Last editedJun 20241 min read

For any business, a seamless payment solution that’s reliable, professional and consistent with your brand can have great benefits - but it’s often hard to achieve.

That's where GoCardless Plus comes in.

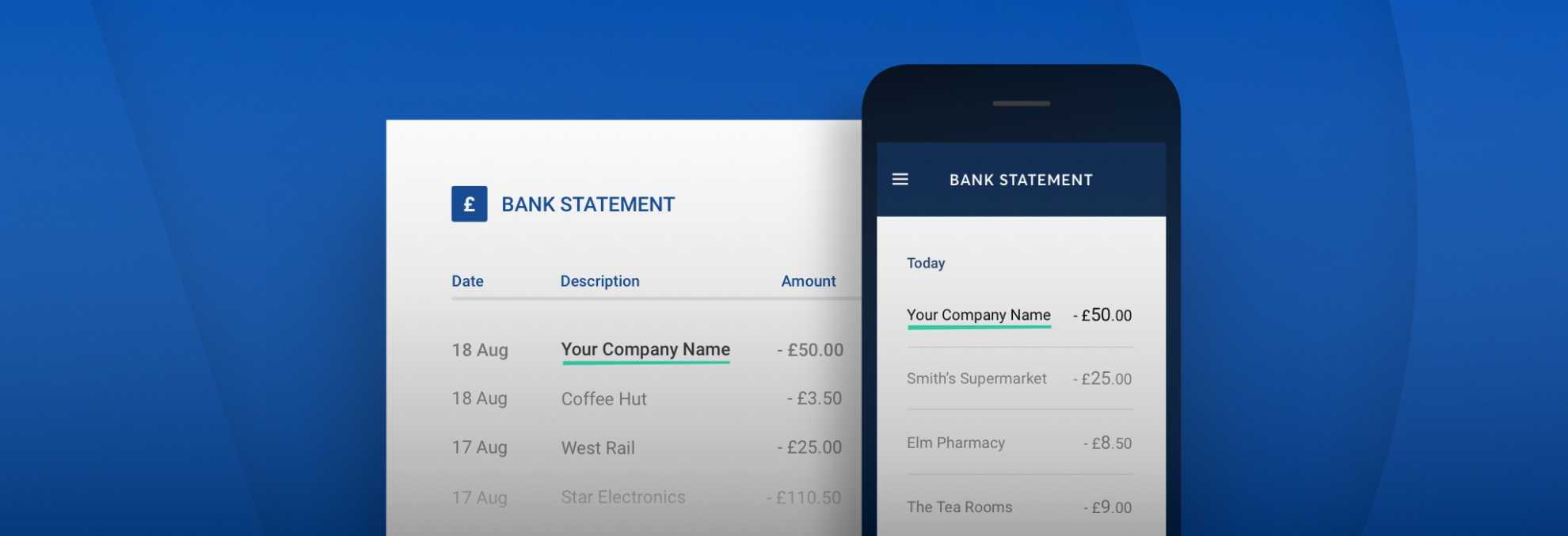

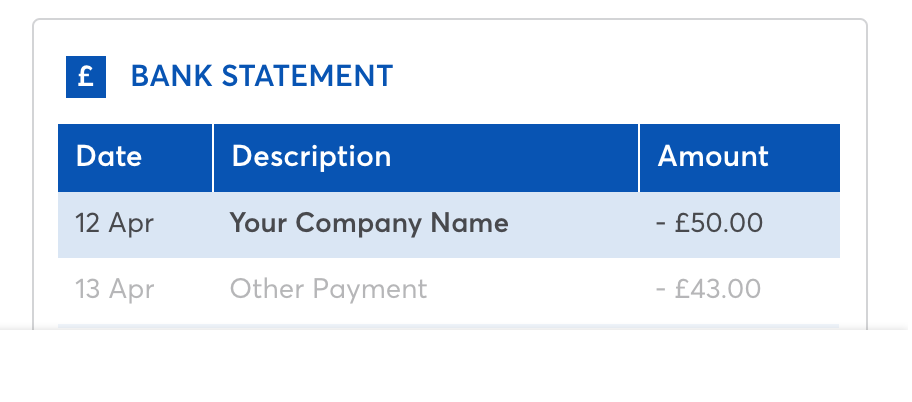

It offers the full range of features available on Standard, along with the ability to have your company name featured on customer bank statements.

The Plus plan makes this possible by providing businesses with their own unique identifier. Known as Service User Number (SUN) for Bacs, and Creditor Identifier (CID) for SEPA, on the Plus plan, these numbers will be specific to each business.

Hundreds of businesses already use Plus to ensure consistent branding via their own unique identifiers.

You can read about SUNs and CIDs in more depth in our handy Guide to Service User Numbers.

Using a personalised identifier brings a range of additional benefits to businesses using Direct Debit as a payment solution. Here, we outline the most important of these.

Cutting churn

When using GoCardless Standard, customers will see ‘GoCardless Ltd’ on their bank statements, followed by a mandate reference that includes your company name. However, only some banks display the second part of the reference we provide. This can be confusing for customers.

Having your business name on bank statements provides clarity and means customers are less likely to cancel their Direct Debit payments. In fact, we’ve noticed that businesses using their own name on statements, via a unique SUN or CID, have a 30% reduction in cancelled mandates.

That leads to even more reliable income for your business, plus the ability to build a loyal customer base while also reducing churn.

Reducing chargebacks

The reassurance of seeing your company name alongside payments on their bank statements means customers are less likely to charge back payments under the Direct Debit Guarantee.

Chargebacks, also known as indeminity claims, are not a common occurance. With GoCardless the amount is just 0.7%, which you can reduce even further by using your own SUN or CID.

You can read more about chargebacks and what they mean for your business in our article ‘Don’t Fear the Direct Debit Guarantee - a Guide for Merchants’.

Achieving brand consistency

In a noisy and competitive world, brand consistency is key for making your company stand out. Your own SUN or CID puts your company name first and foremost on customer bank statements, providing an extra layer of professionalism, security and brand consistency.

The Plus plan helps businesses take payments while reducing churn and reinforcing their branding. At just 1% per transaction capped at £2, plus a small monthly fee of £50, using GoCardless Plus has benefited hundreds of businesses so far.

Ready to reduce your churn rate and boost your brand?

Find out more about our Plus plan.

Ready to reduce churn rates and boost your brand?

GoCardless Plus helps cut churn and increase growth