Last editedApr 20234 min read

As a subscription business leader, you’re probably already looking at customer churn, and know the significant impact it has on the bottom line of any company with a subscription billing model.

But churn can be calculated - and addressed - in lots of different ways. This quick guide to churn brings together key definitions and industry benchmarks from the likes of ChartMogul, ProfitWell and Recurly, as well as tips to help you tackle voluntary and involuntary churn, some of which you might not yet have considered.

After all, your churn rate ultimately determines how big your business can grow.

What does 'churn' mean in a subscription setting?

'Churn’ refers to the rate at which a subscription company loses its subscribers because of subscription cancellations or elapses. This leads to loss of revenue. Churn rates really matter for subscription businesses because they are an important indicator of long term success.

What’s more, churn rates relate directly to the customer lifetime value (LTV) for your subscription business. In the end, reducing churn not only increases LTV, but ultimately leads to greater return on your customer acquisition cost.

That’s why reducing customer churn is one of the most important steps you can take to boost the performance of your subscription business.

Customer vs. revenue churn

Customer churn and revenue churn are two important types of churn. Let's take a quick look at each.

Customer churn refers to how many of your customers cancel their subscriptions in a certain time period. It's a useful metric, because you can use it to calculate the average lifetime value a subscriber.

Revenue churn looks at the percentage of revenue you have lost from existing customers in a given time period.

This guide from subscription platform Zuora gives a more detailed explanation of both concepts, and includes the full set of formulae to help you calculate both of these rates.

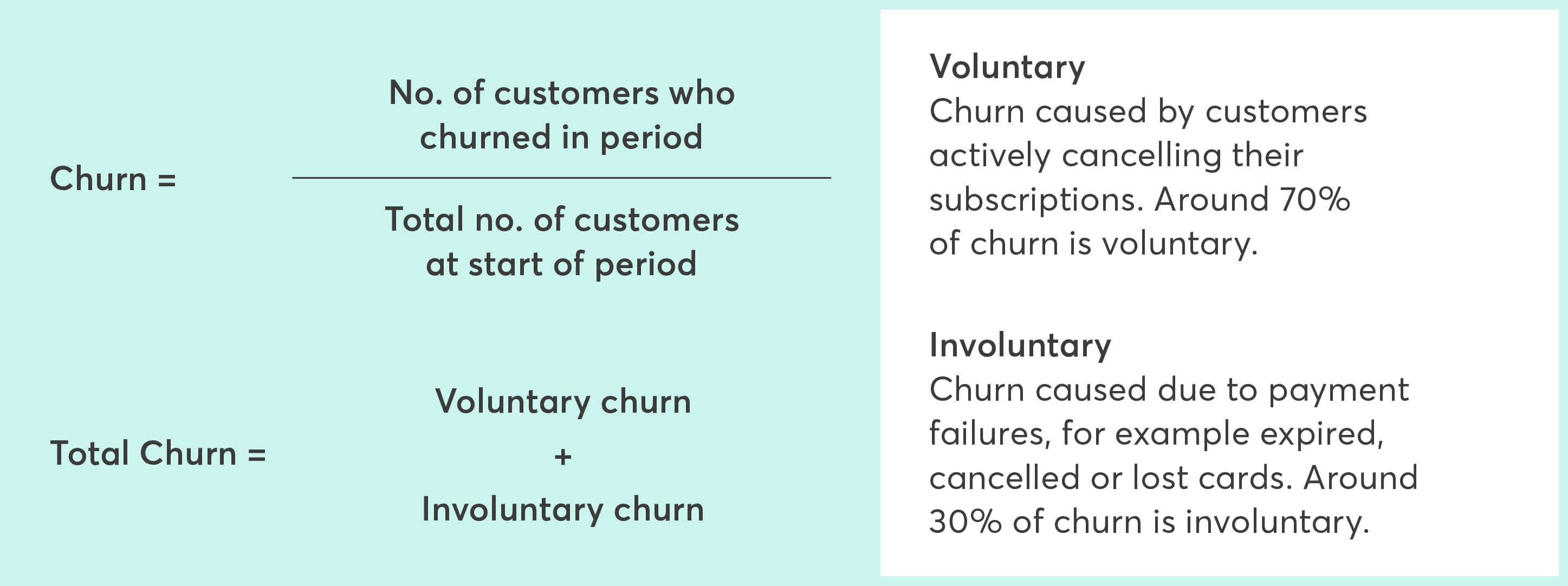

Voluntary vs. involuntary churn

Voluntary churn is where a customer actively decides to cancel their subscription to your product or services. Many SaaS businesses focus on reducing voluntary churn, by, for example, trying to improve customer satisfaction scores.

