Last editedJun 20244 min read

For US companies with existing or potential customers in Europe, payment methods are an area of customer experience that often gets overlooked.

Both European businesses and shoppers have a unique set of preferences when it comes to paying for online goods and services. Optimising the payment process presents an opportunity to outpace the competition and capture a group of customers who are ready and willing to spend.

Let’s start by looking at how modern business payments are made in the European market and then explore what companies need to consider when it comes to the payment preferences of Europe-based customers.

The Landscape: How Payments Are Made Across Europe

In recent years, more companies than ever before are sending and receiving cashless payments around the world.

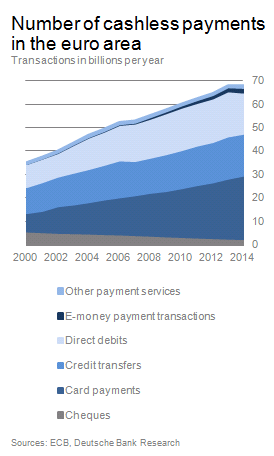

Europe is no exception. Data from Deutsche Bank shows that since 2000, the number of cashless transactions in the euro area has grown to almost 70 billion per year, while cash payments account for only around 2 billion (and decreasing) transactions per year.

And this trend isn’t new. Electronic payment processing has steadily increased across the board since 2000. In fact, data from the US Federal Reserve indicates that electronic payments are up 69% since 2000.

But what does this mean in the B2B setting?

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

Payments in the B2B Setting

As businesses continue to move away from cash and checks as forms of payment, various electronic payment processing methods are becoming increasingly important.

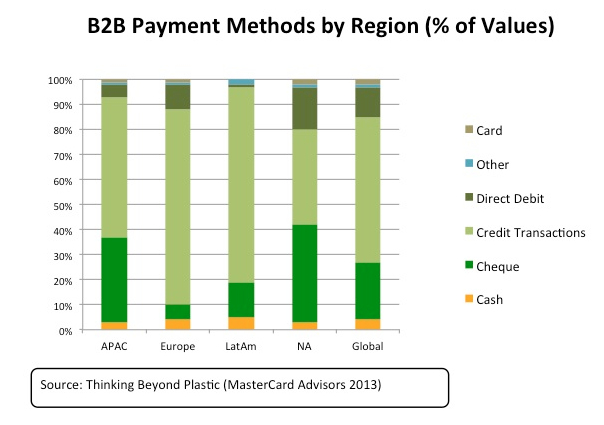

For B2B, credit cards are still the most popular way to pay. As of 2013, data from MasterCard showed that credit cards made up the largest bulk of payments around the globe, including those made in Europe.

However, according to research, Direct Debit is the next most preferred payment method in Europe.

When surveyed, companies of all sizes within the UK said they were most comfortable paying for subscriptions with Direct Debit. 23% said it was the payment method they were most comfortable using, while 20% reported they weren’t at all comfortable paying via credit or debit card - even PayPal.

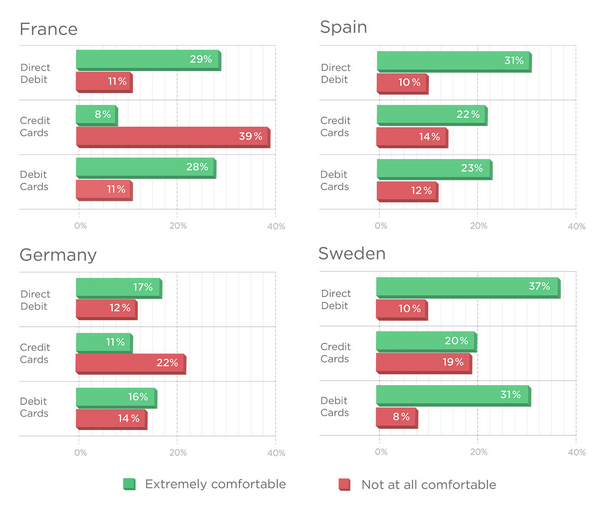

We see this trend echoed across other large European countries like France, Spain, Germany, and Sweden, too.

So why the preference for Direct Debit?

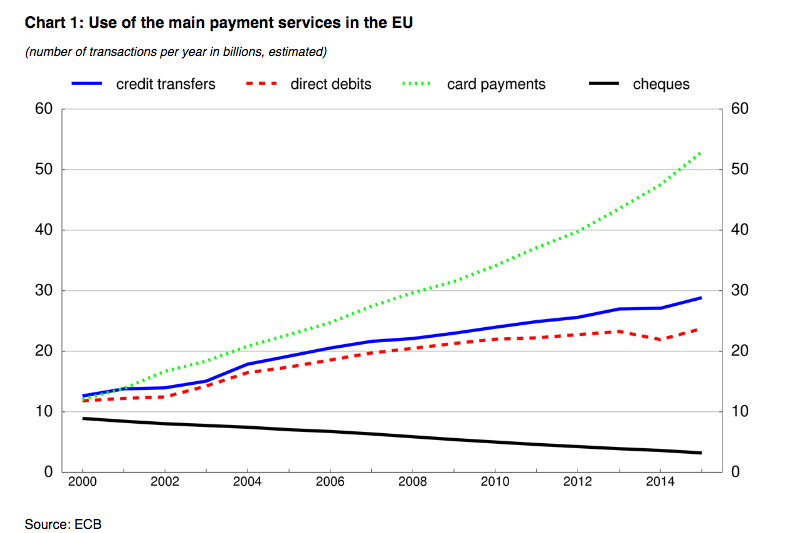

With Direct Debit, payment is linked through the payer’s bank account - not the card itself - so there are fewer payment failures as a result of card-related payment issues. This is one key reason that the data shows Direct Debit continuing to increase in popularity as a payment service in the EU - competing closely with credit transfers.

