Last editedOct 20204 min read

Does your ability to take payments effectively affect revenue?

Chances are, you’ll agree that it does. It’s straightforward enough to recognise that if your membership organisation struggles to set up, collect and manage payments, the resulting membership revenue will suffer.

But is that enough? Think about the following question:

Does your payment experience directly affect members’ decisions to join or renew?

It’s an interesting idea. Will new members be actively put off joining your organisation if you can’t live up to their expectations of a good payment experience?

We put this hypothesis to the test and surveyed 500 current and previous members of various organisations about payments, billings and subscriptions. We focussed on the millennial age bracket as this is the demographic that will dictate your membership organisation’s success for the next few decades.

The survey answers a lot of the burning questions about payment experience and even threw up a few surprises.

The current state of things

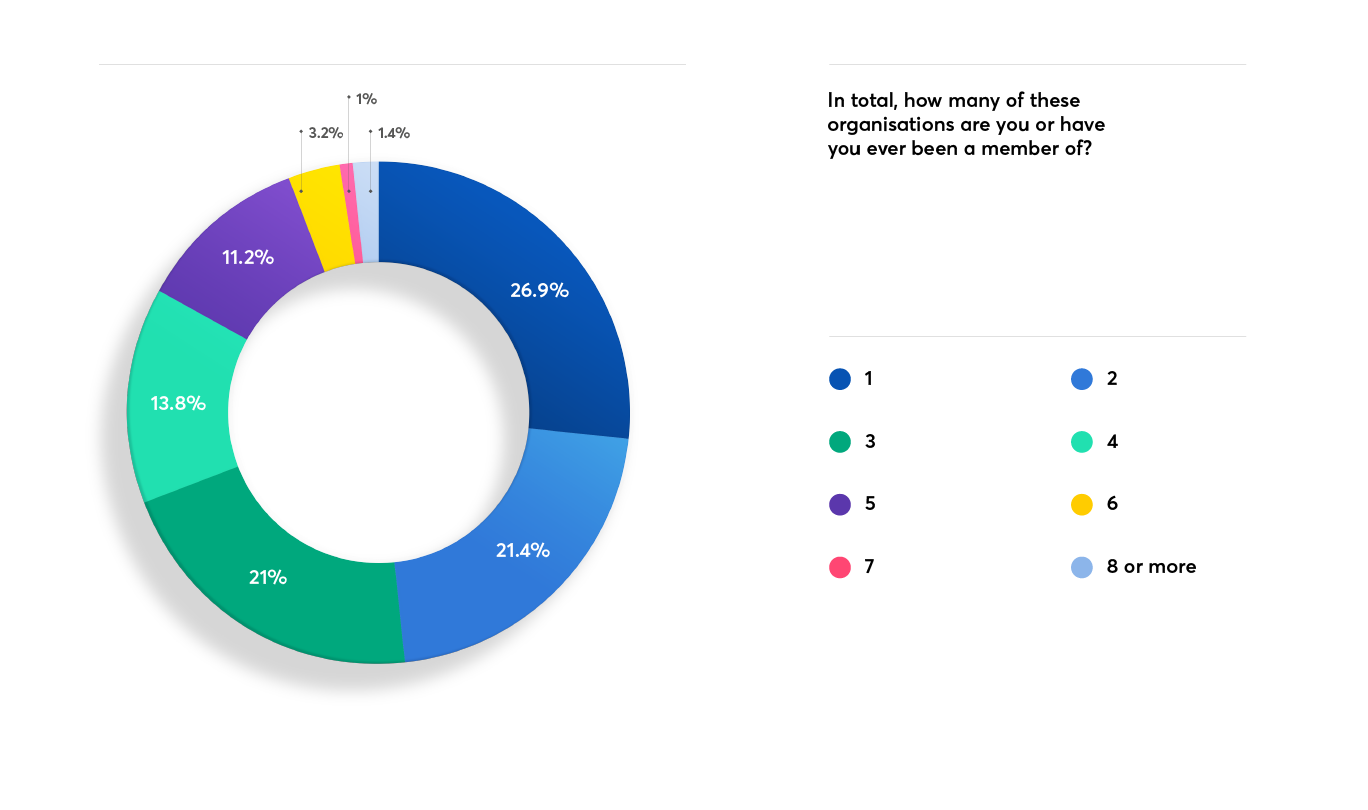

To get a flavour for how things currently stand, we asked each respondent about their current memberships. 73% of people we surveyed hold or held memberships at two or more organisations, while 52% hold or held three or more.

