Last editedSep 20252 min read

Instalment payments work by taking the cost of an item and splitting it into smaller amounts that the buyer pays over an agreed time period. Instalment plans are generally offered by merchants either directly or through third-party processors and are usually interest-free. Instalment loans are offered by commercial lenders and usually have interest added.

The mechanics of instalment payments

Once the buyer has decided what they want to purchase, they need to decide how they are going to pay for it. If a merchant offers instalment plans, the purchaser has the option to spread the cost of the purchase over an agreed period. The length of this period typically depends on the value of the purchase.

In general, instalment plans require the buyer to make payments of equal value according to an agreed payment cycle. When a purchase is for an amount that cannot be easily split, the merchant might request a one-off payment to accommodate this. For example, if an item costs £1,234, the merchant might request a one-off payment of £34 and 12 monthly payments of £100.

If a customer goes on to make further purchases at the merchant, each purchase would usually be set up on its own instalment plan. Therefore, in principle, a customer could have multiple instalment plans running at the same time. This is, however, very unusual.

Merchants who bill in arrears can often run their instalment plans themselves. They can accept partial payments, set up recurring invoices or split invoices into instalments. Merchants who take immediate payment are unlikely to be set up for this. They can, however, sign up for a buy-now-pay-later service so they can also offer the option to pay by instalment.

Instalment payments versus subscriptions

Instalment payments are always issued to repay a specific amount by a specific date. Subscriptions, by contrast, are run on an ongoing basis. Even if they are time-limited in some way, they are generally renewable. In fact, they are often automatically renewed unless the subscriber actively opts out.

In general, it’s more common for instalment payments to be used to pay for physical items. Subscriptions, by contrast, tend to be used to pay for services. This is, however, not absolute. For example, many private education providers allow students to pay for their courses by instalment. Likewise, the “subscription box” industry has become hugely successful.

Instalment plans versus credit cards

Instalment plans are issued for a specific purpose. Credit cards are simply lines of credit the holder can use as they see fit. This means that credit cards offer much more flexibility than instalment plans. They are, however, usually significantly more expensive.

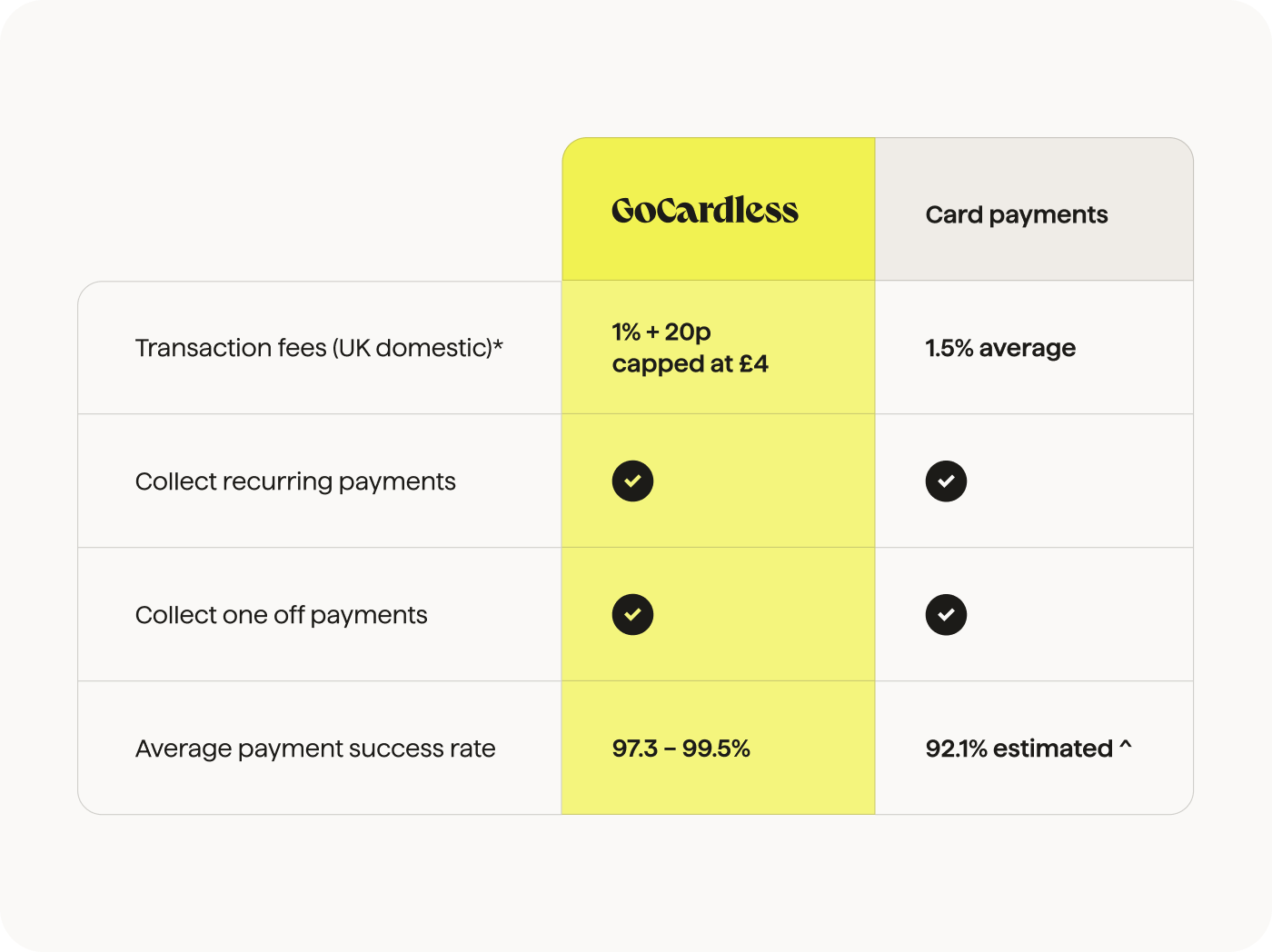

Merchants are charged high fees for taking credit card payments. One way or another, these fees are passed back to customers. In the UK, this is often in the form of a credit-card surcharge. Also, if the cardholder spreads the repayments over an extended period, they will typically be charged a high rate of interest.

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily create payment links to collect one-off or recurring online payments, and share them with your customers.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

* Pricing as of Aug 2025. Fees differ by provider. ^ Based on market research. Payment success rates vary. The benefits of instalment plans

For both customers and merchants, the main benefit of instalment plans is that they provide a straightforward and cost-effective way to pay for higher-value items. Essentially, instalment plans offer much the same level of convenience as credit cards, but at a much lower cost.

Buyers can simply set up a direct debit with the merchant and have their payments collected automatically each month. As soon as the instalment plan is completed, the payments will be stopped automatically.

Instalment plans can also give customers more certainty than credit card payments. With an instalment plan, a customer knows exactly how much they are going to pay each month and for exactly how long. This can help them to budget accurately.

We Can Help

If you’d like to learn more about instalment payments, then get in touch with our financial experts. Find out how GoCardless can help you with ad hoc payments or recurring payments.