GoCardless for small businesses

The easy way to accept Direct Debit payments

Free to set up, no contract required

Collect recurring & one-off payments via BECS

No more chasing late payments

Save your business time and money

Used by 100,000+ businesses. Small to enterprise. Globally.

![[en-AU] Homepage – Merchant logo – Simply Energy (black)](https://images.ctfassets.net/40w0m41bmydz/7e8sFP6AjmPDFa3MkScjlm/20da743939defaba7e6c49cf13308362/au-01-Simply_Energy.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – Deputy (black)](https://images.ctfassets.net/40w0m41bmydz/13LsfVpwWUhqelIbnJRE40/ce11ab0564c25b4681a15ebd4bdac993/au-02-Deputy.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – SiteMinder (black)](https://images.ctfassets.net/40w0m41bmydz/12B1ARE17oDA2N3WUTsYEL/02c64d47da02981c9f6f578e4a54f5f6/au-03-Siteminder.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – DocuSign (black)](https://images.ctfassets.net/40w0m41bmydz/3fMoyxmgPCZYAaXfR9yq8I/93252f7d23450ccb3f5a07c263978d59/au-04-DocuSign.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – Aon (black)](https://images.ctfassets.net/40w0m41bmydz/1eO8nwj5V73PaM7KFmsInL/4fbaae170631770d3ed11ce5889bd733/au-05-Aon.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – UNHCR (black)](https://images.ctfassets.net/40w0m41bmydz/1NivxWaXwV5sE6QxQ8stHe/7717ca499e70b5d004fd0d125e8850ac/au-06-UNHCR.png?w=200&h=100&q=50&fm=png)

