The GoCardless guide to: Optimising your payment mix with customer campaigns

Last editedOct 20217 min read

What are targeted campaigns, and why should I use these to encourage my customers to move to bank debit?

If you’re looking to increase the number of existing customers who pay you by bank debit (often referred to as Direct Debit in the UK), then a targeted campaign could be a good option.

Targeted campaigns are a way of communicating with a specific group of customers to encourage them to complete a certain action. Running a targeted campaign allows you to create a far more personalised message, concentrated to a particular group of your customers, which should ultimately mean that you receive a higher response or completion rate.

In this guide, we’ll provide some principles for creating one or multiple campaigns that are aimed at specific types of customers, with the aim of persuading as many of them as possible to switch to bank debit from their existing payment method.

6 principles to consider when creating your targeted campaign

Segment your customers

Articulate the benefits

Make it (super) easy to switch

Think carefully about timing

Use the best channel for your customers

Track what matters

Segment your customers according to common payment characteristics

When running your campaign, you will need to think carefully about who the campaign will target. We’d recommend segmenting your existing payers into buckets similar to the ones below, as this means that you’ll be able to:

easily adapt your campaign messaging to achieve maximum impact; and

focus on the customers who are most likely to respond

Top tip: Whilst we suggest the following groups into which you can segment your customers, you may wish to explore other options, depending on your business. You may want to think about how your customers currently pay you, where in the world they’re based and how long they have been a customer with you. The key is to ask, how can I segment my customers to target them in the most effective way?

To get you started, here are a few common payer segments:

‘High-friction payers’

The dominant characteristic which groups these payers together is the shared experience of a one-off or repeated point of friction with their recurring payment. As such, they may be more willing to switch payment methods to avoid friction in the future, which can be highlighted to them in your messaging.

How to identify these payers:

Any customers with a history of overdue invoices or customers that you regularly need to chase for payment

Any customers who experience failed or bounced payments

Any customers with payment card details expiring in the near future or who have recently had to update their card details

‘Early adopters’

While this segment of payers hasn’t necessarily experienced any friction with their current payment method, they’re often your most engaged set of customers across all campaign types. Characterised by an openness to change as well as being tech-savvy, they’re more likely to connect with your message and respond to a compelling call to action.

How to identify:

Any customers that consistently engage with social media material or respond to marketing surveys

Any customers that sign up for new product features, or are listed as beta testers

Any customer who accesses your product in the most ‘up-to-date’ method, ie. using an app over a browser, or using the latest version

Any customers who, when given a choice, that prefer in-product or email notifications (over post and/or phone)

‘Steady regulars’

This group will generally be made up of your longer-standing customers, who pay regularly and on time, with minimal payment friction, making them the hardest segment to convince to switch. If your customers have been using the same payment method for a long time, they may need more persuasion to move to bank debit, as this will be a bigger change.

We’d recommend sending a campaign to this group first, but, as this will likely be your hardest segment of customers to persuade, you could later look to explore offering incentives.

How to identify:

These customers will generally pay regular amounts with very few (if any) points of friction with their recurring payments in the past

These customers will generally pay by traditional recurring payment methods, such as credit cards, bank transfer or standing order

They will likely have been a customer of yours for a while and be familiar with your product and communication

Top tip: bank debit generally isn’t suited for collecting high value (£5000+) amounts, so if you do have customers from whom you collect these values, consider excluding them from your campaigns.

Articulate the benefits to your customers depending on what they care about

Once you’ve identified who you will be sending your targeted campaign(s) to, you should think about how you will articulate the benefits of bank debit to your customers, in order to encourage them to switch.

Our research has shown that 37% of consumer payers choose bank debit over other methods due to providing peace of mind and 24% of business payers choose bank debit because it saves them time and/or money.

You can use the table below to identify the message(s) that we will be most useful to the customers that you plan to target. We’ve also included email templates for you to use in the appendix of this guide.

| Why would customers want to switch? | Specific benefits | How can I explain this to my customer? |

|---|---|---|

| Saves time/money | Set and forget | "Once you set up the initial bank debit mandate, payments are taken automatically on the invoice due date. There’s no need to set up reminders." |

| No updating payment details | "You won’t need to update your payment details when your card details expire - bank debit is linked directly to your bank account." | |

| Flexibility | "Even if you’re paying a different amount each month, there’s no need to change this. Bank debit can handle this, with no manual action needed from you." | |

| Lower cost | "Bank debit is a cheaper and more efficient payment method for us, which will help to keep our costs down." | |

| Peace of mind | No accidental late payments | "Payments are collected automatically and on time, so you won’t get chased for payments and there’s no risk of late payment fees." |

| You're protected and in control | "You’ll receive notifications of payment before funds are taken and under the bank debit protection schemes, you’re guaranteed a refund if any payment is taken in error." | |

| A trusted method | "GoCardless is an approved bank debit provider, who work with over 50,000 businesses across the globe, including Sage, TripAdvisor and Les Mills. It offers a very high level of protection to consumers compared to other payment methods such as standing order or cheque." |

