2021 U.S. Payment Trends Study

Last editedAug 20212 min read

Post-pandemic, many U.S. consumers are retiring their credit cards

Young Americans are making this a permanent trend

A quick checkout process is critical to a positive payment experience

Introduction

After decades of dominance in the U.S., credit cards may be on their way out as alternative payments come to the fore. GoCardless recently teamed up with Propeller Insights to survey more than 1,000 U.S. adults about their payment preferences. The survey discovered that three-quarters of Americans would like to decrease their use of credit cards, and a similar proportion (77%) are more likely to use their debit card than a credit card for purchases.

This report looks at what forms of alternative payment are gaining popularity, how the pandemic accelerated the movement away from credit cards, and what American consumers value in a payment experience.

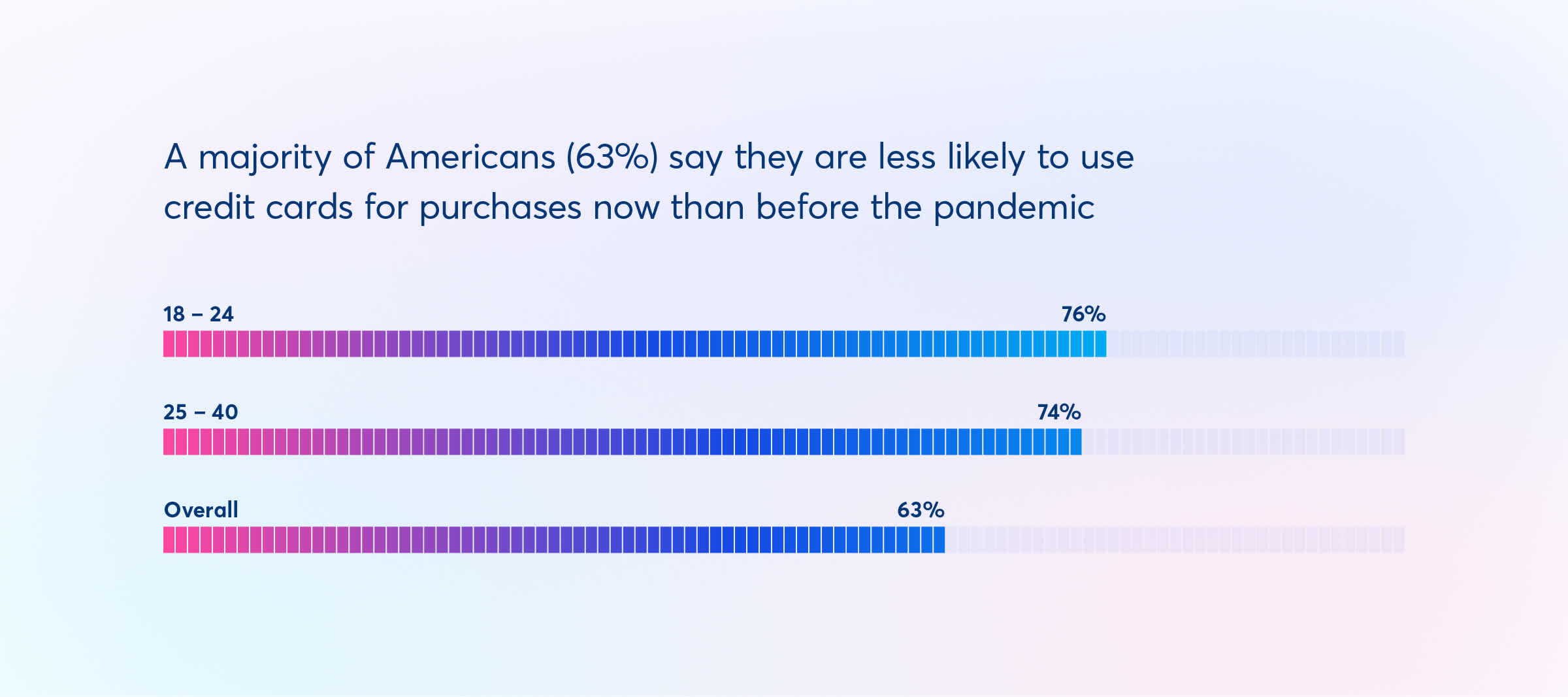

Pandemic dampened American enthusiasm for credit cards

A majority of Americans (63%) say they are less likely to use credit cards for purchases now than before the pandemic. This number is significantly higher among Gen Z and Millennials, rising to 76% among 18-24 year olds and 74% among 25-40 year olds.

Boomers (Americans over age 57) are the most loyal to credit cards: just 39% are less likely to use credit cards now than they were before the pandemic.

