Last editedMar 20227 min read

What is Direct Debit?

Direct Debit is a way of collecting payments straight from your customers' bank accounts, without them having to approve each and every transaction. It's quick, safe and convenient. With the right provider, it's easy for your business to accept Direct Debit payments.

In this guide we'll look at how Direct Debit can help your business by improving cash flow and reducing time spent chasing payments. We'll cover the advantages and disadvantages of Direct Debit, and show you how you can quickly start accepting customer payments this way.

'Direct Debit' is sometimes also used to mean collecting payments from a credit account, via a credit card, in Australia. However, this guide is specifically about bank-to-bank payments from current accounts, which are less expensive and more dependable for your business. Bank-to-bank Direct Debit payments are handled via the Becs scheme, rather than a card network.

Benefits of Direct Debit for your business

The benefits of accepting Direct Debit payments are wide-ranging. If you don't already accept payment this way, your business could be missing out. Ultimately, it's all about getting paid more efficiently. Here are some of the advantages of Direct Debit.

Better cash flow

By helping customers to pay you promptly, your cash flow becomes more predictable. This is very important, because poor cash flow causes many small businesses to fail.

A recent report from the Australian Securities and Insolvencies Commission (ASIC) showed that almost half of insolvencies were due to inadequate cash flow or high cash use. So it's not surprising that poor or unpredictable cash flow is a big concern for many Australian businesses – 48% are struggling to achieve good cash flow and 35.5% say cash flow is their biggest pain point, according to recent statistics from Xero online accounting.

Faster payment

Direct Debit payments are fast. They are paid within a few days of you sending the bill. Other forms of payment can take weeks to process and chase. The average late payment time for Australian businesses is 11.7 days after invoice due date, according to Illion. Direct Debit helps you to get paid on time, every time.

Increased sales

If you sell high-value goods or services, Direct Debit can make them more affordable to your potential customers. Instead of paying one large lump-sum, your customers can pay you in smaller, regular instalments, automated by Direct Debit.

Time savings

Direct Debit can save you time in two ways. First, the payments are automated, so you spend less time chasing customers. Second, if you use a solution that integrates with your accounting software, such as GoCardless with Xero, you can instantly reconcile payments instead of wasting hours checking bank statements manually. The time soon adds up, and you could potentially regain up to one day per week in admin time.

Automatic payments for subscriptions and rentals

If you offer subscription-based or rental services, you won't want to have to chase your customers for payment on a regular basis. Direct Debit makes such payments automatic, so you'll get paid without lifting a finger.

Renewal roll-overs

Direct Debit agreements are usually open-ended. This allows you to receive ongoing renewal payments for some services, such as insurance. Because customers don't need to actively do something in order to keep paying you, you're more likely to retain regular income from them. The barrier to paying is lower than the bar to not paying.

However, it's important to run your business ethically, and not roll over annual contracts without prior notification to the customer, so they have the chance to cancel. According to the Becs Direct Debit scheme rules, you must notify customers in advance of each payment - though providers like GoCardless can handle this for you.

Better business forecasting

Direct Debit makes business forecasting easier, because you can make projections from a broader base of stable, regular income.

How do Direct Debit payments work?

It's very straightforward:

Your customer fills in a simple form, called a Direct Debit request (sometimes called a mandate or authority). This authorises you to take payments from their bank account.

When a payment is due, you notify the customer that you will be taking payment.

The money is transferred from their account to yours. It's possible to receive variable and one-off payments as well as regular, fixed amounts.

Direct Debit with your bank vs with a Direct Debit provider

Large businesses might handle Direct Debit processing themselves. However, this requires lodging a large bank bond and passing stringent regulatory checks. It's not advisable or affordable for most small businesses. Instead, you can use a Direct Debit provider, such as GoCardless, which will handle Direct Debit processing for you in return for a small transaction fee.

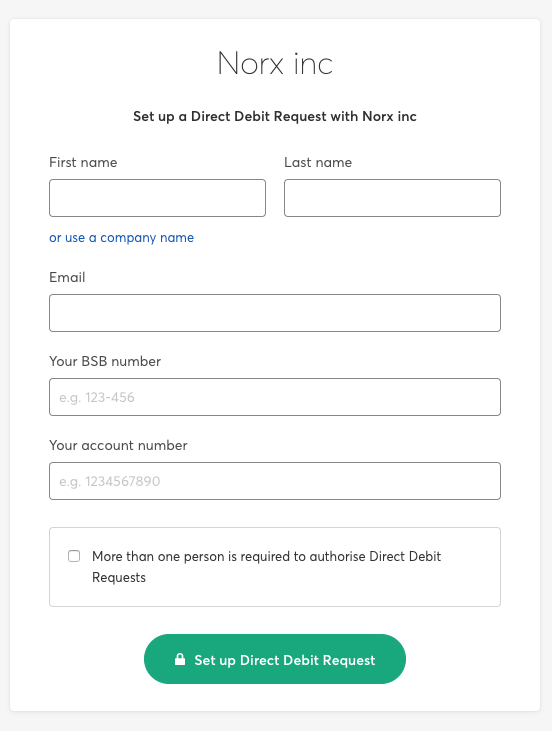

Direct Debit form

This is an example of the Direct Debit request form which your customers will fill in. Once this authorisation is complete, you will be able to receive payments quickly and easily by Direct Debit.

