Free invoice templates

Last editedApr 20232 min read

Example invoice templates to download for a limited company, a VAT-registered business and a sole trader.

Below you'll find three simple-to-use invoice templates that can be used to create professional-looking invoices in minutes - for limited companies, sole traders, and for VAT invoices.

How to create your invoice in minutes

Identify the appropriate invoice template below.

Click 'Download here' to open the editable PDF in your browser window (if this doesn't work in your browser, please try again using Google Chrome).

Click on the blue fields to edit, adding in the relevant invoice information.

When you're done, click the download button in the browser window to download the PDF to your computer.

Email the invoice PDF to your customer.

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily create payment links to collect one-off or recurring online payments, and share them with your customers.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

Invoice best practice features

The layout of an invoice often varies depending on the business issuing it.

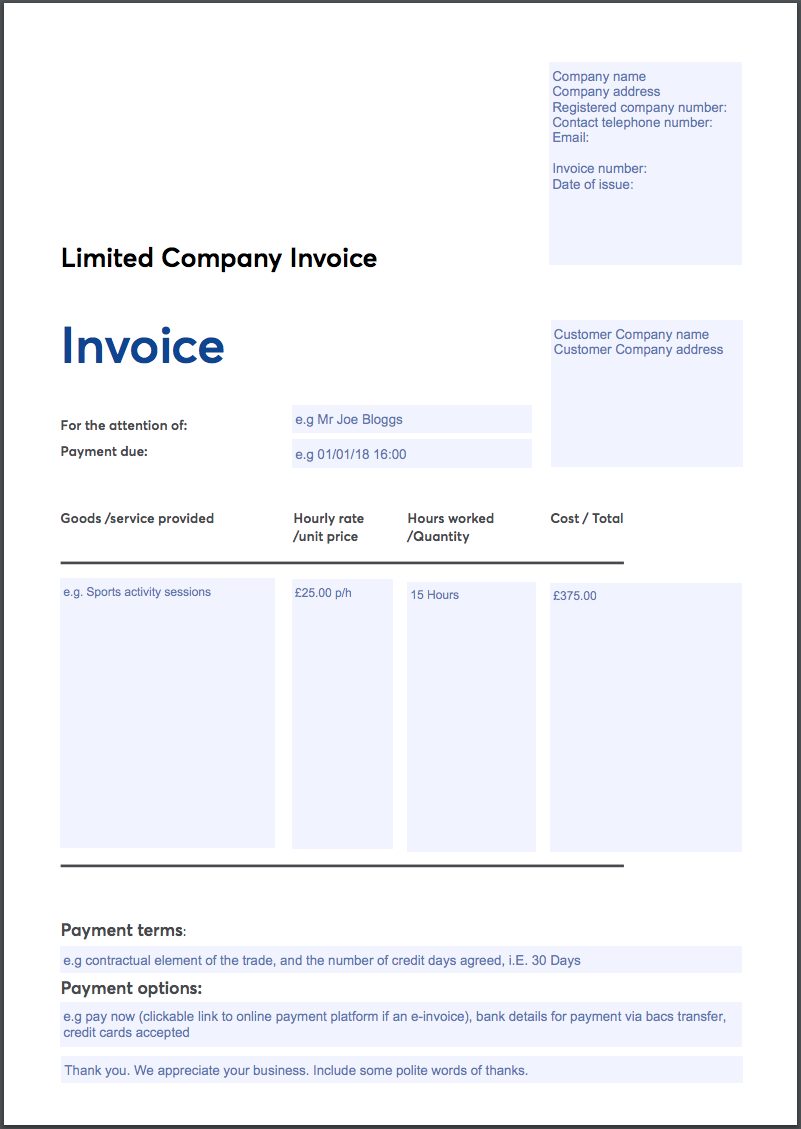

Limited company invoice

Below is a sample invoice template for a limited company.

Eliminate stressful & costly late payments with automated invoice collection. GoCardless is quick & easy to set up & gets your invoices paid on time, every time.

