Instant Bank Pay: Everything partners need to know

Forget bank transfers and card payments. Give your users a better way to collect one-off payments.

A better way to collect one-off payments

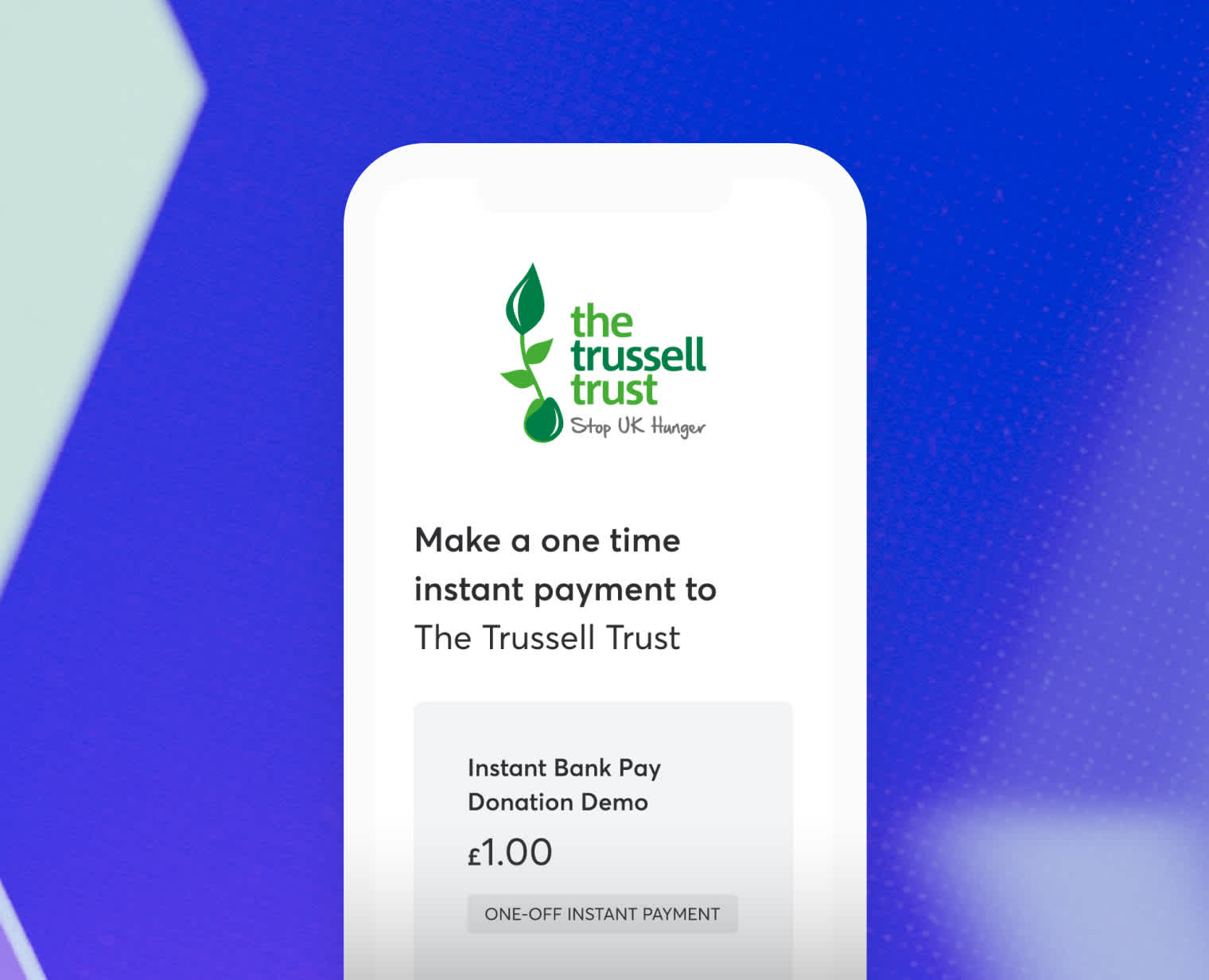

Bank transfers are slow and admin-heavy. Cards are expensive and failure-prone. Instant Bank Pay is the better way for your users to collect instantly-authorised, one-off payments.

