Last editedSep 20255 min read

Payment gateways are not just a tool for processing payments but are critical components of the subscription business model, making collecting regular subscription payments, whether by credit or debit card, bank payment, or digital wallet, easy for businesses. The robust security measures incorporated into these gateways ensure secure data handling, mitigating fraud risks. Additionally, they assist in recurring payment management, refunds, and reporting, making them indispensable for subscription-based businesses.

A thriving subscription business is contingent on the reliability of recurring payments. This model of payments is seen in various industries, from streaming services such as Netflix to software subscription services and even in small local gyms. The essence of the recurring payment model is security and consistency, hinging on the reliability of the payment gateway in place.

Payment gateways provide versatility, establishing direct connections with banks and card companies and facilitating swift and seamless transaction processing. With many payment gateways available in the market, we guide you through the top five payment gateways for subscription businesses.

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily create payment links to collect one-off or recurring online payments, and share them with your customers.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

1. GoCardless

Designed specifically for businesses with recurring payment models, GoCardless is distinct from competing payment gateways as it is a global leader in bank payments. Providing multiple payment solutions that help businesses reduce the time and money costs associated with payment processing, GoCardless's comprehensive coverage of bank payments and its focus on fraud prevention makes it a true market leader.

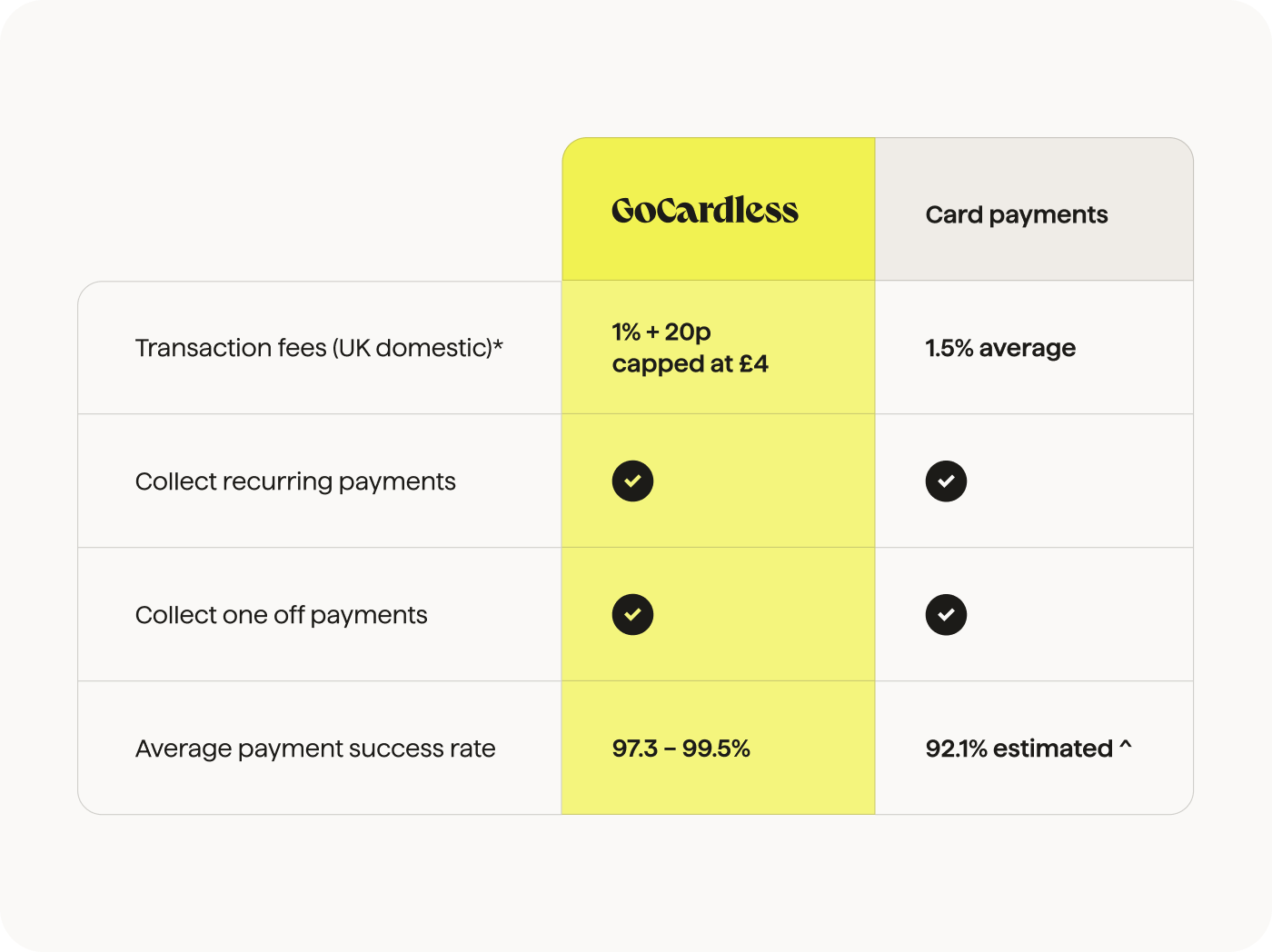

Bank payments hold an advantage over card payments as they enjoy higher success rates and lower fees, meaning you can collect more funds for lower costs and can automate a significant portion of your finance admin. Read more about GoCardless for subscription businesses.

GoCardless vs card payments

* Pricing as of Aug 2025. Fees differ by provider. ^ Based on market research. Payment success rates vary.

