Online payment gateway for your business

Automate payment collection

Reduce late and failed payments

Save money

Reduce time wasted

Integrate your accounting software

Collect instant, one-off & recurring payments, with no chasing, stress or high fees

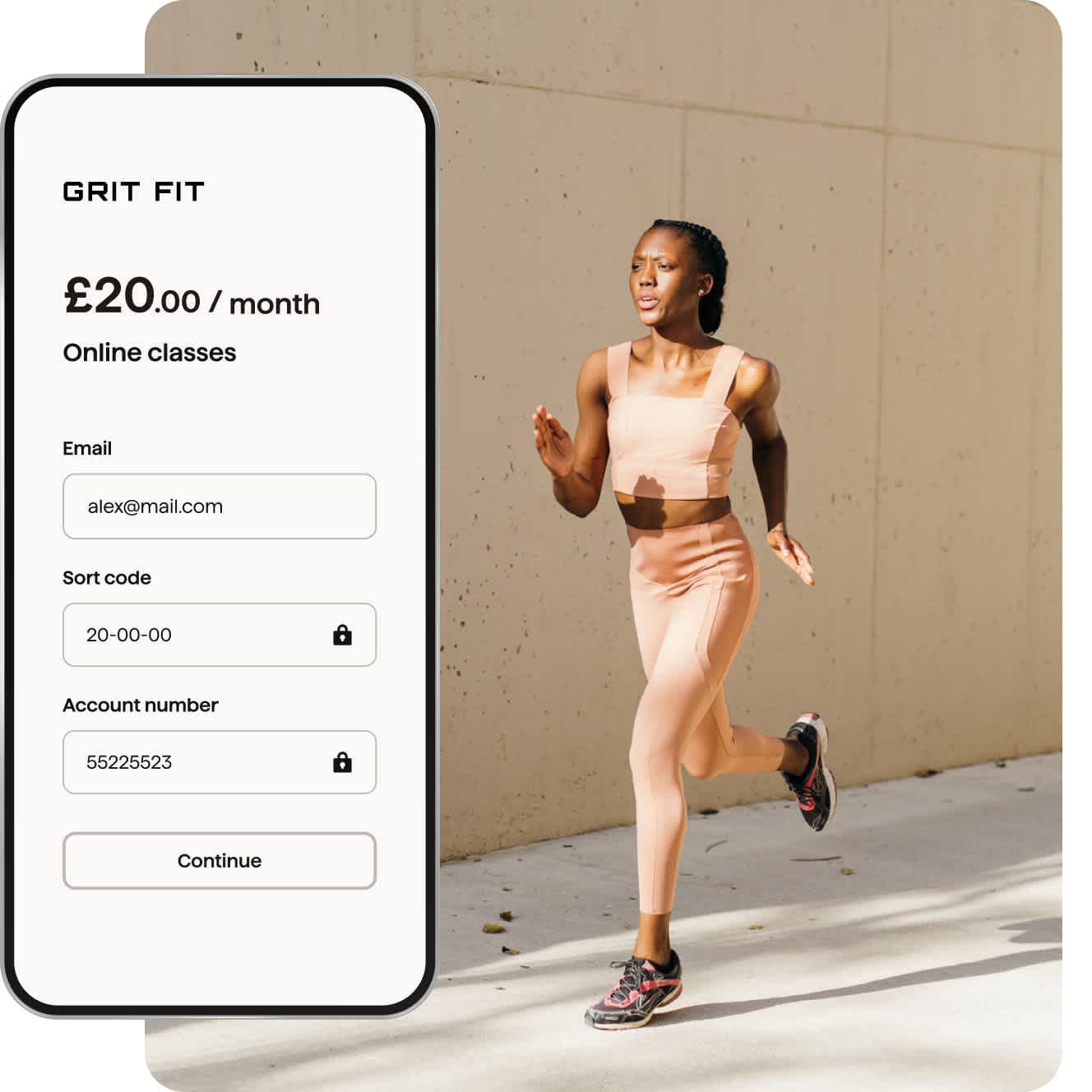

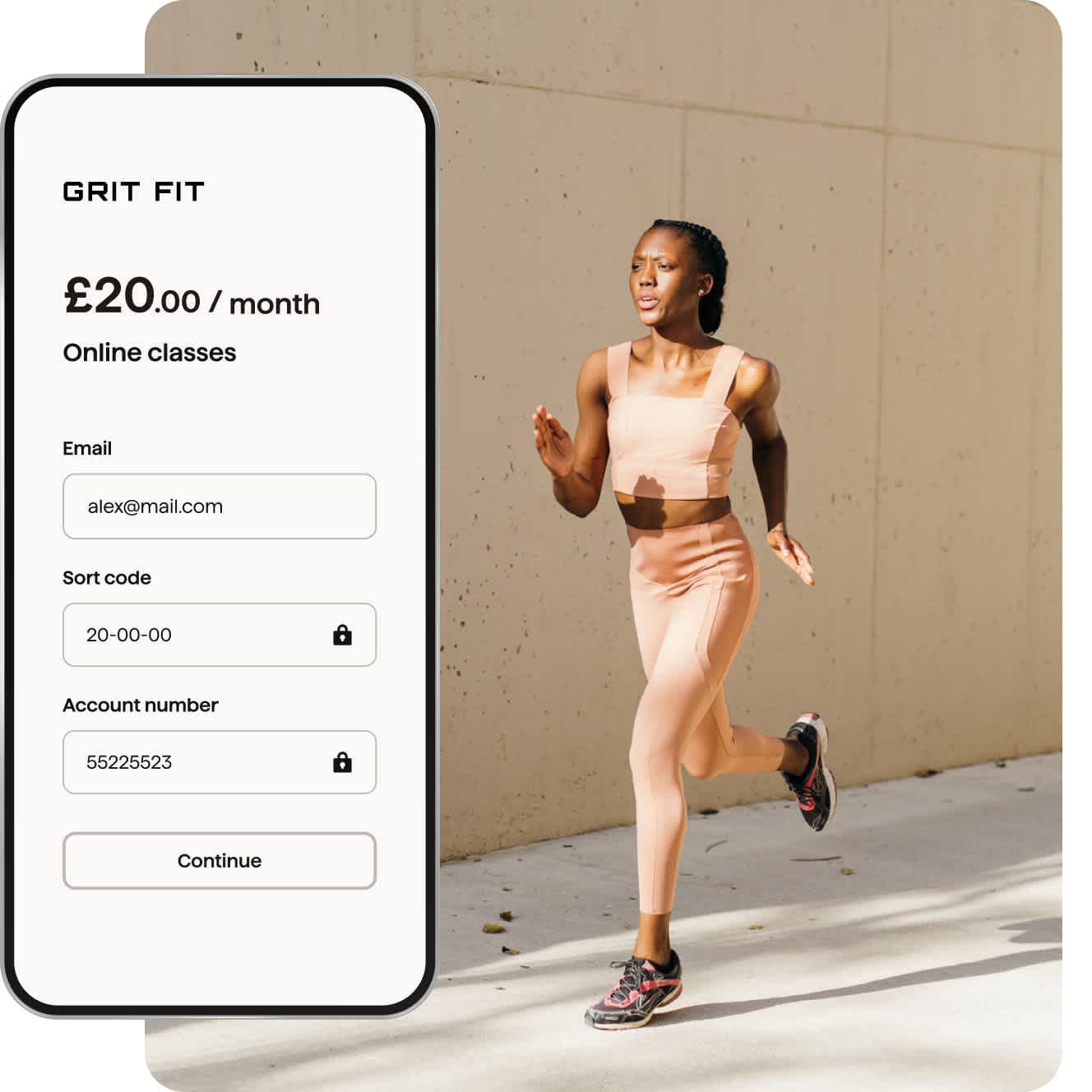

Quick & easy online payment system

Online payments are simple to set up and easy to manage in our user-friendly dashboard in just a few clicks.

Integrate with your accounting software

GoCardless integrates with over 350 different software packages and also offers API access should you require it.

Save hours of admin

Automate your payments and finance admin. No more wasted time manually balancing the books.

Say goodbye to late & failed payments

GoCardless collects via bank payments which means fewer failed payments compared to cards. You can easily schedule payment collection for the dates you require in just a few clicks.

No sign up costs. No contract.

No contracts required

GoCardless offers a pay-as-you-go pricing model with no contract or long-term commitment required.

Merchants can sign up to the GoCardless platform and set up payments for free - you only pay for payments you collect.

Cheaper than cards

Using another payment gateway to accept online payments via cards can be over 3x more expensive than GoCardless!

Exactly how much you'll pay will depend on the card network & your specific fee structure, but on average, fees range between 1.5% - 3%.

Cost-effective & Transparent

Not only is GoCardless a cheaper web payment gateway, but we also provide pricing transparency.

Accepting a £500 card payment will cost a merchant between £7.50 and £15. However, with GoCardless, that transaction costs just £4 on our Standard Plan.