Try it now with a donation to The Trussell Trust, or watch a video of the payment process.

It's great for your users

Better payment experience

It’s quick and easy to make a payment. On mobile or desktop.

For businesses of all kinds

Gyms, clubs, agencies, and more. It’s perfect for upfront, one-off, or ad hoc payments.

Works with bank debit

Together, they let merchants cover even more use cases with GoCardless.

Bye bank transfers, bye cards

Instant Bank Pay means less waiting, less chasing, and no more expensive card network fees.

And it's great for you

Better retention + growth

Instant Bank Pay means lower costs, better visibility, and faster funds for your customers.

New revenue streams

Replace un-monetised, “offline” payments like bank transfers, cash, and cheques.

More data, better insights

Greater visibility over the payment process means better insight into your customers’ cash flow.

Stickier customers

Improve your customers’ overall product experience, and encourage them to stay in your ecosystem.

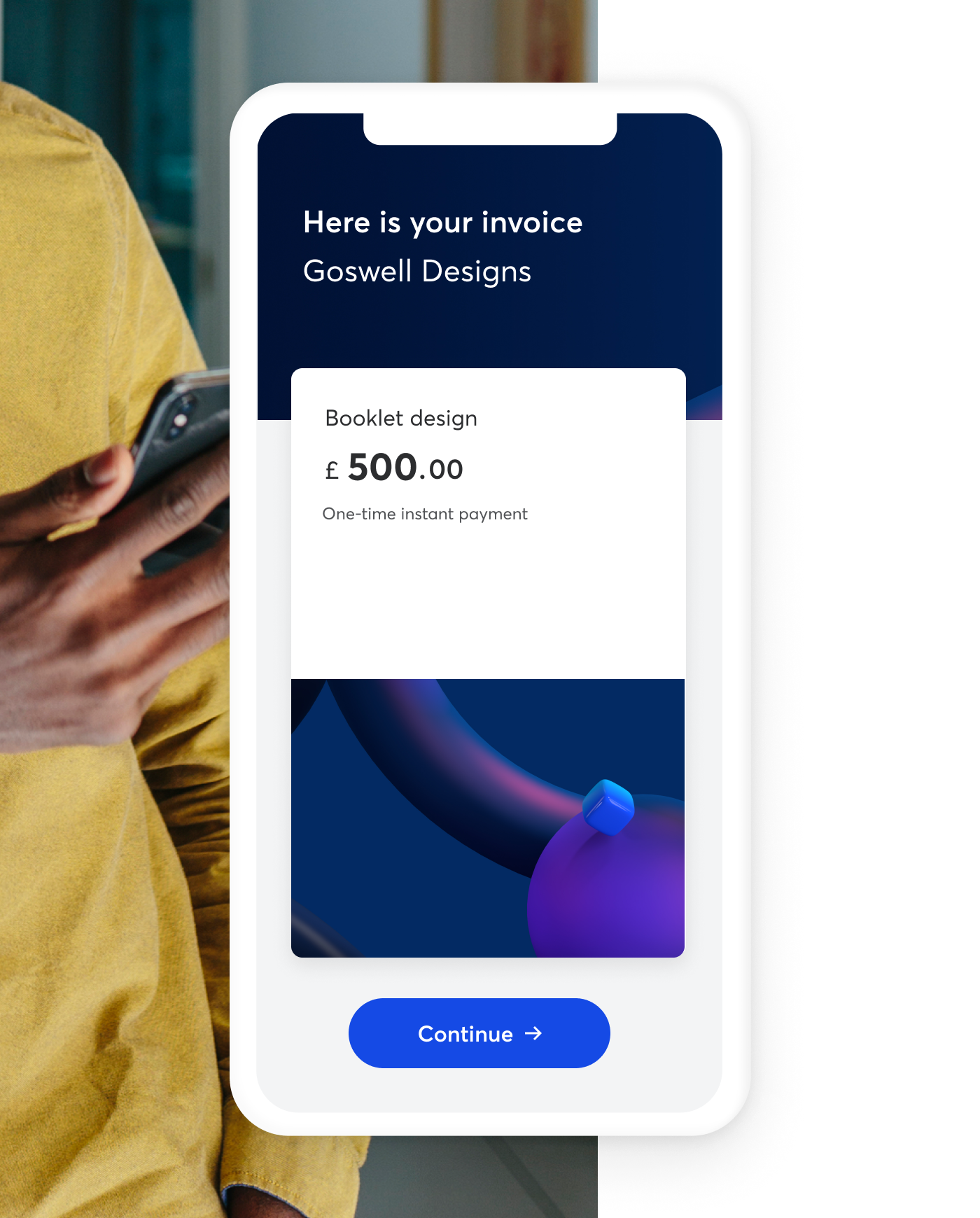

How it works with invoicing

First time payments

Do your users need upfront deposits before beginning work charged in instalments? Now they can collect the upfront payment with Instant Bank Pay and set up a bank debit mandate in the same flow.

High value payments

If your users or their payers are uncomfortable using bank debit for high value payments, Instant Bank Pay is the better alternative to manual bank transfers.

Pay now

If your users need payment before they send out goods or begin services, Instant Bank Pay gives them instant payment authorisation, without the admin of manual bank transfers or high card fees.

Regular invoice collection

Are some of your users worried about chargeback risk? Or do they have payers who refuse to automate payments? Instant Bank Pay gives them the comfort and control of manual bank transfers, but with less admin.

Give your users Instant Bank Pay now

It typically takes 1 week to build it into your GoCardless integration. One GoCardless partner did it with just a single developer.

How it works with subscriptions and memberships

First time payments

