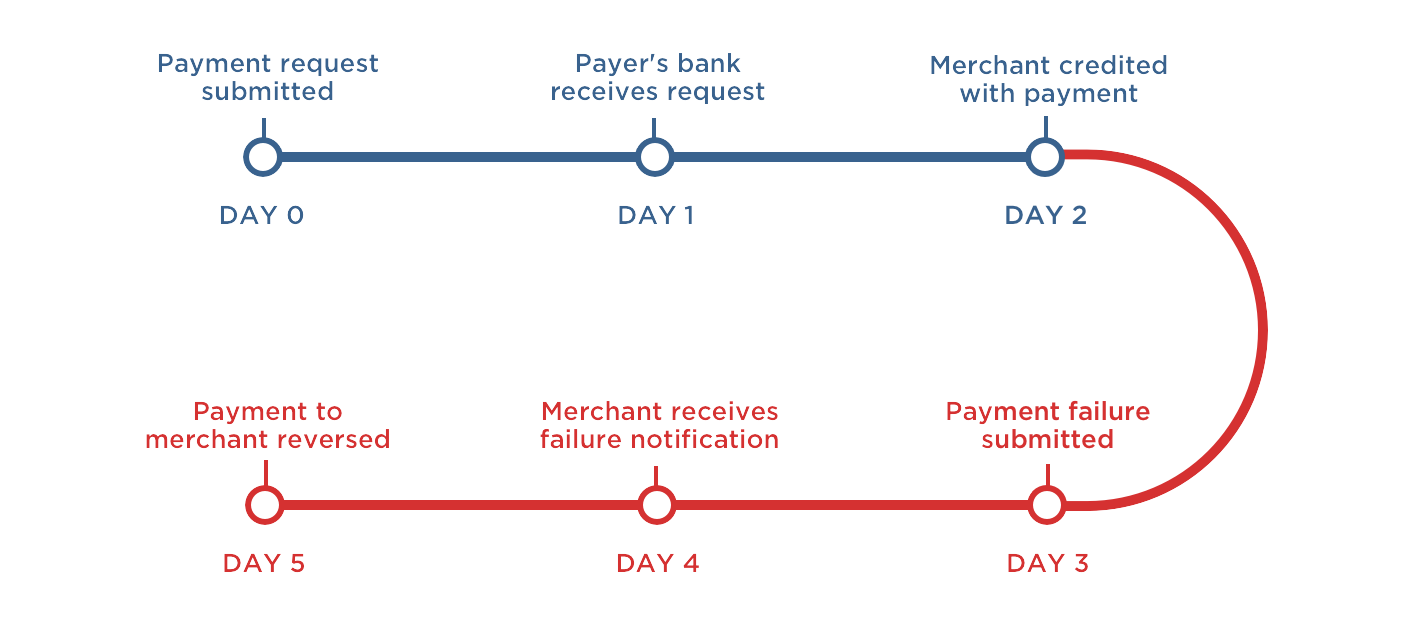

Collecting payment when no mandate exists

If you don't already have a mandate with your customer, one needs to be set up before payment can be collected. This adds an additional Bacs processing cycle. Taking into account the 1% of cases where failure notifications are submitted a day late, collection through confirmation takes six working days:

As indicated above, payment requests can be submitted as soon as a mandate has been approved on day 2. Submitting a payment request before this (for example, on working day 0) is explicitly disallowed by the scheme.

Many businesses are caught out by these initial longer timings when setting up a new customer with Direct Debit.

To solve this issue, GoCardless seamlessly combines Instant Bank Pay with Direct Debit to enable both an instant initial payment and reliable recurring payment collection via Direct Debit.

Learn more about Instant Bank Pay and Direct Debit.

Why a Direct Debit may not be taken on the due date

It’s important to be aware that funds are not collected on non-working days or weekends in order for you to be able to optimise your collection timings.