But that’s not all. Especially within the subscription model used by many SaaS companies, Direct Debit tools like GoCardless help eliminate failed transactions that happen as a result of credit or debit card expiry or cancellation, which contribute to churn, lost revenue, and poor user experience.

And platforms like GoCardless are making Direct Debit easier than ever before. With an online dashboard setup, automatic email notifications for failed or cancelled payments, and no fees for failed transactions, no failed payment goes unchecked.

The benefits of Direct Debit for payments extend beyond the B2B world as well - it’s also extremely helpful for companies working to expand their B2C bases within the European market.

Opportunities in the European Market

First things first: Let’s get on the same page about why the European market presents an important opportunity for revenue growth.

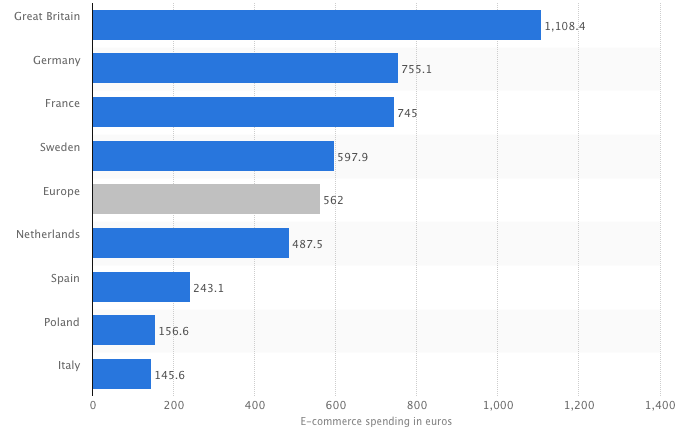

With a population of about 743 million, Europe has an ever-growing number of consumers and potential customers. What’s more: European customers are willing to spend. Research from Statista shows that, per capita, many countries within this region don’t hesitate when making online purchases. As of 2016, the UK’s average per capita spending for online shopping was about 1,108.40 euros.

And US-based companies are taking note of this willingness to spend--especially within the SaaS environment. Many of these companies are already working on growing their audiences of European customers.

Hull, a US-based customer analytics SaaS company, sees as much as 40% of its customer base come from Europe according to the company’s Head of Growth, Ed Fry.

Kim Stiglitz Courvoisier of SaaS Campaign Monitor said that they also see 40% of their customer base coming from Europe.

E-commerce platform BigCommerce now sees 11% of total processed revenue coming from European customers. Tracey Wallace, Head of Content at BigCommerce, said, “Some of our European-based retailers like AwesomeGTI and Erdem are fairly large--and they’re seeing impressive growth in sales.”

Ben Carpel, the CEO of analytics SaaS Cyfe said, “Roughly one-third of our customers are based in Europe. We’re continuing to grow globally, and Europe will continue to be a strong and important part of our growth, without a doubt.”

WordPress hosting SaaS company Kinsta sees 23% of its customers come from Europe. The company’s CFO Tom Zsomborgi said, “The European Union has more than 22 million small and medium-sized businesses, so I think none of the US SaaS companies should ignore this market. We are planning to expand to more European countries like Germany or France in the near future.”

And about 30% of CRM SaaS company Close.io’s customers are located in Europe. What’s even more interesting: Their European customers are often higher value, as they typically pay 50% more than US/Canadian customers ($110 vs. $165) because they need to be on the company’s international calling plan.

But as expansion into the European market continues, SaaS companies have to consider the payment preferences of this demographic. When it comes to paying for invoices or subscriptions, European businesses and customers have a unique set of needs and desires.

Accommodating European Consumer Payment Preferences

Customers in Europe seek convenience when it comes to payments - but that doesn’t mean credit cards are the preferred method when paying for subscriptions. SaaS companies should consider that in Europe, Direct Debit accounts for 5.4 billion annual transactions, while credit cards represent a mere 700 million.

One reason for this is that bank accounts are simply more common than plastic cards here. For example, in Germany, almost every citizen has a bank account, but only 29 million of the total 80M+ population have credit cards. Therefore, by offering Direct Debit as a payment method (which connects via bank account - no need for a card), you automatically open your door to more European shoppers.

So what can we take away from this data? For SaaS companies looking to grow their customer base in Europe and tap into this demographic of high-spending shoppers, adding Direct Debit with a tool like GoCardless is an easy way to improve customer experience, increase conversions, and make this audience feel more secure about their online purchases.

Grow Your Audience with Direct Debit

By adding Direct Debit as a payment method, you reap the benefits of lower customer churn and fewer card-related payment errors - all while accommodating European customers with their preferred payment method. By integrating a tool like GoCardless, you can make life easier for your European customers and expand your company’s reach at the same time.