Bank debit lacks instant payment authorisation. So your users need an alternative for the first payment in a subscription. Now there’s Instant Bank Pay, so they can manage every payment with GoCardless.

Ad hoc payments on top of subscription

Do you users offer additional goods or services outside of their recurring fee? Instant Bank Pay lets them quickly and easily process ad hoc payments outside their regular billing.

Account top-up payments

Some merchants offer services where their customers have an account balance, such as energy providers. Instant Bank Pay lets customers quickly and easily top up their account in a streamlined flow. Without expensive card fees.

Give your users Instant Bank Pay now

It typically takes 1 week to build it into your GoCardless integration. One GoCardless partner did it with just a single developer.

4 stats that show why merchants need Instant Bank Pay

Instant info about payments

58% of GoCardless merchants that connect via a partner say they need instant updates on payment success.

Links that trigger bank transfers

83% of GoCardless merchants that connect via a partner and send invoices, want to be able to send a link that triggers a bank transfer.

![]()

Instant info about payments

58% of GoCardless merchants that connect via a partner say they need instant updates on payment success.

![]()

Links that trigger bank transfers

83% of GoCardless merchants that connect via a partner and send invoices, want to be able to send a link that triggers a bank transfer.

Card payments are too expensive

65% of GoCardless merchants that connect via a partner and sell subscriptions, say credit card payments are too expensive.

Want to stay within GoCardless

80% of GoCardless merchants that connect via a partner and sell subscriptions, want to be able to take instant payments through GoCardless.

![]()

Card payments are too expensive

65% of GoCardless merchants that connect via a partner and sell subscriptions, say credit card payments are too expensive.

![]()

Want to stay within GoCardless

80% of GoCardless merchants that connect via a partner and sell subscriptions, want to be able to take instant payments through GoCardless.

