4 essentials to consider when choosing a payment method

Last editedFeb 20224 min read

It may seem that selecting payment methods for customers is a relatively straightforward decision for businesses to make. Simply collecting revenues and incorporating the right mix of different methods can positively impact company performance, operations and customer behaviour.

Optimising payment methods can ease cash flow concerns by collecting funds faster, which can be invested to aid company growth, reduce time spent on manual reconciliations, and lower outgoings by minimising customer acquisition costs.

There are various payment methods available, so it's worthwhile for companies to take the time to review whether their existing options are maximising the impact they could be making.

Total cost of ownership

The cost of accepting different payment methods should be high up on the agenda of businesses considering their options.

In a cashless society accepting funds electronically has an associated cost. While this factor shouldn't be considered in isolation, reducing these costs helps companies generate higher gross margins. Payment methods with lower running costs minimise the cost of sales.

Given that gross profit margin is a strong indicator of a businesses' long-term viability, increasing this by reducing payment method costs can be a strong indicator that companies are sustainable.

While the number of businesses that accept credit cards for payment in Europe is double the size of those who accept Direct Debit (23%), card fees are typically much higher.

Credit and debit cards cost businesses between 1.5%-5% for each transaction, with bank debit transactions being significantly lower at around 1%.

The savings from nudging customers away from credit cards towards Direct Debit can be significant when collecting payments on a recurring basis and may be particularly relevant for businesses with a relatively low gross profit margin.

The total cost of ownership goes beyond transaction fees. Direct Debit lowers costs by reducing the admin and resource needed from finance teams to reconcile payments to accounting software and manually analyse transactions by exporting them to spreadsheets. This time saved is most relevant for businesses that handle recurring payments, which typically employ 20 full-time employees just to manage this reconciliation work.

Direct Debit also drastically reduces time spent chasing invoices due to its pull-based mechanism. This gives businesses more control of when revenues are taken. A further benefit of collecting payments in this way is that cash flow is improved due to funds typically being received sooner than other payment types. This could give businesses the means to make long-term and future-focussed investments for growth.

