Addressing the Triple Threat for Lenders

Last editedNov 20223 min read

As a lender, higher interest rates are good for short-term profits, but what about the broader risk environment? With a slowing economy affecting demand for credit and an increase in payment failures and defaults on the horizon, keeping the cost of funding your book to a minimum should be a priority.

The developing economic situation is something of a double-edged sword for lenders. While higher interest rates can mean better net margins and increased income, three key issues have implications for lending businesses that can quickly deplete these additional profits.

Inflation

Already at its highest level in 40 years, UK inflation is expected to hit a 50-year high of 18% by 2023. The growing impact of rising prices means consumers are starting to feel the pinch — in a recent YouGov poll, nearly half of UK adults surveyed were ‘fairly worried’ about the soaring cost of living, while a quarter were ‘very worried’.

Inflation means many businesses are already dealing with higher input costs for energy and materials. With discretionary consumer spending starting to slow down, they are also likely to face lower demand and reduced revenue. In fact, according to the Bank of England, the UK may already be in recession. Just like the customers and businesses they serve, lenders will need to reduce key operational costs wherever possible in this difficult environment.

Interest rates

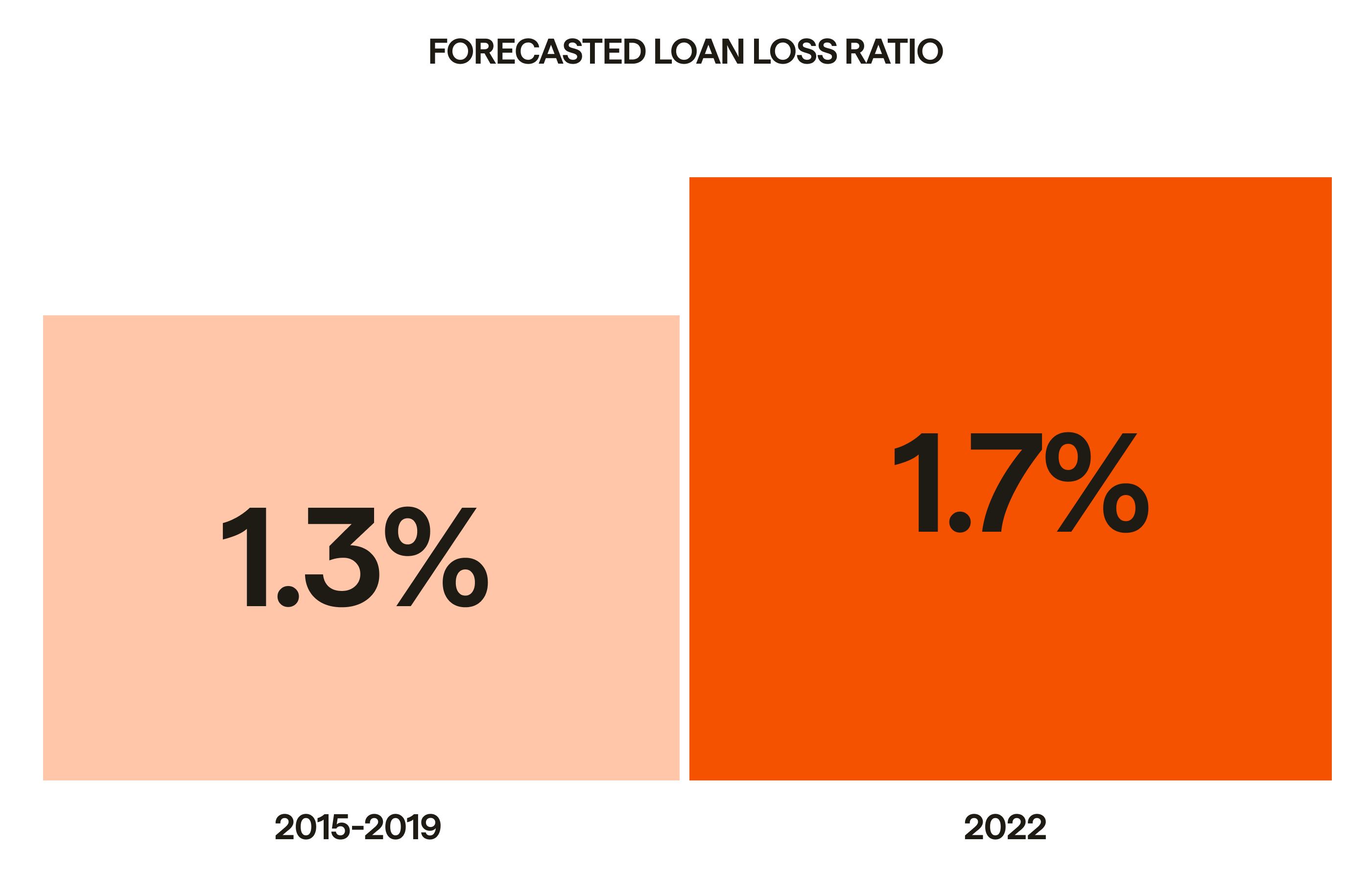

As a lender, the increased revenue from higher interest rates is obviously welcome in the short term. However, the flipside for products like mortgages and car loans is a drop in demand. At the same time, as higher rates continue, costs for payment collection and the loss of revenue from payment failures, defaults and write-offs start to build up. In fact, according to forecasts by EY, the loan loss ratio will rise to 1.7% in 2022, having averaged 1.3% from 2015-2019.

