Last editedJun 20244 min read

Payment processing presents many obstacles for the modern SaaS company. From managing failed transactions effectively to handling payments smoothly across different devices --there’s no shortage of challenges to deal with.

For all businesses, payment processing is a critical part of revenue collection. But in the subscription business model, it’s paramount--as it’s often a key metric that’s closely tied to growth.

That's one reason why many SaaS companies are adopting simpler, more efficient payment processing models.

In this article, we’ll explore a few of the most significant payment obstacles, while learning what companies are doing to overcome them.

The user experience obstacle

SaaS companies are focusing heavily on improving the payments section of the user journey. The reason: It improves user acquisition and is particularly important for the company when moving from a free to paid product.

Improved user experience, especially when it comes to payment processing, helps remove barriers to smooth the transition from free users to paid customers.

This move is especially key in 2017, as latest data indicates that 89% of businesses will compete mainly on customer experience.

Many companies are improving the user journey by implementing payment solutions that offer a simple, positive customer experience across all devices, as well as catering for varying local payment methods.

Improving user experience also means finding ways to better accommodate customers’ payment requirements and preferences. To achieve this, it’s important to poll your customer base and discover the payment methods they prefer.

For example, research shows that Direct Debit, as well as credit cards, is a favoured payment method in European countries such as France, Spain, Germany, and Sweden, as shown in the chart below.

Customer experience improvements are closely tied to key SaaS metrics like conversion, churn and lifetime value(LTV)--so focusing on building an easy to use, customer-centric payment process is definitely a step in the right direction.

The failed transactions management obstacle

Failed payments are a big deal, as they mean lost revenue for growing SaaS companies. Without a reliable system in place to manage and retry them, these failed transactions can easily fall through the cracks.

Companies can gain great value from a system that automatically retries failed payments, an approach which can resolve 70% of failures.

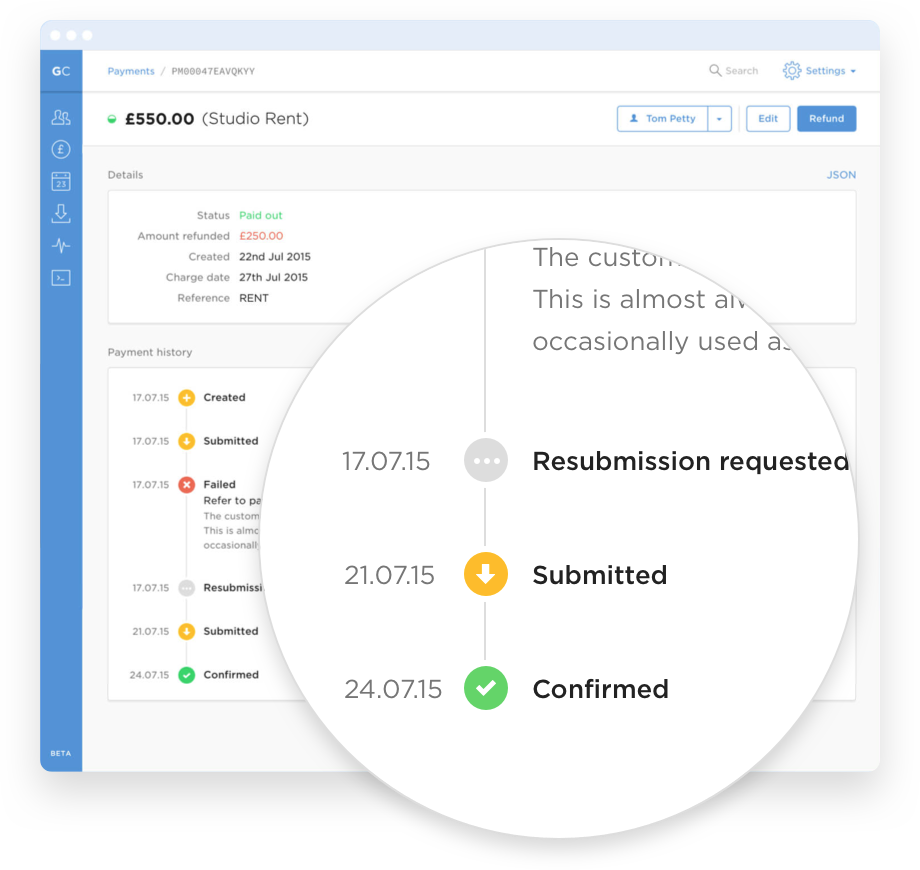

Plus, customers no longer churn involuntarily - a significant benefit for SaaS companies. The most useful tools have email notifications and a CRM integration for payments that failed to go through, as the below screen capture from the GoCardless dashboard shows.