“Overdue invoices are virtually non-existent and that makes us happy!” - George Ford, Director, Veriphy

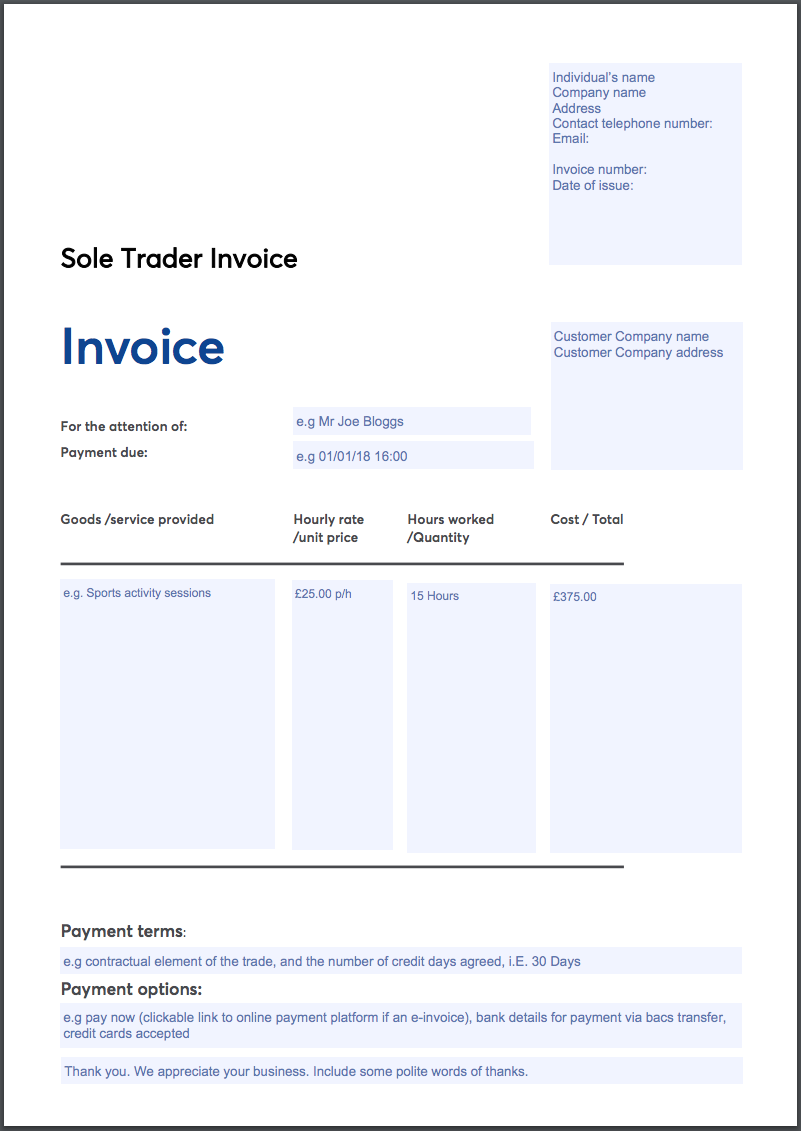

Sole trader invoice

The requirements for sole traders’ invoices are more straightforward, though they have many of the elements of a limited company invoice. Below is a sample invoice template for a sole trader.

