Last editedJan 20265 min read

Direct Debit is a simple, secure and convenient ‘pull’ payment method that allows businesses and organisations to automatically collect recurring payments from a payer's bank account with their prior authorisation. Often used for bills, subscriptions, and memberships, Direct Debit streamlines the payment process by reducing the risk of late or missed payments, offering payers a hassle-free experience while providing businesses with improved cash flow and reduced administrative work.

6.78 billion Bacs payments were processed in the UK in 2023 (source), with 4.8 billion of those transactions Direct Debits across the following use cases:

Business-to-business collections

Subscriptions

Utilities and household bills

Insurance premiums

Other payment types

Contra (barter-based accounting)

Direct Debit is widely used in the UK:

80% of Brits have at least one Direct Debit

the average consumer has six Direct Debits set up

89% of payers trust bank payments more than other methods.

Despite this, many remain unsure what Direct Debit is or when it should be used. If you want to set up a regular payment, read this guide to find out what Direct Debit is and what it means for you.

What is a Direct Debit?

A Direct Debit is an instruction from you to your bank, authorising a business or organisation to collect payments from your account when they are due. You give this authorisation by completing a Direct Debit Mandate form – this can be a paper form or a web page that you complete online.

Once authorised, the organisation can automatically take payments from you based on a flexible but pre-agreed schedule. The Direct Debit scheme has strict rules to protect consumers from unauthorised payments through the Direct Debit Guarantee.

Direct Debit in other countries

Direct Debits are governed by rules established in each country and are generally limited to domestic transactions. One exception to this is the Single Euro Payments Area (SEPA), which allows for Euro-denominated cross-border (and domestic) Direct Debit payments since November 2010. This means that recurring payments can be taken internationally in Europe with ease.

SEPA Direct Debit

SEPA Direct Debit is a Europe-wide Direct Debit system that allows merchants to collect Euro-denominated payments from accounts in the 36 SEPA countries and associated territories.

SEPA Direct Debit is now available in all eurozone countries as well as non-eurozone SEPA countries. However, in these specific countries, all Euro-denominated payments must be collected via the SEPA payment scheme.

What can Direct Debit payments be used for?

Direct Debit can be used for most payments but below are some examples of where it's used most often:

Regular bills for variable amounts - With Direct Debit, you know all your important bills will be paid on time each month.

Fixed subscriptions or memberships - Direct Debit is the safest and easiest way to make recurring payments like magazine or gym subscriptions.

Paying on account – Some organisations will provide Direct Debit as an option for spreading your costs or paying on account.

Direct Debit can be used for one-off payments too

While Direct Debit is usually associated with regular and recurring payments, it can also be used for one-off payments. Direct Debit should not be used for one-off payments where instant funds transfer is needed, like e-commerce. However, if the organisation you're paying doesn't need the money immediately, Direct Debit can be a great option.

Direct Debit for business invoicing

Due to its flexibility, Direct Debit is also perfect for collecting on invoices, as its automated nature eliminates late payments entirely. GoCardless provides legal, technical and administrative compliance on behalf of our merchants to access the Direct Debit scheme. Merchants set up payments inside the online merchant dashboard by selecting amount, frequency and start/end date and authorisation forms are then sent to your customers.

Why choose Direct Debit Payments?

Direct Debit is trusted, well-known and can be used by all businesses in the UK.

Direct Debit offers payers a secure and convenient way to pay for goods and services.

For businesses, Direct Debit eliminates late payments and reduces manual admin.

Direct Debit offers all types of businesses flexibility and control over incoming payments.

For consumers Direct Debit offers convenience and control over outgoing payments.

Consumers are protected by the Direct Debit Guarantee, given advance notice of payments and can cancel at any time.

What are the important Direct Debit scheme rules that I should know?

Advance notice - You must be told the amount and date of each payment in advance.

Direct Debit guarantee - You are entitled to an immediate refund for any payments that shouldn’t have been taken.

It's important to familiarise yourself with the requirements of the Direct Debit scheme. Take a look at our blog posts linked here to get a more in-depth view of both advance notice and the Direct Debit guarantee.

Direct Debit is safe, convenient and cost-effective for customers

There are three benefits to making payments using Direct Debit:

Convenience - Payments are automatic, so bills are never forgotten, lost or delayed.

Cost - Businesses may offer incentives for paying by Direct Debit.

Customer Protection – Direct Debit is the safest payment method in the UK.

Getting paid shouldn't cost you time, money and stress!