78% of businesses using GoCardless say it reduced stress

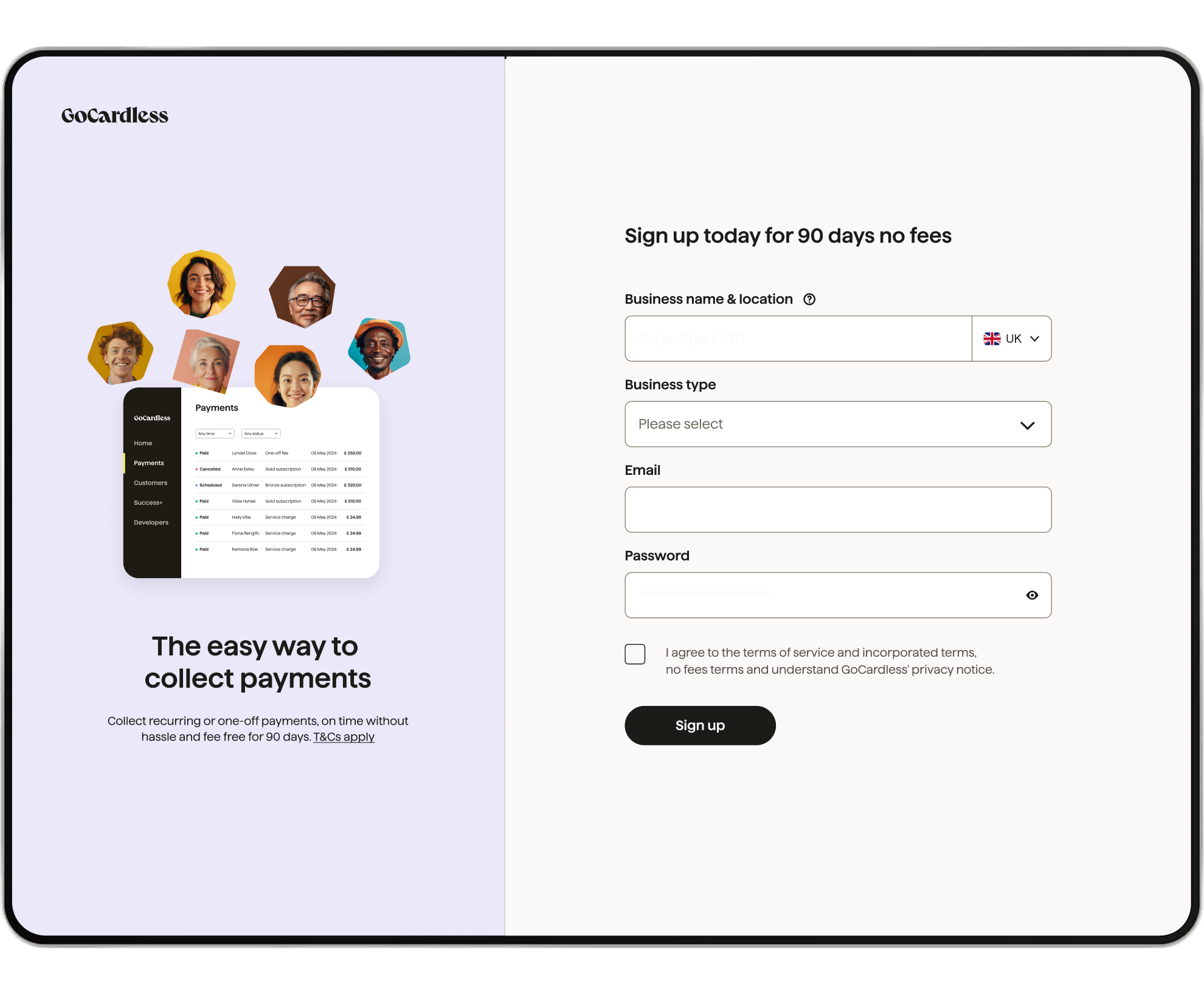

Quick and easy to set up

GoCardless is simple to set up - there are no setup costs, hidden fees or contract needed. We also give you 90 days with no transaction fees (T&Cs apply).

Forget expensive card fees

We collect direct bank payments via BECS. Meaning no card network fees. And with all that wasted admin time cut away, the savings really stack up.

Save your team time on admin

Easily see the status of any payment from any client, at any time. And if you connect GoCardless to your accounting software, reconciliation is automatic.

Say goodbye to late payments

With GoCardless, you don’t have to rely on your clients remembering to pay on time. Saving your business all those costly hours chasing up late payments.