How to set up a Direct Debit – three simple steps

It's easy to set up Direct Debit for your business. It can all be done online in just a few simple steps, as follows:

Choose a Direct Debit provider. You can do this by researching the market yourself or by asking for recommendations. It makes sense to choose a provider who's already a partner of your accounting software provider. That makes sign-up and bank reconciliation much easier, saving you time.

Invite your customers to pay you via Direct Debit. Email your customers a mandate request form, or include a link on your website or invoice, which they can fill out online securely. Once they have authorised the mandate, you can start taking payments from them. Find out more about moving your customers to Direct Debit.

Request payments from your customers. You can request one-off or regular payments via Direct Debit. You should be able to set up a payment schedule through your provider’s tool, or from within your billing system if the two systems are integrated. Customers need to be notified in advance, to ensure they have sufficient funds in their account, but your provider should handle this for you.

These are bank-to-bank payments, not credit or card payments, so they usually go through without problems.

The customer will see your merchant name plus the Direct Debit provider's name on their bank statement (although you can pay some providers extra to remove their name from your customers bank statements).

You will be charged a fee for each transaction, typically a very small percentage and capped at just a few dollars, even for large payments.

Direct Debit is popular with buyers because it offers strong protection against fraud, along with refunds for unauthorised or invalid payments. These facts encourage more customers to use Direct Debit, because they know they can trust it.

How do I choose a Direct Debit provider?

It's important to choose the right provider to handle Direct Debit payments from your customers. You need to know that the provider you choose is reliable and efficient, so that you are paid as quickly as possible yet without significant cost to you. Here are five tips that will help you select a provider.

Choose a bank-to-bank specialist

It's possible to receive Direct Debit payments via card or credit, but the best option for most businesses is bank-to-bank transfer. This type of payment is cheaper, and the mandates don't expire, hit spending limits or fail, making them far more reliable.

Choose a provider with transparent fees

You won't want any hidden costs when processing Direct Debit payments. Go with a provider that's honest and up-front. For example, GoCardless offers zero set-up costs, low fees, and no hidden costs. Customers only pay for successful transactions, and fees are 1% capped at A$3.50, £2 or €2.

Ensure you can get started quickly

Your chosen provider should enable you – and your customers – to get started quickly. Ideally it should be possible to sign up for free and start taking Direct Debit payments in minutes.

Make use of automation

Technology should make life easier, and that includes Direct Debit payments. The most popular providers have automated systems that handle error prevention (so there's no double entry) and automatic reconciliation, which can save you hours of time each week.

Opt for integration with your accounting software

Direct Debit payments are great, but if they connect with your billing system, they’ll save you even more time. No more manually reconciling payments with your accounts – that can all be done automatically.

For example, GoCardless connects with Xero and other accounting software, meaning there’s no need to switch between systems. All payments are automatically reconciled, with the relevant invoices marked as paid and the GoCardless fee posted as an expense.

How long do Direct Debit payments take?

It will typically take a few working days for payments to clear. It may take longer if there are service interruptions or other unforeseeable problems. This is longer than for some other types of payment, but remember: with Direct Debit the customer doesn't have to do anything, which makes it more likely that you'll be paid without significant delay.

Payment via Direct Debit is fast, but not instant. It's a form of 'pull' payment – the business requests funds from the customer – rather than 'push' payment, in which the customer sends funds to the business.

How much do Direct Debit payments cost?

Costs vary from one provider to another, which is why it makes sense to shop around. Be wary of hidden costs, such as fees for set-up or payment failures.

Popular providers charge a flat rate based on a low percentage, such as 1%, but capped at a small sum so that you don't pay much, even for larger transactions. Reputable providers don’t charge fees for failed or dishonored payments.

Transaction fees are charged to your business, not to your customers. If necessary, you might decide to increase the value of your invoices in order to cover the cost, but this risks upsetting your customers. The benefits of using Direct Debit usually far outweigh the fees, so for most businesses it’s unnecessary anyway.

Are there any disadvantages to using Direct Debit?

Direct Debit is a payment method that increases the chances that you'll be paid regularly and on time. It's suitable as an accepted method of payment for many different kinds of goods and services.

However, there are some factors that you should bear in mind. Direct Debit isn't generally suitable for:

Instant clearing of funds such as for e-commerce, because payment can take a few days to clear

High value physical goods because there's a limit of A$10,000 per transaction

Transactions likely to experience refund requests such as gambling, because your Direct Debit provider is likely to exclude these due to risk.

Bear in mind that Direct Debit has strong protection for customers. This means that, under some circumstances, the customer could demand a refund of their payment – which you would have to repay. However, this rarely happens, and only around one in 500 Direct Debit payments are disputed.

Remember also that you can choose to use Direct Debit together in conjunction with other payment methods. If you’re using it through your billing, CRM or subscriptions platform, you won’t have to deal with a separate payments tool either – you can can use your Direct Debit system seamlessly alongside other integrated payment options.

How is Direct Debit different with GoCardless?

As this guide has shown, Direct Debit payments can help you get paid faster, improve your cash flow and get more business from your customers.

GoCardless helps thousands of businesses worldwide get paid on time, every time. But how is Direct Debit different with GoCardless? GoCardless's Australia & New Zealand Country Lead explains in the video below.