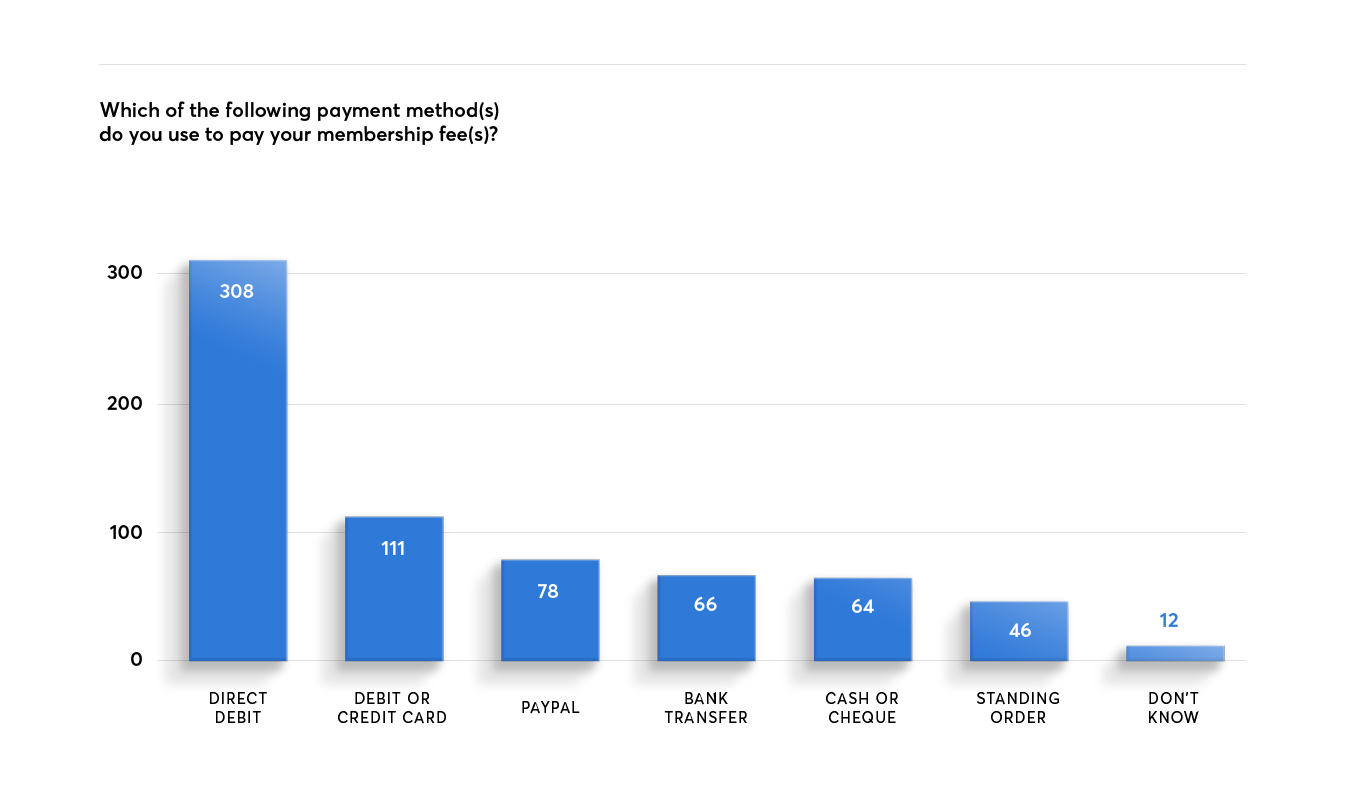

When it comes to payment types, 62% of respondents currently pay at least one membership by Direct Debit, while 22% pay at least one membership using the 2nd most common method, credit or debit card.