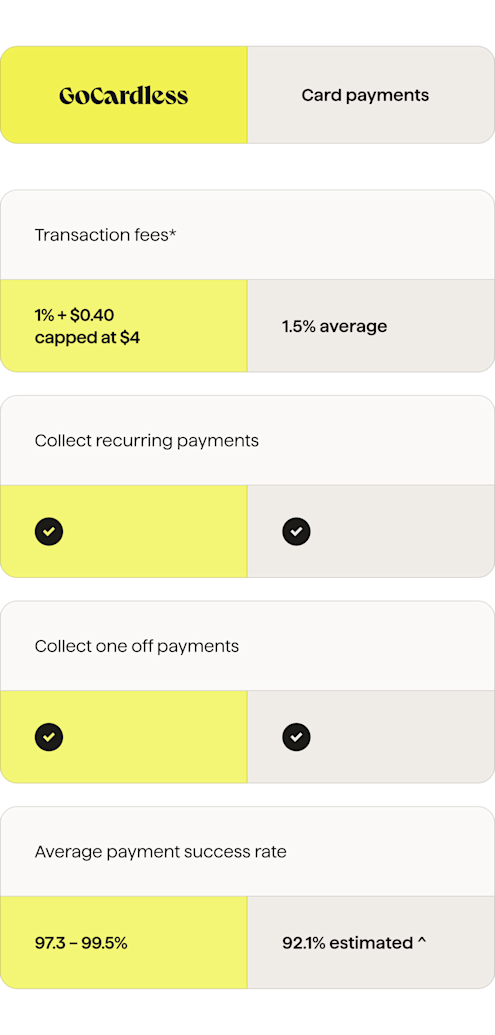

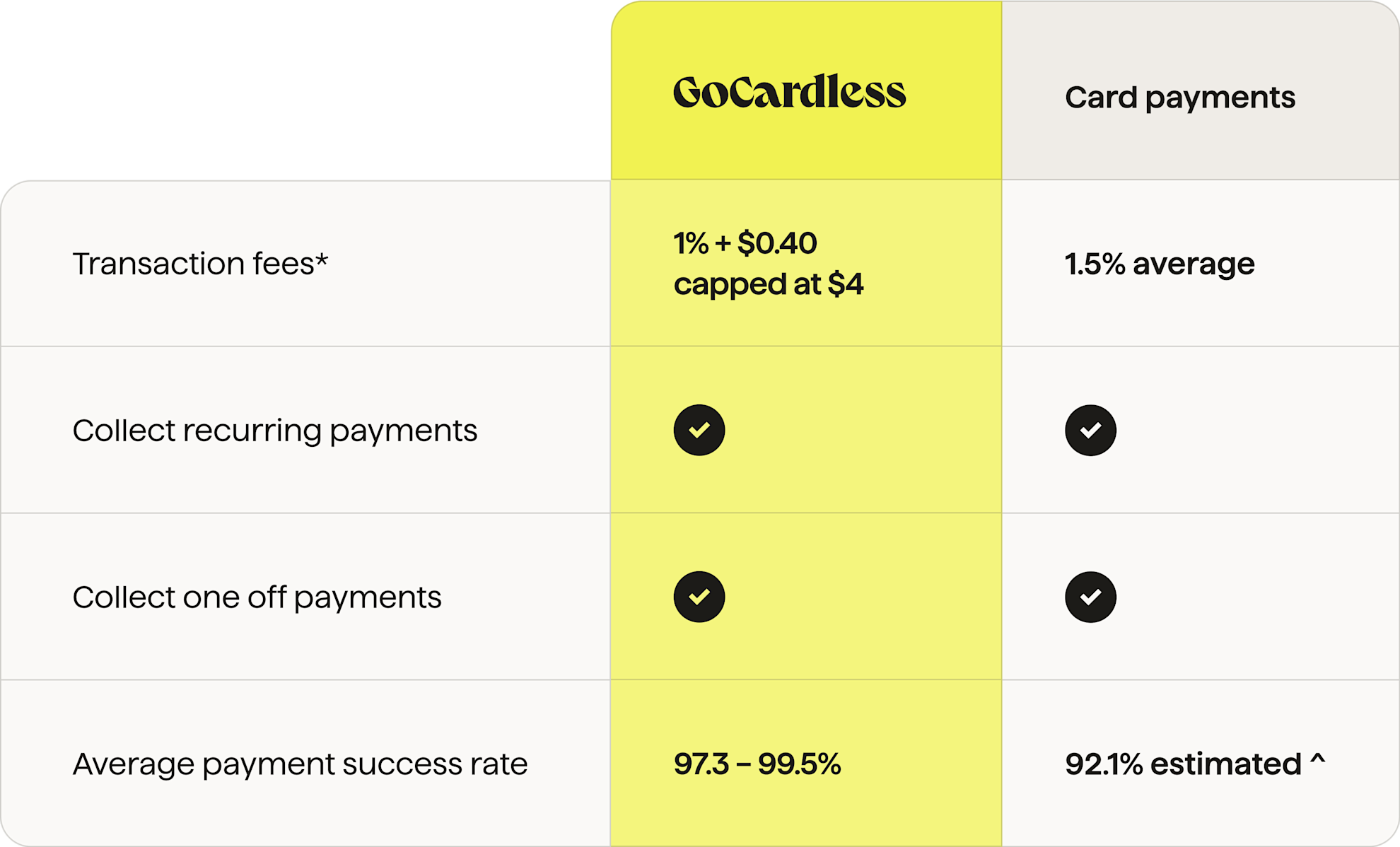

See how GoCardless compares

* Pricing as of Jul 2024. Fees differ by provider. See our pricing

^ Based on market research. Payment success rates vary. See the report

Mörk Chocolate's cash flow improved by 85% with GoCardless

“Without GoCardless we would need an accountant or a debts collection person, so that’s a massive direct saving of about $90,000 a year.”

