What do customers see when they use GoCardless?

Last editedJun 20242 min read

We know how important it is to see what your customers are seeing, so we've put together some screenshots to show what your customer will see when you are collecting payments with GoCardless. This blog post will show you how simple and quick using GoCardless is for your customers and which elements of the payment pages you can customise.

Your customers will enter their details on our secure payment pages, and we'll immediately redirect them back to your site when they complete the payment process.

What your customer sees

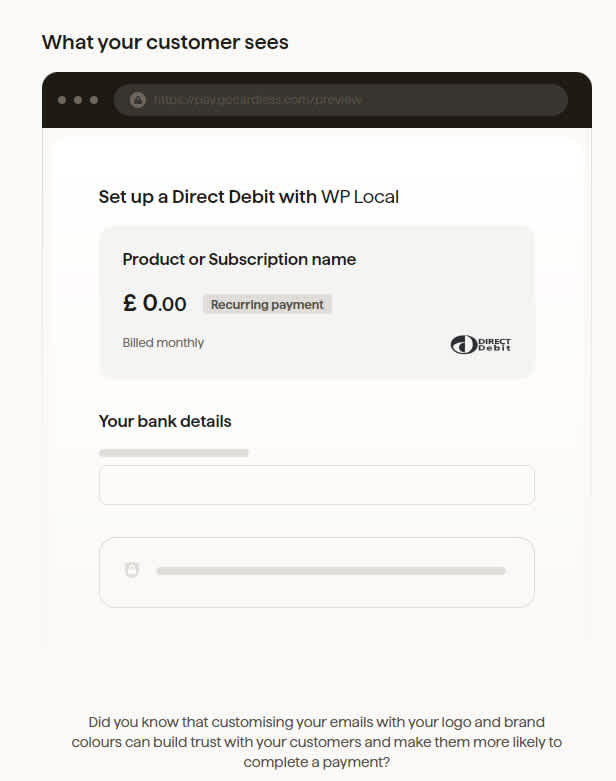

GoCardless allows different levels of customisation depending on which plan you have chosen. You can upload your company logo to change the appearance of your customers' payment page and notification emails. Customising your emails with your logo and brand colours can build trust with your customers and make them more likely to complete payment.

What your customer sees when you send a Direct Debit mandate for recurring payments:

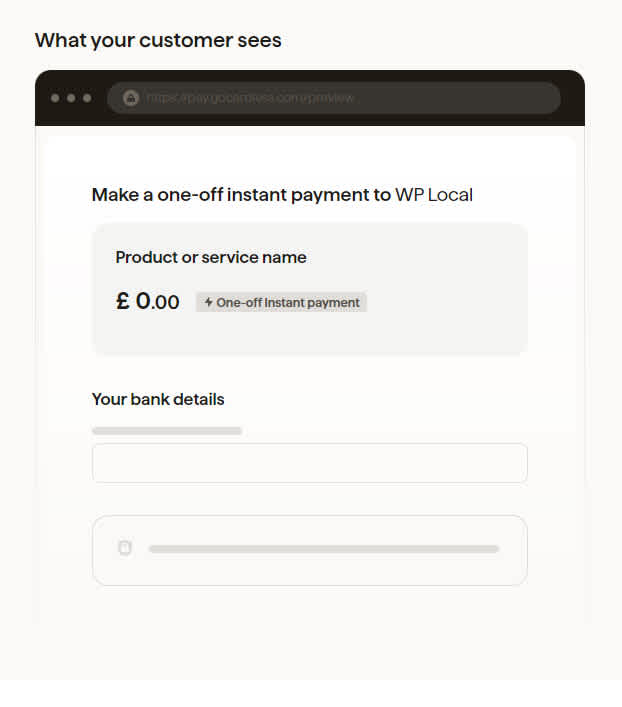

What your customer sees when you send an instruction for a one-off payment:

The examples of the payment pages a customer sees above are simplicity itself, but some key points to note are:

We only ask your customers for absolutely required information

You can add your own branding by sending us a logo which will appear in the top left of the authorisation form. (alternatively, we can just put your company name there)

The page clearly tells the customer what they're purchasing. The name and description of the item(s) are as chosen by you

More information about our credentials is instantly available so that customers can pay with confidence

Once we've collected the essential payment details from your customer, we ask them to confirm the payment, and that's it! Payment done. We'll redirect the customer to the URL of your choice and send them an email confirming their payment.

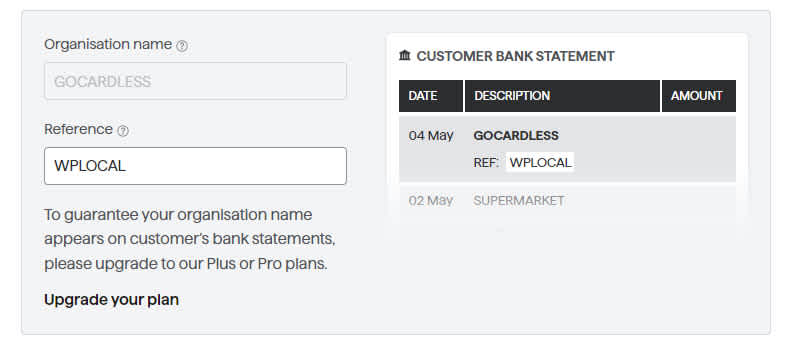

What your customers will see on their bank statements

With our Standard plan, your customers will see "GoCardless Ltd" on their bank statements whenever they make a payment to you.

You may add a 12-character reference (letters and numbers only) to help customers recognise the payments you're collecting from them.

Please note: how this reference appears on customer bank statements can vary depending on who your customer banks with.

Visit our support hub to read more about our hosted payment pages and what your customers see.

We can help

Setting up payment collection is fast and efficient with GoCardless. By automating the payment collection process, GoCardless drastically cuts down the administrative responsibilities of managing and tracking invoices for your team.

GoCardless makes it quick and easy to get started, and with no contracts or long-term commitment required, there’s no risk. You can set up instant, one-off, or recurring payments in the merchant dashboard in just a few clicks, and GoCardless automatically creates and sends all the necessary forms, doing all the heavy lifting for you. You can also connect to GoCardless via over 350 partner apps, such as Xero and Quickbooks.

Discover how GoCardless can streamline your payment process, making it easier for you to concentrate on what matters most - your business growth.