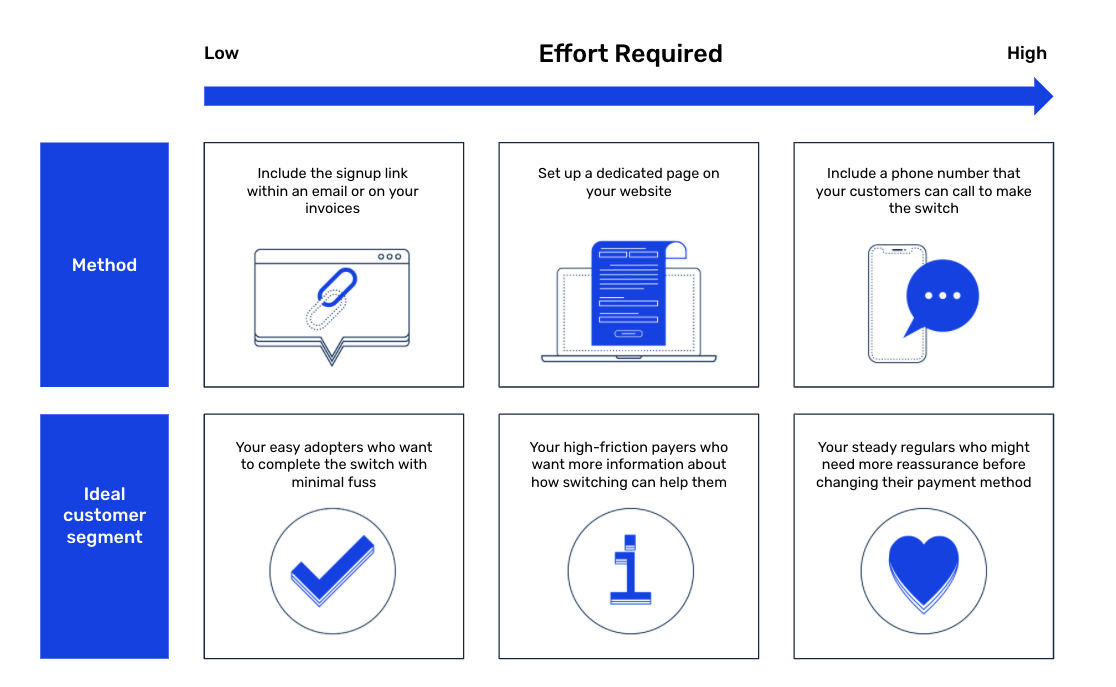

Make it (super) easy for your customers to switch

When you’re running a campaign, you need to make it as easy as possible for your customers to switch, so that once they make the decision to move to bank debit, they can complete this straightaway. There are a few ways that you can achieve this:

When should you run customer campaigns?

There are certain events or times when it makes more sense for your customers to make a change to their payment method. We have divided these into three potential event types:

Seasonal events - relates to a particular time of the month or year

Business events - relates to a company action or initiative

Customer events - relates to any customer-led activities

Think about triggering your campaign based on or around a specific event - we’ve added some suggestions below:

The start of a new tax year

Category: Seasonal

Why it matters: Most businesses will already be looking at their finances and completing payment admin around this time, so switching payment method could be another task that fits in with their current to-do list.

The start of a new calendar year

Category: Seasonal

Why it matters: Many customers will be looking to make improvements to the way they budget or spend their time at the start of the year, so, coupled with an incentive, a switch to bank debit may be more attractive to them right now.

When your business implements a pricing change

Category: Business

Why it matters: If your business is increasing its prices, you can frame bank debit as one of the methods you’re using to try and keep costs down for the future, to reassure your customers.

Your customer’s renewal or end of contract/subscription date

Category: Customer

Why it matters: You will likely already be in touch with your customers at the time of their renewal date, so you could combine offering an incentive with the communications that they will already be receiving.

During a package or service upgrade/downgrade

Category: Customer

Why it matters: Again, you will likely be in touch with your customer already around this time, so take the opportunity to highlight the benefits of changing to a different payment method and offer an incentive for switching.

During a payment event, e.g:

Credit/debit card details expiring or about to expire

A payment fails

Invoice due date is missed

Category: Customer

Why it matters: When anything goes wrong (or could go wrong) with a payment, it’s a good opportunity to get ahead of this and offer your customers an alternative, which will help to relieve some of the payment anxiety or stress they may be feeling.

During ad-hoc service events, e.g. if the customer contacts your customer service team

Category: Customer

Why it matters: If your customer is already in touch with you to discuss an issue or query, you can advise your Customer or Sales teams to offer the incentive for switching in addition to a resolution.