Kiril Shaginov, Co-Founder of Mörk Chocolate

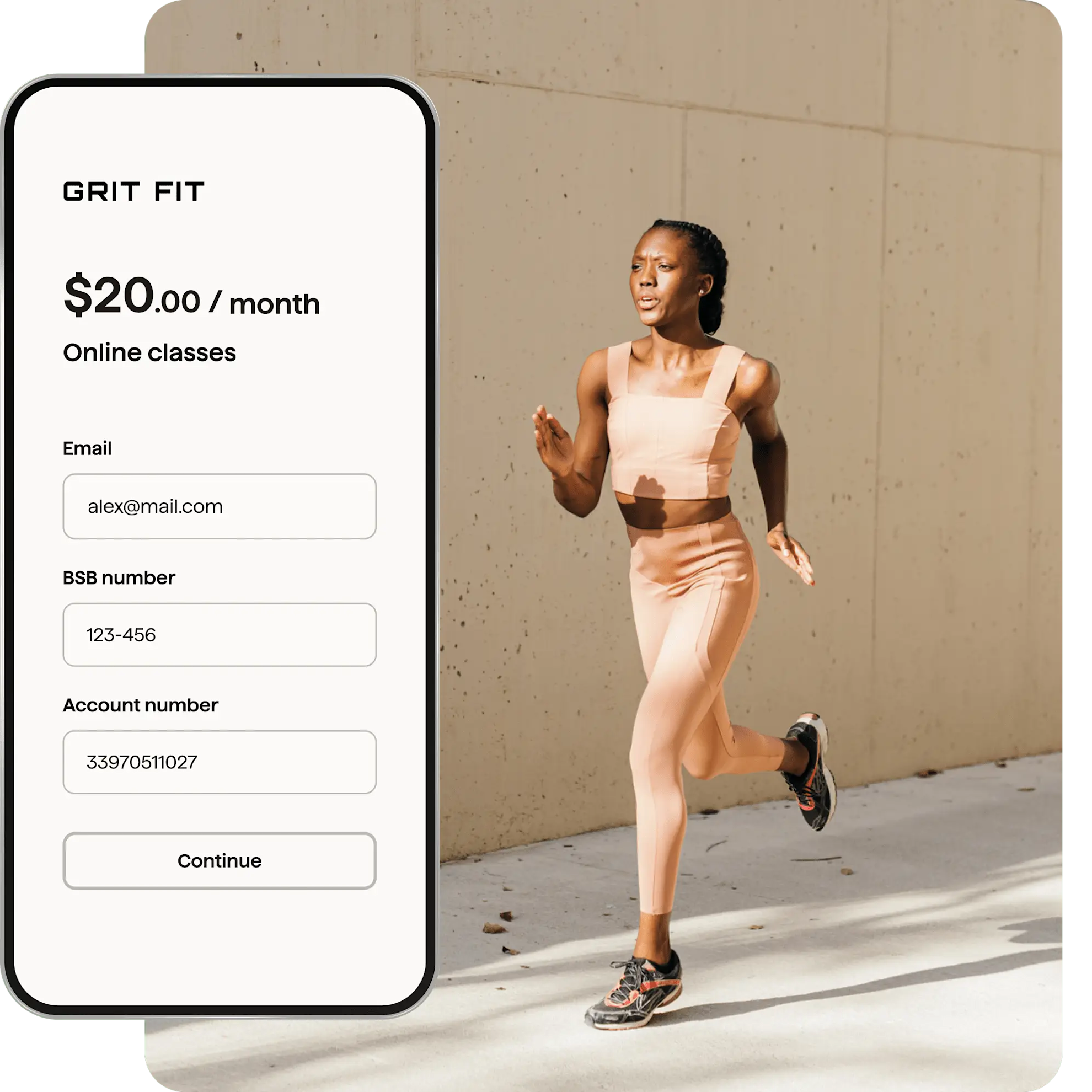

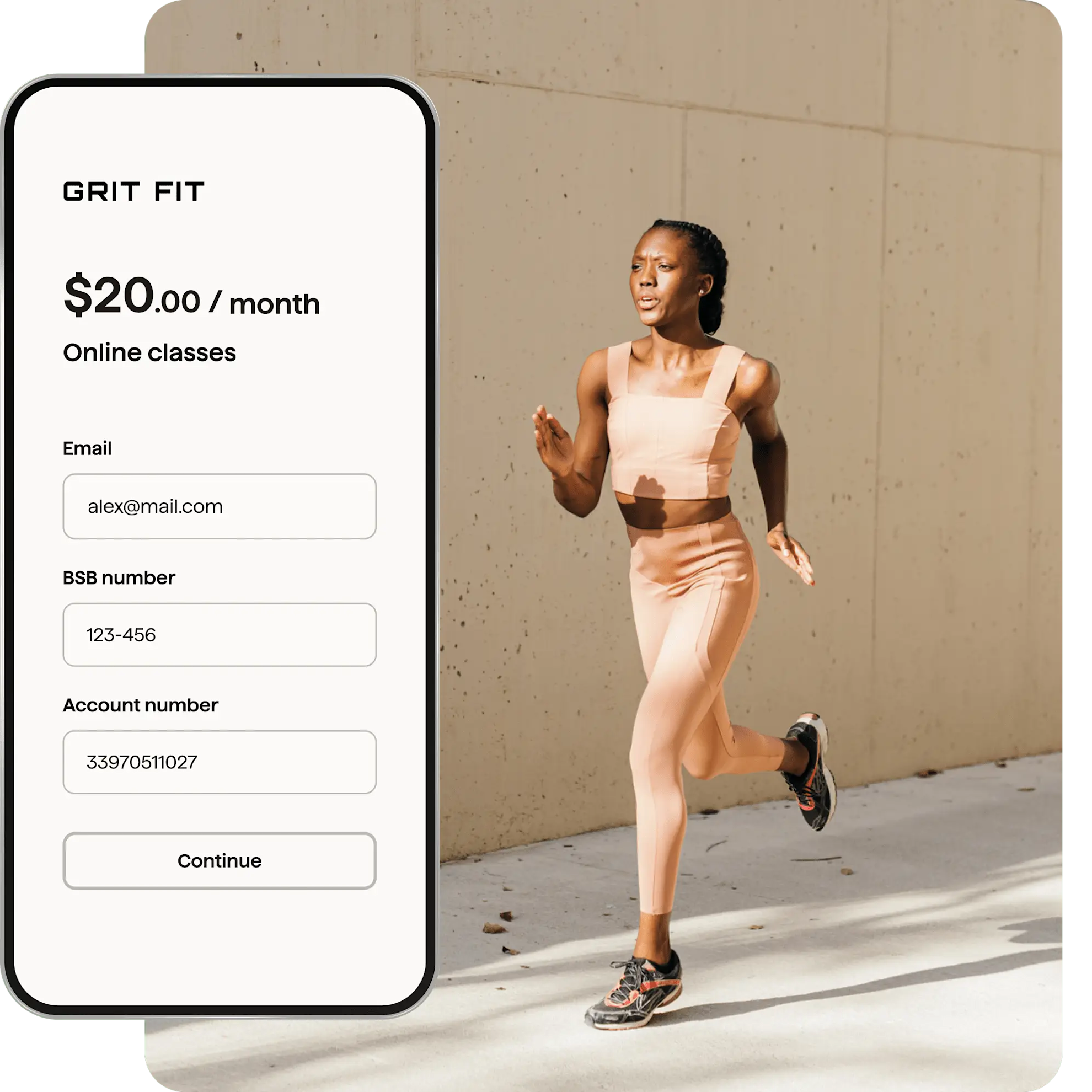

How it works

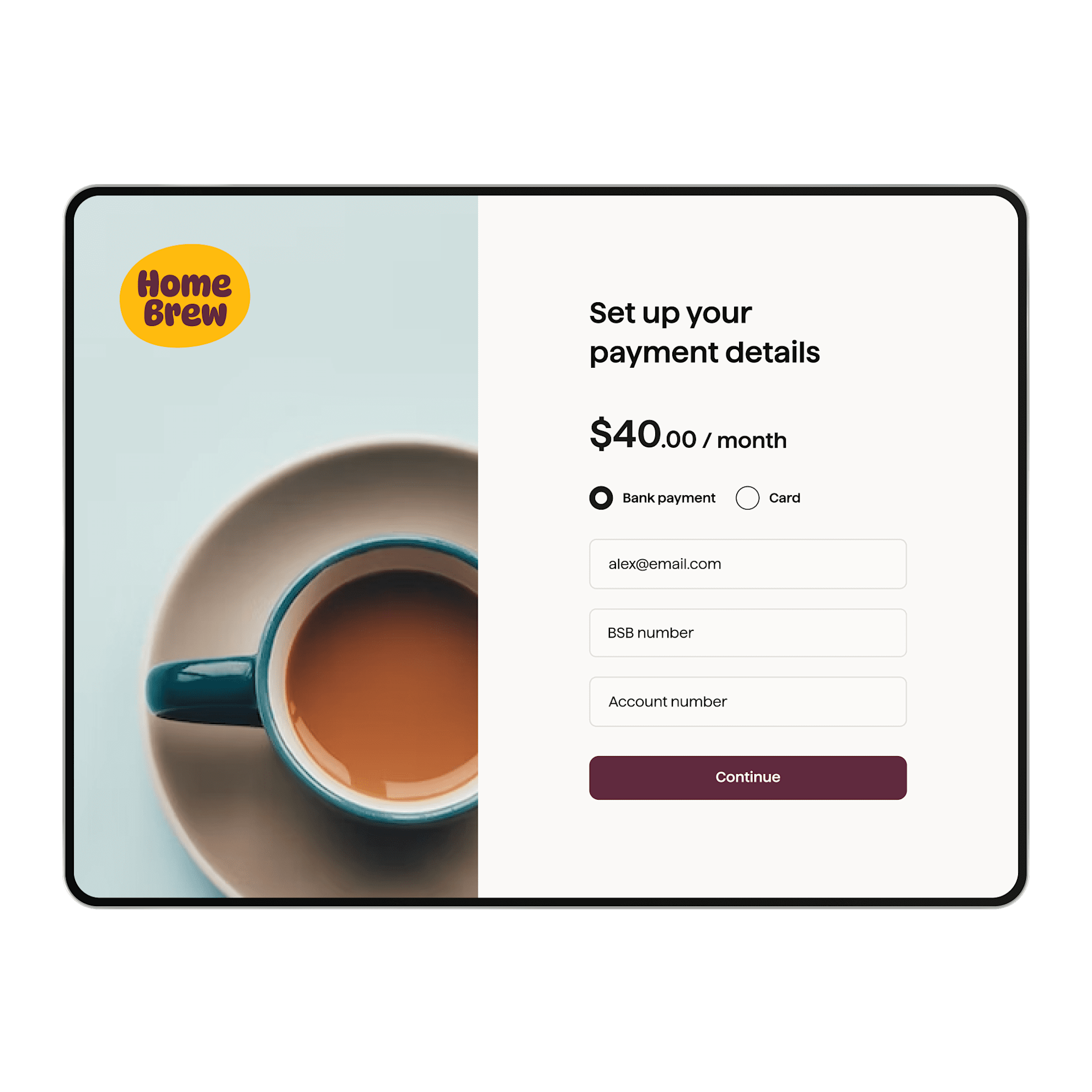

The easy way for your customers to pay

56% lower average cost per transaction*

Standard

Collect recurring and one-off payments in a straightforward way

1%

+ $0.40

per transaction, capped at $4. An additional fee of 0.3% applies to payments above $3,000.

Full fee structure

2% + $0.40 for international transactions.

All fees quoted are exclusive of GST where applicable

Advanced

Boost your payments with a smart way to recover failures and full customisation

1.25%

+ $0.40

per transaction, capped at $5. An additional fee of 0.3% applies to payments above $3,000.

Full fee structure

2.25% + $0.40 for international transactions

All fees quoted are exclusive of GST where applicable

How much GoCardless will cost you

Estimate your monthly fees and savings based on your business revenue