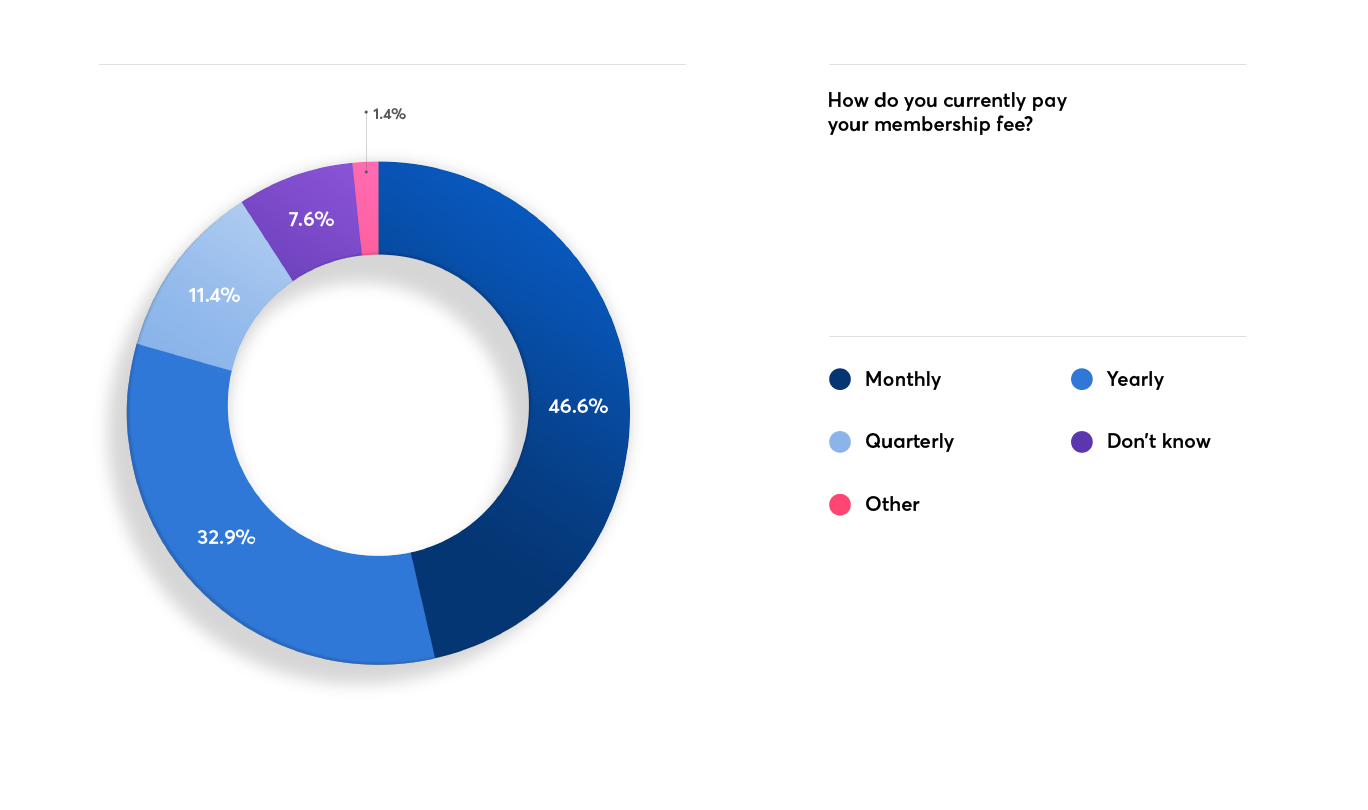

47% pay for their membership on a monthly basis, while 33% of members pay yearly. The results show that while there are some payment methods and billing cycles that are more common than others, there isn’t a ‘standard’ as yet.

