Introduction to Direct Debit Mandates

Last editedJun 20221 min read

An introduction to Direct Debit mandates explaining what they are, what they look like and how you can set one up.

What is a Direct Debit mandate?

To collect Direct Debit payments you need to set up a Mandate. This is an authorisation from your customer to collect future payments from them when they are due. It is also called a “Direct Debit Instruction”.

Accept Direct Debit payments for your business with GoCardless

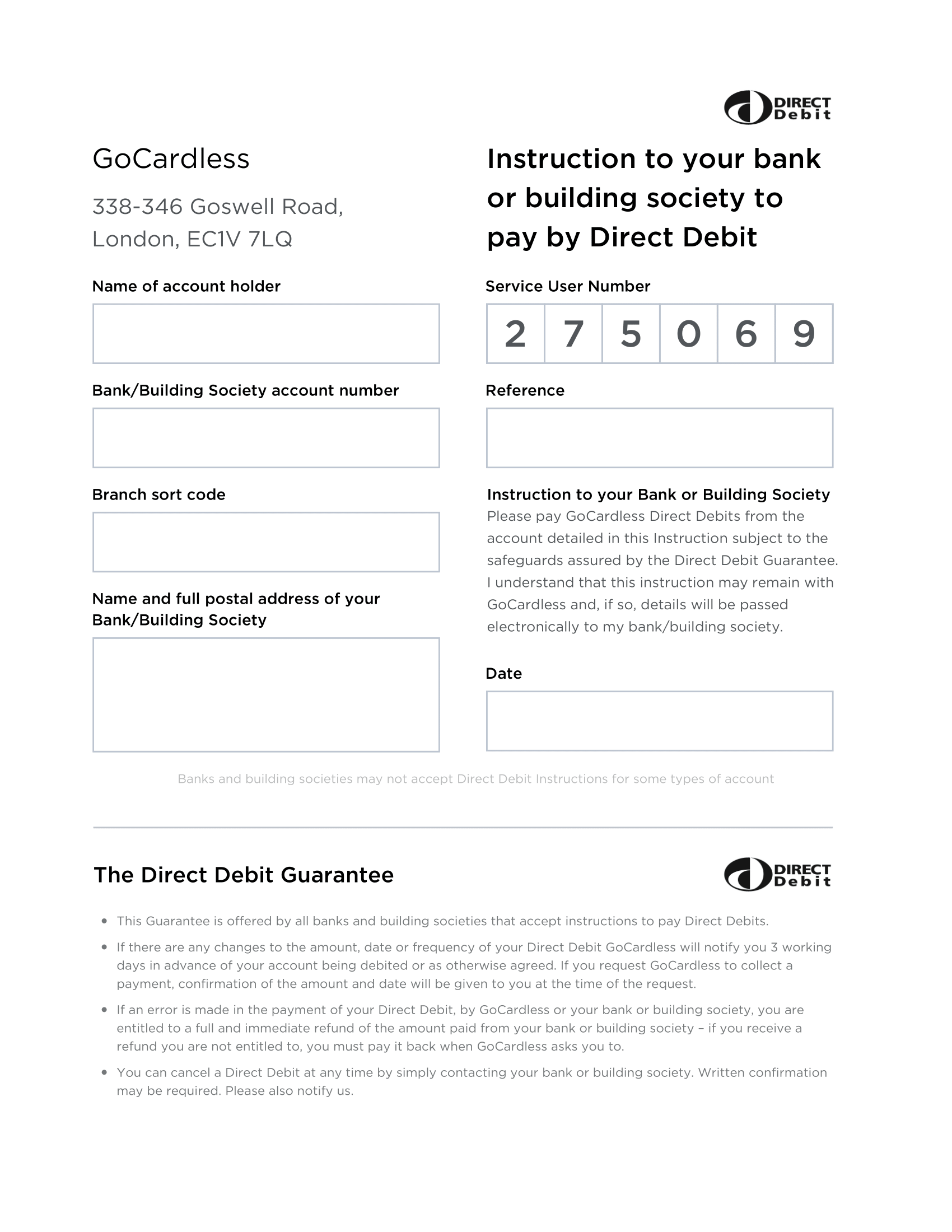

What a Direct Debit mandate looks like:

How can I set up a Direct Debit mandate?

1. Prepare a mandate form and give it to your customer

To set up a Direct Debit mandate, your customer will need to complete a mandate form. The three most common ways to do so are:

Paper - A paper Direct Debit Instruction form can be completed by your customer and returned to you.

Telephone - Your customer's details can be collected over the phone, using a bank-approved script.

Online - An electronic mandate form can be completed by your customer.

2. Customers complete, sign and return the mandate

GoCardless makes it easy for you to set up a mandate with:

Your own branded payment page - This payment page is a securely hosted online form that you can brand.

A link that you can easily share via email or from your website - You can send the link to the payment page to your customers via email or embed it into your own website. Customers can then complete the form online in seconds.

3. Submit the completed mandate to the bank

The mandate will become active within a couple of working days.

GoCardless submits any mandates on your behalf. You just need to tell us when you want to collect by. To find out about how this differs for banks and bureaus check out our 60 second guide to accessing the DD scheme.