The digital transformation of energy payments in the UK: how other countries can take note

Last editedApr 20235 min read

An in-depth look at how energy providers have steadily transformed the way they collect payments to help reduce costs and improve review scores.

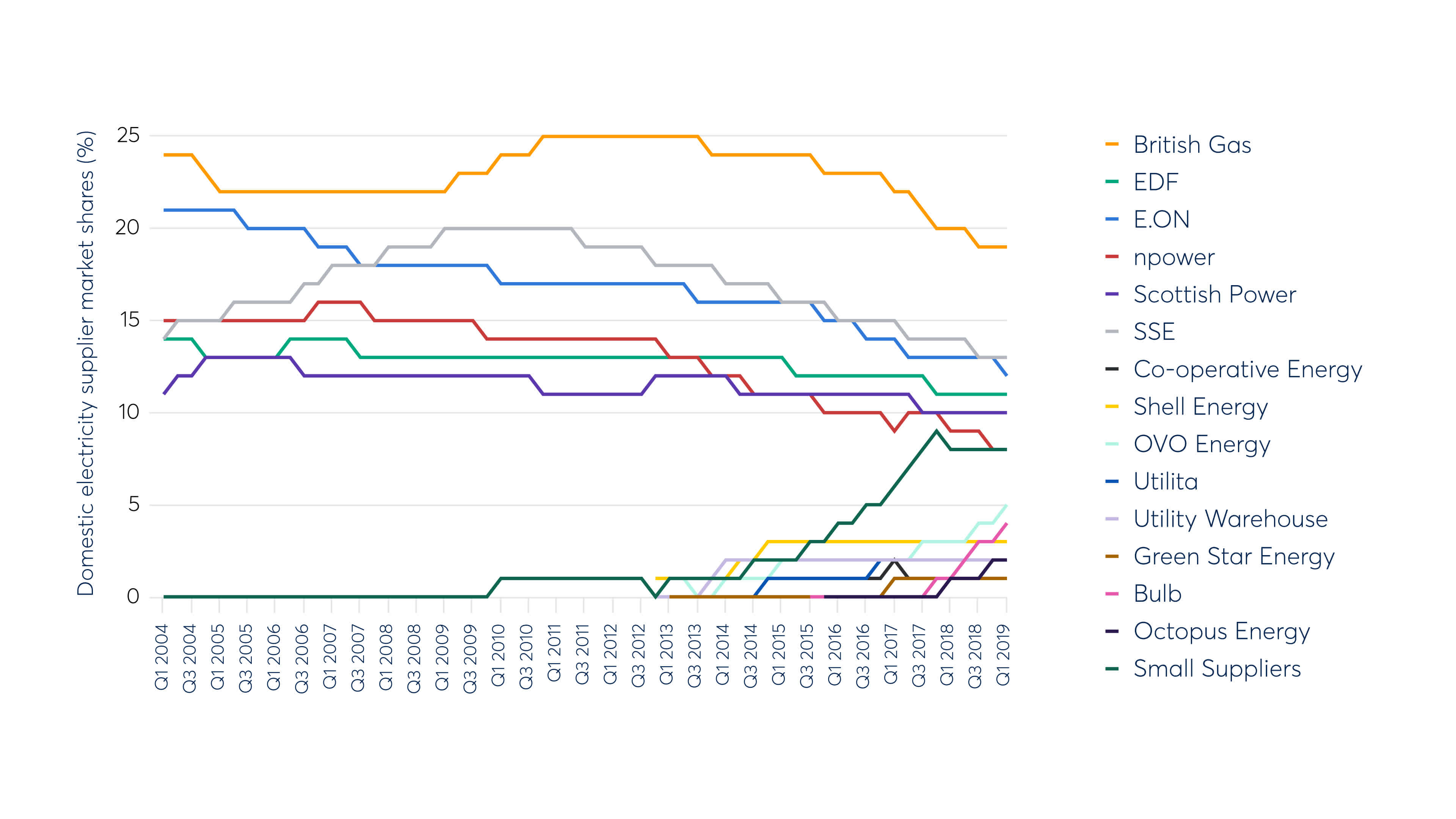

The UK energy market has been deregulated since 1990 when customers were first given the freedom to choose their gas and electricity suppliers. However, even with that freedom of choice, the consumer market has been traditionally dominated by the ‘Big Six’ suppliers.

