Last editedSep 20252 min read

Leveraging the right payment technologies can help merchants remove barriers to sales, and ensure convenience and security for their customers. But what if the barrier to sales is your price point? You could reduce your costs. But that would place a stranglehold on your profit margins and place your cash flow in peril.

Instead, you may want to consider offering an instalment payment method. This allows the customer to spread the cost of their purchase without resorting to the use of a credit card or short-term loan. Here we’ll look at how this form of credit can benefit merchants, and how to account for instalment sales in your books.

Different types of instalment payments

The term ‘instalment payments’ is a fairly broad church. It can refer to any arrangement between creditor and debtor where payments are made in small instalments over a prearranged period of time.

Different types of instalment payments include:

Instalment sales – An arrangement is reached between a buyer and a seller where goods are paid for in a series of instalments rather than upfront. In retail sales, this is usually facilitated by a third-party payment service provider (e.g. Klarna)

Instalment loans – A loan is taken out through a financial institution and paid back in instalments. Usually, interest is paid on the outstanding balance

instalment debt – When a large debt is outstanding, the debt may be repaid in instalments. For instance, HMRC offered this service to SMEs that were struggling to repay their tax liability in the wake of the pandemic

For merchants, the first option is the most applicable to their operations.

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

The advantages of instalment payments

Offering customers the option to pay for their purchases in instalments can benefit both you and your business. This sale-financing makes products available to customers who may not have the liquid funds free to pay for them outright. So merchants get a sale and customers get a product that they might otherwise have missed out on.

Let’s take a closer look at how the instalment payment method benefits merchants and customers alike.

Advantages for your customers

Financially conscious customers get to treat themselves to something that might not otherwise be affordable on their carefully calculated household budgets. When you offer an instalment payment method, your customers benefit from:

Low monthly payments

Potentially more favourable terms than a loan or credit card

The ability to make desirable purchases without compromising their monthly budget

Advantages for your business

Of course, when your customers benefit, your business benefits too. While instalment payments can complicate your bookkeeping slightly, they can also be highly beneficial for SMEs like yours:

Bring in more sales that you may otherwise have missed

Regular payments allow you to regulate cash flow

Offers flexibility and convenience for your customers, bolstering your brand’s appeal

Accounting for instalment payments

Most merchants that offer instalment payments use automated invoicing software to ensure that payments are made on time. Because the revenue for these sales is deferred, you’ll need to be extra careful in recording the income from these sales.

Your gross margin for these sales is calculated as the value of the net sale minus the cost of goods sold. You can choose to either set up partial payments on a single invoice or set up recurring invoices for each payment until the balance is settled.

We Can Help

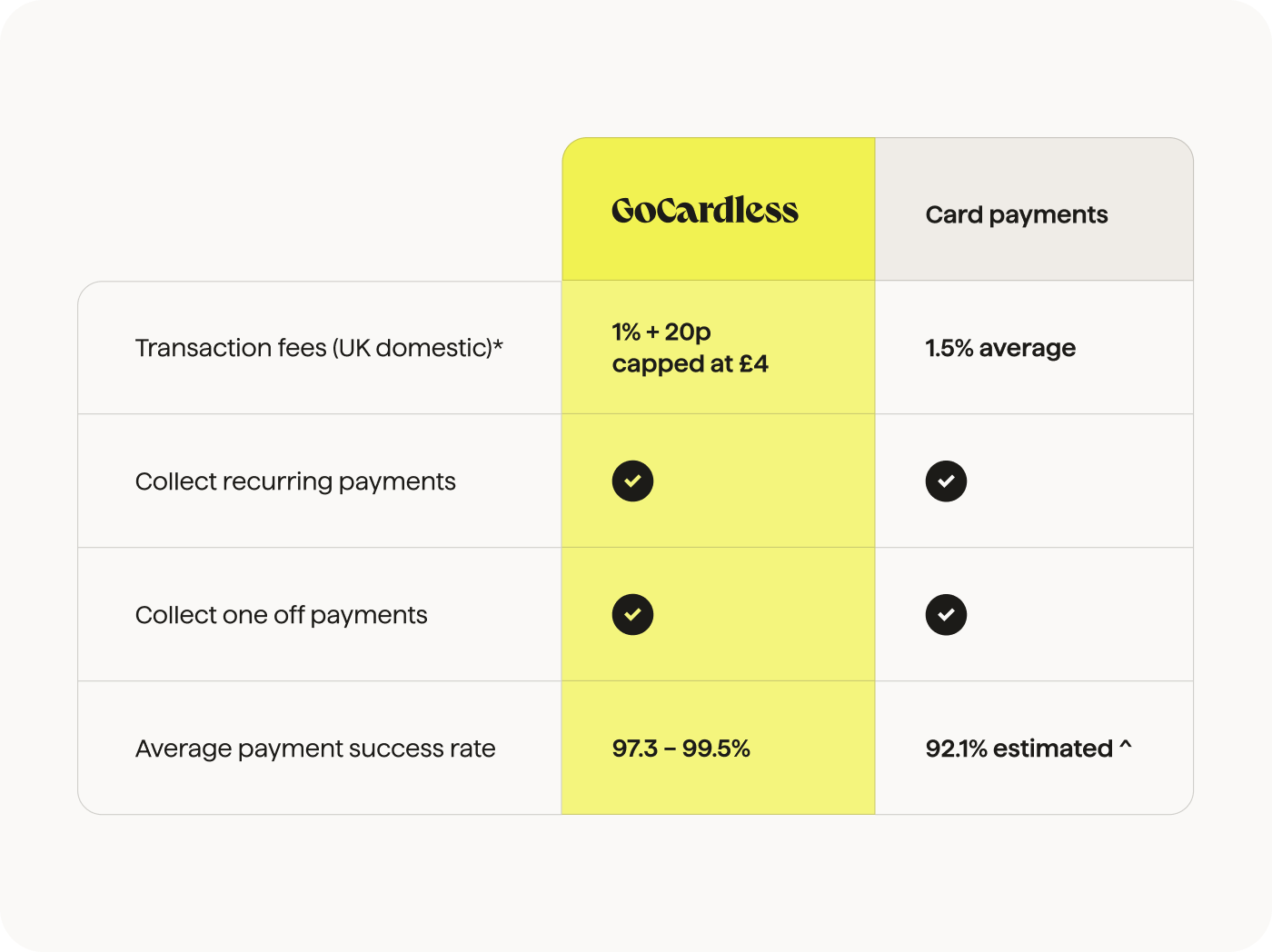

If you’re interested in finding out more about the instalment payment method and offering consumer credit to your customers, then get in touch with our financial experts. Discover how GoCardless can help you with ad hoc payments or recurring payments. How we compare against card payment:

* Pricing as of Aug 2025. Fees differ by provider. ^ Based on market research. Payment success rates vary.