Last editedSep 20253 min read

This guide describes the protection your customers receive, your obligations under the Direct Debit Guarantee, and how to dispute an invalid refund claim.

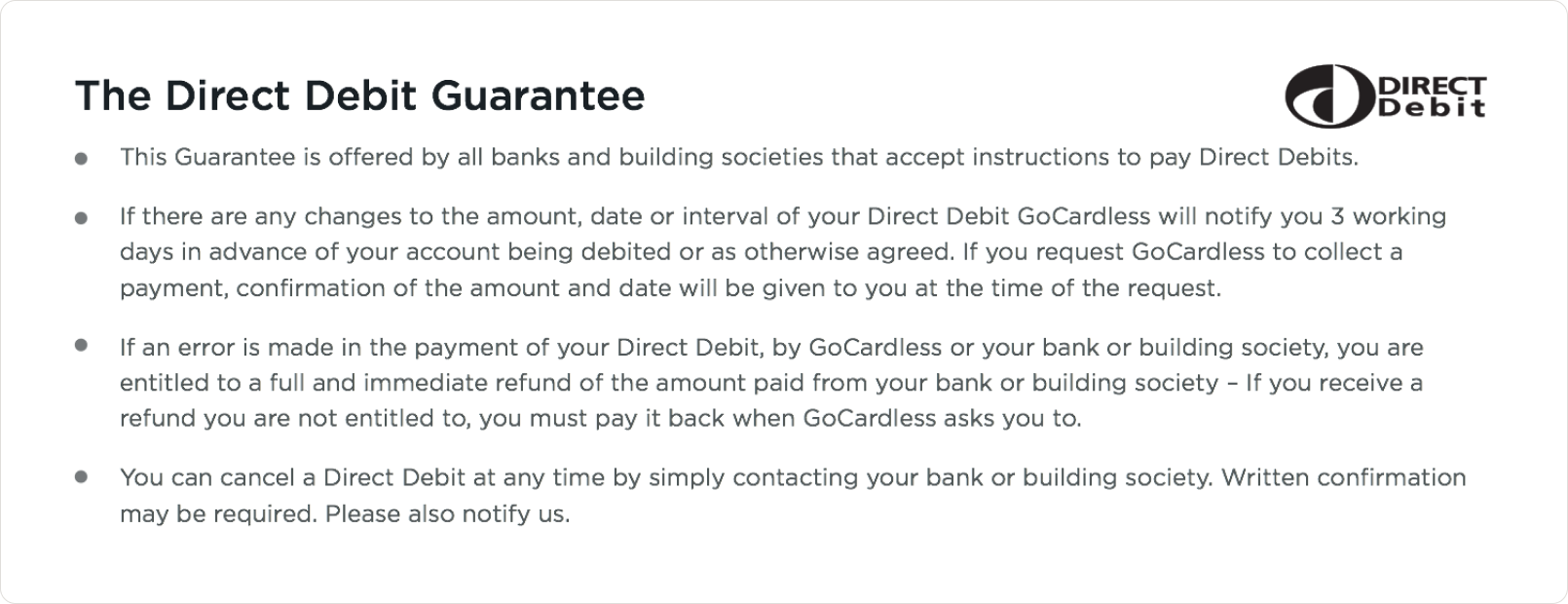

What is the Direct Debit Guarantee?

The Direct Debit Guarantee protects customers from payments taken in error. In the case of any incorrect or fraudulent payments, the payer is entitled to a full and immediate refund from their bank.

The protection granted by the guarantee makes Direct Debit a particularly safe and appealing payment method for users.

The full text of the Direct Debit Guarantee is available below.

The Direct Debit Guarantee rules

The Direct Debit Guarantee protects customers in three ways

Notifications - Customers must be notified in advance of each payment. Failure to follow the scheme rules can result in refunds under the Guarantee (or even a merchant being barred from the scheme). See our guide to taking payments for more details.

