Latest articles

Find out how to stand out by creating a seamless customer payment experience

Reflecting on open banking's latest milestones and what's still left to achieve

What is the Blueprint and how will it impact payment progress in 2024 (and beyond)

Find out how you can better harness open banking.

Discover what 51% of people said would make them want to donate more often

We make Direct Debit accessible to small businesses.

Find out how you can better harness open banking as a lender

Discover the five must-haves that merchants are using to compare Payment Service Providers and how you can use them to become viewed as mission critical by your customers.

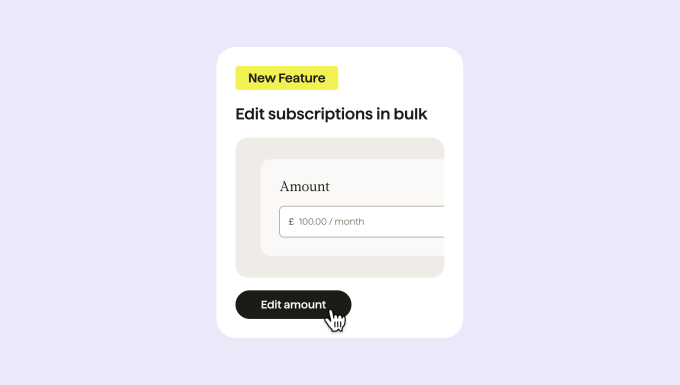

We listened to our customers and editing subscriptions in bulk just got easier.

![[Webinar] Payments for the future of insurance](https://images.ctfassets.net/40w0m41bmydz/47SwH9bzBZjX7xyZBlhpEq/85dffef84687ad5500e93f3fbe5e19ff/BD-1092_UKI_Demo_Webinar-Q2-Blog-Thmbnail.png?w=680&h=385&q=50&fm=png)

Hear first-hand from ManyPets on how the road for insurance is changing and keeping up with customer expectations has never been more important. Having the right payment strategy could evolve the way you do business. Watch on-demand.

Our CCO reflects on sponsoring the Awards and how we power payments for good