In 2004, there were a total of just 13 active domestic electric energy providers, and the Big Six enjoyed a market share of close to 100%. But as of 2019, there are now 60 active suppliers and the challenger brands now supply 28% of the market.

So what changed in the last 15 years that caused such a stark shift in the UK’s energy landscape?

The UK consumer energy market over the last 15 years (source: Ofgem).

Digital transformation and advancing technology

The increasing use of digital technology in the energy market has radically changed the industry’s relationships with customers, by handing those customers increased market power.

This transformation has also enabled customers to make informed decisions about their energy supply, coming at a time when competition in energy truly lifted off.

This digital transformation has seen the introduction of smart meters, giving customers improved visibility on what they’re spending, more diverse ways to contact their supplier, and online or app-based portals for managing one’s account with a provider.

In short, it’s all about the customer experience. As former First Utility (which is now a part of Shell Energy) CTO Bill Wilkins put it: “You have to make sure the customer gets great service and experience. Beyond service, utilities have to differentiate themselves and there is no better way to do that than through a digital offering.”

The challenger brands have generally made the customer experience a huge priority, scoring much higher marks on average than the incumbents in wide-scale customer surveys. For example, in the Which 2019 report, the highest-rated ‘Big Six’ member for overall satisfaction was a lowly 22 out of a list of 31 suppliers.

The dominance of the Big Six may well be truly at an end, as it was recently announced that OVO Energy has purchased SSE’s retail business, and will become the 2nd largest supplier to the UK consumer market in the process.

Despite all this, there’s one aspect of digital transformation that many energy providers in the UK market (and beyond) aren’t always paying close enough attention to: billing and payments.

Payment experience as a differentiator

According to the Council of European Energy Regulators, “the basic forms of product differentiation in retail energy markets are pricing and billing options.”

The potential for saving money will always attract customers to energy suppliers, but CEER suggests that the only other major way to put your brand ahead of the competition is to improve the billing experience. This should be a wakeup call to those who aren’t yet taking it seriously.

But how do energy providers differentiate themselves from competitors using payments?

The freedom to choose a better payment method

One obvious way is to diversify the payment methods available to customers or offer alternative methods that are more desirable to the end customer.

According to extensive surveying carried out by YouGov on over 12,000 consumers, 68% of those in the UK prefer to use Direct Debit (also known as Bank Debit) to pay household bills, compared to 34% on debit card and 13% on credit card.

While Direct Debit has generally been embraced by the UK energy market, not all Direct Debit is created equal, and providers can turn to more technologically-adept payment providers like GoCardless to turn payments from a box to tick to a competitive advantage.

Bolstering reviews with better payment experiences

One tangible way for an energy provider to measure customer experience is through review scores. The now very-widely recognised Trustpilot 1-5 star rating mechanism is held as a badge of honour for those with scores approaching the 5-star average.

However, the average overall review score for the Big Six suppliers is just 2.3 (as of 18 September 2019), with only EDF (4.3) and British Gas (3.8) scoring over 2 on Trustpilot.

This presents an excellent opportunity for challenger brands to leverage their approaches to payments to increase their average review scores. Compared to the lowly review scores of the incumbents, the next 6 biggest UK consumer energy suppliers have an average overall review score of almost 4.3.

Reviews are a key way for energy providers to get ahead of the competition.

And if you take a look through the reviews of any UK energy provider, whether their aggregate scores are excellent or poor, payments are a key source of joy or frustration for customers making their reviews.

While it’s hard to pinpoint one key difference between ‘good’ payment experiences and ‘bad’ payment experiences, it’s perhaps no coincidence that a digitally integrated payment solution provides the energy supplier and customer with a great deal of actionable information very quickly, much of which can answer the kind of questions that lead to a bad payment experience in the first place.

