Global payments

Connect

Add-ons

More

Skip to content![How to create a professional purchase order template]()

![A complete guide to Pay by Bank]()

![Integrating payments into your accounting software is essential for real digital transformation - here’s why]()

![Small businesses share their tips for better cash flow and payment collection]()

![Everything new at GoCardless - Product updates February 2026]()

![The sole traders' guide to Making Tax Digital 2026]()

![Partner Product Update]()

![Octopus Energy customers can now get their credit back in as little as ONE day]()

![Commercial VRPs: The new card-on-file?]()

![A landlord’s guide to Making Tax Digital 2026 Making Tax Digital for landlords in 2026]()

![Making Tax Digital for VAT, limited companies, and partnerships]()

![]()

![]()

Latest articles

How to create a professional purchase order template

Get rid of manual procurement woes with a professional PO template that scale.

7 min readSmall Business

A complete guide to Pay by Bank

Lower costs by 54% and get instant settlements with our Pay by Bank guide.

7 min readSmall Business

Integrating payments into your accounting software is essential for real digital transformation - here’s why

Consistent cash flow, less admin and faster, more reliable payments await...

5 min readSmall Business

Small businesses share their tips for better cash flow and payment collection

Expert payment tips from four successful small businesses

4 min readSmall Business

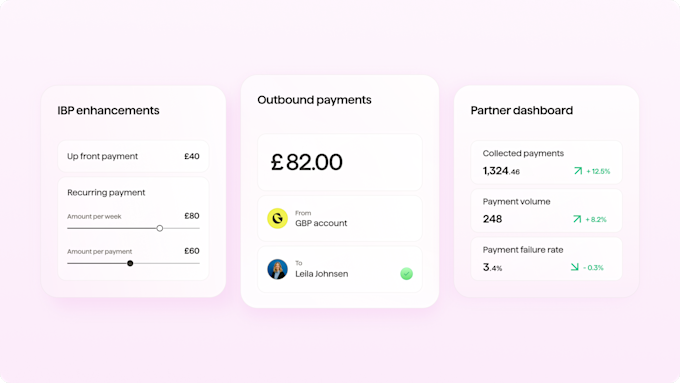

Everything new at GoCardless - Product updates February 2026

See what improvements we’ve made recently

1 min readOpen Banking

The sole traders' guide to Making Tax Digital 2026

Tax is going digital in 2026 for those who do an Income Tax Self Assessment.

4 min readSmall Business

Partner Product Update

Get up to date with the latest product features and launches to offer industry-leading payments to your customers.

Webinar

Octopus Energy customers can now get their credit back in as little as ONE day

Octopus Energy customers now get account credit back faster than ever before.

2 min readPress Releases

Commercial VRPs: The new card-on-file?

What are commercial VRPs and how do they compare to cards?

3 min readEnterprise

A landlord’s guide to Making Tax Digital 2026 Making Tax Digital for landlords in 2026

Making Tax Digital is the biggest shake-up to property tax in decades.

3 min readSmall Business

Making Tax Digital for VAT, limited companies, and partnerships

Your guide to Making Tax Digital for VAT, partnerships and Corporation Tax.

3 min readSmall Business