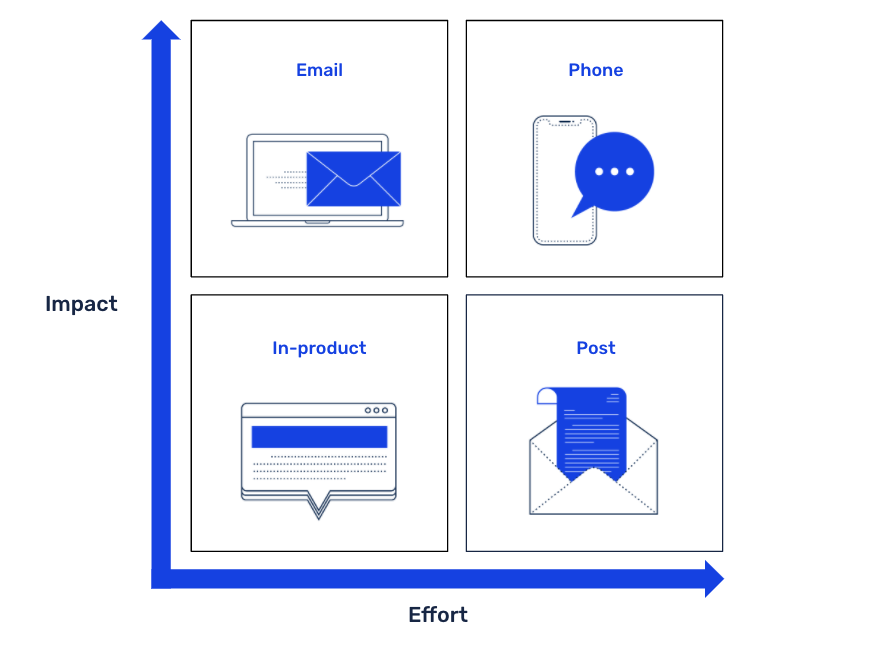

Use the best channel for your customers, so they’re more likely to engage

There are multiple methods of sending a targeted campaign, with benefits to each. Ultimately, you need to make sure that you communicate with your customers in a way that’s not surprising, or intrusive to them.

| Channel | Explanation |

|---|---|

| Phone | Customers who are less comfortable with new payment methods may respond better to a targeted phone campaign, which will allow them to ask questions and alleviate any doubts they may have. |

| In-product | If your customers are able to login to your app or website, you could consider creating popup notifications to highlight the benefits of switching to bank debit, with additional links provided if they wish to learn more. |

| Post | If you already send content to your customers via physical post, then you could easily look to incorporate your targeted campaign messaging. Remember to make it super clear to your customers on how they should make the switch. |

| This is by far the quickest and easiest way to send a campaign to a large group of customers. You can tailor the messaging depending on how you have segmented them. |

Top tip: If someone within your organisation already manages the customer relationship - for example, a customer success manager or account manager - ask them to call or email the client as part of the campaign. Your customer is more likely to switch if the advice comes from someone they trust.

Track the outcomes of your campaign to maximise success

It’s critical that you remember to track the success of your campaign, by recording how many of your customers that you contact go on to switch to bank debit. By doing this, you:

Have the visibility to follow up effectively with customers that don’t switch on the first attempt - for example, you can send a reminder via email, or arrange a proactive phone call

Can identify the aspects that resonate most strongly with your customer base and then replicate this for future campaigns

Finally, don’t be afraid to test out your campaigns. Choose a control group of customers (1-2% of your target base) and track the switching success rate. Once you’ve done this, you’ll have a better idea of how to drive future campaigns.

Top tip: If you’re a GoCardless dashboard user, you can use the dashboard’s email method to send campaigns to multiple customers at once. Once you’ve invited them to set up a bank debit mandate, they’ll appear in your list of Pending customers, where you can send periodic reminders.

Three most important things to remember

Segment your customers to ensure that you can tailor your campaign more effectively to achieve maximum impact.

Make it as easy as possible for your customers to switch. Include a call to action within your emails, or think about setting up a dedicated page or portal where your customers can find out more information to make the switch as quickly as possible

Be clear on the benefits of switching to bank debit for your customers, so that instead of “why”, they’re left thinking “why not?”

Appendix

Email example 1: You want to save your customers time and/or money

Hi [customer name],

Here at [your business name], we want to save you time paying us each month. So we’d like to move your regular payments to bank debit.

All you need to do is enter your details online here [enter link to bank debit signup page].

You won’t have to remember to make future payments or update your payment details; as soon as [your invoice due date is reached/subscription/fee is due], we’ll collect the payment straight from your pre-agreed bank account.

You’ll be notified before each payment is taken and your payments are protected, so you’re guaranteed a refund if a payment is ever taken in error.

Bank debit through GoCardless is now our preferred payment method. It saves us admin time, which means that we can focus on giving you great service.

If you have any questions, you can find out more details on [business webpage] or get in touch with us on [email/phone number].

All the best, [your business name]

Email example 2: You want to provide your customers with peace of mind

Hi [customer name],

Here at [your business name], we want to provide you with additional peace of mind regarding your payments. So we’d like to move your regular payments to bank debit.

To set up your bank debit payment, please complete this secure online mandate form here [enter link to bank debit signup page].

You’ll be notified before each payment is taken by [email/letter] and your payments are fully protected, so you’re guaranteed a refund if a payment is ever taken in error.

GoCardless is an approved bank debit provider, who work with over 50,000 businesses across the globe, including Sage, TripAdvisor and Les Mills.

If you have any questions, you can find out more details on [business webpage] or get in touch with us on [email/phone number].

Kind regards, [your business name]