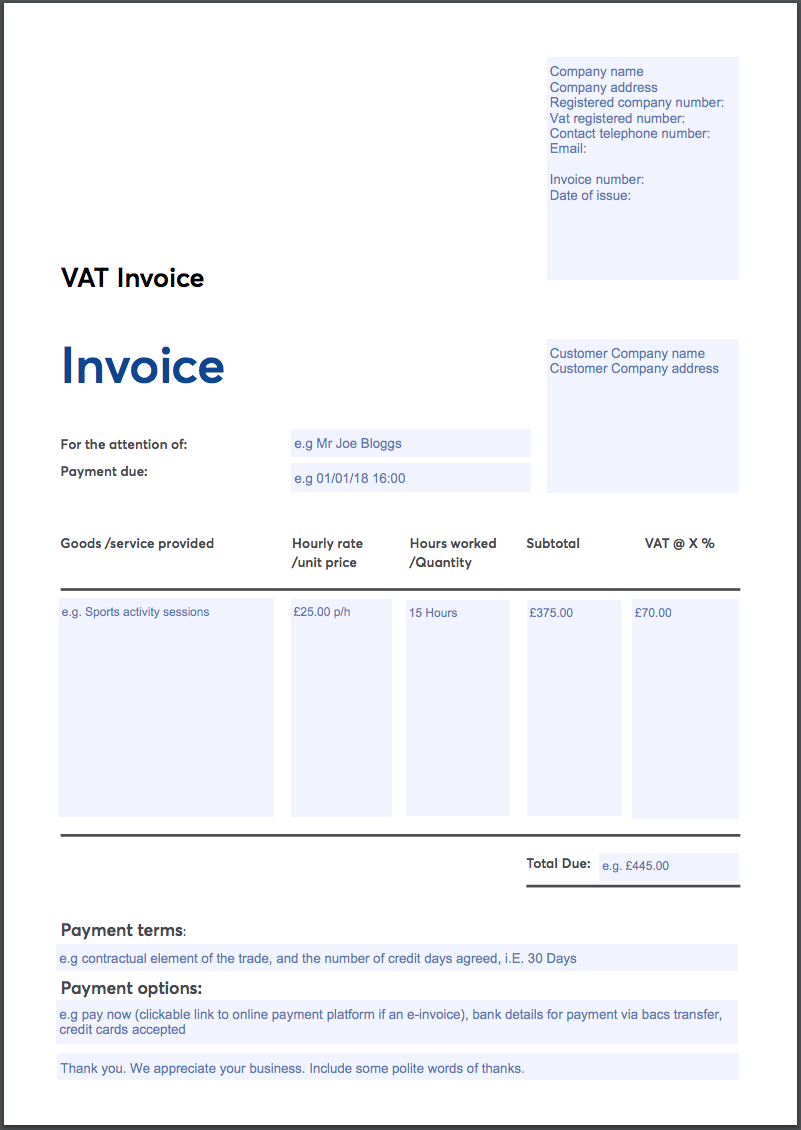

VAT invoice

Only VAT-registered businesses can issue VAT invoices, and this type of invoice must be used if you and your customer are registered for VAT with HMRC. Usually, VAT invoices should be raised within 30 days of the date of supply or the date of payment if the vendor was paid in advance. VAT invoices include more information than a standard invoice. Below is a sample invoice template for a VAT trader.

What are VAT invoice requirements?

Unique invoice number that follows on from the last invoice

Your business name and address

Your VAT number

Date

The tax point (or ‘time of supply’) if this is different from the invoice date

Customer’s name or trading name, and address

Description of the goods or services

Total amount excluding VAT

Total amount of VAT

Price per item, excluding VAT

Quantity of each type of item

Rate of any discount per item

Rate of VAT charged per item - if an item is exempt or zero-rated make clear no VAT on these items

These requirements may differ depending on the type of invoice you use.

(Source: gov.uk)

Invoice checklist

If you're not using a cloud accounting system or invoicing platform to produce your invoices for you, the following can guide you on how to write an invoice:

Create a new document in your word processing software

Type the word ‘Invoice’ in large text at the top

Add a unique invoice number or reference

Add your company's name, address, and contact details

Add the name and invoice address of the person or organisation you're invoicing

Write brief descriptions of the goods or services the invoice covers

Add the supply date of the goods or services

Add the date the invoice is being issued

Include the amount of money owed, detailing the VAT sum, if applicable, or any pre-agreed discounts, plus the overall total due

Add the invoice due date (deadline for payment to be made)

Export your document as a PDF

Send the invoice PDF to your customer's email address

Eliminate stressful & costly late payments with automated invoice collection. GoCardless is quick & easy to set up and gets your invoices paid on time, every time.

“Overdue invoices are virtually non-existent and that makes us happy!” - George Ford, Director, Veriphy

Interested in collecting payments by Direct Debit?

Find out if online Direct Debit is right for your business