Payments explained: Your 101 guide to taking payments

Last editedApr 20255 min read

Once your business is up and running, it’s essential to look at ways that you can minimise manual tasks and admin, and maximise your return from every sale. How your business is taking payments, both online and in-person, and the payment platforms you use to manage them can have a big impact on the rest of your business. Failing to do due diligence to understand what suits your business model and customer base best can result in late or failed payments, extra admin and resources to manage, and even create friction with customers. This guide explains the foundations of taking payments, comparing payment methods, payment gateways and processors, and explains the key factors you need to review.

The different payment methods you can use for taking payments

Let’s go back to the start. There are several common payment methods available to choose from when taking payments.

Cash and cheques

Since the start of the pandemic, the UK has had a significant shift towards digital payments, with cash usage halving and cheque usage dropping by more than two-thirds. Despite this, a recent GoCardless survey, conducted through the Federation of Small Businesses (FSB), found that small businesses in the UK are still using both in their payment mix - with 34% still taking cash payments and a further 28% accepting cheques.

Credit and debit cards

Card payments filled the gap that cash and cheques previously occupied, with 163.4 million debit and credit cards in circulation across the UK by the end of 2024. Whilst cards can be easily used for in-person and online purchases, offering convenience to payers, taking credit card payments can come with a variety of drawbacks for businesses. These include an extensive list of add-on fees, including merchant service fees, authorisation fees, gateway fees and even terminal charges for point of sale transactions.

E-wallets

When it comes to taking mobile payments, e-wallets like Apple Pay or Google Pay can be great. If a payer has their e-wallet set up, then they can use it for both online purchases that are made on a phone or tapped at a point of sale terminal in person. The downside is that adoption is predominantly amongst younger generations and is more desirable in a select number of use cases. For example, an e-wallet can be used on a desktop or laptop to pay an invoice with a payment link attached, but it will still require authentication and verification steps even if the payer is logged in or using a compatible device. This can create a poor customer payment experience, and is one of the contributing factors to e-wallet users having an average churn rate of 16%.

Manual bank transfers

Bank payments are the most trusted payment method in the world, but there are multiple types of bank payments. Manual bank transfers are considered a ‘push payment’ as they rely on the payer remembering to log into their banking app, enter the right details and total amount, and hit send - pushing the payment into a business’s bank account. This leaves businesses with little control over the payment process, making cash flow hard to predict.

Automated bank payments

An alternative way of taking bank payments is to use automated bank payments, such as Direct Debit. Unlike manual transfers, Direct Debit is a ‘pull payment’ as the payer pre-authorises a business to pull money out of their bank account on a specific date and frequency. This gives businesses greater control and it can be included as part of an online checkout in the same way as other payment methods, which makes it easy to use for businesses taking online payments. Plus, advances in AI and banking technology mean that there are accessible ways to intelligently retry failed banking payments. For example, GoCardless offers Success+, which automatically retries a failed payment up to three times to reduce manual chasing and increase success rates without added friction.

How to choose which payment method to use for taking payments

We’ve created a full guide that details all of the pros and cons of each payment method, but to help keep it simple, think of the following:

You can use multiple payment methods - there isn’t always one way to collect payments that suits your whole customer base. And that’s ok!

Do you have customers who have subscriptions, repeat orders or rolling memberships? If so, choosing a payment method you can automate will save you time and make it easier for your customers.

Does the way you take payments set you up to grow? If you’re using payment methods that require manual admin, lots of manual inputting into software or sheets, and need to be constantly checked to make sure they’ve been processed, that time and effort will only grow with you and become harder to manage.

Choosing the right payment processor and payment gateway for taking payments

Now you’ve decided which ways you want to take payments, you need to decide on payment processors and gateways. Payment processing solutions and payment gateway solutions are both essential when taking online payments, but they don’t do the same thing.

Payment Gateway:

The payment gateway acts as a bridge, collecting and encrypting customer payment information (like bank account details) and then sending it to the payment processor. It's the payer-facing part that your customers interact with in the checkout experience, allowing them to enter their payment information securely.

Payment Processor:

The payment processor's role is to verify the transaction, authorise it, and then facilitate the actual transfer of funds from the customer's bank to yours. It also handles tasks like managing refunds or payment disputes.

If you’re thinking ‘how do I set up a payment gateway? What’s the best approach to choosing a payment processor?’ Don’t worry! We’ve highlighted a few key details to help you.

