GoCardless for Enterprise Business

Minimise your churn, with GoCardless

30% of churn is involuntary – caused by failed payments. GoCardless maximises your payment success, so you retain your customers longer.

Fight failures, cut churn

Fewer payment failures means less involuntary churn. Fight failures with GoCardless – successfully collect 99% of instant one-off payments, and 97.3% of automated recurring payments, on the first try.

If a payment does fail, Success+ uses payment intelligence to retry payments on the best day for each customer.

We didn’t want recurring card payments because as soon as the card expires, you lose that donor.

Charlotte Hillenbrand, Executive Director of Innovation & Digital, Comic Relief

Read what 700 decision-makers say about churn

GoCardless commissioned Forrester Consulting to conduct a study of 700 payment decision-makers in organisations with recurring revenue models.

Businesses with B2C revenue see 16-20% of failed payments turn into bad debt. With B2B, 11-15%.

Read the full report to see the challenges and opportunities facing global enterprise businesses, and what they’re doing about it.

Payment failure rates as low as 0.5%

Reduce your failed payments. Successfully collect 99% of instant, one-off payments – and 97.3% of automated, recurring payments – on the first try.

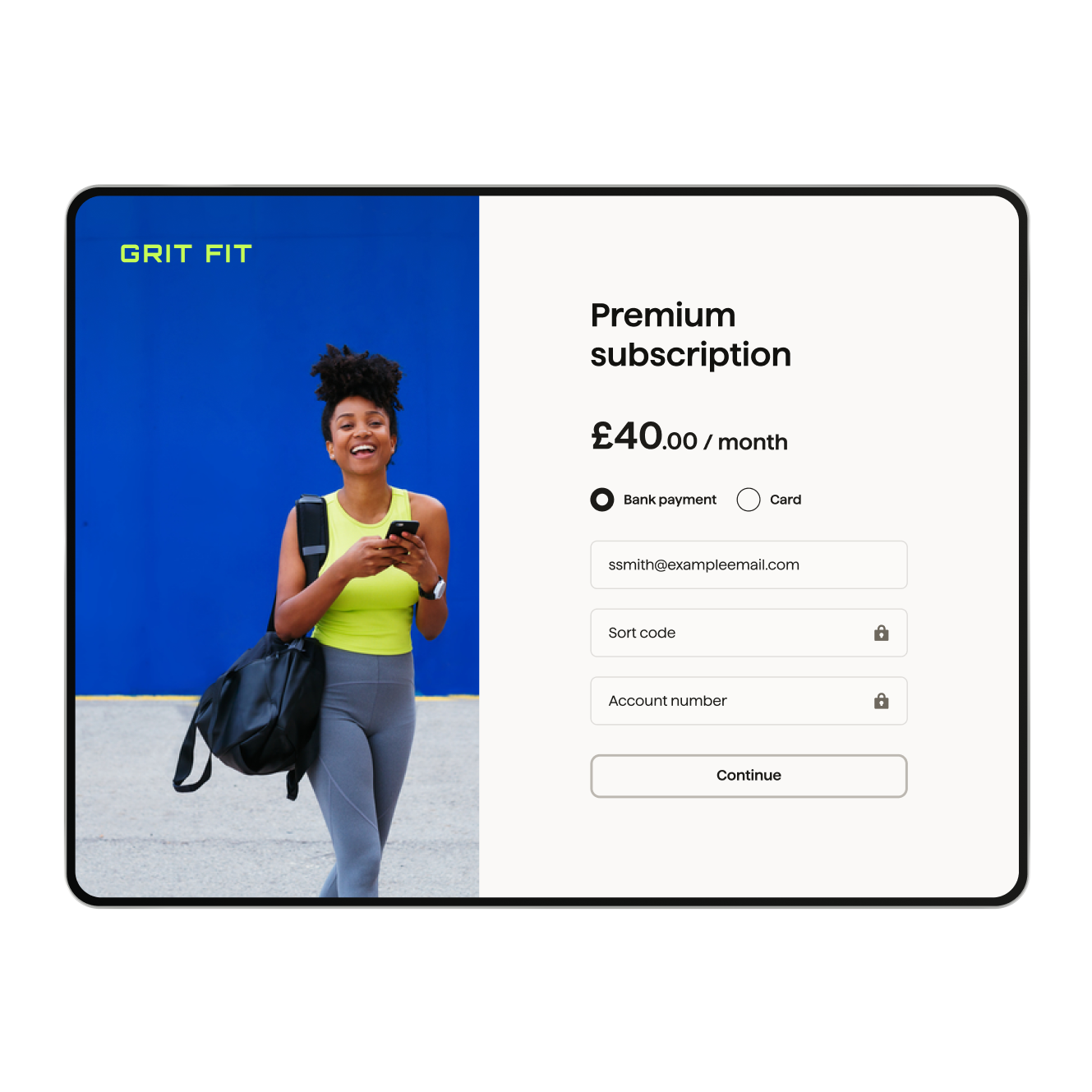

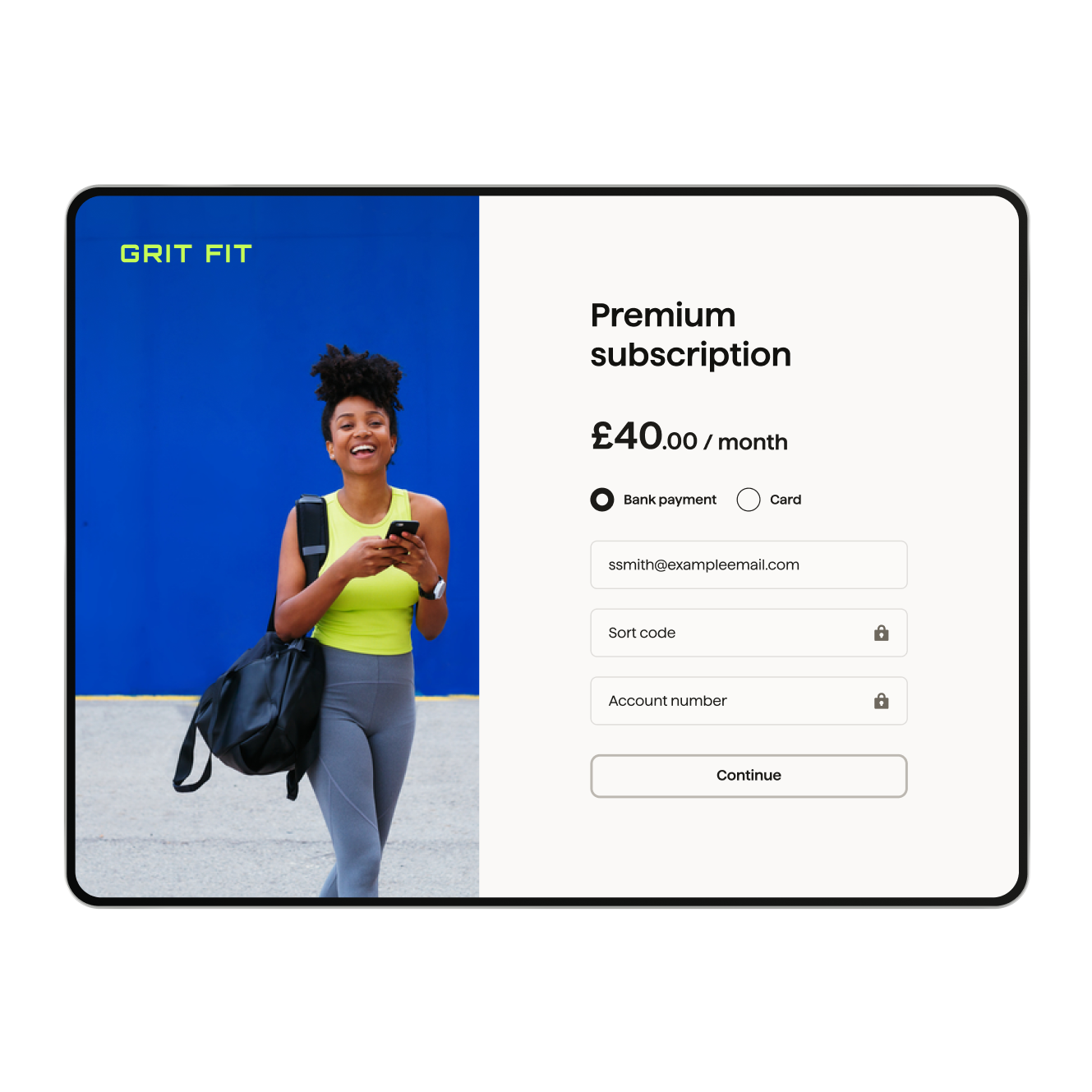

Pull-based payment collection

GoCardless is built on bank debit, a pull-based, bank-to-bank payment method that allows businesses to pull payments directly from their customers’ bank accounts.

