Crank up your conversion rates, with GoCardless

Simple and Secure Direct Bank Payments

Optimise your checkout experience, and give your customers a smooth payment process.

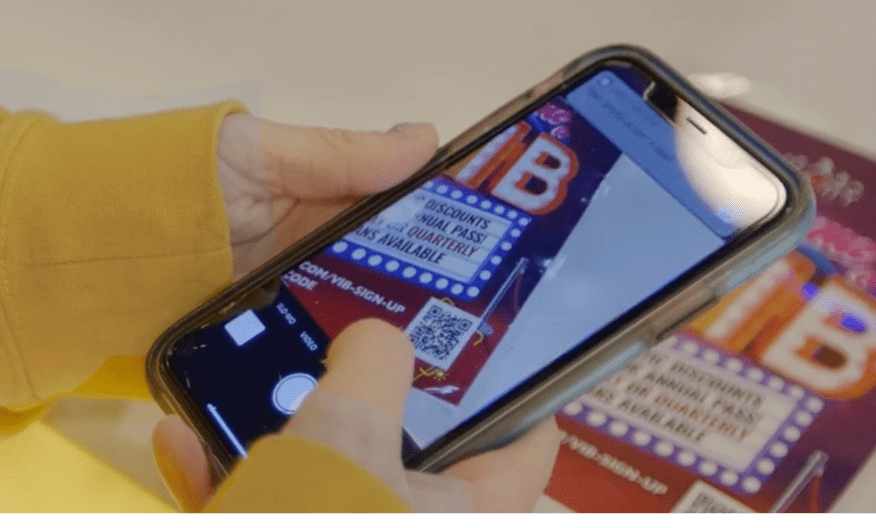

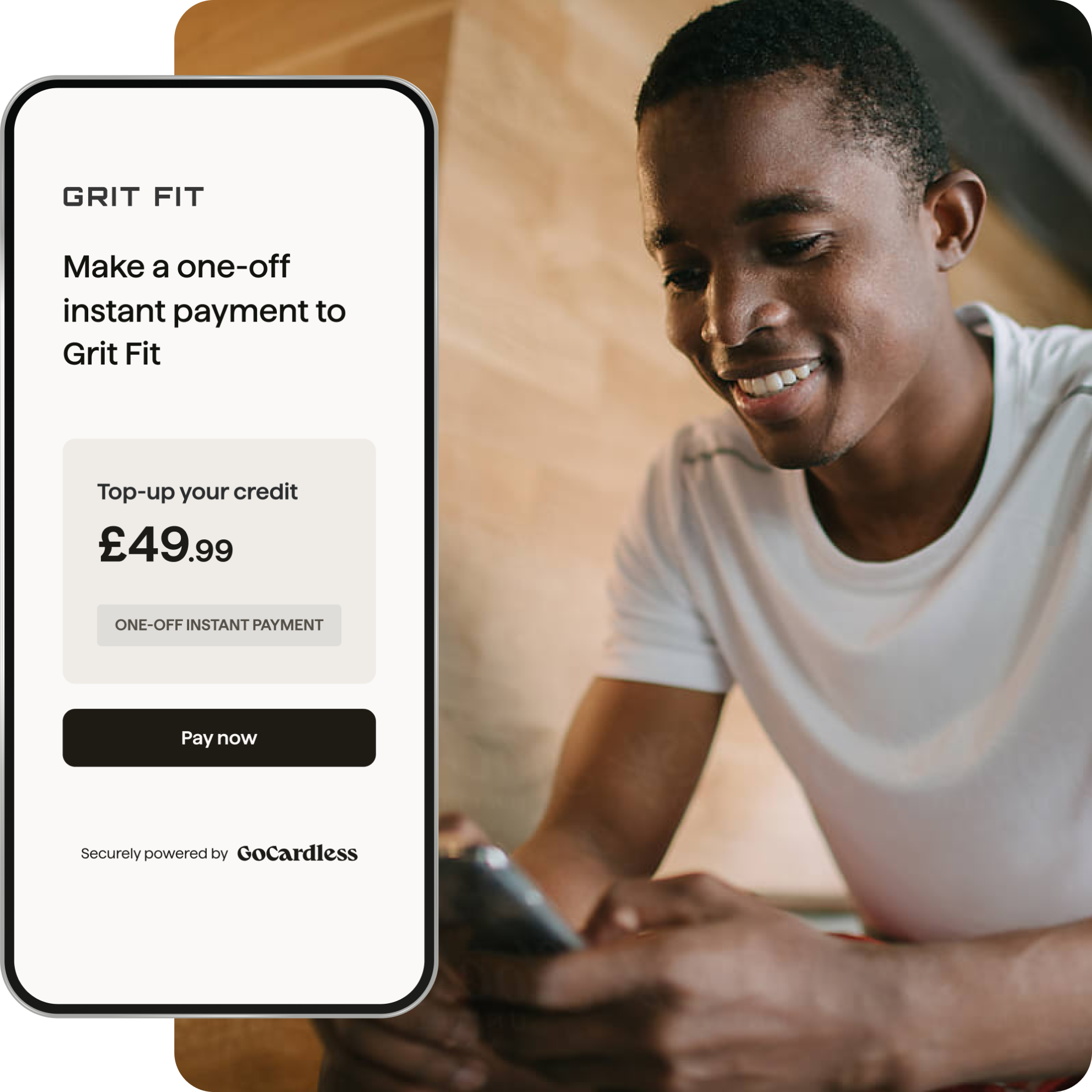

Payment pages that convert

Whether it’s instant, one-off payments or automated, recurring payments – GoCardless is the payment solution that lets your customers pay you quickly and easily. Direct from their bank account.

You can even collect international payments from 30+ countries. And you don’t need to have a local bank account there yourself. We can handle the FX for you automatically, at the real market rate, powered by Wise.

First-class design. Flexible to you.

Your customers will love us too

Quick and easy

They can pay in a few taps or clicks, on any device. Or set up convenient, automated payments.

Transparent

Email notifications give your customers a heads up before payments are taken. No nasty surprises.

Secure

We’re authorised by the FCA, GDPR compliant, and any payments collected via our Direct Debit feature are protected by the Direct Debit guarantee.

Trusted by 75,000+ businesses. Of all sizes. Worldwide.

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready for a checkout that really converts?

Give GoCardless a go – no obligations – with low, pay-as-you-go pricing. And get started in minutes.