What do members want?

While the above stats show how things are now, it is interesting to see what members would actually prefer when it comes to their subscription. The results prove membership organisations as a whole still have to offer more flexible options to meet the needs of members.

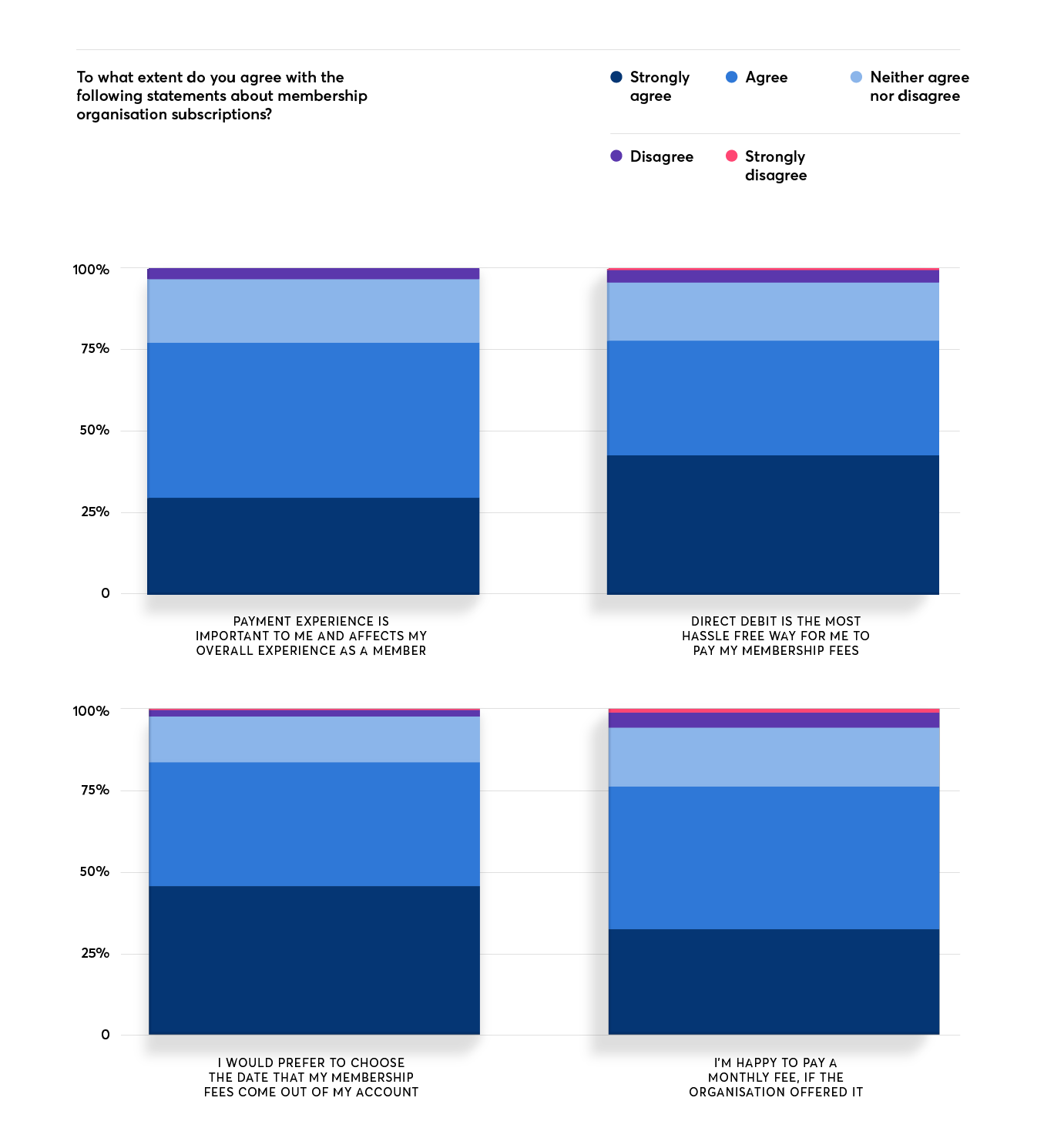

78% of respondents agreed that Direct Debit is the most hassle-free way of paying their membership fees, but that compares to only 62% of respondents currently using Direct Debit.