Payments powered by GoCardless, for example, can notify customers on various aspects of their payments, such as:

If payment was taken successfully or if it failed

Whether the initial Direct Debit mandate was set up correctly

Confirmation of subscriptions/payment plans being successfully set up, amended or cancelled

Cutting payment failures to save time and provide better support

While improving payment experience to improve customer satisfaction has tangible benefits to energy providers, these benefits are the halo effect of making payments a customer-focused entity.

But there are more direct benefits to improving your approach to collecting payments, especially by leveraging technology to do so.

An end-to-end payment solution can reduce your operating costs and allow your business to spend less time focussing on payments in the long run.

Take payment failures. Every failed payment may require human intervention to find out that the payment failed in the first place, to retry the payment and to get further actionable information on that - not to mention the long-term cost of providing a poor experience to a customer that may then churn.

While Direct Debit generally has lower failure rates than credit or debit cards (3% compared to 15%+), a payment provider such as GoCardless can help energy providers cut their failure rates to well below 1.5% on the very first try.

Yorkshire Energy, for example, enjoys failure rates of just 0.48%. As well as the instant monetary savings of reducing failures, it also provides another opportunity to offer a better experience to your customers.

More customers will see payments completed successfully at the first attempt, and for those that don’t, energy providers will have more bandwidth to assist them, as well as more useful information to help them, as quickly as possible.

Are the incumbents catching up?

While the UK energy market has seen challengers such as Bulb, OVO Energy and others make the biggest leaps forward with the biggest bets on technology, incumbents from the traditional Big Six are using technology to power innovation, both in payments and on a broader scale.

An online portal and a mobile app, which allows customers to set up, manage and pay their bills are now par for the course with all of the Big Six offering this in some form.

Away from payments explicitly, EDF Energy has set up its own “innovation accelerator”, dubbed Blue Lab, which “brings together people with skills and expertise from across the business, and beyond, to help accelerate innovation,” says EDF Energy Director of Innovation, Jean-Benoit Ritz. The company has located Blue Lab near Brighton where there is, according to Ritz, “the highest proportion of creative small to medium-size enterprises in the UK.

Most major suppliers have made at least some bet on smart energy meters, and while feedback from consumers is mixed, to say the least, Hive by British Gas is now effectively a marketplace for connected home devices and a brand in its own right.

The question is, will incumbents simply be content to offer a payment experience that at least resembles the innovation that has been shown from many of the challenger brands or use their considerable power to attempt to get ahead of the accelerating competition when it comes to payments?

Can other countries learn from the UK’s approach to payment experience?

While the UK is a great example of a country enjoying the benefits of greater competition in the consumer energy market, the Australian market is also seeing challengers take on the traditional incumbents - albeit with key differences to take into account.

In Australia, the traditional ‘Big Three’ incumbents have, like the UK, experienced a reduction in their combined market share to 65% as of June 2019. A recent Australian Energy Market Commission (AEMC) report stated that “New and emerging retailers are driving lower prices and the market is starting to shift towards simpler and more comparable pricing structures, and greater product innovation.”

Some new entrants, including UK-founded supplier and GoCardless customer OVO Energy, are planning to enter the Australian market - and already offer a customer-centric payment solution.

In short, competition from new entrants will only continue to increase, but there is an opportunity to improve payment experiences to stay ahead of the competition.

Upgrading your payment experience with GoCardless

Over 40% of all UK consumer energy suppliers, along with many others from across Europe already work with GoCardless to power their recurring payments and enable them to deliver 5-star payment experiences.

Bulb, now the fastest-growing private company in the UK explained why they chose GoCardless to process their payments:

“We wanted to give our members whatever payment options they most trusted and were the most convenient. GoCardless was the most simple, reliable and advanced Direct Debit system we found.”

To learn more about how GoCardless can help transform the way you take recurring payments, speak to our sales team.