That's why GoCardless automates payment collection to make it simple, affordable & hassle-free.

Direct Debit vs Standing Order

The differences between Direct Debits and standing orders are subtle, and many people confuse these two payment methods. However, it's essential to understand what they are, as they vary quite substantially in their pros and cons for payers.

We’ve set out a summary of these differences for you below:

| Standing Order | Direct Debit | |

|---|---|---|

| What is it? | An instruction to your bank to make payments to a person/organisation. | An authorisation for a person/organisation to take payments from your account when they are due. |

| What is it used for? | Regular, fixed payments like rent payments, monthly charity donations or regular payments into a savings account. | Regular payments of variable or fixed amounts like mortgage payments, utility bills or other bills based on usage. |

| How do you set one up? | You instruct your bank. You decide when and how much to pay, and tell your bank to do this. | You complete an instruction form then you won’t need to do anything else. |

| Customer protection | None. Once you pay, you can't get it back. | High. Immediate refunds from your bank in the event of an incorrect payment. |

Standing orders give you control. Direct Debit gives you flexibility and safety

Standing orders are suitable for regular payments of a fixed amount. However, standing orders are not the most practical option if you want to pay variable amounts or might need to change payment amounts.

Direct Debit lets you pay variable amounts or at varying intervals without needing to do anything more. This makes it great for paying bills where you are charged depending on what you have spent that month.

Direct Debit is the safest way to make payments in the UK. The Direct Debit Guarantee gives you a right to immediate refunds for any payments which shouldn't have been taken. Find out more about security with GoCardless.

Direct Debit and GoCardless

GoCardless is the UK’s leading Direct Debit provider and is used by over 70,000 small businesses and organisations, including Docusign and The Guardian.

Once authorised Direct Debit allows businesses to collect automated payments on specified dates without the business or the customer needing to take further action.

Automated payment collection eliminates a number of the issues that plague small businesses:

the problem of late payments that comes with manual invoicing,

the problem of failed payments from lost or expired credit and debit cards,

the time-consuming manual admin that comes with late and failed payments.

Therefore switching to collecting payments via Direct Debit with GoCardless will:

eliminate late payments

reduce the number of failed payments

save you time on manual payment admin

improve cash flow for the business

reduce stress for the owner and finance manager

For customers:

it’s easy and convenient

they’ll be automatically notified of upcoming payments

they can cancel them whenever they want.

The Direct Debit Guarantee makes this the safest way to pay.

GoCardless makes it easy to collect Direct Debit payments on your Xero invoices. Automate Direct Debit payment collection. Reduce manual admin. Get paid on time, every time

How to use GoCardless

GoCardless merchants can set up payments and automatically send authorisation forms using the online merchant dashboard in just a few clicks. It is quick and easy to use and offers visibility on payment status. Once your customer has given authorisation, payments will begin on the date you specified and will be automatically taken on the schedule set by you.

GoCardless can also easily integrate with over 350 software packages, including all major accounting software such as Xero and QuickBooks, allowing merchants to set up Direct Debit payments from inside their software of choice.

The GoCardless API can also be used to build an integration with your current payment stack.

To learn about the basics from a business perspective, try our overview of Direct Debit for small business.

