Open Banking

We surveyed 2,500 UK payers to uncover their knowledge and appetite for VRPs

Embarking on a payments innovation like open banking can be daunting for non-financial services people. In this guest blog, Cuckoo's Alexander Fenton explains how the benefits offered by open banking make it well worth investigating.

In this guest blog, Nude’s CMO Yoann Pavy discusses how open banking is helping Nude's customers meet their financial goals (without having to give up avocado on toast).

Open banking in the UK hits another milestone

Payments are mission-critical. And so is your payer experience.

With open banking Income verification no longer takes days or weeks but seconds!

Increase your customer retention with our 5 Open Banking examples.

In this guest blog, Plend's James Pursaill discusses how the start up is reinventing the loans landscape through the greater transparency and data capabilities offered by open banking.

The UK’s most advanced payments innovators demystify open banking.

We've answered your questions on fraud and GoCardless Protect+

Watch our free webinar to discover the four key ways that you can utilise GoCardless Protect+ to prevent payment fraud.

Discover payer preferences and the drivers behind them, how your current checkout maybe impacting your conversion, and the key areas your competitors are investing in.

JustGiving's Head of Payments discusses the power of open banking

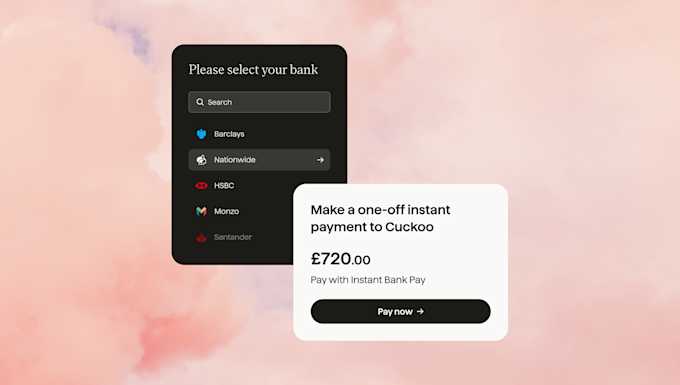

Tackle failure rates and poor visibility with one-off instant payments

Always be a step ahead of fraud with GoCardless Protect+

Hear payment experts from GoCardless and Plum as we deep dive into payment fraud to provide you with a better understanding of the different types of fraud and how they are already impacting your business.

Could open banking help to transform your business?

Discover our guide to the top open banking providers in the UK.

Make one-off payments the easy way with Instant Bank Pay.

GoCardless to offer free access to open banking data

Find out everything you need to know about reducing payment failure