A Black Friday deal you’ll be talking about for months

Join now to take advantage of paying no fees for up to 90 days and feel set up for success this Black Friday. T&Cs apply

No transaction fees for 90 days

Standard

Collect recurring and one-off payments in a straightforward way

1%

+ £/€0.20

per transaction, capped at £/€4. An additional fee of 0.3% applies to UK Bank Debit payments above £ 2,000.

Full fee structure

2% +£0.20 for international transactions.

VAT applies to all fees

Advanced

Boost your payments with a smart way to recover failures, enhanced customer verification and full customisation

1.25%

+ £/€0.20

per transaction, capped at £/€5. An additional fee of 0.3% applies to UK Bank Debit payments above £ 2,000.

Full fee structure

2.25% +£0.20 for international transactions.

VAT applies to all fees

Pro

Take full control of your payments with end-to-end fraud protection and access to all features

1.4%

+ £/€0.20

per transaction, capped at £/€5.60. An additional fee of 0.3% applies to UK Bank Debit payments above £ 2,000.

Full fee structure

2.4% +£0.20 for international transactions.

VAT applies to all fees

How GoCardless works

Connect to your software and save hours of financial admin

You can use GoCardless through our dashboard, custom integration or a partner.

If you’re already using billing, accounting and CRM software, connecting GoCardless to your account via our seamless integration is easy to set up.

On average GoCardless merchants spend 59% less time managing payments.

Customer case studies

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Try the GoCardless payment gateway service risk free today

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate payment collection.

Get started in minutes. No upfront commitment.