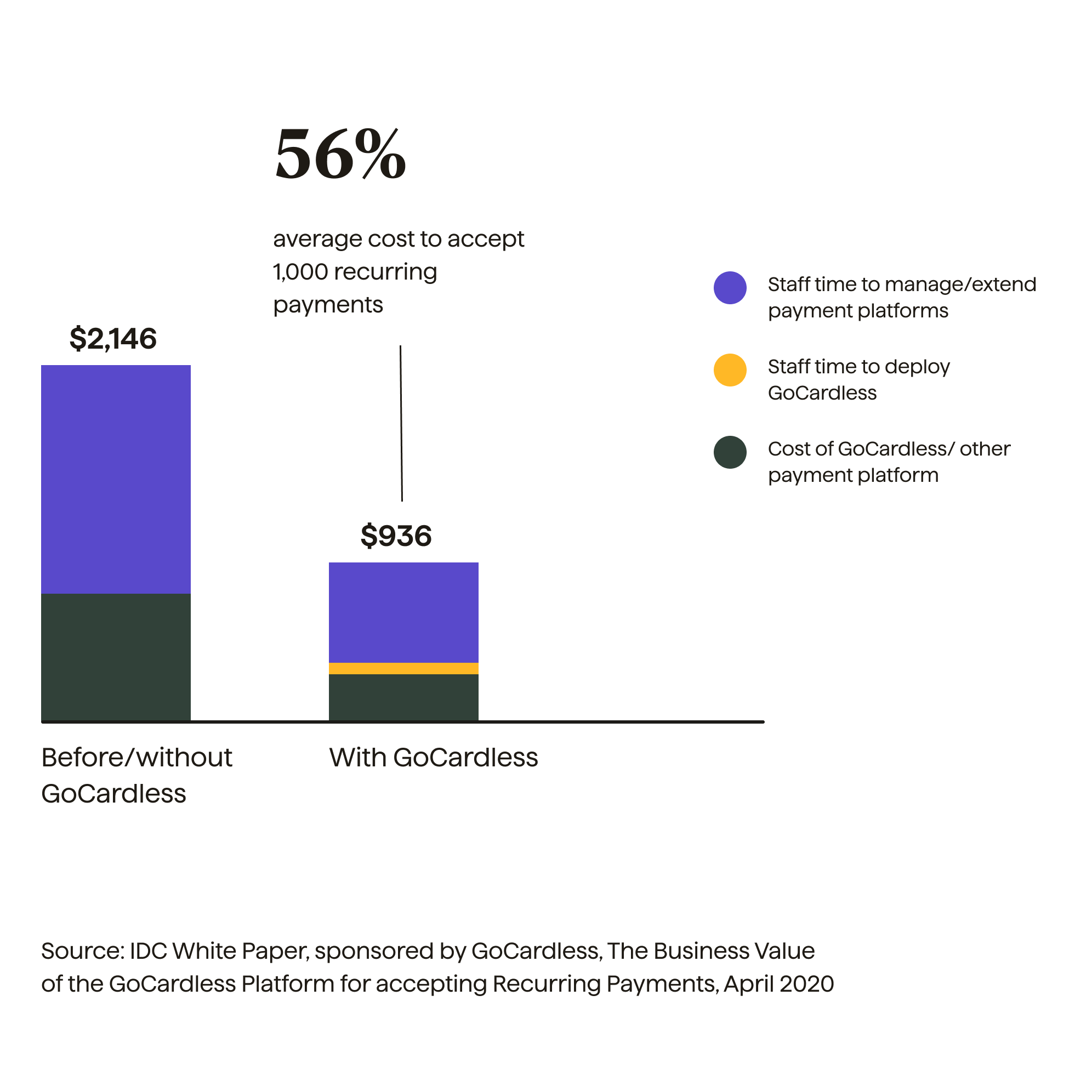

Recent research from businesses also supports Direct Debit as a cost-effective payments solution for accepting and managing recurring transactions compared to other methods. The study reveals that companies who use GoCardless report that, on average, it costs them 56% less per transaction than a weighted average of other payment types (including credit and debit cards) excluding GoCardless.

There are also other important factors to consider when choosing which payment methods to offer; such as the costs associated with customer acquisition, payment recovery and churn, which we will cover below.

Customer preference

Consumers are increasingly getting used to the concept of recurring payments. A few years ago, these payments for individuals used to relate exclusively to utilities, council tax, and everyday household bills.

However, the rise of essential streaming platforms such as Spotify and Netflix has resulted in consumers getting used to making recurring payments for a wide variety of services they consume. As a result, Direct Debit is now UK consumers’ favourite way to pay for all types of recurring payments (i.e. household bills, digital subscriptions etc.), with it being 2-4 times more popular than debit cards.

As we move towards a fully digitally enabled economy, all types of businesses have had to become comfortable incorporating subscription services to provide cloud tools related to accounting, CRM, web hosting and virtual storage facilities. This has led to Direct Debit becoming the favourite payment method for companies, with 44% of businesses ranking it as their favourite for B2B online subscriptions. Similar to consumer preferences, debit/credit cards are the second most popular way for companies to pay for online subscriptions, at 34%.

