Our customer-first approach

With you every step of the way

Our team is here to help you get the most out of GoCardless from day one.

Getting paid should be easy, right?

But from our 10+ years in the market, we’re surprised at how frustrating and outdated many payment methods still are.

That’s why we build simple and secure bank payment solutions. And why we have a dedicated Customer Success Group. So that getting paid is a breeze – like it should be.

“Customer-first” isn’t just words to us

Everyone says they’re customer-first. We’re different – we’ve invested significantly in building a robust, customer-focused group within GoCardless.

(And we’re all a bit obsessed with making sure you’re consistently getting great value out of our product.)

We feel we have a true ally in GoCardless that can help us achieve our goal of making customers’ lives as simple as possible.

Mauro Bartoletti, Head of Digital Programs, Epson Europe

We're committed to a customer culture focused on...

Trust

Because you should be able to rely on your payments partner to always be looking out for the best for you.

Inspiration

Whatever your ambitions are, we’ll be by your side, cheering you on and helping you get there.

Advocacy

We build GoCardless for you. Which means your voice is the one that matters most to us.

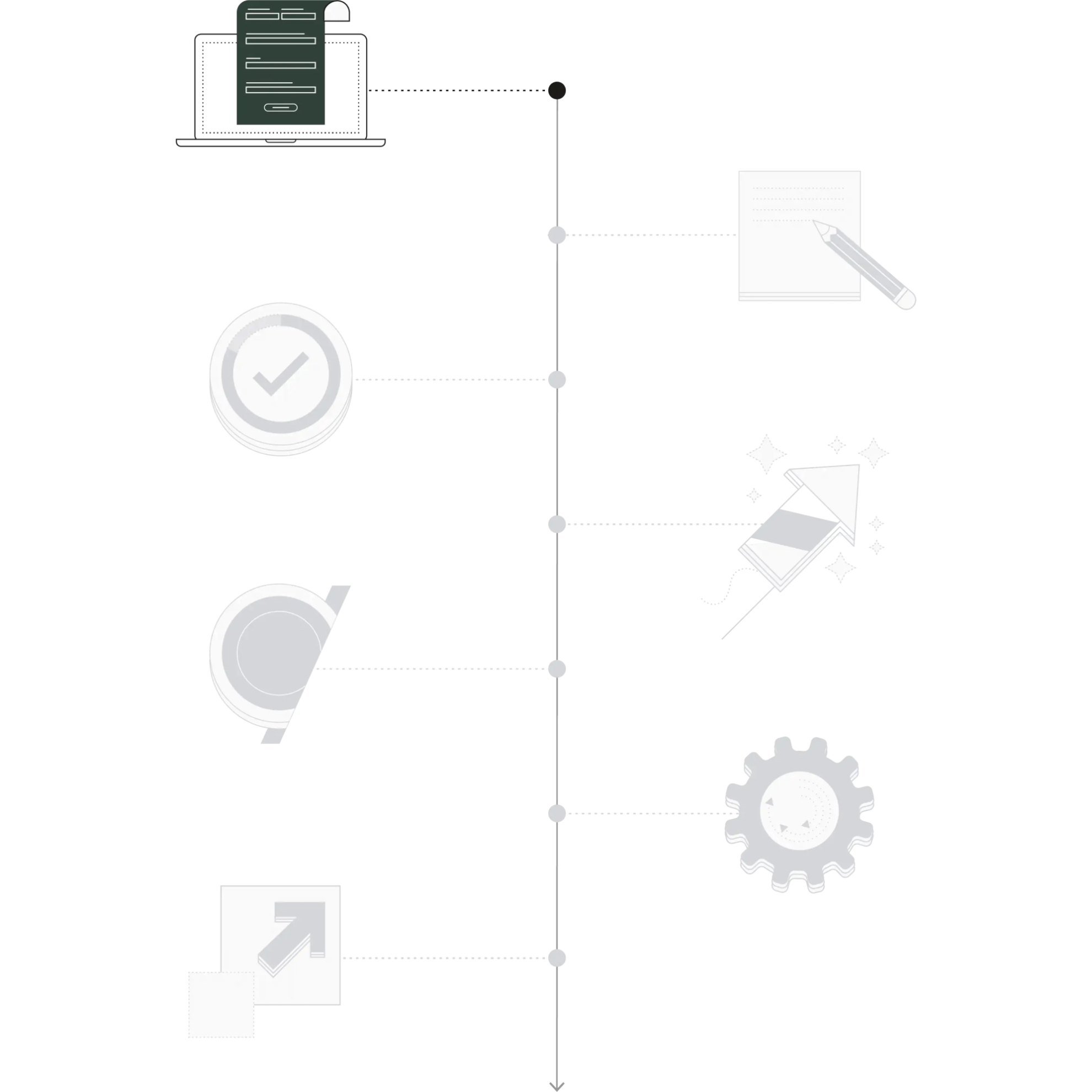

Our customer-first framework

We’ve been at this a while. So we know what we need to do to deliver the right resource to you, in the right way, at the right time.

Here’s what your journey will look like

Say hello to your new best (work) friend

Our team of specialists is here to ensure you maximise the benefits of using GoCardless throughout your journey with us.

Don’t just take our word for it

We’re thrilled to be trusted by 75,000+ businesses around the world. From local window cleaners to global SaaS companies.

You can hear about some of their experiences – and successes – with GoCardless below.

Check out the support and services we offer

You have a whole team of experts, and an array of services on offer, from us here at GoCardless.