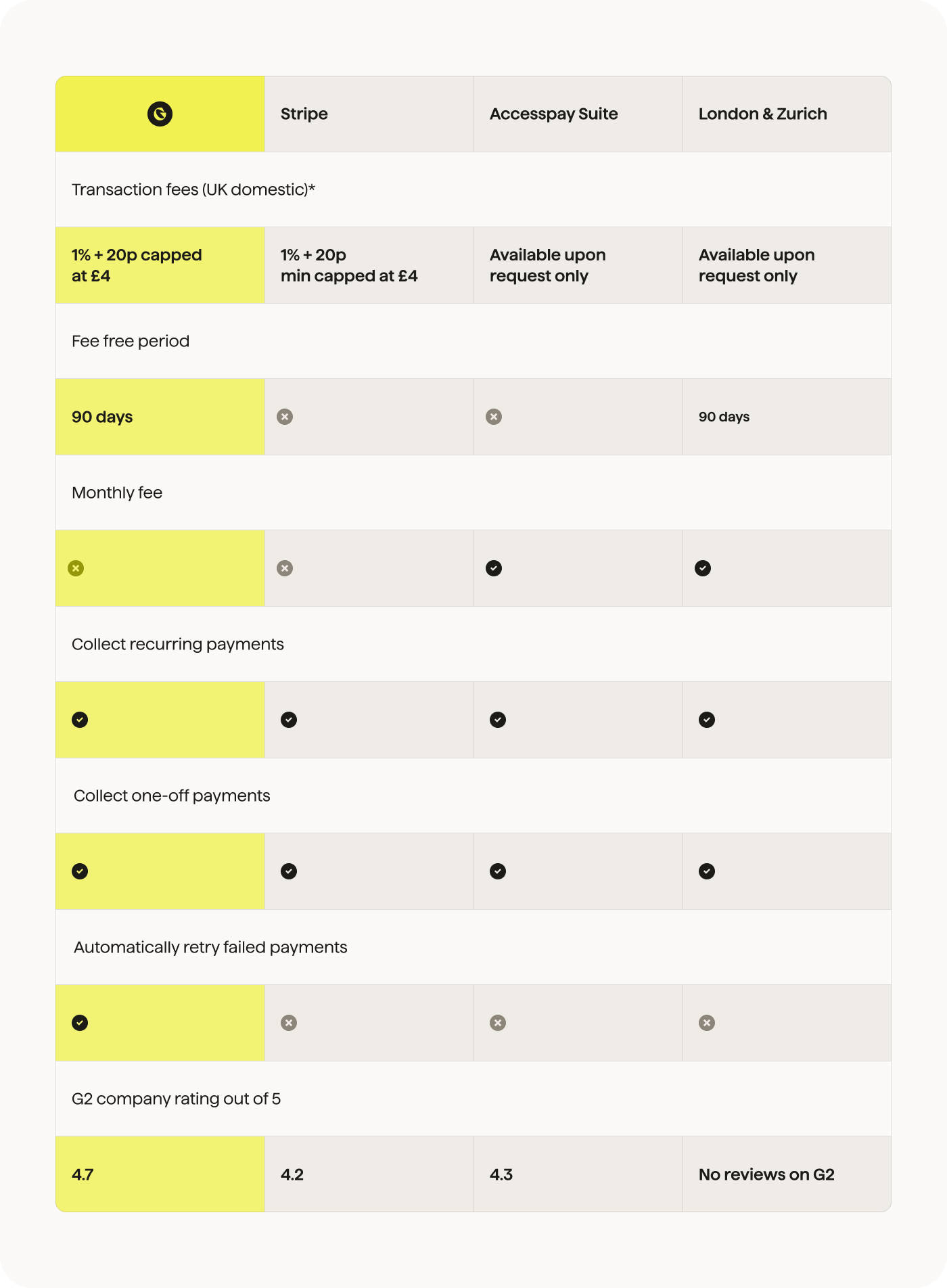

How we compare against others

* Pricing as of July 2025. Plans vary.

Cost-effective, secure and reliable subscription payment collection for SaaS businesses.

"For ongoing monthly payments it’s perfect. You can easily adjust the subscription amounts and don’t suffer from the problem of expired cards." - Charles Cridland, Technical Director, YourParkingSpace

2. Stripe

Stripe provides a comprehensive payment solution with various add-ons, making it an ideal choice for businesses that require card payments, such as retail, hospitality and e-com. Stripe primarily focuses on card-based transactions and is subject to the relatively high fees and failure rates associated with card payments.

3. Adyen

Adyen's end-to-end payment solution and its vast array of payment methods have made it a popular choice among SMEs. While robust as a payment gateway solution, its functionality in failure resolution can be limited. Therefore, Adyen might serve better as a complementary solution than an all-in-one solution for businesses with recurring payments.

4. Recurly

As an easy-to-set-up payment gateway, Recurly presents an excellent option for emerging businesses. With its integration capabilities with several other payment gateways and scaling fees in its subscription plans, Recurly becomes a feasible choice for businesses just starting out.

5. PayPal

PayPal's familiarity and ease of use make it a suitable option for businesses that want to offer a checkout experience that customers can use with their existing PayPal accounts. However, PayPal's higher fees and increased failure rate for recurring payments might not be the most reliable or cost-effective option for businesses focused on recurring payments.

Choosing a payment method

The choice of collecting via bank or card payments is crucial to the monetary and time costs of your payment collection process.

Accepting bank payments is more cost-effective than accepting card payments. This is because bank payments are direct account-to-account transfers between two banks, but card payments, by contrast, are routed through a network of intermediaries, each of which adds a fee to the cost of the transaction.

