Last editedDec 20252 min read

Even minor delays in invoice payments can clog up your business’s cash flow, making it difficult to pay your own suppliers on time. Overdue invoices can also make relationships with customers awkward with the consistent need to send a request for payment. Payment request links make it easy for customers to pay you with a single click, combatting these issues. Here’s how to automate payment collection using payment requests.

What is a request for payment?

In the general sense, a request for payment refers to any communication sent out to customers asking for them to pay for goods and services. Payment requests are often sent in the form of clickable links over email, SMS text, or chat service. They might take the form of a URL or QR code embedded into the communication method of your choice. When the customer clicks the link or scans the code, they’re redirected to a checkout page with instructions for payment. It takes all the guesswork out of payment for both you and your customers. There’s only a single step to follow and the customer is presented both with the correct amount owed as well as accepted payment methods.

How does Request to Pay work?

Another example of a payment request is the UK’s Request to Pay messaging service. Designed to work with your existing payments infrastructure, it gives merchants the option to send a request for payment to customers. Customers can then choose to pay the full bill, pay a partial amount, or send communication to the seller.

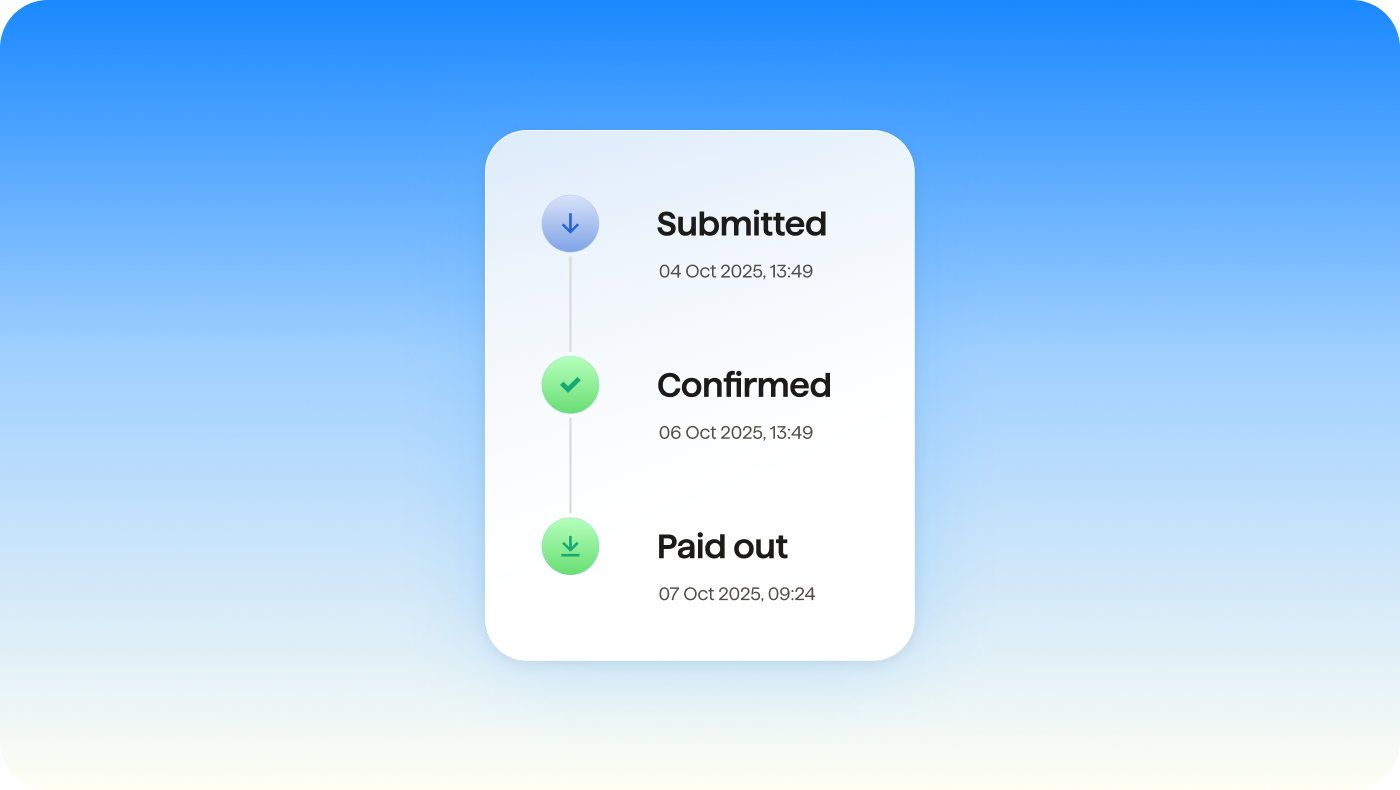

Request to Pay settles payments in real-time. The seller sends their request to the customer, who receives it through a third-party fintech app or banking app. They can then take action to pay, decline, or delay payment using the same app. The payment’s pushed through to the seller accordingly.

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily create payment links to collect one-off or recurring online payments, and share them with your customers.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

What should be included in a payment request email?

While the Request to Pay service uses mobile apps to ask for payment, many businesses will send a payment request link inside of an email. These can be sent in advance of invoices or as an automated follow-up. While you don’t need to include all the same technical details that would be listed on an invoice, there should still be some reference to the goods or services provided. Be polite, professional, and brief to ensure a response to your payment request email.

What are the benefits of using payment request links?

No matter how it’s sent, there are multiple benefits to using payment links.

Faster payment: Clients can pay you with fewer steps, making this a more convenient alternative to lengthy checkout forms or traditional invoicing.

Automated reminders: You can set up automatic reminders to be sent out at regular intervals to customers, reminding them of the amount owed and accepted payment methods.

Payment preferences: Paylinks work with a variety of payment methods, letting customers choose their preferred option. While payment requests were typically used for credit card payments, customers can also choose from options like bank-to-bank payments and in-app payments.

Multi-currency payments: Many payment request services enable international payments by using links to processors that facilitate currency exchange. The customer pays in their local currency, and you receive payment in your own currency.

Tips for getting paid on time

Payment request links are increasingly popular for their convenience and efficiency. GoCardless allows merchants to request one-off payments by link using Instant Bank Pay. This service is powered by open banking, with the customer simply clicking on the link provided to make an instant bank-to-bank payment. We also facilitate recurring payment requests using Direct Debit and integrate with over 350 systems. This makes it easy to work GoCardless bank payments directly into your existing invoicing system.

In addition to using payment request links like those mentioned above, here are a few additional strategies for on-time payments.

Keep accurate records and receipts using accounting software

Write a contract before work begins

Ask for a deposit for work paid in advance

Use a reliable payment processor that integrates with your systems

With the latest banking tools, you can improve cash flow and ensure a steady stream of timely payments as you grow your business.

We can help

GoCardless is a global payments solution that helps you automate payment collection, cutting down on the amount of financial admin your team needs to deal with. Find out how GoCardless can help you with one-off or recurring payments.