Bacs provide a list of working days for the Direct Debit system in their annual Bacs processing calendar. Submissions to the banks cannot be made on non-working days, and the banks themselves will not process any Bacs messages on non-working days.

This means that Direct Debit payments are not made on weekends or bank holidays. If a payment date falls on a Saturday or Sunday, it will be processed on the next working day. You can find out more about Bacs payments made on Fridays here.

While the banks may not work on non-working days, it is possible to receive messages they previously sent you. For example, payment failure reports distributed overnight on a Friday are available to download on a Saturday morning.

How long do Direct Debit mandates last?

The Direct Debit instruction will continue until you or your customer cancels it by contacting your respective banks or payment providers. GoCardless provides a merchant dashboard where you can quickly and easily set up and cancel payments in just a few clicks. Furthermore, GoCardless merchants are notified if a Direct Debit is cancelled by the customer at their bank, providing good visibility on payment collections and forewarning of any potential issues.

However, when a Direct Debit becomes inactive and no collections are made for a prolonged period, typically 13 months, the Dormancy Period Rule comes in. After this time, the Direct Debit Instruction is removed from the bank's system. Payments can be resumed with re-authorisation from your customer.

Payment timings with GoCardless

GoCardless process all Direct Debit payments according to the fully optimised timetable above. This means that payments will reach your account after 5 working days, or 6 days if no mandate exists.

Click here to find out more about collecting Direct Debits with GoCardless.

With GoCardless, you we do all the heavy lifting taking care of the whole Direct Debit process on your behalf. For businesses that require faster payment times, we offer Instant Bank Pay which can be combined with Direct Debit to offer a comprehensive payment solution - see the case study below for how Instant Bank Pay and Direct Debit combine to improve payment collection.

Case study: combine instant and recurring payments

For many UK SMEs, Direct Debit holds many advantages as a payment collection method:

affordable transaction fees,

a high level of automation which eliminates late payments

strong consumer protections providing customers peace of mind

However, one sticking point has often been the three-day payment cycle which has been problematic for certain businesses that need to see funds clear that day or the next day.

Gravity, a trampoline park business, used to offer customers both card payments and Direct Debits. However, card payments meant expensive transaction fees, and Direct Debits took too long to clear the first payment, which meant that customers could use the service and then cancel their mandate before a payment went out.

GoCardless was able to offer a combination of Instant Bank Pay and Direct Debit, this allowed Gravity to take an initial payment instantly and then reliably collect future payments through Direct Debit.

As a result of using Instant Bank Pay, Gravity was able to:

prevent subscription cancellations and subsequent revenue loss

save 50% on transactions fees

reduce customer sign-up time by 55%

get 90% of new customers to use the Direct Debit and Instant Bank Pay combination

make sign-up easier and quicker for customers

Watch the short video on how Gravity used Direct Debit & Instant Bank Pay:

Learn how you can combine recurring payments with Instant Bank Pay in a fast, simple and convenient way to collect instant and recurring payments.

FAQs: Direct Debit Timings

How long do Direct Debits take to clear?

Direct Debits run on the three-day Bacs cycle and so take at least three days to clear. Due to the batched nature of Direct Debit file transmission submission times can result in delayed clearance.

How long does it take to set up a Direct Debit?

Setting up a Direct Debit can be very quick - if your customer responds promptly and returns mandate authorisation the same day it is received, then the payment can be set up within a day.

However, a new mandate needs to be processed, and this can mean that it takes up to six days for the first payment to clear.

For businesses that need instant payment, GoCardless offers Instant Bank Pay.

What time do Direct Debits go out?

Typically Direct Debit payments will be debited from an account between 1am and 7am. However, in reality, Direct Debits can be deducted at any time of day. Direct Debit files are submitted in batches, and the time at which the files are submitted can affect exactly when funds are debited and credited.

If you are waiting to receive a Direct Debit payment, then GoCardless merchants can use the merchant dashboard to check on the status of that payment.