Credit and debit card payments have a high failure rate because they become lost, expire and even stolen, meaning they are cancelled and payments fail at around 10%. Bank accounts cannot be lost, stolen or expired and so GoCardless merchants enjoy a payment success rate of 97.3% on the first attempt.

Failed payments need to be chased and then manually reconciled, all of which adds to the manual administration required by you or your finance team. Furthermore, these failed payments often result in customer churn, as many failed payments are not recovered, and the customer’s subscription lapses, impacting your bottom line.

In summary, a payment gateway automating recurring payment collection is critical for subscription businesses. There are clearly advantages to collecting subscriptions via bank payments rather than card payments, including lower transaction fees, higher payment success rates, more automation and less manual admin.

Cost-effective, secure and reliable recurring payment collection for subscription businesses.

"For ongoing monthly payments it’s perfect. You can easily adjust the subscription amounts and don’t suffer from the problem of expired cards." - Charles Cridland, Technical Director, YourParkingSpace

Case study

In an effort to digitise its operations, UK health and fitness chain Lifestyle Fitness replaced its old, unresponsive card-based system with GoCardless, an advanced solution for collecting recurring and one-off payments.

Chris McQuillan, Commercial Manager of Lifestyle Fitness, commended the quality of GoCardless' technical support during the transition:

"The quality of the support we got from GoCardless was brilliant. Whenever a question arose about the integration, we were never stuck because we got the answers back very, very quickly."

GoCardless brought massive improvements in financial reporting for the company. McQuillan revealed,

"Our monthly accounts used to take three weeks to put together – now it’s about five days and the team can get an up-to-date picture of financial performance at any given time.”