76% of respondents agreed that they would pay monthly if offered the opportunity. Yet 53% of members are still billed annually, quarterly or another way.

Another standout finding from the survey found that 84% of respondents would prefer to choose the date that membership fees came out of their accounts. Often, traditional Direct Debit solutions restrict the ability to take payments on multiple dates, as each new date increases the admin burden. Automated solutions, like GoCardless, represent a better opportunity to offer members the flexibility they demand.

As if to hammer home the point that the above preferences do play a part in their decision making, 77% agreed that payment experience affects their overall experience as a member.

Meeting the demands of the digital user

The millennial member, unsurprisingly, necessitates a much bigger shift in your membership organisation than just billing options. One of the areas where this shift is so clear is in the online space. A lot of membership organisations are going through a digital transformation to prepare for this.

85% of members indicated that it was important or very important for them to be able to both set up and manage payments online.

Online payment options are no longer an added benefit or a bonus for millennial members, but a core expectation. While flexibility to offer payments on paper or over the phone is a positive, it is now simply a niche option for a very small part of your membership base.

The demand for payments on a mobile is not far behind. 76% of respondents said it was important or very important to manage their membership via mobile phone. Again, this is unsurprising as 95% of all UK residents between the ages of 16 and 34 own a smartphone.

If your membership organisation lacks this very fundamental online functionality, it will impact member recruitment and retention, and immediate action needs to be taken to remedy this.

Getting added value from their membership

While the membership itself often forms the core of the relationship between member and organisation, many members seek to add extra services to their membership to add value, whether or not these services are paid for.

In general terms, 74% of respondents indicated that it was important to be able to easily add extra services to their membership.

Specifically:

72% of members would likely take advantage of professional qualifications if offered

60% of members would likely take advantage of industry events if offered

58% of members would likely take advantage of mentorship if offered

While the cost of additional services will obviously impact a member’s decision to use them, the survey does show a definite appetite for them.

If you’re considering adding paid-for extra services or new revenue lines, consider how your members will be able to pay for these. Your ability to change payment amounts and offer these extra services to spread out the cost over several months will impact the likelihood of a member taking advantage of them.

Everything else

Our survey also uncovered a few other insights that show how the overall payment experience impacts a member’s opinion of an organisation.