Calculate your fees

What is the monthly cost?

Calculate your fees

What is the monthly cost?

=

Estimated monthly saving compared to card payment fees

--

Estimated time saving per month not chasing late payments

--

Partner search

Connect with your accounting software

GoCardless seamlessly integrates with over 350 billing, accounting and CRM platforms including Salesforce, Quickbooks and Xero. Search for your partner to find out more.

FAQs

Who is GoCardless for?

With GoCardless, businesses collect payments directly from customer’s bank accounts. Whether domestic or international, one-off or recurring, scheduled or instant. We do it all – quick, easy, and secure.

Where can my customers be based?

Collect direct bank payments in 30+ countries, including Australia, New Zealand, the UK, USA, the Eurozone, Sweden, Denmark and Canada. Collect payments in your customers’ currency and settle in your own, at the real exchange rate.

Is it easy to switch my customers to GoCardless?

Moving a group of customers with existing Direct Debits with another provider over to GoCardless is straightforward. Go through a simple step-by-step process and switch customers without disrupting any existing mandates.

How do I receive the funds that I have collected with GoCardless?

The funds collected are paid directly into your bank account. With GoCardless, our fees are deducted automatically.

When do I receive my payment?

All payments are paid out two working days from when the payment was collected. We don’t hold back any of your funds in reserve.

What are the hidden fees?

There aren’t any! We want to be as transparent with you as possible and offer a pay-as-you-go pricing model with no contract or long-term commitment required.

Ready to get started?

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate collection.

Get started in minutes. No upfront commitment.