Customer satisfaction and staff morale increased substantially, too. The system provided instant responses to customer payment queries, resulting in a happier customer and staff base. Chris noted,

“Since launching GoCardless, we haven’t had one negative piece of customer feedback about payments.”

Notably, GoCardless's Success+, a feature using payment intelligence data and machine learning to reduce failed payments, lifted the recovery of failed payments to around 71.6%. The feature automatically retries payments when customers are most likely to have funds in their accounts, easing the stress of failed payments.

As a testament to GoCardless' success, McQuillan said,

“GoCardless has gone from being the cherry on the cake of our digitalisation to the backbone of the business. GoCardless has been integrated into our systems in a way that I’d compare to a heart transplant for the value it has brought to the core of our business.”

Cost-effective, secure and reliable recurring payment collection for subscription businesses.

"For ongoing monthly payments it’s perfect. You can easily adjust the subscription amounts and don’t suffer from the problem of expired cards." - Charles Cridland, Technical Director, YourParkingSpace

We can help

Setting up recurring payments for subscription businesses is effortless and efficient with tools like GoCardless. By automating the payment collection process, GoCardless drastically cuts down the administrative responsibilities of managing and tracking payments.

GoCardless makes it quick and easy to get started, and with no contracts or long-term commitment required, there’s no risk. You can set up instant, one-off, or recurring payments in the merchant dashboard in just a few clicks, and GoCardless automatically creates and sends all the necessary forms, doing all the heavy lifting for you. You can also connect to GoCardless via over 350 partner apps, such as Xero and Quickbooks.

Discover how GoCardless can automate the collection of your subscriptions, making it easier for you to concentrate on what matters most - your business growth.”

Cost-effective, secure and reliable recurring payment collection for subscription businesses.

"For ongoing monthly payments it’s perfect. You can easily adjust the subscription amounts and don’t suffer from the problem of expired cards." - Charles Cridland, Technical Director, YourParkingSpace

Frequently asked questions

What does a payment gateway do?

A payment gateway is a digital conduit between a customer's financial institution or credit card company and a business's merchant account, enabling secure, swift, and efficient online transactions. Acting much like a physical point-of-sale terminal in a brick-and-mortar store, the payment gateway encrypts sensitive data like credit card numbers and authorisation codes, submits the transaction details to the card issuer, awaits approval, and ultimately facilitates the transfer of funds from the customer to the merchant. Crucially, for subscription businesses, many payment gateways also offer recurring billing functionality, an essential feature allowing automatic, scheduled charges consistent with the subscription model. Thus, a payment gateway not only ensures secure and reliable financial transactions but also simplifies and automates the billing process for businesses operating on a subscription basis.

What is an example of a payment gateway?

GoCardless is an excellent example of a payment gateway, a tool that facilitates online financial transactions. As a UK-based service, GoCardless is unique because it focuses on Direct Debit payments, providing a seamless way for businesses to collect recurring payments across multiple countries. It acts as an intermediary, securely handling customer data and transactions between the subscribing business and their bank. The robustness of its system means it can handle anything from subscription charges to one-off payments. Its user-friendly dashboard, extensive integrations, and automated payment features make GoCardless a popular choice for subscription businesses. This is crucial in today's digital economy, where smooth, reliable, and secure payment processing forms the backbone of successful subscription businesses.

Are payment gateways free?

While some payment gateways may offer free setup or initial trials, it is essential to understand that most payment gateway services operate on a fee-based model. Typically, these fees include transaction charges, either a fixed amount, a percentage of the transaction value, or a combination of both. Some providers may also charge monthly or annual service fees, termination fees, and other charges for additional services. Free payment gateways are rarely truly free in the long term, as they usually incorporate their costs within other charges or offer a basic level of service with premium features available at a cost. Therefore, when selecting a payment gateway for a subscription business, it's crucial to carefully evaluate the entire fee structure and consider how it fits into your overall business model.

Cost-effective, secure and reliable recurring payment collection for subscription businesses.

"For ongoing monthly payments it’s perfect. You can easily adjust the subscription amounts and don’t suffer from the problem of expired cards." - Charles Cridland, Technical Director, YourParkingSpace