Armed with tools like these, you’ll spend less time chasing down payments and monitoring failed transactions. You’ll have more time for the core business efforts that drive additional revenue.

The obstacle of collecting electronic payments across borders

SaaS companies often struggle to find an electronic payment processing resource that’s versatile enough to handle varying payment needs within Europe and the UK. Payment habits, rules and preferences differ quite significantly by country.

Failure to understand these properly can risk excluding customers in certain countries, meaning potential buyers could be left unserved. Additionally, this can lead to poor conversion rates if the user doesn’t want to pay using the options given.

Many US companies don’t realize that large groups of customers in Europe prefer Direct Debit.

Customers in Germany, for example, prefer to pay for products and services by Direct Debit, not credit cards--and so offering Direct Debit as a payment method means a much wider opportunity for SaaS businesses targeting Germany.

According to ECB, 51% of German non-cash transactions are via Direct Debit. Additionally, Direct Debit accounts for 5.4 billion annual transactions in Germany, while credit cards represent a mere 700 million.

Adding an electronic payment method that accommodates Direct Debit for customers in Europe opens the door to a whole new set of business opportunities - while still keeping audience preferences front and center.

The encryption and secure payments obstacle

Scaling up your business means being able to onboard a growing number of users--plus handling an increased volume of payments.

There’s also an ongoing need for compliance with the various security regulations associated with customer payment processing; a need that becomes more complex as customer volume increases.

For effective business growth, it’s important to find a payment processing solution that offers RSA encryption, stores customer payment data safely, and has approval from local European regulators.

The best payment solutions will simplify this piece of the revenue puzzle for you, removing some of the intricacies of processing sensitive customer information.

The churn reduction obstacle

On average, about 50% of customers will churn involuntarily every five years, although this can differ depending on industry and type of customer. Moz, for example, sees a churn rate of about 51% due to card expiry.

Compound this with unexpected churn from unhappy customers, and the churn rate goes even higher. It’s no surprise SaaS companies want to keep this number as low as possible.

Tom Zsomborgi of SaaS company Kinsta said, “Keeping revenue and user churn low means you have to manage failed charges in an efficient way and onboard your paying customers to maintain MRR and increase lifetime value. It’s important to take care of this because chargebacks cost money and it hurts brand reputation.”

Handling churn is another instance where Direct Debit makes sense. Because Direct Debit payments take place through the customer’s bank account, churn from card expiry is no longer a problem.

For SaaS companies looking to lower their customer churn rates, adopting Direct Debit payments is one way to tackle that challenge.

The integration obstacle

Research shows that when it comes to SaaS, integrations cause many of the major challenges for businesses.

In fact, the 2015 SaaS Application Business Impact Survey found that the top three challenges all involved SaaS apps gaining access to other apps and their data, while 38% of respondents cited ‘complex integration efforts’ as the biggest problem for their SaaS business.

And payments are no exception.

“If a payment processing resource has ready-to-go integrations, that’s great. If not, you end up spending weeks coding it,” said Robert Senoff of SaaS firm Ramp Ventures.

Flexibility is essential when selecting a payment processing tool. Often you’ll need a solution with an open API so you can develop the necessary integrations for your growing SaaS business.

Plus, opportunities for integration means more automation and simpler, more efficient processes across the board, which also gives you a more complete understanding of the customer.

In short, a payment processing tool that can grow with your organization is a good idea.

Overcome SaaS payment obstacles: find the right tools

The SaaS industry is facing a variety of payment processing obstacles. But these can be overcome with smart, flexible tools.

SaaS companies should look for solutions that have robust support, empower them to hit their goals, deliver stronger customer experiences, and that can grow alongside their businesses.

Want to talk? So do we.

SaaS success across the customer lifecycle

Insights and practical tips from B2B SaaS leaders about optimising each stage of the SaaS customer lifecycle.