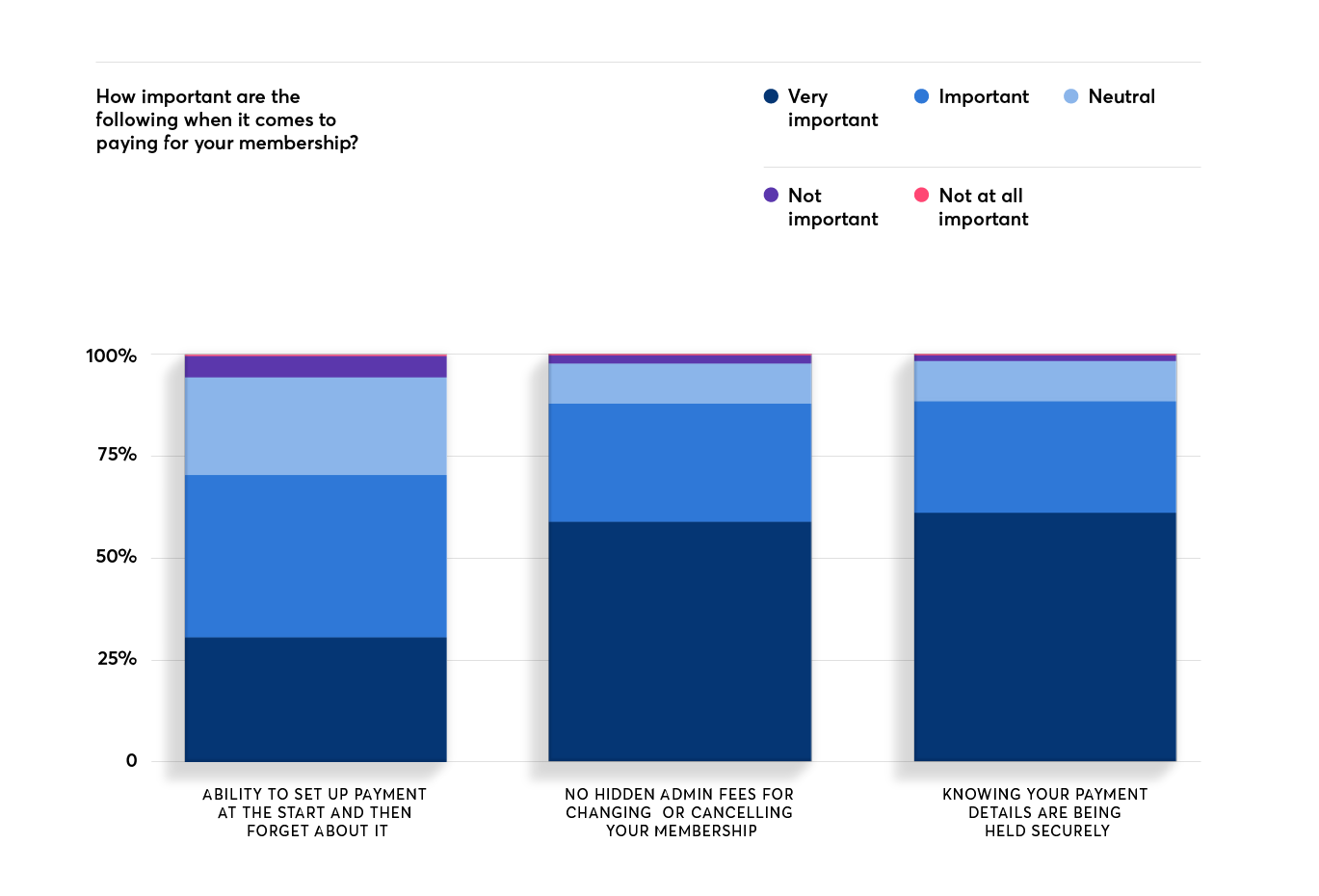

One of the strongest-held opinions revolves around security, with 88% of members saying that knowing payment details are stored securely is important, with the large majority (61% of all respondents) saying it is very important.

Another strong theme is transparency. 88% of members surveyed said it was important or very important to know that there were no hidden charges for leaving a membership organisation.

Additionally, 70% of members indicated it was important or very important for them to be able to set up payments and then forget about it.

The above findings point to the idea that a member needs to be able to feel they can trust an organisation and by acting in a way that goes against these preferences will inevitably damage the relationship of the two parties.

What does this all mean?

There are a lot of takeaways here that you should use when considering how you integrate your payment experience into your wider member journey. It also proves that a good payment solution is more than just a box to be ticked, but something that actually forms part of the member experience and the decision-making process for the member.

The realities of persevering with a DIY or fragmented payment solution are laid out in our recent guide, the hidden dangers of your DIY Direct debit solution.

If, however, you’ve reached the conclusion that now is the time to switch, whether because you’re changing CRM system or simply want to take advantage of the benefits of an online Direct Debit solution, fill in this form and one of our Direct Debit experts will get back to you.

Worried about the process of switching Direct Debit provider?

Find out the most common misconceptions why switching doesn't have to be painful.