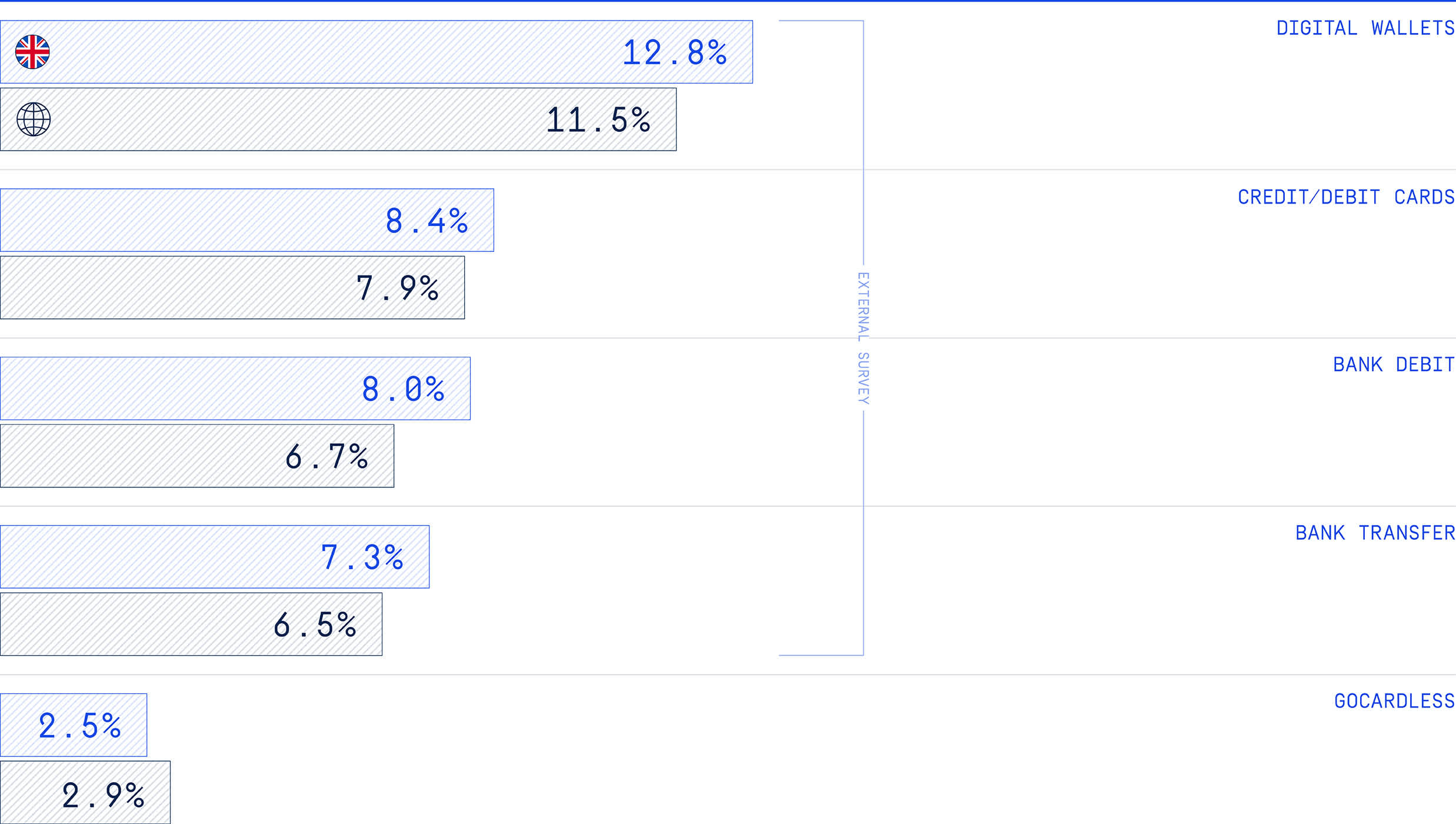

While it is still a popular payment method compared to other choices, UK businesses view debit/credit cards particularly unfavourably when ranked against other markets. The UK dislikes it more than all other territories surveyed.

Given that the sales cycle for B2B online subscriptions can be particularly long, businesses should strongly consider payment preferences as doing so may help to convert sales leads into paying customers.

Involuntary churn & failed payment rates

To improve operational efficiency and working capital, businesses also need to consider the risk of failed payments. Rectifying related issues takes up precious time and creates the risk of companies not being paid at all. Unfortunately, failed payments can be a frequent occurrence with credit cards.

This occurs due to them easily being lost, stolen or having reached their expiry date. Failed payments also create inconvenience for customers, resulting in them having to manually intervene to input the details of new or replaced cards.

Presently the average failure rate of cards is 7.9%. Comparatively, the failure rate of businesses using Direct Debit with GoCardless, is markedly lower at 2.9%. Direct Debit overcomes many of the failure issues associated with physical payment methods and provides a frictionless experience for customers too.

Failed payments also increase the churn rate of businesses and can raise it involuntarily by up to 30%. This can be particularly problematic as each subscribing customer that churns is a source of lost recurring revenue. This means that both present and future revenues suffer. Furthermore, the churn rate of subscription businesses is one of their most important KPIs as it is up to 25 times more expensive to acquire a new customer than retain an existing one.

Another downside of failed payments is that they are costly for businesses to recover so this gives businesses an extra incentive to improve their payment success rates. Recovering failed payments can be costly for businesses too. A recent white paper from Forrester found that for more than two-thirds of B2B and B2C companies, the cost of recovery is 11% or more of their average payment size.

Trust and safety

Safety and trust elements of online payments are more relevant than ever due to increased fraud during the pandemic. Over the last year, phishing attacks have used NHS branding to trick victims into handing over their personal data, including payment details.

A research paper between the IDC and GoCardless shows that Direct Debit is one of the safest methods to pay for consumers. While rules around national guarantees vary on a country by country basis, they all essentially safeguard customers by allowing them to claim back their money immediately.

In relation to this, the report says: “This makes Direct Debit faster than credit cards, where it can take months to reclaim a fraudulent transaction, and much safer than fund transfers and other push payments, where there is no way to reclaim funds given the liability lies with the customer.”

Conclusion

Picking the right mix of payment methods can significantly increase the success of businesses through attracting and retaining customers and driving accounting and generational operational efficiency.

Direct Debit is cost effective compared to other methods and preferred by both B2B and B2C customers. It also has lower failure rates across competing payment types, so businesses should encourage revenues to be collected in this way wherever possible.