GoCardless for Xero

Enter the new era of bank payments

GoCardless puts you in control of collecting payments directly from your customers’ bank accounts.

Automatically collect payment for your invoices

Predictable cash flow

Take control of unpaid bills. When your invoice is due, GoCardless automatically collects payment from your customer’s bank account.

Lower-cost alternative to cards

Bank-to-bank payments cut out the costs of card networks. The automation also greatly reduces the costs involved in chasing and managing payments.

Popular with your payers

When it comes to paying invoices, bank debit is the preferred alternative to manual bank transfers and more popular than card payment.

How it works

“What used to be a very manual payments process is now completely automated.”

Adam Castleton CEO, Startle Music

How it works demo

Get a tour of how GoCardless works with Xero

All the features you need to streamline your payments

Flexible payments

Collect recurring payments - like annual subscription fees using Direct Debit - as well as one off payments using Open Banking.

Popular with your payers

When it comes to paying invoices, bank debit is the preferred alternative to manual bank transfers and more popular than card payment.

Instant Bank Payments

Complement your recurring payments with a simple way to immediately collect one-off bank transfer payments, powered by Open Banking.

Plans to suit you

Get started with no sign up costs, no commitments and no hidden fees. If you’re a larger business, come chat with us about a bespoke plan.

Collect international payments

It’s easy to collect payments from your customers, whether they’re across the road or across borders. With currency conversion from Wise built-in (so you get the real exchange rate).

The real exchange rate

Using the real exchange rate powered by Wise, GoCardless provides you with the best value you can get from your international payments.

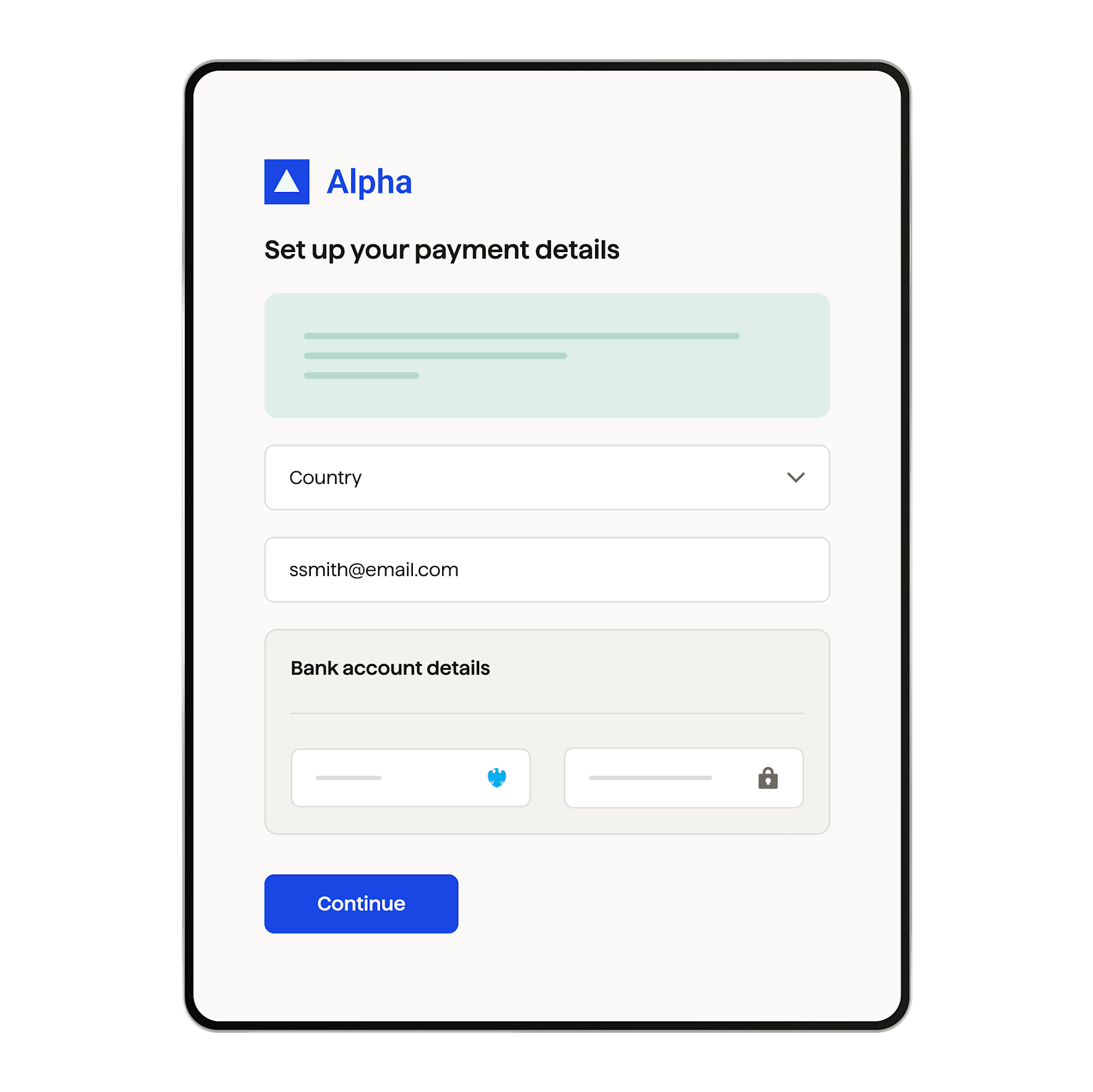

Connect GoCardless to Xero

It's simple to attach GoCardless to your Xero invoices and collect payments from your customers. Just create a GoCardless account and connect it to Xero. You can do this in the invoice or payments services section of your Xero account.

“GoCardless stops those awkward conversations with clients, it saves time and it obviously helps cash flow – that’s a huge thing!”

Saija Mahon, Founder & MD, Mahon Digital

Trusted by 100,000 businesses worldwide

Ready to get started?

Stop chasing late payments and save precious time by connecting GoCardless to your Xero account now.