Having satisfied customers is great for business. But by focusing only on voluntary churn, SaaS businesses may be missing out on another important route to reducing churn.

This is where involuntary churn comes in. Involuntary churn happens where customers unintentionally lose access to your services, and, according to ProfitWell, it makes up 20-40% of overall churn. This kind of churn can't easily be solved by improving your product or service, as even the most satisfied of customers aren’t immune to involuntary churn.

Involuntary churn can happen when:

a customer forgets to update their payment information when their credit or debit card expires (at least every three years per customer)

a customer loses their credit or debit card

a customer’s card gets stolen

a customer’s bank rejects their payment to you because their payment encounters a network error, or because the customer exceeds their credit limit.

As you can see, there are many reasons for involuntary churn, and they’re nothing to do with customer satisfaction. In fact, they’re almost all related to the payment process.

Specifically, research from IBM has shown that involuntary churn affects a significant number of SaaS customers. In this survey, 16% of respondents reported that their subscriptions had been cancelled after forgetting to update their payment information with new credit card details.

Involuntary churn can also have a knock-on effect on customer satisfaction. Customers will be confused if they don’t know their payment has failed, yet find themselves mysteriously unable to access your product or service. This is a recipe for dissatisfaction, and may even lead to an increase in voluntary churn.

How to calculate your churn rate

There are many ways to calculate SaaS churn rate, up to 43 of them according to ProfitWell. Just like ProfitWell do, we recommend keeping things simple.

To calculate basic churn rate for your business, first pick a time period to focus on (for example, monthly), then divide the total number of churned customers over that period by the number of customers you had on the first day of that period.

For more insights into measuring churn, check out this handy Churn Rate Cheat Sheet from SaaS metrics specialists ChartMogul.

Churn industry benchmarks

Tracking churn is the first step to stopping it. But it's also important to regularly benchmark your churn rate against industry averages. Research from Recurly, conducted over 12 months on a sample of 1200 sites, provides some useful benchmarks for assessing the churn performance of your subscription business. According to Recurly:

Overall industry monthly churn rate is 6.73%

B2C companies experience more churn than B2B: 6.22% for B2B, and 8.11% for B2C

Voluntary churn benchmark is 4.8%; involuntary churn is 1.73%.

Focusing in on the SaaS industry, overall monthly churn rates were slightly lower, at 6.19%, with a B2B vs B2C breakdown showing rates of 6.15% vs 6.93%, respectively.

How to reduce voluntary churn

In SaaS, most businesses start making money after 9 to 12 months; so if you lose a customer in month 8, it's worse than never attracting them in the first place.

SaaS businesses must bring constant value to the customer, or else risk them jumping ship to a more attractive offer. One important metric to consider here is ‘time to first value’. This is the speed at which we can deliver the first visible spark of value to a customer. And in the fast-moving world of SaaS, ‘time to first value’ needs to be almost immediate.

Human perceptions of value matter a great deal in this mission. Perceived value demands that a service receives our conscious attention on a regular basis. For SaaS, that should be every day. A good starting point is Zuora’s helpful guide for cutting down voluntary churn.

Here are a number of examples of ways your team can work together to boost customer joy and reduce voluntary churn.

Find different ways to increase customer usage of your platform, e.g. by creating a welcome video to help new subscribers quickly get to grips with your product.

Keep the added value of your service front of mind for users while they are active, e.g. like the team at Receipt Bank, who remind their customers on every login how much time they’re personally saving by using the service.

Maintain ready access to your service on every platform and device, in multiple contexts, e.g. by providing a full-featured mobile app.

Develop a range of templates, guides, shortcuts and other valuable assistance for your customers, such as Zuora’s comprehensive Academy.

For more information on ways to reduce voluntary churn, check out our guide, From Hello to Hero: SaaS Success Across the Customer Lifecycle.

How to reduce involuntary churn

You're probably already taking proactive steps to manage voluntary customer churn, but what about sorting out involuntary churn?

Failed payments are the number one cause of involuntary churn. In short, involuntary churn means customers want to pay you, but their payments can’t reach you.

Subscription billing platform Chargebee, have produced a detailed guide to cutting involuntary churn, crammed full of useful tips around the entire customer lifecycle. Viewing involuntary churn in the context of the whole customer lifecycle is an effective way to put in place solutions which don’t clash with each other.

The tactics mentioned in the guide, including dunning processes, smart retries and account updaters, can deliver a welcome decline in failed payments for many SaaS businesses.

But tackling the root of payment failures means reducing your reliance on card payments. For example, by using bank to bank payment methods like Direct Debit (also known as bank debit), you can achieve failure rates as low as 0.5%, cutting involuntary churn by more than 70% - ultimately enabling you to increase lifetime value and ROI by more than 30%.