Payments + cloud accounting: 4 reasons smart businesses connect them

Last editedJan 20213 min read

We learned something recently - quite a few small businesses are making their financial admin harder than it needs to be, by either:

Not integrating their payments software with their cloud accounting or invoicing software, or

Not using cloud accounting or invoicing software at all (for brevity, we’ll shorten these two to just “invoicing software” below)

If you sit in either of those camps, this guide is for you. If you know someone who sits in either of those camps, you should send this guide to them.

Either way, small businesses can make things much easier on themselves by simply connecting their software up. And it’s incredibly easy to do so.

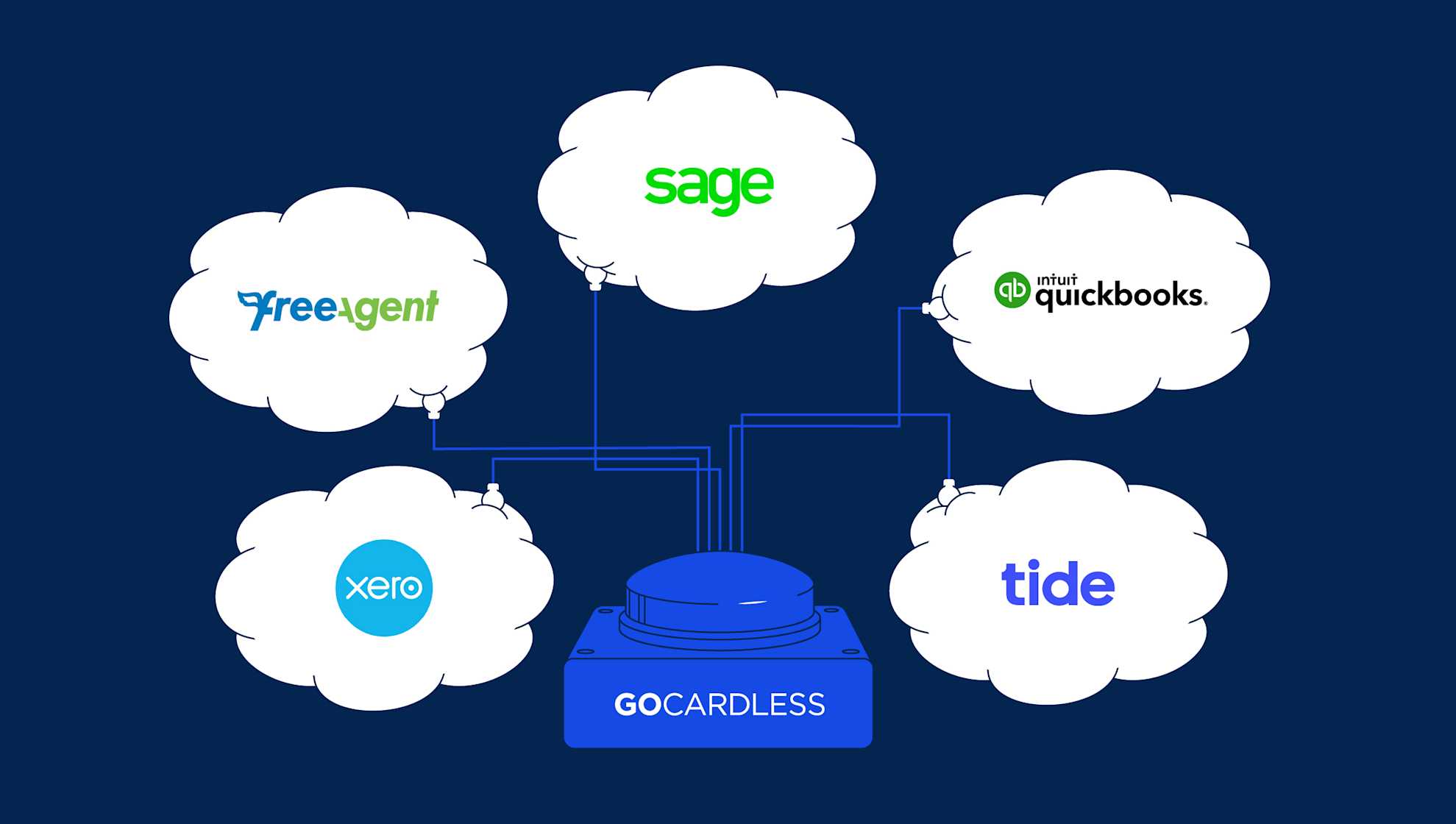

🔌 Connect GoCardless to your cloud accounting software now

It’s super simple, and saves you time and hassle by getting rid of unnecessary financial admin. (If you don’t yet use cloud accounting or invoicing software, click through to see who we integrate with.)