Refunds - Customers are entitled to a full and immediate refund of any payment that has been taken in error.

Cancellations - customers can cancel a Direct Debit mandate by contacting their bank. If any Direct Debit collections are made after the cancellation, a refund can be provided under the Guarantee. For more information see our guide to cancelling Direct Debit mandates.

Each of the above protections are enforced by the banks and so form an intrinsic part of the Direct Debit scheme. Refunds and cancellations are processed by the payer's bank without prior discussion with the merchant.

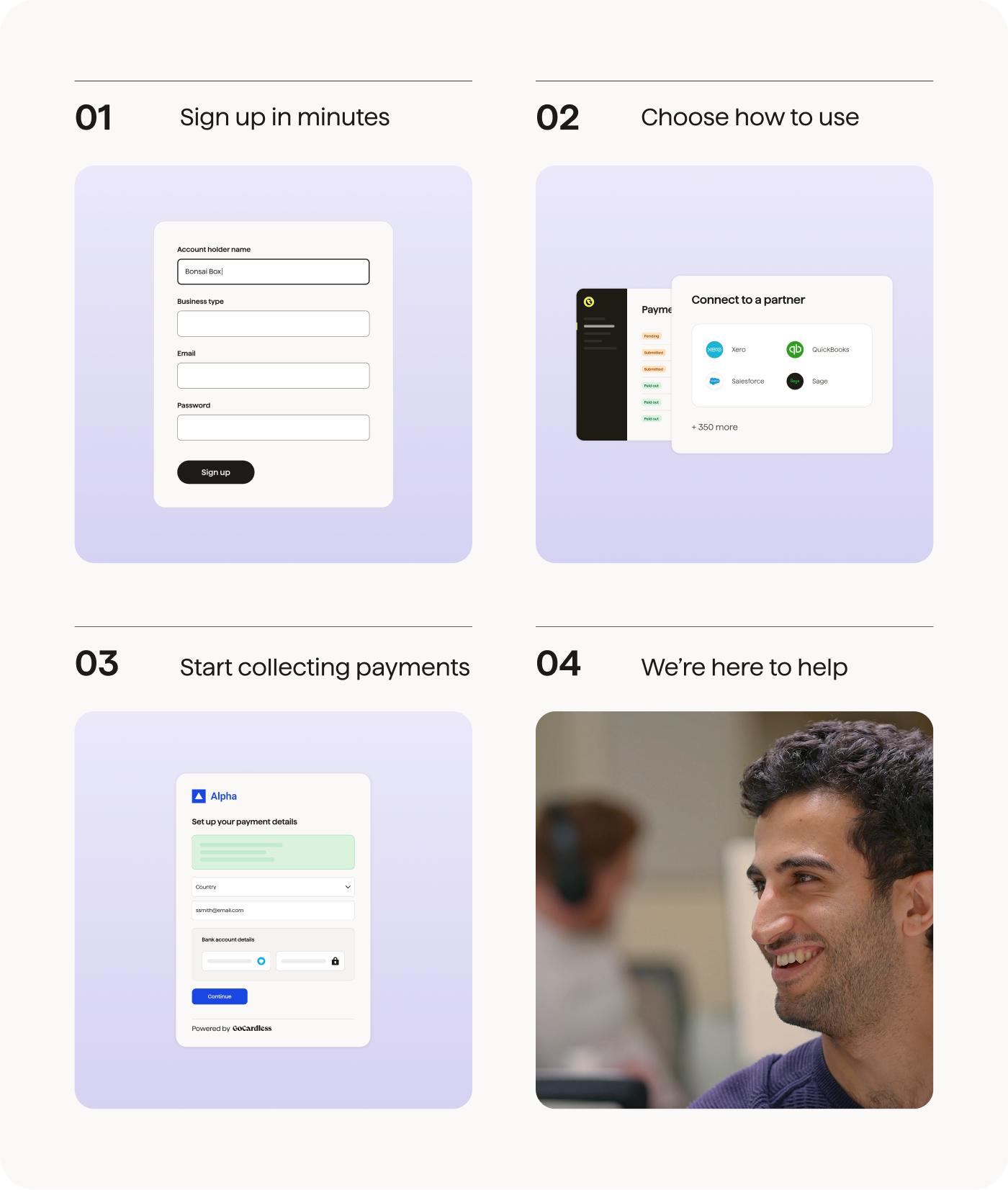

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

The refund and indemnity claim process

Under the Direct Debit Guarantee, the rules around refunds are particularly strong. A customer can request a refund for any payment and, provided the bank agrees with the validity of their claim, the customer will receive an immediate refund. Further, there is no time limit on when claims can be made.

To request a refund under the Guarantee, a customer must notify their bank that they believe there has been an error with the collection.

The customer’s bank is entitled to investigate further to satisfy themselves that an error has occurred. If accepted, the bank will immediately credit the payer with a full refund. The bank will then notify the merchant, by raising an indemnity claim via a DDICA message with a reason code, available through Bacs.

The amount refunded to the customer will be reclaimed from the merchant automatically 14 working days later.

Getting paid shouldn't cost you time, money and stress!

That's why GoCardless automates payment collection to make it simple, affordable & hassle-free.

The challenge process

Indemnity claims can be challenged prior to settlement. There is a specific process to be followed, but this documentation is only available to Bacs Service Users and the paying banks.

Please be aware that GoCardless as a service provider is unable to assist with disputing indemnity claims. For more information, visit our support centre.

The Direct Debit Guarantee does not impact any contractual agreements between a merchant and their customer, and fraudulently charging back a Direct Debit payment is a criminal offence, covered by the 2006 Fraud Act.

Merchants also have the right to pursue their customer, for example through claims courts, for any money owed after a refund has been provided, if the refund puts the customer into a position of owing money to the merchant.