Low payment failure rates

With GoCardless, around 97.3% of payments will be collected successfully at the first time of asking. With real-time reporting, know instantly when a payment does fail so you can take action.

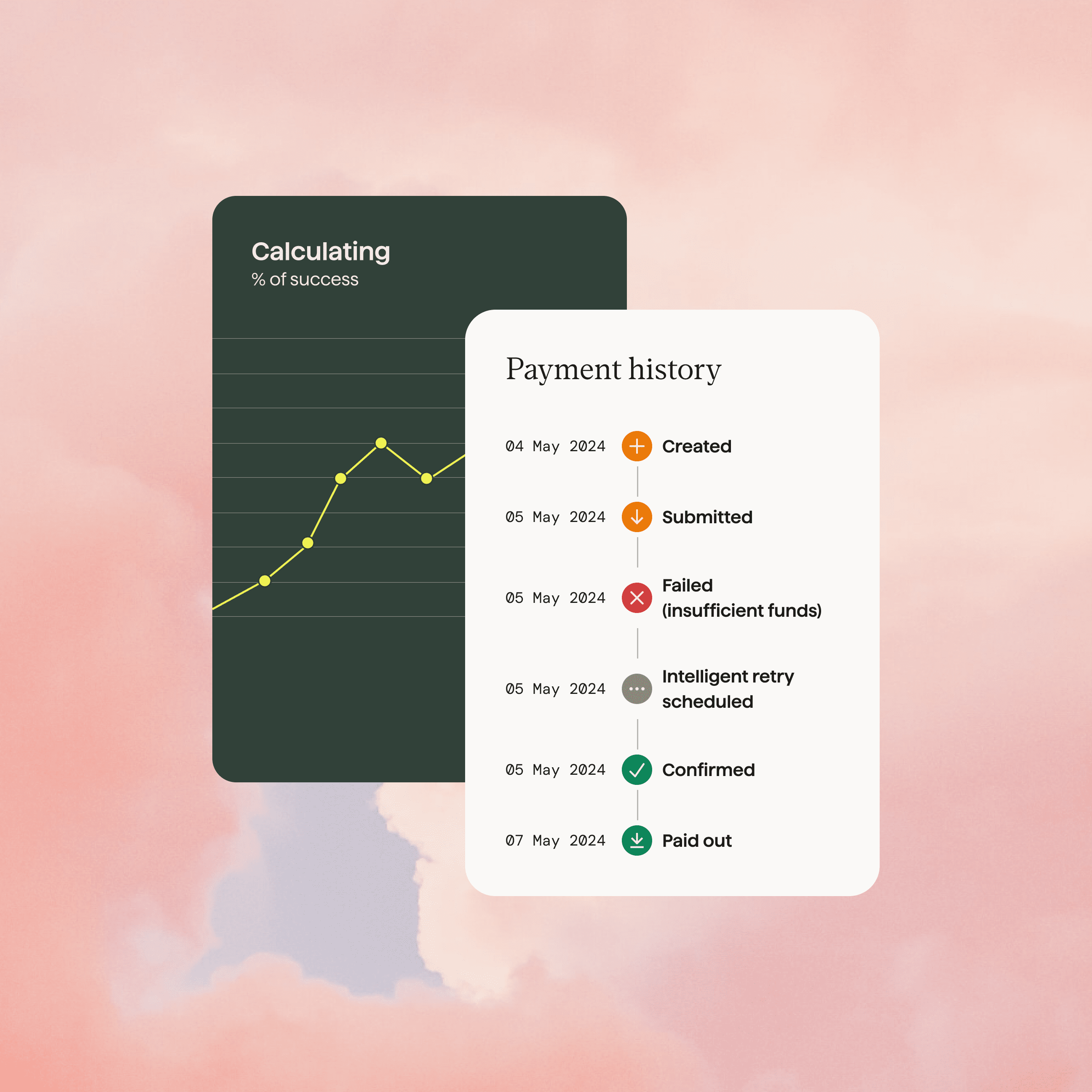

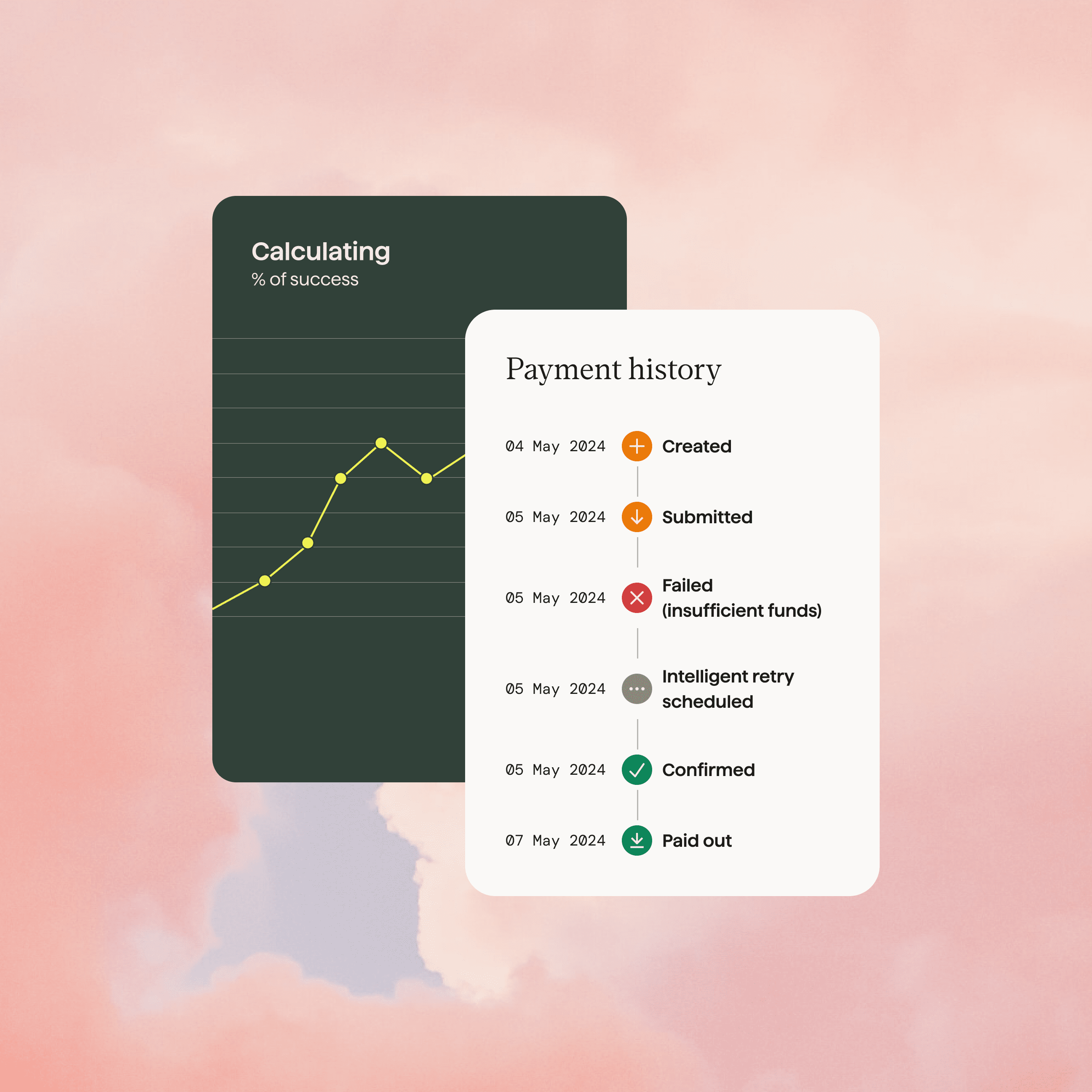

Intelligent retries

Success+ uses payment intelligence to retry payments on the best day for each customer. Recover, on average, 70% of failed payments.

Save time with Success+

Success+ is our payments intelligence product that does the heavy lifting for you. Automatically retrying failed payments on the best day for each of your customers.

89% of businesses said Success+ saves them time.

Local payments, global reach

No matter where your customers are in the world, make paying your business quick and simple. With GoCardless, offer a trusted payment method and localise your payment pages for more than 30 countries including the UK, Eurozone countries, the USA and Australia.

We have a payment failure rate of only 0.4%, and many of those are rectified instantly upon retrying the payment.

Damian Clements, Finance Director, Yorkshire Energy

"Getting everything live was totally painless"

Using GoCardless, The British Journal of Photography has been able to increase renewal rate from 60% to 90%.

Trusted by 75,000+ businesses. Of all sizes. Worldwide.

Ready to cut churn with GoCardless?

Speak to one of our payment experts about your challenges with churn. We’ll show you how GoCardless can help.