Last editedDec 20253 min read

You’ve done the hard work in acquiring and retaining your customers, and your automated payment systems and processes are all set up. It’s time to collect your fees. It’s here that many businesses experience the pain of failed payments and may struggle to recover all the revenue they were counting on.

When you take recurring or subscription payments, each customer represents significant long-term potential value to your business. Especially when you consider that acquiring a new customer can cost 5-25x more than retaining an existing one. On average, 30% of churn is involuntary. This happens when a payment fail,s and otherwise happy customers lose access to your product or service, multiplying the impact of that failure.

Thankfully, Direct Debit is the most reliable way to collect recurring payments, with success rates of 95-100%, compared to 80-95% for other payment methods, including cards. That’s because it’s a bank-to-bank payment method and a “pull” mechanism, which means fewer intermediaries and points of failure, businesses can initiate the payment collection rather than relying on the customer and no expired or cancelled cards to deal with.

GoCardless makes it easy to collect Direct Debit payments on your Xero invoices. Automate Direct Debit payment collection. Reduce manual admin. Get paid on time, every time

What failure rate can you expect with Direct Debit?

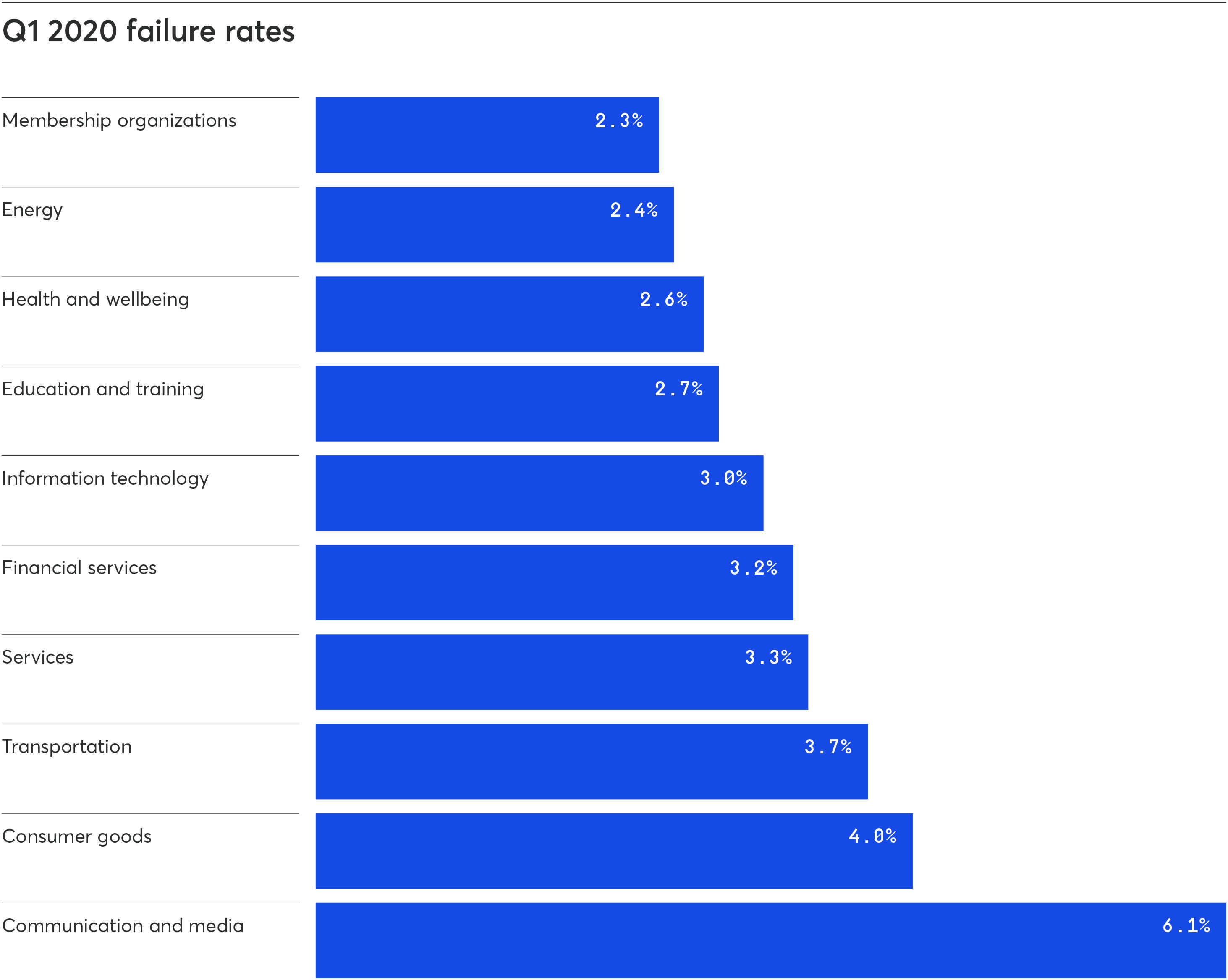

Though more reliable than cards, Direct Debit payments can still fail. Failure rates vary depending on your sector, your customer base, your provider and whether you have successfully taken a payment from a customer in the past.

According to research by Forrester, half of the businesses surveyed experienced a payment failure rate of 7% across all payment methods. Meanwhile, GoCardless’ average UK Direct Debit failure rate across 55,000 customers and 52m transactions is around 2.9%, with customers in many sectors enjoying lower failure rates than this (you can see some examples below).

Businesses that use our Success+ product, which combines machine learning and automation to retry payments, recover up to 70% of failed payments, reducing failure rates even further to around 0.9%. In fact, more than half of our customers have a 100% success rat,e and payment retries can reduce failure rates by almost a third.

So, why do Direct Debit payments fail – and what can you do about it?

Payments can fail for a number of reasons, from invalid bank details and bank accounts being closed to not enough money in the payer’s account. The UK Direct Debit scheme Bacs assigns one of 10 possible reason codes for payment failure (plus 2 additional codes to mean that a customer has disputed a payment).