Supply chain issues

While lower demand is starting to hit many businesses, ironically, supply issues continue to be a problem in many sectors. Labour shortages, post-Brexit red tape, staff shortages and the residual impact of the global pandemic are all having a continuing impact.

For example, car buyers are routinely waiting for months from placing an order to receiving their new car (and in extreme cases a year or more). In the meantime, the loan revenue is delayed for the lender. Similarly, shortages of high-value consumer electronics products mean that fewer are being sold and so less finance being taken out to pay for them.

What it means for lenders

The consequences for lenders are two-fold. Firstly, demand for credit for discretionary purchases and house buying will fall. With new customers becoming scarcer, minimising churn becomes more important than ever.

Secondly, a rise in demand for credit cards, personal loans and payday loans to cover bills and additional spending will be accompanied by an increase in payment delays, failures and credit defaults. This will negatively impact cash flow and increase the cost of funding loan books, making it vital to ensure your payment processes are as efficient and inexpensive as possible.

Leverage the power of bank payments

At GoCardless, we free money to flow directly from one bank account to another. As it’s one of the most efficient ways of paying, it means you can save money and time, get paid faster and reduce the number payment failures and customer churn, all critical in the fight against increasing costs and waning demand.

We also automate the entire process through one simple API integration meaning less time spent managing payments.

Inflation

To help with inflation, lenders want to ensure they reduce the cost of taking payments as much as possible and get funds into their account as quickly as possible.