The Direct Debit Guarantee in practice

In practice, considerably less than 0.2% of all Direct Debit payments are refunded via the Direct Debit Guarantee. However, this rate does vary significantly depending on business type, as does the financial impact of the indemnity claim.

The risk of indemnity claims under the Direct Debit Guarantee is particularly high for businesses selling:

High value goods such as cars, where the merchant stands to lose a lot from a single fraudulent indemnity claim.

Liquid assets such as currency or loans, which could be a target for fraudulent indemnity claims.

Services likely to see indemnity claims, such as gambling and payday loan services.

The risk of facing an indemnity claim can be minimised by:

Giving proper advance notice - If customers are provided the required advance notice they will be able to raise any issues or cancel the payment before it is made. For more information see our guide to advance notice.

Providing good customer service - Clear contact information and good, easy to reach customer service will encourage customers to bring any complaints to you before seeking a refund from their bank.

Promptly processing cancellation requests - Direct Debit Instruction cancellation requests should be processed immediately to avoid attempting payments on a cancelled mandate.

Following the Direct Debit scheme rules - Make sure you and your provider precisely follow the Direct Debit scheme rules, including any updates.

The Direct Debit Guarantee in action at GoCardless

The GoCardless processes are designed to minimise the risk of an indemnity claim, and to make sure you always abide by the Direct Debit Guarantee and the Direct Debit scheme rules.

These include:

Notifications sent in advance for you - Under the GoCardless terms and conditions, customers agree to a three day notice period. GoCardless automatically notifies your customers via email 3 working days in advance of a payment.

Following Direct Debit scheme rules - GoCardless keeps up to date with all Direct Debit scheme rules. We precisely follow the rules and help you do the same.

Alerting you to indemnity claims - GoCardless will notify you if you receive an indemnity claim, and our support team can help guide you through any available next steps.

GoCardless makes it easy to collect Direct Debit payments on your Xero invoices. Automate Direct Debit payment collection. Reduce manual admin. Get paid on time, every time