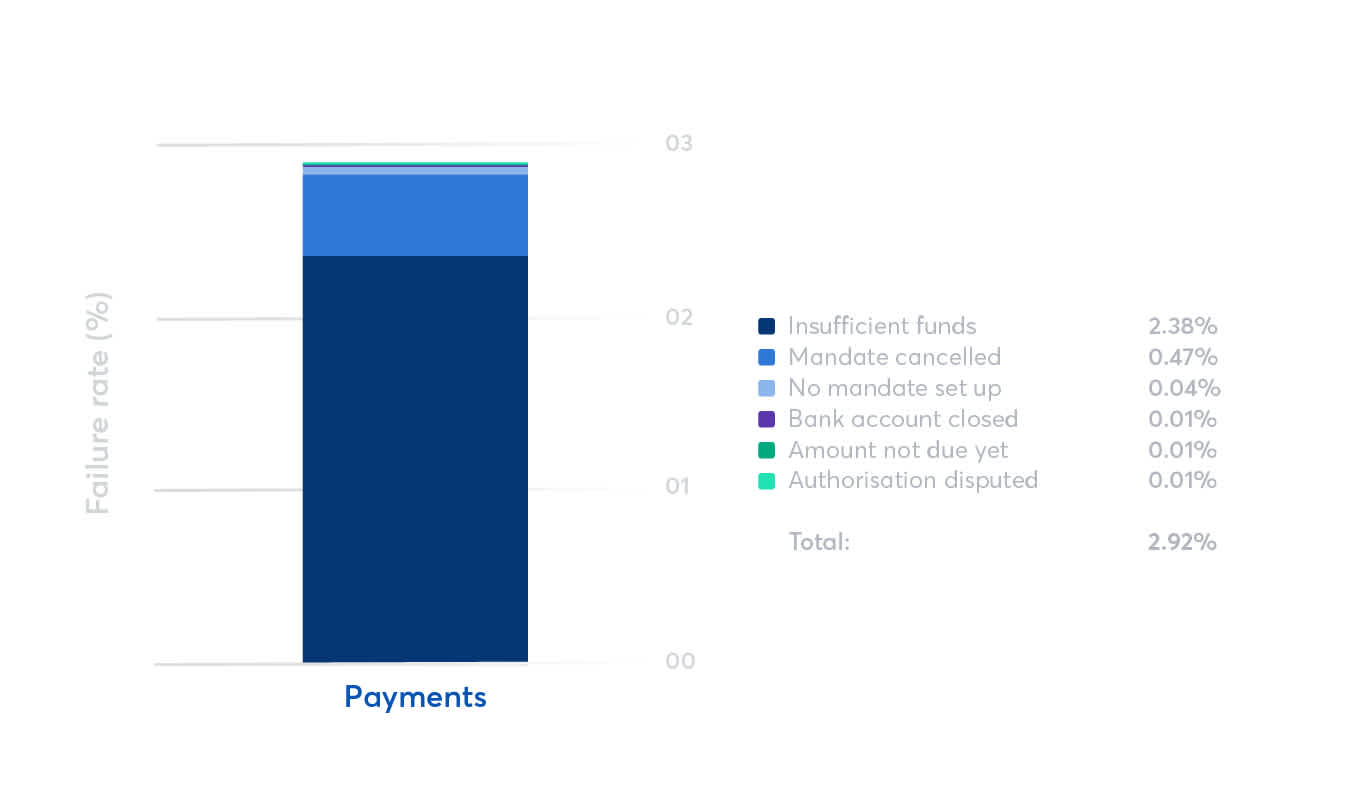

In reality, most of these are rare. We’ve analysed our transaction data to identify the two most common reasons Direct Debit payments fail. Here they are – along with our recommendations for what to do about them.

Reason 1: Insufficient funds

Bacs uses the error code ‘Refer to payer’ to mean that the payer's bank wasn't in a position to pay the Direct Debit, which usually means there wasn’t enough money in the payer’s account.

This is by far the most common reason, representing more than 80% of our customers' failures – accounting for 2.38% of the 2.9% average failure rate.

The Payment Success Index 2020 identified that unsurprisingly, higher-value payments have higher failure rates, as the likelihood of having insufficient funds increases with larger value payments. Payment failures for amounts between $0-$250 have a steady failure rate of between 2.6% and 3%. Meanwhile, payments over $250 experienced failure rates from 4.1% to 5%.

Manually Retry the payment

If you’re using GoCardless through our dashboard, our API or through certain partner software, you'll see a manual Retry button (this is different to Success+, which is automated) in the top-right corner of the GoCardless payment status page. If you click this button, we'll resubmit your payment immediately. You'll see a new charge date and you can follow the status of the retried payment in the payment timeline. Payments can be retried a maximum of 3 times. Customers who use our retry function significantly improve their payment success rate.

As well as manual retries, we offer an automated solution to recovering failed payments. Read more about how our intelligent retry product Success+, recovers up to 70% of failed payments automatically.

Agree on a different payment date

If this is happening regularly, you might want to consider agreeing a better payment date with your customer, for example, after they get paid. GoCardless offers daily collections to facilitate this.

