Last editedSep 20252 min read

With more and more businesses moving to asubscription model, the way that customers are making payments is changing. For both companies and consumers alike, automatic payments are a much more convenient way to pay for regular goods or services, ensuring payments are made on time and with minimal effort.

There are a number of different benefits of automatic payments, including a steadier stream of income for your business and greater customer satisfaction, which is why so many companies are moving to this model. It’s also simple to set up, with GoCardless helping to streamline the process for businesses. Keep reading to find out more about how to set up automatic payments.

What are automatic payments?

Before answering the question: “how do automatic payments work?”, it’s important to first consider what automatic payments actually are. It’s easy to confuse these with standing orders or direct debit, but there are some important differences.

Put simply, automatic recurring payments involve an agreement between the customer and the company. A pre-agreed amount, frequency and term are selected, and the payments are automatically transferred from the customer’s account on the dates chosen. The customer simply needs to provide their card information, unlike direct debit and bank transfer which will require bank details.

In addition, automatic payments work 365 days of the year, including bank holidays and weekends. You can even choose the time of day that you wish to receive payment, with most companies choosing an early morning transfer.

How do automatic payments work?

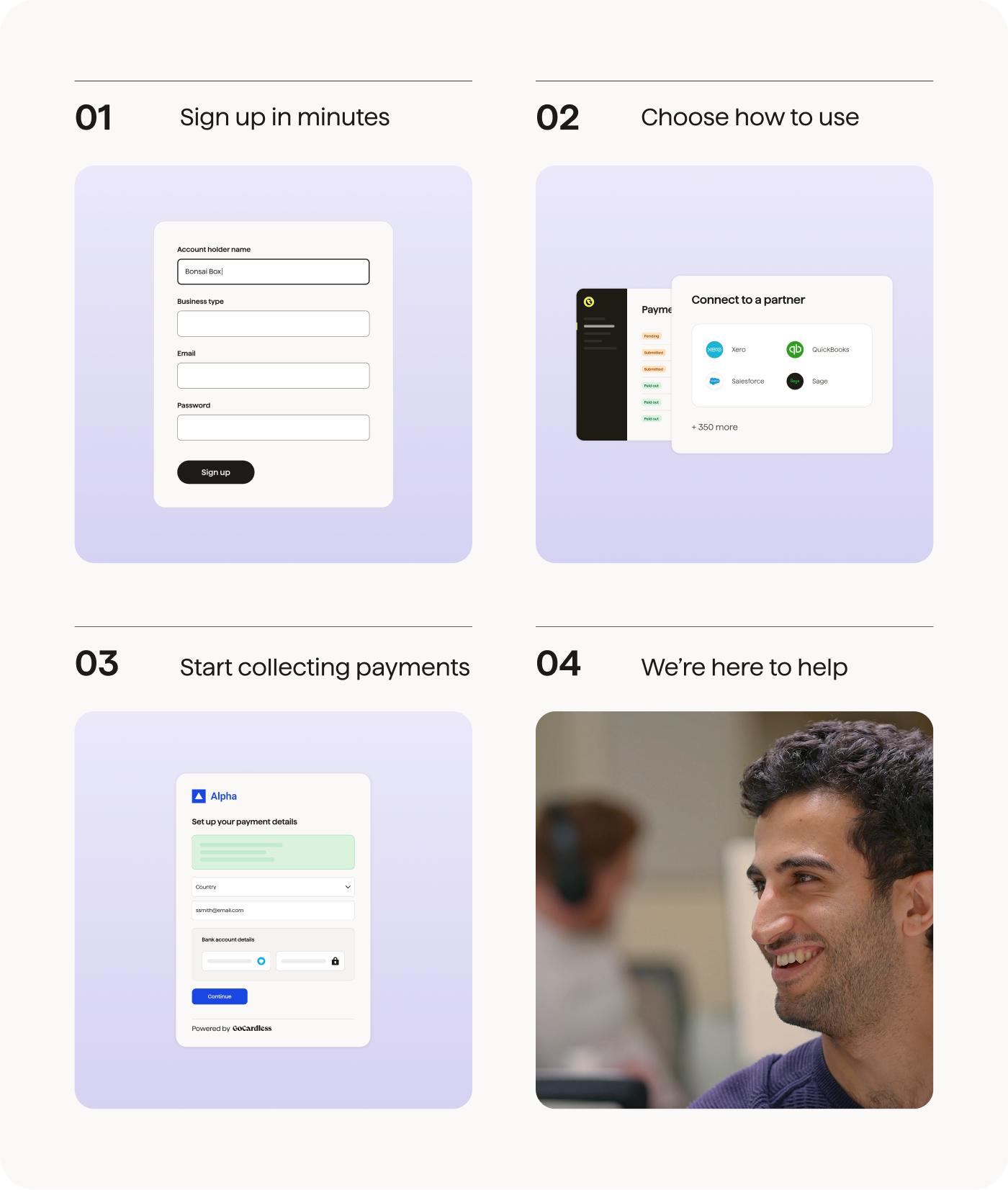

Now that you’re clear on the definition of automatic recurring payments, you might be wondering how to set up automatic payments for your business.

The first step is to find the best payment service provider for you. It’s important to consider cost and security when making this decision. GoCardless offers a cheap and safe alternative to accept regular payments from your customers, making it a great choice for first timers.

Each payment provider will have a different process for setting up the payment system which you will be guided through. Once this is complete, the customer simply needs to provide payment information and authorisation, and funds will automatically be transferred on the agreed date.

Benefits of automatic payments

There are a number of reasons why so many companies are choosing automatic payments, including:

Ease for the customer, who no longer has to remember when payments are due and saves the hassle of repeatedly entering their details and providing authorization.

A steadier cash flow for the business, with guaranteed income on given dates.

Better security, with automatic payment software offering high levels of encryption and protection of sensitive data.

Time saved for both businesses and customers.

Less environmental impact. Since automatic payments are all carried out digitally, you can reduce your paper trail by switching to this system, reducing the need for paper invoices and documentation.

Using automatic payment software

The process of how to set up automatic paymentsfor your business is made much easier and cheaper by automatic payment software such as GoCardless. Customers just have to complete a simple set-up process, and then funds will automatically be transferred to your business on the agreed date, meaning no more chasing up late payments. You can view the status of these payments live on the GoCardless dashboard.

What’s more, it can improve the customer experience, as they no longer need to remember when payments are due.

Around 97% of GoCardless automatic payments are successfully collected. For those that fail on the first attempt, the Success+ intelligent payment collection system will make another attempt, catching 76% of payments that initially failed.

We can help

GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments.