Last editedFeb 20269 min read

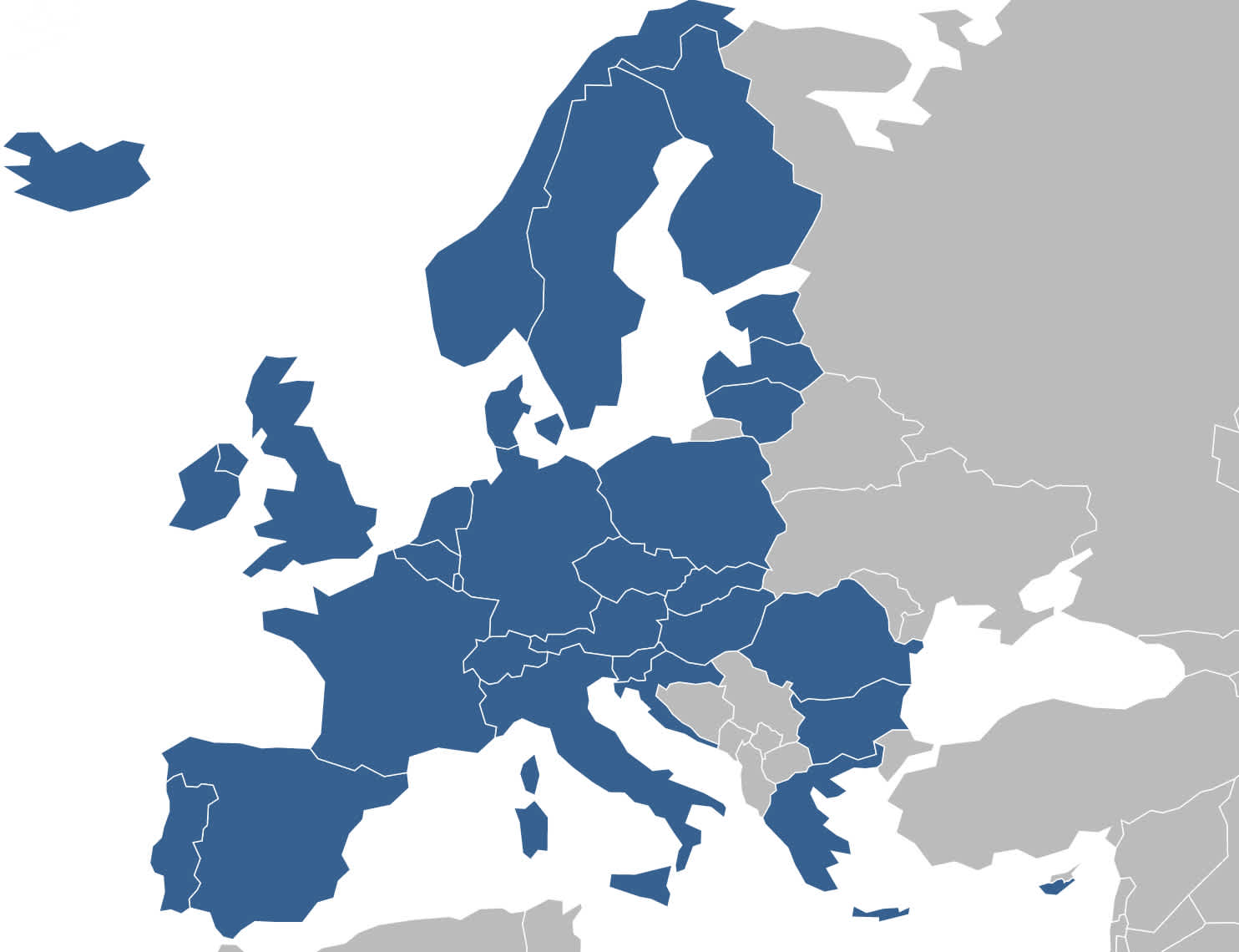

Taking payments from customers in a European country has traditionally been a confusing affair. With different payment habits, country-specific terminology and 24 different languages to operate in, you might find it rather daunting when expanding your business across Europe.

With the arrival of the new Single European Payments Area (SEPA), taking payments from across Europe has been made a lot easier. This guide will give you an overview of the payment methods used in European countries. We'll also explore some of the most popular payment methods on a country-by-country basis.

Overview of payment methods in Europe

The best payment method for your business will depend on the type of payments you are collecting as well as the country you’re collecting payments from.

1. Bank Transfer

Bank transfers are typically used across much of Europe to collect payments in business to business transactions. They can also be used to collect payments from individuals although this is usually only for large one-off amounts.

The cost of making cross-border bank transfers can vary greatly for non-Eurozone currencies. However, with the arrival of the SEPA credit transfer scheme it‘s now much cheaper to make transfers in the Eurozone.

You may still be subject to currency exchange fees if customers are transferring Euro-denominated payments to a GBP account. To reduce your exposure to currency exchange fees, you could either open a Euro-denominated account at your UK bank or use a peer-to-peer platform such as Wise or Kantox.

If you’d like to use bank transfer to collect payments from customers in Europe, you’ll need to provide your customers with an International Bank Account Number (IBAN) and Business Identifier Code (BIC, also known as a SWIFT code). You’ll need to do a bit of work to reconcile the received payments with your books. Billing software, such as Sage or Kashflow, can often do this for you automatically. Alternatively, you could manually match the payments on your bank statement to invoices that have been issued to customers.

2. Credit Card

Credit cards can be an easy and convenient way of collecting money from customers across Europe.

The main disadvantage of accepting credit card payments is high fees: you’ll typically be charged 2-4% of each payment plus a fixed fee. There’ll also usually be additional fees for collecting international payments and you will need to have a merchant account in a major trading country. Therefore if you are collecting payments within the SEPA area you may find an alternative payment method more cost effective.

If you’d like to accept credit card payments on your website, you’ll either need to integrate with a payment service provider (PSP) or a payment processor. Examples include Stripe and Braintree. See our recurring payments guide for more information.

3. E-money

E-money is a digital equivalent of cash but is stored on an electronic device or remotely on a server e.g. in a payment account on the internet. E-money providers like PayPal - also referred to as 'digital wallets' - are a popular choice for businesses working in multiple countries as it is accepted in all countries.

Despite a fast set-up and broad reach across Europe, e-money payment methods have three main drawbacks:

Cost - They are generally expensive with fees of around 1.5 - 3.5% plus a fixed charge. For instance, PayPal charges 3.4% plus a 20p fee for every transaction. There’s also a 0.4-1.5% cross-border payments fee and a currency conversion fee charged by the provider.

Usage - They generally account for less than 10% of online payments across European countries.

User experience - Your users will need to create an account at the e-money provider. This leaves you exposed to the reputational risk of that e-money provider.

If you’d like to offer an e-money payment method, we’d suggest considering it as a complementary payment option for your website. We would advise also accepting alternative payment methods like credit card or Direct Debit. Businesses who only accept payments via e-money methods like PayPal typically have poor customer conversion and experience.

4. Direct Debit

While Direct Debit is a payment method used across most of Europe, until earlier this year, separate schemes existed within each country. As such, it wasn’t possible to collect cross-border payments using Direct Debit. With the advent of the SEPA Direct Debit scheme, it’s now as easy to take Direct Debit payments from across the 18 Eurozone countries as it is within the UK. GoCardless provides multiple benefits for businesses collecting SEPA payments from their European customers.

SEPA Direct Debit is particularly great for invoicing and regular subscriptions. It’s a popular choice for recurring payments as it’s cheap, safe and convenient. Customers living in most European countries are also highly familiar with Direct Debit payments.

Direct Debit isn’t suitable if you work with high-value goods or need payments to be cleared immediately. Within the SEPA Direct Debit scheme, funds will take several days to clear and are liable to an eight-week “no questions asked” refund period.

If you’d like to collect payments through SEPA Direct Debit, there are several ways you’re able to do this. If you are currently collecting Direct Debit payments yourself via a bank you’ll be required to complete significant legal and financial paperwork including applying for a Creditor Identifier. You’ll also need to make changes to processes, messaging formats and bank account details. If you’re using a Direct Debit bureau or management software provider, you’ll need to check whether your provider offers payments outside of the UK. If they do these will typically be at an additional cost.

With GoCardless, you can collect and manage your payments using a simple online tool. You can also integrate with our REST API at no extra cost. Fees are also the same no matter where your customers are based. Sign up today to give it a try.

“One good thing that GoCardless does is it supports international payments from different currencies coming through to our account, keeping it really simple and streamlined.” Ali Shariat, Co-founder, ThisWayUp.

Looking for an easy & affordable way to collect SEPA payments?

GoCardless saves merchants time, money & stress collecting SEPA payments.

5. Cheque

We haven’t looked at cheques in detail as most countries are phasing them out. However, they are still popular in some countries such as France and Italy. Nevertheless, we’d suggest considering another payment method for cross-border transactions. While technically possible, banks often charge prohibitive fees for cross-border and foreign-currency cheques.

Popular payment methods by country

Across Europe, the most popular or most convenient payment methods can differ on a country-by-country basis. As a merchant looking to take payments in multiple European countries, you'll therefore need to be aware of country-by-country differences when deciding on which payment methods to offer. For instance, in countries such as Germany, card payments account for a very low market share. If you were only to accept card payments in Germany, you could miss out on a large number of customers.

It's also important to be aware that the European payments landscape has recently changed. Until now, lower cost payment methods such as Direct Debit and Bank Transfer have only been available within domestic markets. With the arrival of SEPA, these types of payments can now be taken just as easily across Europe as domestically. These options are therefore likely to grow rapidly in popularity, particularly if providers can offer coverage across Europe.

In this section, we'll run you through the most popular payment methods in Ireland, France, Italy, Germany and the Netherlands.

Popular payment methods in Ireland

There are three main options for taking payments from customers in Ireland:

Credit card - Cards are currently the most prevalent payment method in Ireland, accounting for 87.2% of transactions.

PayPal - While not hugely popular, E-wallets account for 8.5% of payments in Ireland, with PayPal making up the lion�’s share of that at 6.5%.

SEPA Direct Debit - Similarly to in the UK, Direct Debit has traditionally been difficult to get access to in Ireland. With the advent of SEPA Direct Debit, providers like GoCardless, who offer cheap, simple ways to take payments in Ireland and across Europe, are likely to become more prevalent.

While you need to understand local preferences and therefore will want to consider offering card payments, you will also need to consider which of the options suits your business best - particularly in light of the SEPA schemes and newer providers which make Direct Debit more accessible.

For e-commerce or other businesses where you need instant payment credit card is probably your best payment option in any case. However, if you collect regular or recurring payments you might want to consider whether with easier access and low cost payments across Ireland and the Eurozone Direct Debit could suit your business.

Popular payment methods in France

There are five main options for taking payments from customers in France:

Carte bancaire - Payments in France are dominated by credit and debit cards - card payments account for almost 50% of payments.

Virement bancaire - The transfer of funds from one account to another (in the same or another bank). In 2012 virement bancaire accounted for 17.2% of payments.

PayPal - E-wallet payment methods like PayPal are the second most popular online payment method in France with PayPal accounting for 10% of transactions.

Cheque - Cheques are still popular in France - much more than in any other European country, particularly for invoicing. According to BCE, cheques accounted for 16% of payments in France in 2012. However, even here their popularity is declining as cards and alternative payment methods become more popular.

SEPA Direct Debit - With the advent of SEPA Direct Debit, providers like GoCardless, who offer cheap, simple ways to take payments in France and across Europe, and SlimPay, a French online Direct Debit provider focussing on French e-commerce and SaaS, are likely to grow in popularity.

If you need to take instant payments, in France e.g. in e-commerce, you will want to consider Carte Bancaire. However, if you are taking payments for invoices or other recurring payments you may want to consider whether Direct Debit might be a better option than cheque - particularly if you plan to take payments outside of France (or are based outside of France) as banking cross-border cheques can be prohibitively expensive.

Popular payment methods in Italy

There are five main options for taking payments from customers in Italy:

Credit card - Cards are the most popular payment method in Italy: About 71% of Italian households own at least one credit or debit card and customers usually use cards to pay for goods and services online.

PayPal - An online payments and money transfer service that allows you to send money via e-mail, phone, text or Skype. PayPal is particularly popular in Italy, accounting for 17.1% of online payments in 2013.

Cash on Delivery/POS - The customer pays for the goods at the date of the delivery or point of sale. This is still a surprisingly popular option in Italy, accounting for 40% of payments although unsurprisingly it is a less popular choice for online payments.

Prepaid cards - These are a fast growing segment, currently accounting for about 15% of payments. However, failure rates are even higher than for cards with frequent expiration dates or balance issues so this isn’t a great payment method if you take recurring payments.

SEPA Direct Debit - Until now Direct Debit has not been particularly popular in Italy (only accounting for 7.85% of payments) as there has been no easy way of accessing it. With the arrival of SEPA Direct Debit, providers like GoCardless, who enable companies of all sizes to take Direct Debit payments from Italy and across Europe at low cost and with minimal admin are set to become more popular.

While you should consider Italian payment preferences when choosing a payments option you should also consider which option suits your business best. For e-commerce or other businesses where you need instant payment credit card or PayPal are great options in Italy as your customers will be familiar with these. However, if you collect regular or recurring payments you might want to consider whether adding Direct Debit as a payment method could help you cut costs and admin particularly in light of the SEPA schemes and newer providers which make Direct Debit easier to use and more suited for recurring payments.

Popular payment methods in Germany

Payments are traditionally taken in Germany via bank account-based payments like bank transfers and ELV (German Direct Debit). There are six main options:

ELV (Elektronisches Lastschrift Verfahren) - The German Electronic Direct Debit scheme supported by most, if not all, banks in Germany, which uses bank account details. This scheme accounts for 25% of all payments in Germany, both online and offline and is very popular for e-commerce transactions. ELV now only offers SEPA Direct Debit for online payments.

Sofort (Sofortueberweisung) and Giropay - These are popular methods where customers enter their bank login details (as they would to log into their online banking) and Sofort/Giropay triggers a bank transfer in the background.

Bank wire transfer - The transfer of funds from one account to another (in the same or another bank).

PayPal and cards - Payments using credit card or PayPal account details are relatively unpopular in Germany, only accounting for 20% of online transactions.

Klarna - Klarna can be summarised as smart invoicing. The customer receives an invoice which they can pay in under 10-30 days. Klarna also offers a full payment gateway with all other payment methods, expanding from being a payment method to becoming a PSP.

Other SEPA Direct Debit providers - With the advent of SEPA Direct Debit, providers like GoCardless, which enables companies of all sizes to take Direct Debit payments from Germany and across Europe at low cost and with minimal admin may start to rival domestic Direct Debit schemes and providers.

Unlike most of Europe, in Germany Direct Debit and bank transfers are the main payment options - both on and offline - so you should consider how you can use these payment options in your business. However, if you plan to collect payments from other countries in Europe you may want to consider whether a SEPA Direct Debit provider could be for you. If you also want to take payments outside of Europe you will also want to use card payments but may want to choose an alternative option for customers within Germany.

Popular payment methods in the Netherlands

There are three main options for taking payments from customers in the Netherlands:

iDeal - This is very similar to Sofort or Giropay in Germany. iDeal uses online (real-time) bank transfers with immediate online authorisation via the customer’s bank. It accounts for 60% of online payments and is really appreciated by consumers. Due to the popularity of iDeal, card use is very low compared to the rest of Europe. The same can be said of e-wallet methods like PayPal (which accounts for 2.3% of payments).

Incasso - Incasso now only offers SEPA Direct Debit. It has historically accounted for 15% of online payments, however, there are several restrictions that make it hard to access DD unless you are a larger company.

Other SEPA Direct Debit providers - With the arrival of SEPA Direct Debit, providers like GoCardless, which enables companies of all sizes to collect Direct Debit payments from the Netherlands and across Europe at low cost and with minimal admin may start to rival Incasso.

Similarly to Germany, Direct Debit and bank transfers are the main payment options in the Netherlands so you should consider how you can use iDeal, Incasso or other Direct Debit options in your business. If you plan to collect recurring payments you may want to look at newer providers like GoCardless which make Direct Debit accessible to companies of all sizes. If you also want to take payments outside of Europe you will also want to use card payments but may want to ensure you choose an alternative option for within the Netherlands.

Learn more about SEPA Direct Debit

Read our SEPA user guide or our learn more about our SEPA direct debit service.