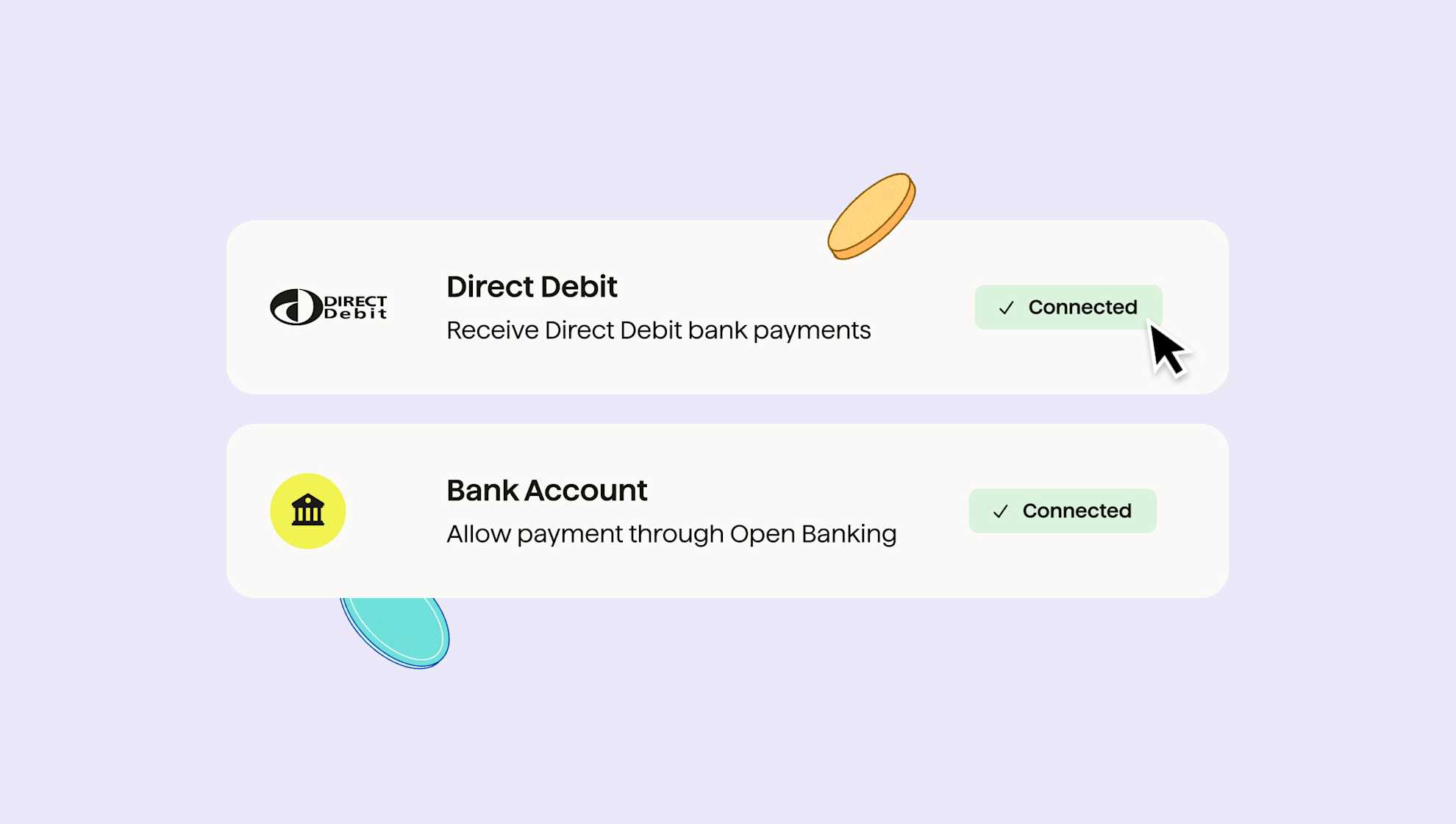

There are payment platforms out there that act as both payment processors and payment gateways. This means you can have all the functionality you need in one place. Examples include GoCardless, Stripe, PayPal, Adyen and WorldPay.

Check which payment methods a payment platform offers you. Some may only support card payments, others bank payments, and what you need will vary depending on whether you’re taking digital payments, mobile payments, or payments in-store at the point of sale.

Use platforms that offer a wide range of easy integrations. GoCardless has over 350+ integrations, from accounting software to CRMs (customer relationship management platforms). If you’re using multiple software tools to manage orders, consider how you could streamline the end-to-end management of your sales and payments by integrating everything into one login.

Prioritise payment security. Compliance in payment processing is really important, as taking payments isn’t just about moving money; it’s about making sure both the payer and your business's payment details are kept safe. To make sure you’re taking payments securely, you should make sure you only use a provider that’s level one compliant with the Payment Card Industry Data Security Standard (PCI DSS) and that offers built-in security capabilities (such as tokenization).

Consider your customer payment experience. You want to keep your checkout as easy as possible, minimising the number of steps your customers have to take to complete a purchase. That’s why it’s important to use a payment provider that only requires essential details and doesn’t ask your customers for pages of fields to fill out.

Payment acceptance rates - but this one is so important that we’re going to go into a bit more detail on it.

Payment acceptance strategies when taking payments

The final part to understanding the basics of taking payments is acceptance rates. Your payment acceptance rate is the percentage of transactions that are successful out of all payments you attempt to collect. It’s an important metric as it can indicate that a payment method or provider isn’t suitable for your business, it can also help highlight fraud or where you’re spending most of your time and resources.

Common factors that can impact your payment acceptance rates are:

Lack of funds in a customer's account

Incorrect or expired details are input by the customer, causing it to decline

Technical issues. Some payment methods use several intermediaries to move and send money, which can increase the chance of one of them failing or having an outage

Verification failure when a customer fails to pass two-step authentication or use matching security details

Poor customer payment experience caused by a complicated or long checkout, resulting in abandoned orders and potentially churn

Both the payment methods and the payment providers you select can influence your payment acceptance rate. For example, card payments have an average failure rate of 10-15%, compared to around just 2% of GoCardless Direct Debit, and failed payments have a direct correlation to customer churn. In addition to a 10-15% failure rate, cards also have an 11-15% customer churn rate. That’s customers and money lost just because of the payment method.

Summary: Optimising taking payments

To make sure the way your business is taking payments minimises overhead costs and creates room for scaling, just remember three key things.

Make sure the way you collect payments suits your business and your customer needs, with low manual admin and high success rates. And remember, you can use more than one payment method

Choose a payment provider that can be your payment gateway and payment processor, combining as many elements as possible in one place to cut admin, costs and to streamline processes

Payment acceptance rates are influenced by how you’re taking payments and who you use to help move the money - think of expiry, fraud and ease of use for your customers