Last editedMar 20232 min read

Over the last few years, subscription services have become extremely popular. Driven by technology, customers can now subscribe to a huge range of products and services, from digital services such as Netflix and Spotify, to having your groceries delivered to your door.

Businesses are also jumping onto the subscriptions bandwagon with increasing adoption of SaaS (software-as-a-service) tools across all areas of business, in particular accounting, finance and sales functions.

If your business provides a subscription service, whether that's B2C or B2B, the payment method you offer really matters. The ability to take recurring payments efficiently can mean the difference between success and failure. Having a carefully planned and executed payments strategy improves the customer experience, increases customer retention, and can significantly see revenue uplift.

In this guide we outline some best practices for taking recurring payments. These ideas will help you maximize revenue and squeeze more value from your subscribers.

Reduce churn by optimizing billing and retrying processes.

Transactions are commonly declined due to insufficient funds, but there are other reasons transactions may fail. The rejection may be due to technical issues, and you may want to retry the payment after anything from one hour to three or four days. It’s critical to make sure you have the right technology in place to immediately notify you about payment failures, tell you the reason, and offer a simple solution to retry.

Two common reasons for failed payments are insufficient funds in the customer’s account, and the customer cancelling the mandate via their bank. GoCardless offers a full range of notifications to help you identify exactly what is causing your payments to fail, equipping you to solve the problem.

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

Avoid cancelled or expired cards.

Bank debit (known as ACH in the US, Direct Debit in the UK, and SEPA across Europe) is a great way to avoid cancelled or expired cards. As bank debit schemes operate from bank-to-bank, payments are much less likely to fail. As a result, there is potential to reduce your churn rate to as low as 0.5% - a figure which some of our customers enjoy. This situation compares favourably to alternative payment methods such as credit cards, where churn rates can be as high as 5-10%.

Getting paid shouldn't cost you time, money and stress!

That's why GoCardless automates payment collection to make it simple, affordable & hassle-free.

Allow customers to choose their preferred billing frequency and day.

This is one of the best ways to ensure that your customers have enough funds available when payment time arrives. Taking payments using bank debit lets you to offer your customers flexible payment terms; monthly, quarterly or annually - and to pay on the date that suits them best.

Get familiar with local or regional payment cycles.

If monthly billing failures occur due to insufficient funds, it’s a good idea to examine local or regional payday cycles and bill customers immediately after those. You could also consider automating the whole process using bank debit, allowing your customers to choose the payment timings that suit them best.

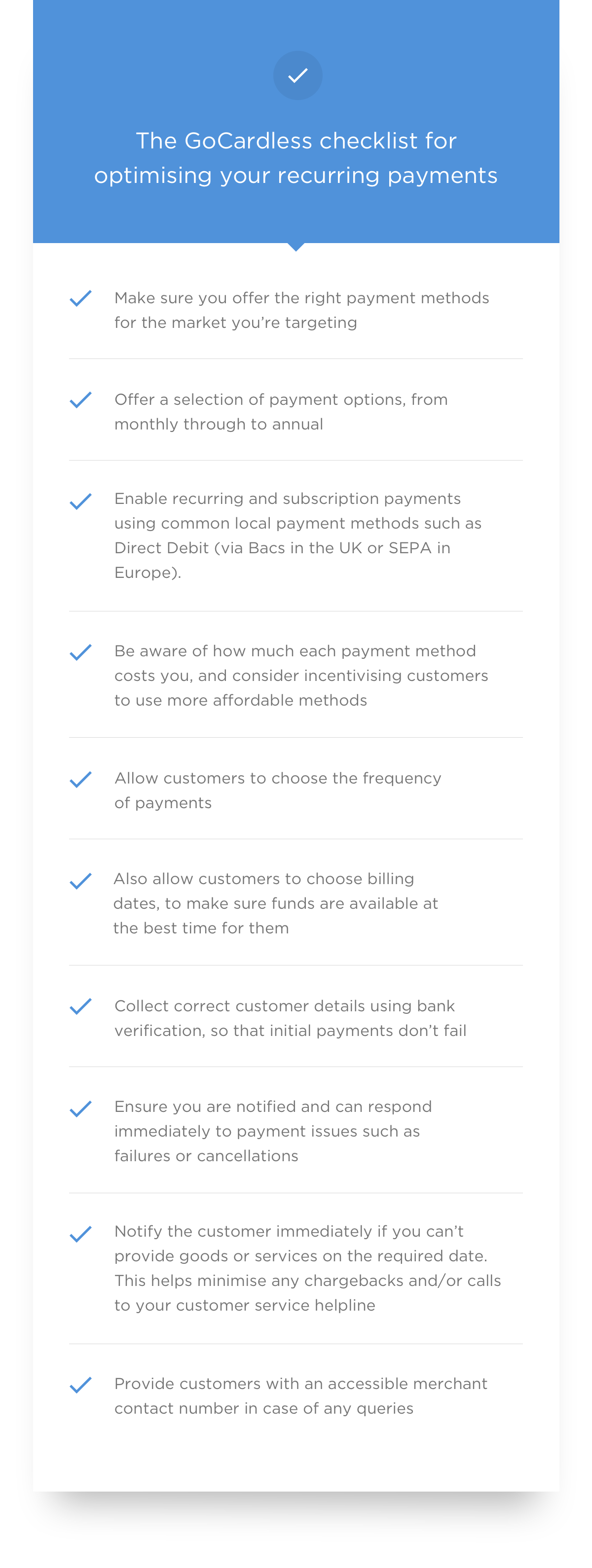

To make sure you get payments right first time, we’ve put together a helpful checklist for recurring payments.

Better still, you could streamline your payments process and avoid the above hassles altogether, by using bank debit as your preferred payment method.

How GoCardless can help.

With GoCardless, you can manage all customer bank debit payments seamlessly, taking advantage of our low fees, flexible timings and fully-automated system. The online signup process is quick and easy with no contract and no minimum term.

We offer you the ability to create your own custom integration, via our API, or take advantage of our range of pre-built integrations with popular subscription billing and accounting software, including Zuora, Sage, QuickBooks and Xero.

Find out how GoCardless can help you improve your subscription payment success rates.