Levelling up against the new lending fraud challenge

Last editedNov 20222 min read

Loan fraud rose by 39% during 2021, and overall fraud by a further 11% in the first half of 2022 (Cifas), but how can you outsmart the criminals as they prey on the current economic situation?

Fraud in the current economy

Over the last year we have seen interest rates and inflation skyrocket across the world and with it, a steep rise in lending fraud. Fraudulent attempts to access loan products increased by 39% in 2021, with unsecured personal loans being the most targeted.

On the consumer side, recession means that times are tight and people are more taken in by fraudulent schemes where they may give up personal details used in identity fraud. As Amber Burridge, Head of Fraud Intelligence for Cifas put it, “Criminals are glorified marketers - they’ll use any opportunity to steal from innocent consumers.”

We saw the same story back in 2008, when there was a 7.3% increase in fraud during the global economic downturn (SEON). Since then, many lenders have moved their operations online, and whilst it’s brought about boundless business benefits, digital crime has also been on the rise, creating a new challenge for lenders.

Losses from online fraud are now 7.5 times higher than in 2009 (SEON). Large digital lenders that earn a large amount of their annual revenue through digital channels are the most at risk, with an average of 50% more fraud attempts than non-digital lenders and online fraud accounting for 34% of all fraud (SEON).

With the rise in potential for fraud and the complexities of online fraud, businesses need to address fraud differently to how they may have in the past.

The fraud dilemma

Until now, businesses have had to make a choice when it comes to fraud. Do you add additional layers to checkout whilst putting conversion at risk? Or do you do nothing, maximise conversion and deal with fraud as it happens?

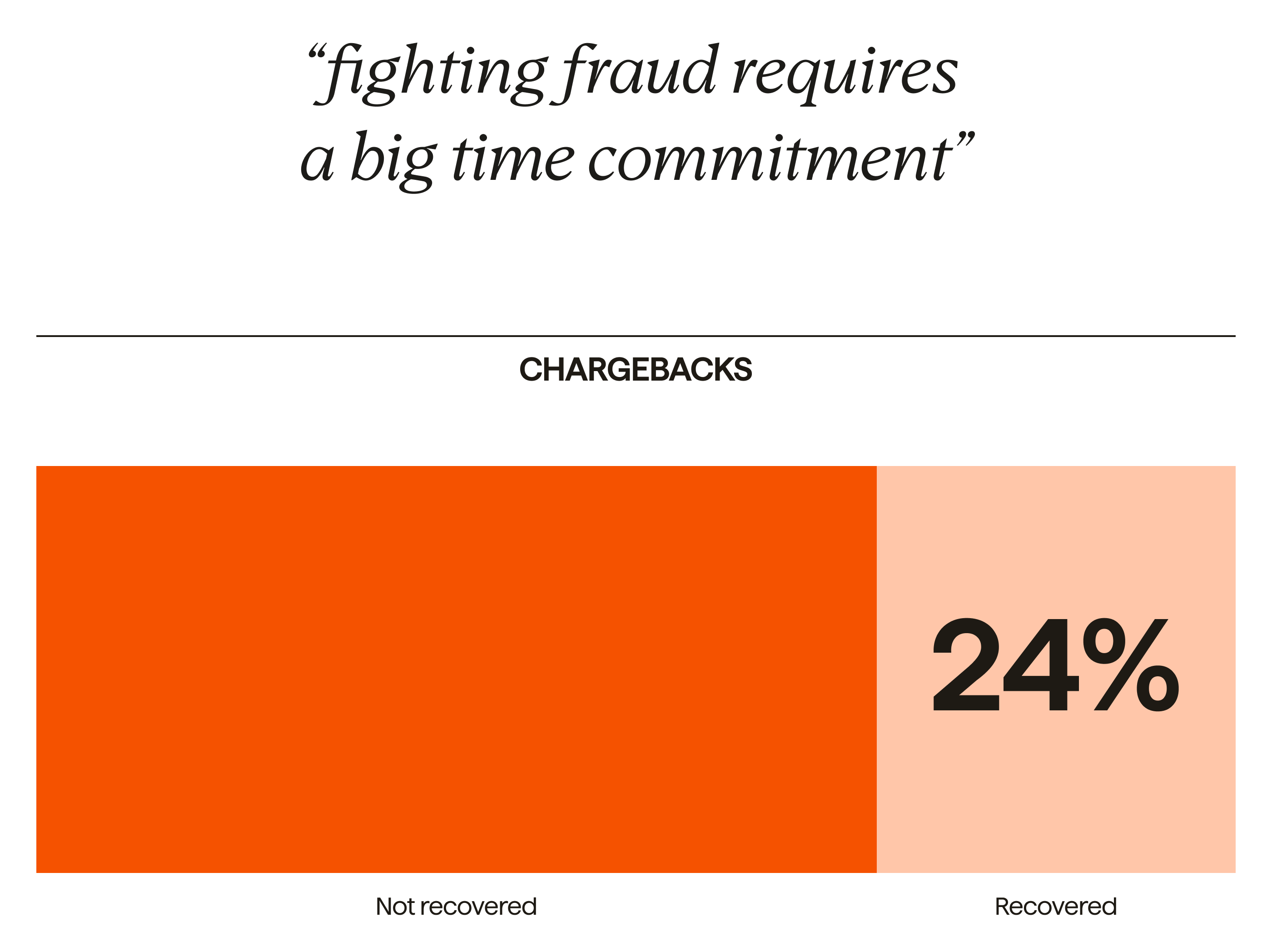

Both have their downsides. More friction at check out means 18% of UK businesses have seen a negative impact on their conversion. Dealing with fraud retrospectively costs time and money, with a quarter of businesses telling us that fighting fraud requires a big time commitment from their teams, with only 24% of chargebacks actually being recovered.

To meet the challenge means businesses need to detect fraudulent payers early and deal with them differently to not hurt conversion but keep fraudsters at bay.

Fight fraud the intelligent way

Protect+ from GoCardless uses payment intelligence from our global network to detect potential fraudulent payers the moment they attempt to create a mandate - even if they are a new customer.

Once identified, these higher risk payers are routed to a different check out flow where they have to authenticate that they own the account details they are trying to use.

This means that you can tackle identity fraud head on. It also means that for honest payers, their checkout process is not affected and you don’t hurt conversion.

It balances your response to fraud to minimise the overall impact on your business.

Ready to level up against fraud? Speak to one of our payment experts about protecting your bank payments from fraud with GoCardless Protect+.

Learn more about the different types of payment fraud

If you want to better understand the different forms of payment fraud and learn how you can calculate its true cost on your business, then register now to watch our free webinar Fraud 101: The real impact on business.

Data:

GoCardless and YouGov 2022 survey of 8,507 global payers (GoCardless Payer Experience Report 2022)

Market research conducted on behalf of GoCardless, to 1800 merchants across UK, US, France, Australia & Spain, February 2021