Reason 2: Mandate cancelled

Bacs uses the reason code ‘Instruction cancelled’ to mean that your customer may have cancelled the Direct Debit mandate at their bank, or requested this action from GoCardless.

This is the second most common reason for Direct Debit failure, accounting for around 15% of failed payments among GoCardless customers.

Contact your customer

In most cases, if a mandate is cancelled, you won’t be able to process a payment, but there might be times when a mandate is cancelled shortly after a payment has been submitted. In all these cases, you’ll need to contact your customer to set up a new mandate.

Don’t be the last to know a customer is leaving

Unlike other Direct Debit solutions, GoCardless sends automatic notifications when a payer cancels a mandate, giving you the opportunity to put in place re-engagement initiatives before it’s too late.

Optimise your payment retries with Success+

Success+, from GoCardless, automatically optimises your failed payment retries, using recurring payment intelligence to schedule retries on an optimal day for each customer.

Success+ helps businesses to efficiently recover up to 70% of payments that initially fail* - making your collections more customer-centric, reducing the admin burden of chasing failed payments, and increasing your overall revenue.

Customers, occasionally, might not have the funds in the bank account. Success+ has helped us guarantee those collections, even if they are a bit delayed. It gives customers confidence that they're dealing with a business that knows what it's doing, too.”

Made for payment success

Success+ uses recurring payment intelligence to predict and manage payment failures. Recover, on average, 76% of failed payments.

* 70% figure is a global average based on 3 retries during a 4 week period, as per a sample of 1,000+ in November 2019.