Save time and money

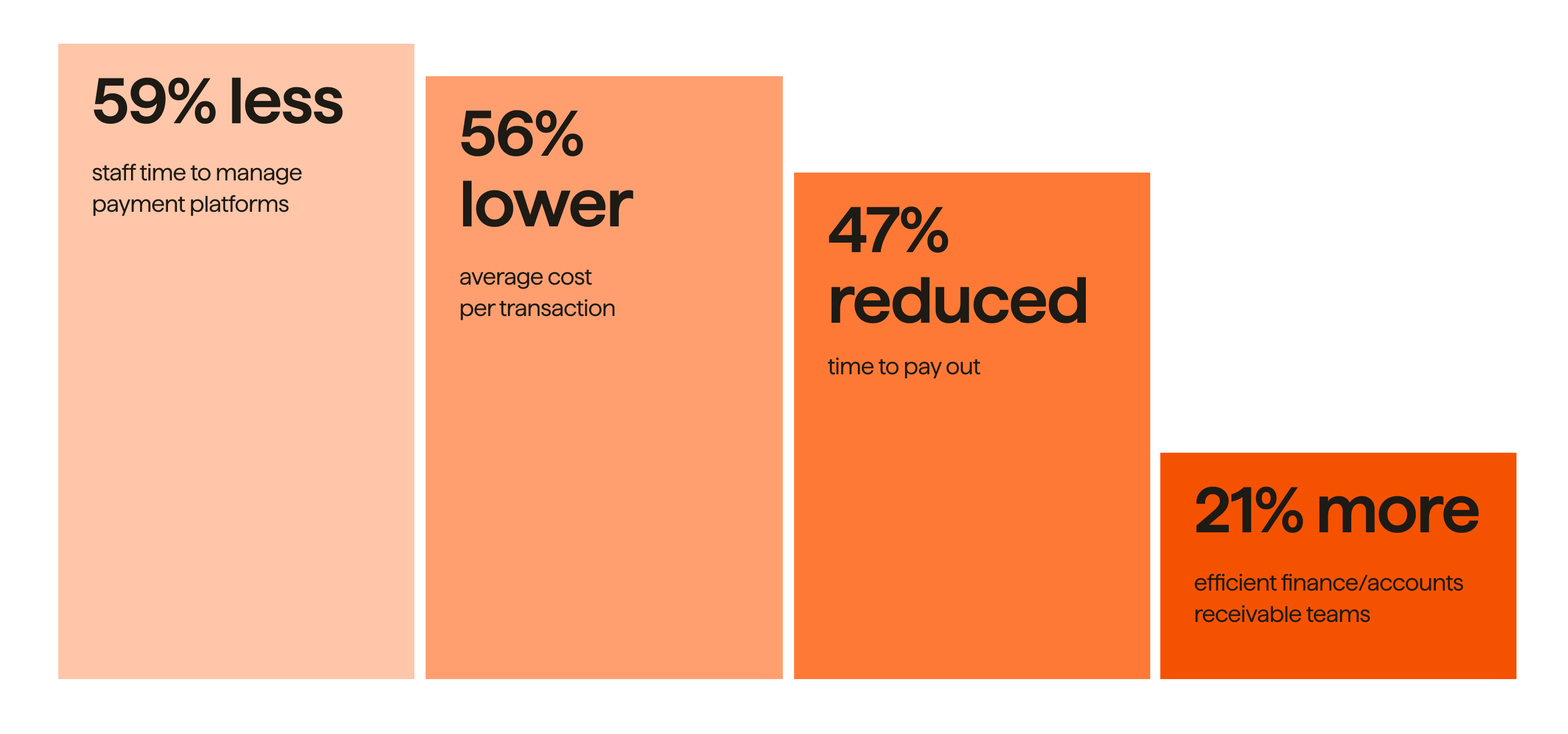

With automated direct bank payments, there’s lower fees (1%) than other payment methods such as cards (2-3%) and less time spent chasing payments with a 56% lower average cost per transaction, reducing the overall cost of taking payments with 59% less staff time to manage payment platforms.

“Since moving to GoCardless, we have reduced the cost if processing by 90%” - Damian Brychcy, COO,

Capital on Tap

Get paid faster

Through the faster payment rails of bank payments, businesses working with GoCardless reduce their payments timings by 86%. This frees up working capital and means you get paid faster.

“We’re also down to 30 days DSO,” Sam Coulton, CFO of ReLeased, the property management business said, “which, as we have 30-day payment terms, means most invoices are being paid on time.”

Increasing interest rates

Increasing interest rates will, in the long term, spell a reduction in demand and an increase in defaults and failures.

Reduce payment failure and customer churn

As a more secure payment method, without intermediaries, direct bank payments only fail 2.9% of the time. Card payments, due to card expiry or or loss, fail almost 4 times as much at 8% of the time. Payment failures then result in customer churn 11-15% of the time.

Supply chain issues

The reduction in demand from supply chain issues will affect certain lenders more than others and keeping costs low will help dampen the impact.

Two-thirds of lenders say they would consider partnering with a third-party platform provider to deliver services to consumers. Why not become one of them?