“Let’s say you have a customer who places an order every month but the amount they order each time is different. Currently, let’s say you create and send them an invoice every month, maybe have to chase up that payment, and then have to reconcile it when it comes in.

You can make things much simpler and quicker by integrating your invoicing and payments platforms. With Tide and GoCardless, the payment you collect automatically adjusts to the amount on the invoice you send to your customer. Even better, your customer doesn’t need to do anything – the money is collected automatically!”

- Amit Kahana, VP of Credit Services @ Tide

4 problems from not integrating payments with cloud accounting or invoicing

If you aren’t integrating your payments software with your invoicing software, you’re going to be unnecessarily subjecting yourself to:

1) Duplicated effort

Unlinked systems means duplicated effort. Raising an invoice in your invoicing software? Now you have to go to your payments software and create a payment. Time wasted. And irritating, right?

Then what if the invoice amount needs to change? That’s one update in your invoicing software, and another one in your payments software to ensure they match.

In fact, a survey from GoCardless partner QuickBooks showed that 80% of customers who use QuickBooks invoicing save more than 3 hours on sending invoices per month.*

2) Extra manual tasks

On top of the duplicated effort, having your payments software unconnected to your invoicing software means missing out on automatic reconciliation.

Most invoicing software platforms that offer online payment options will automatically reconcile the invoice once it has been paid. That’s a lot less bookkeeping for you to worry about.

Which means less wages wasted on that financial admin - with the person responsible able to add value to the business elsewhere, instead.

3) Greater chance of error

If you have to manually duplicate changes in your invoicing software across to your payments software, and undertake manual reconciliation, you’re opening yourself up to unnecessary human error.

Which could harm not just your business, but also lose you customers if you accidentally charge them incorrectly, or chase them up about late payments when they’ve actually already made them.

4) Poor visibility over payment status

If you want to know how your business is going financially, you might consult your invoicing software. So if your payments software isn’t linked to it, helpful information is going to be missing.

And if you want that info, you need to go separately log in to your payments software and waste time finding it.

All this wasted time isn’t just a case of “oh well, that’s too bad” - Xero’s Small Business Insights show that, on average, only 51% of UK small businesses are cash flow positive in any given month. If your cash flow is struggling, wasted time is lethal - anything that takes you away from becoming cash flow positive puts the existence of your business at risk.

The benefits of integrating

Integrating your payments software with your invoicing software is incredibly easy to do. And when you do it, you wave goodbye to those four problems and say hello to:

✅ Less hassle - With your softwares integrated, they can now speak to each other, meaning less manual work for you keeping them aligned with each other.

✅ Time recovered - No more duplicating effort means half your time spent is back in your pocket. You can better use that on strategic or revenue-generating activities.

✅ Confidence - No more duplicating effort also means you’re reducing your chances of making errors. And with data from your payments software automatically being shared with your invoicing system, you can get better visibility of the financial status of your business.

Xero customers who accept GoCardless payments on their Xero invoices get paid up to twice as fast as those who don’t use online invoice payments.^

Haven’t got cloud accounting or invoicing software yet?

The world of cloud accounting and invoicing is big, with many different providers selling many similar, but different, solutions.

Cloud accounting software tends to include invoicing functionality within it, and is commonly considered a must-have for small businesses.

If you’re looking for the right one for your business, we wrote a guide on how to choose cloud accounting or invoicing software.

“Accounting software is not one-size-fits-all so take some time to think about your specific needs before you choose a product for your business. FreeAgent is specially designed with small businesses in mind.”

- Matt Perkins, Senior Partnerships Manager @ FreeAgent

Software providers to consider

We’re partnered with some of the biggest names in accounting and invoicing:

With any of these providers you’ll be able to quickly and easily integrate GoCardless, saving yourself time and hassle, and enjoying the confidence of automating your financial admin.

"The time-saving benefits of integrating cloud accounting and payments software can be hugely significant. We see businesses that integrate Sage and GoCardless saving dozens of hours a month, or hundreds of hours a year."

- Michael Office, VP Product for UK and Ireland @ Sage

🔌 Connect GoCardless to your cloud accounting software now

It’s super simple, and saves you time and hassle by getting rid of unnecessary financial admin. (If you don’t yet use cloud accounting or invoicing software, click through to see who we integrate with.)

*Based on an August 2020 survey of QuickBooks active subscribers. 80% of respondents who state they send invoices via QuickBooks agree or strongly agree they save time sending invoices with QuickBooks. They estimate they save more than 3.5 hours/month.

^This figure is based on paid invoices that were created in Xero between 1 July 2019 and 30 June 2020. Average invoice payment times may vary for each business using the service.