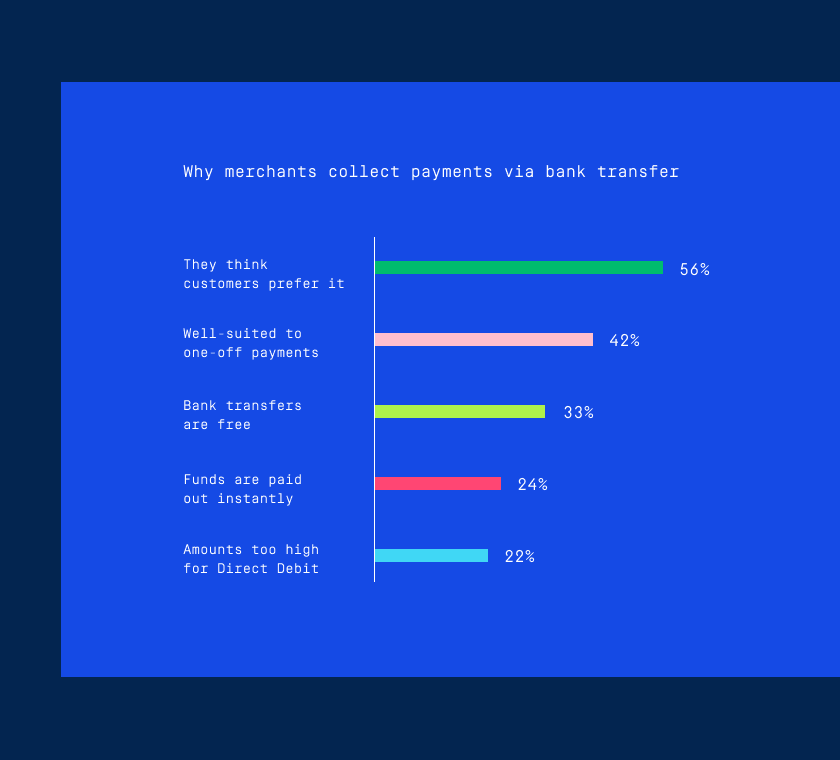

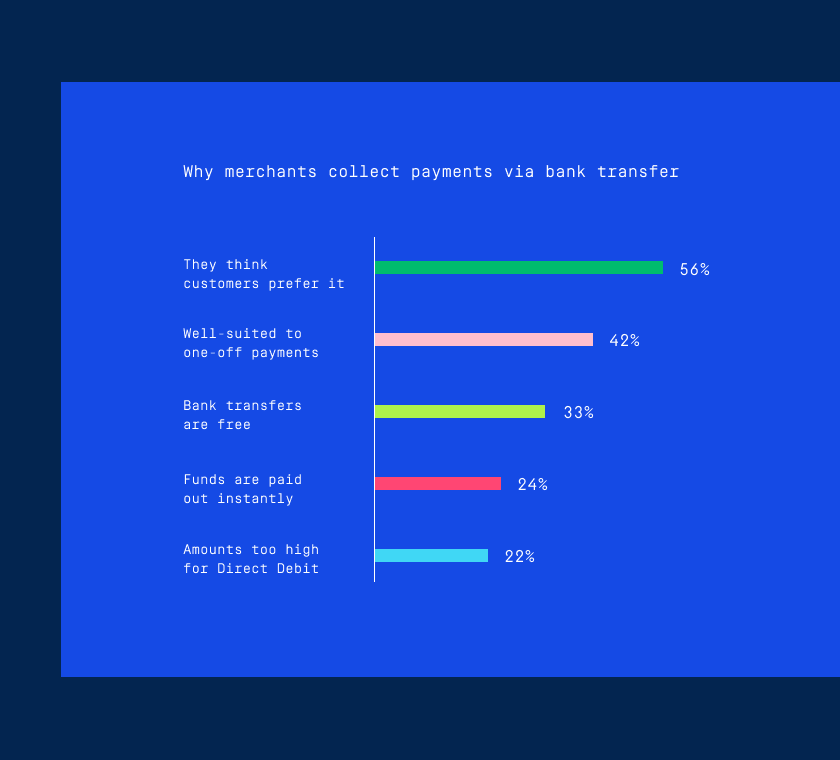

But aren't regular bank transfers "free"?

The main reason merchants choose to collect payment via bank transfer isn’t because they’re free. For two-thirds of merchants we surveyed, cost wasn’t a consideration. So give your users a better alternative with Instant Bank Pay.

Give your users Instant Bank Pay now

It typically takes 1 week to build it into your GoCardless integration. One GoCardless partner did it with just a single developer.