Security vs convenience: How will your customers react to new SCA rules?

Last editedOct 20202 min read

New data suggests the SCA payment security rules will impact conversion. While consumers value security at checkout, our findings show that increased security can make customers more suspicious.

Strong Customer Authentication (SCA), which came into force on 14 September 2019, is a set of regulatory requirements, designed to make paying online more secure, as part of PSD2.

SCA will require shoppers to provide two sets of additional security information to authenticate online purchases. This information could be a password or PIN, biometric information like a fingerprint, or information provided by a device like a mobile phone.

(Note: On 13 August 2019 the Financial Conduct Authority (FCA) confirmed that enforcement of SCA in the UK will include a phased 18-month implementation, starting on 14 September 2019 and ending March 2021.)

To find out how consumers will react to these new security measures at the checkout we conducted a survey into consumer attitudes around security and convenience when buying online.

The study, 'Security vs convenience in the payment experience', asked 4,000 consumers in the UK, France, Germany and Spain about their attitudes and behaviours towards online shopping. In this article, we discuss some of the key findings.

Online shoppers are torn between security and convenience

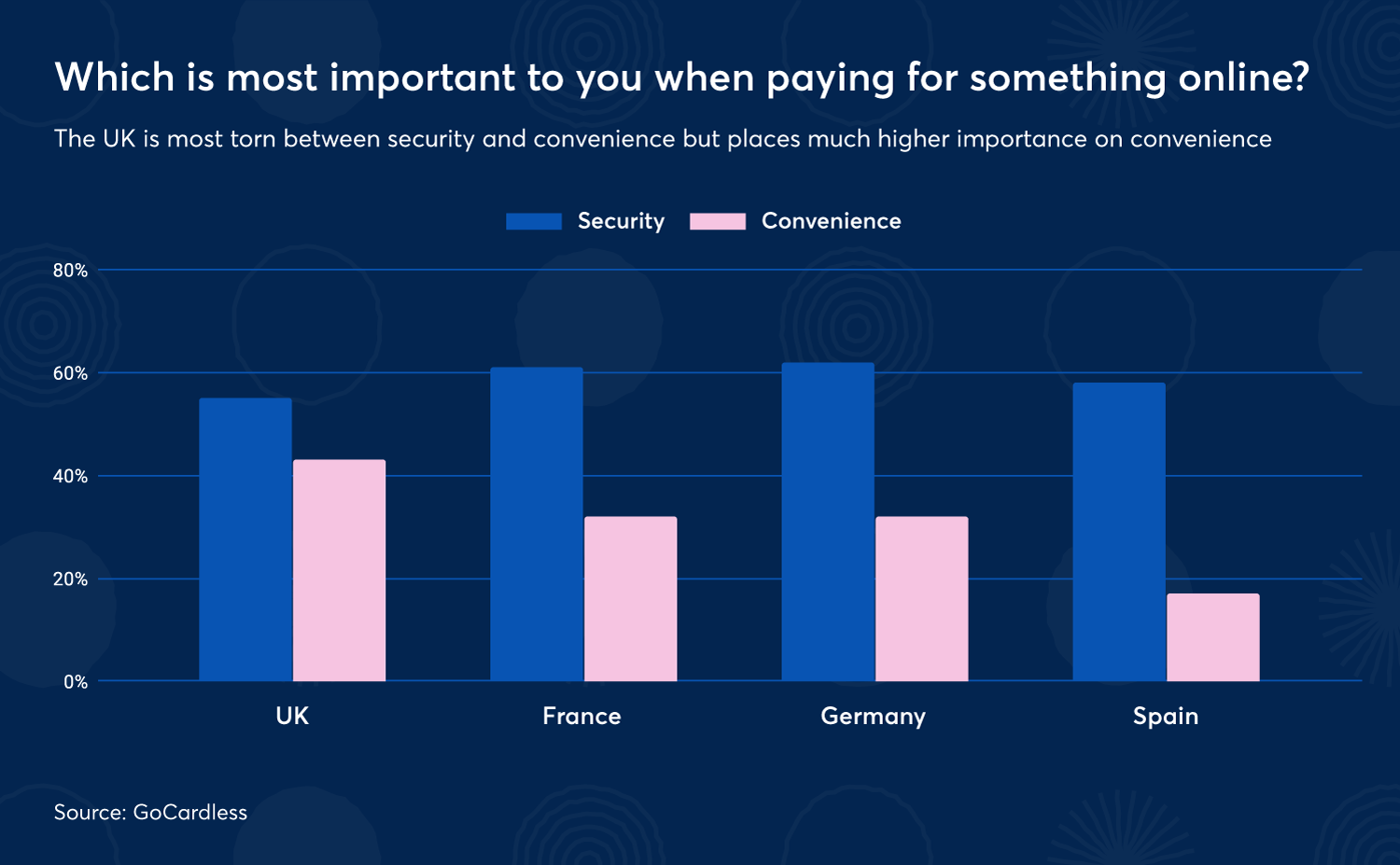

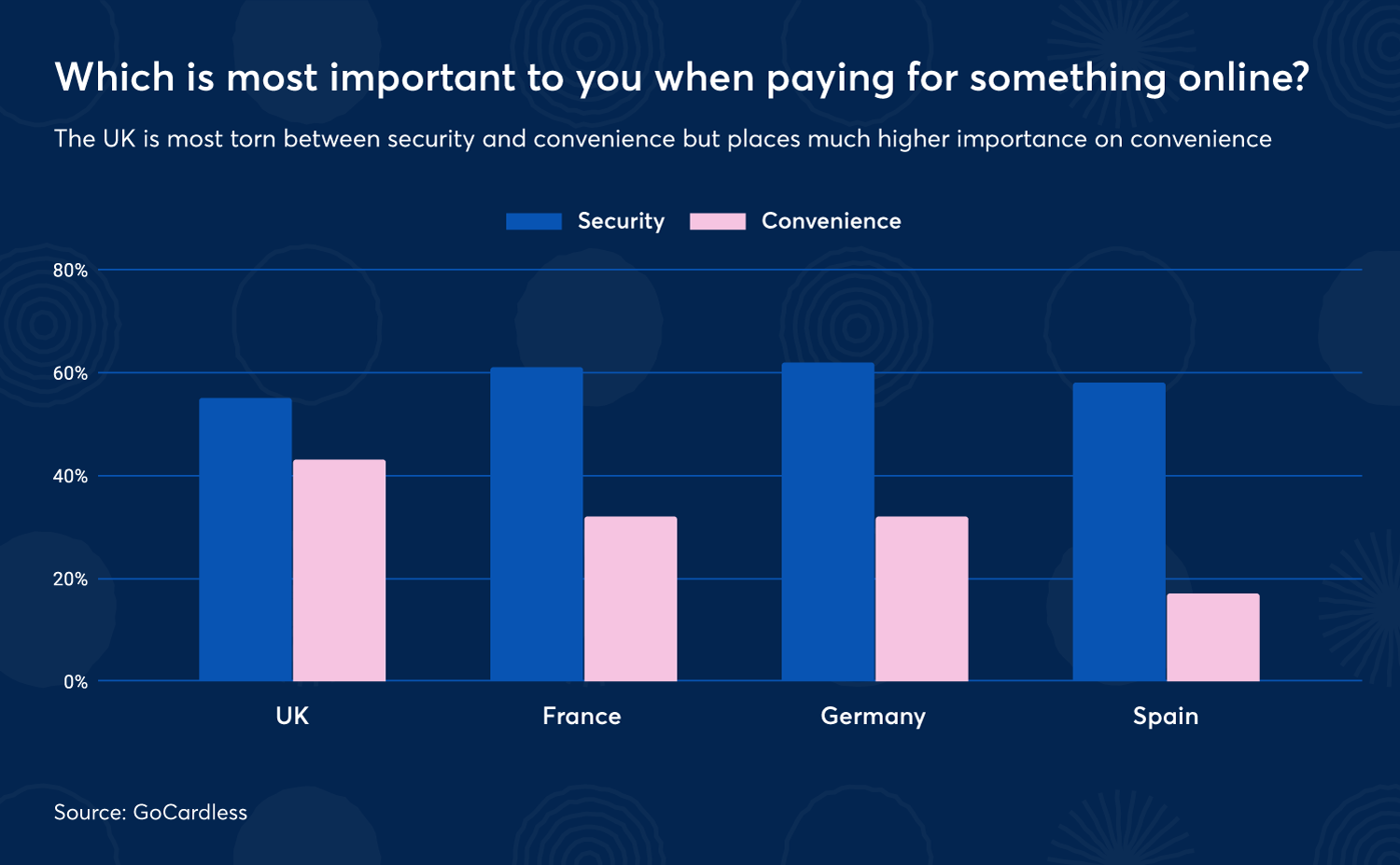

The results show that shoppers in all markets place a higher value on a secure checkout process than they do for a convenient one.

In the UK particularly though, this is split with 43% saying that “speed and ease of payment” is the most important factor when paying for something online (compared to 32% in France, 33% in Germany and 17% in Spain).

Extra steps in online payment experience make some customers more suspicious.