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

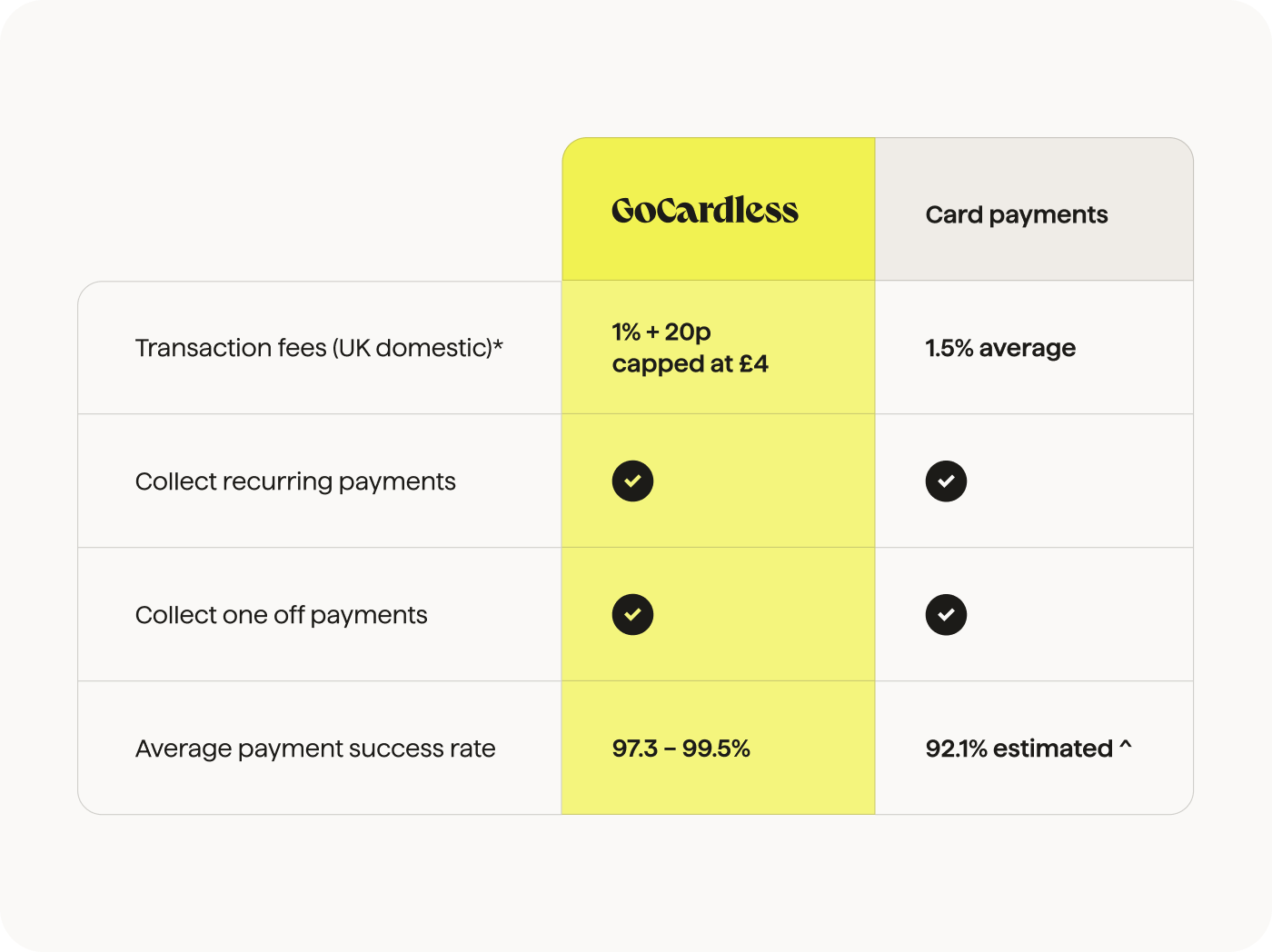

* Pricing as of Aug 2025. Fees differ by provider. ^ Based on market research. Payment success rates vary.

Bike Club saves with Direct Debit powered by GoCardless

Bike Club is a pay-monthly service that rents bikes to families meaning they never have to buy a kid’s bike again. Direct Debit was the obvious choice for such a large volume of payments because it can be automated and needs little manual input once set up. GoCardless made it easy for Bike Club, as CEO James Symes explains:

“We knew that to make this work we had to have the least hassle, least admin payment solution – for both us and customers. A mainstream bank pitched its Direct Debit payment system, but GoCardless won hands down. It was cheaper, easy to use and plugin, and super easy to build into our customer journey.”

Today, Bike Club’s customer base is larger and growing, and the majority pay via GoCardless, generating significant savings.

We're collecting tens of thousands of payments a month and 90% of our revenue goes through GoCardless saving us about three FTE (full-time employees) per year, which equates to around £100,000 worth of overhead. It's been really, really valuable for our business – if we don't have GoCardless, we barely have a business.

Bike Club have been able to further reduce manual payment admin via GoCardless’ intelligent retry product, Success+, James notes,

In consumer finance, you have customers who are going to pay you all the time, on time, people who are struggling perhaps with a life event, or fraud. The intelligent retries in Success+ allow people who have missed a payment to catch up naturally, while the solution’s data allows us to identify the ones who might be struggling so we can proactively help them get to the right place.

He continues:

In the past 18 months, Success+ has helped us recover nearly £200,000 worth of revenue. Meanwhile, the clever use of machine learning means our payments team isn’t burdened with worrying about every failed payment. Instead, they can focus on helping customers who are actually struggling. That’s also allowed us to make huge savings on finance and admin costs.