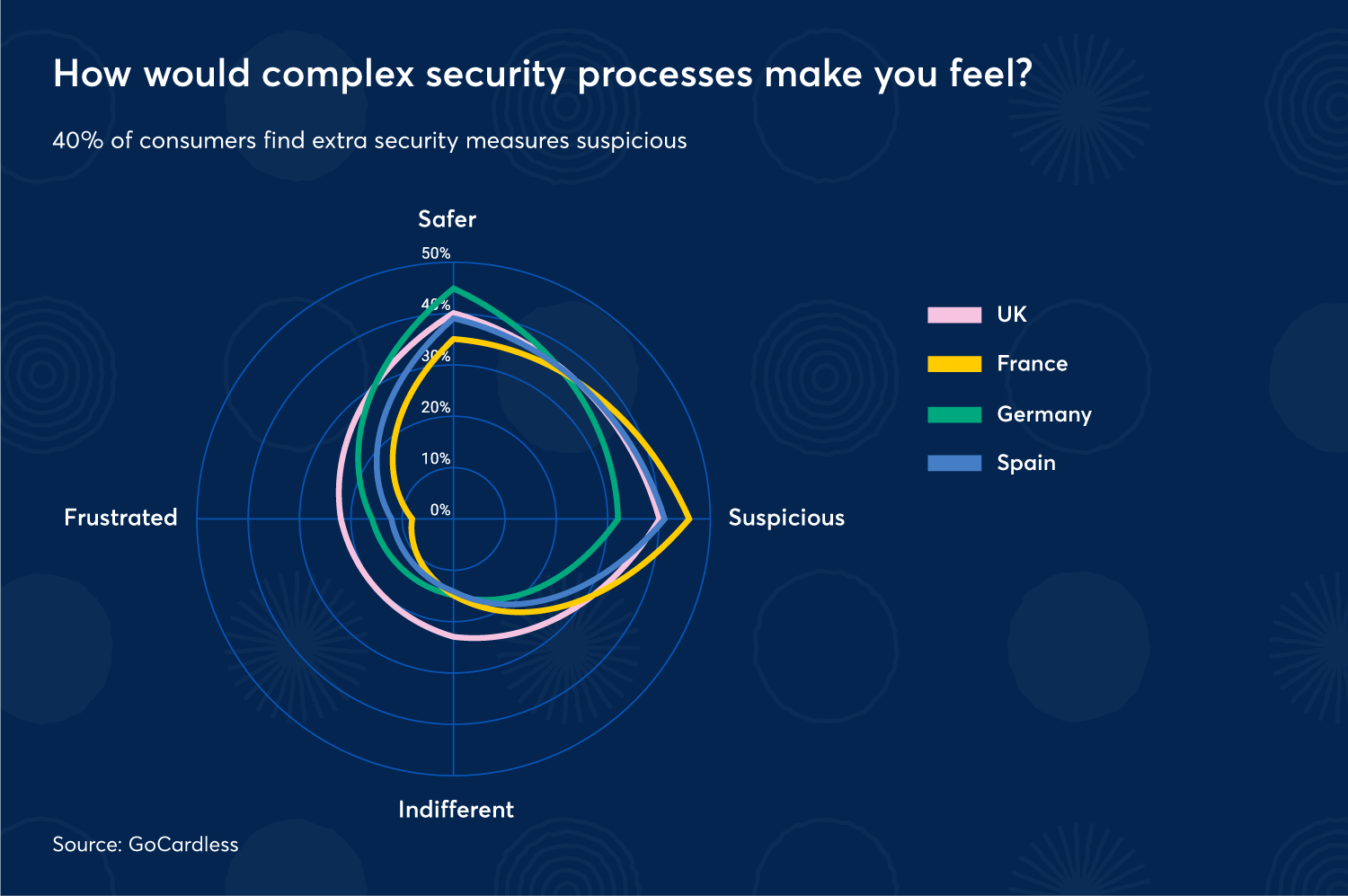

While consumers clearly value security at checkout, the results found that complex security processes and the need to give out additional security information makes as many people feel suspicious as it does safe.

Consumers would shop with their favourite brands less if they increased security and length of the checkout process

We also asked consumers about how they would react to changes in the checkout flows of their favourite brands. The results suggest that changes to a checkout flow could impact conversion – over a fifth of respondents in each market said a longer checkout process would cause them to shop with their favourite brand less.

Shopping with new brands may also decline

When it comes to converting a new customer, having a seamless checkout experience is key. 27% of our survey respondents in the UK said that they would abandon a purchase if a retailer they hadn't shopped with before offered a secure, but inconvenient, buying experience.

Biometric information (e.g. a fingerprint) is the least favoured method of security

Under SCA, consumers will have to provide additional security information in the form of a password or PIN, biometric information, or mobile number.

While the survey showed that, in general, customers were comfortable giving up certain security information, biometric information (such as a fingerprint) came out least favourably at 69%.

For recurring purchases, Direct Debit could be the solution

Our survey suggests businesses will need to manage the changes to checkout flows carefully to avoid a drop off in conversion. This means listening to customers and working with payment providers to find the right balance between security and convenience at checkout.

Almost two-thirds (63%) of respondents said that they would pay for an online subscription with a low-risk payment method like Direct Debit as a way to avoid complex security at the point of purchase.

SCA was primarily designed to increase the security of online payer-initiated transactions, and to reduce the problem of payer fraud. To understand the likely business impact of SCA, view the complete guide to Strong Customer Authentication (SCA).