“The pandemic put people in tough positions financially, and that likely accelerated the move away from credit cards,” said Hiroki Takeuchi, co-founder and CEO of GoCardless.

‘Zoomers’ versus Boomers on using less credit

The reasons people are less likely to use their credit cards vary considerably by generation.

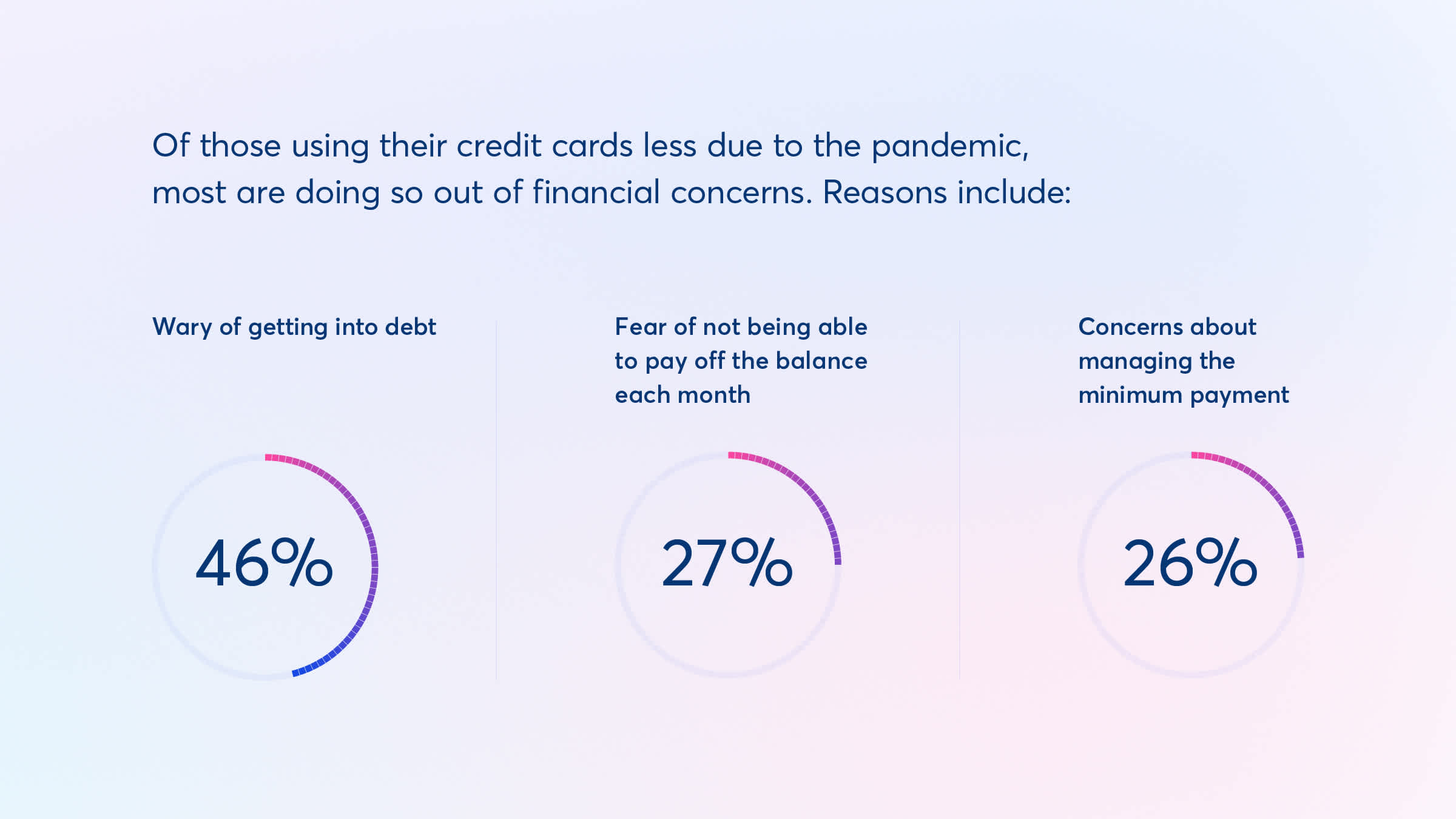

In general, those less likely to use their credit cards are doing so out of financial concerns:

Wary of getting into debt (46%)

Fear of not being able to pay off the balance each month (27%)

Concerns about managing the minimum payment (26%)

But debt avoidance is a much bigger motivator for Boomers (59%) than it is for Gen Z (39%).

Meanwhile, a primary motivator for Gen Z is that they don’t want to enable their outrageous spending habits (44%)—something that Boomers are less concerned about (32%).

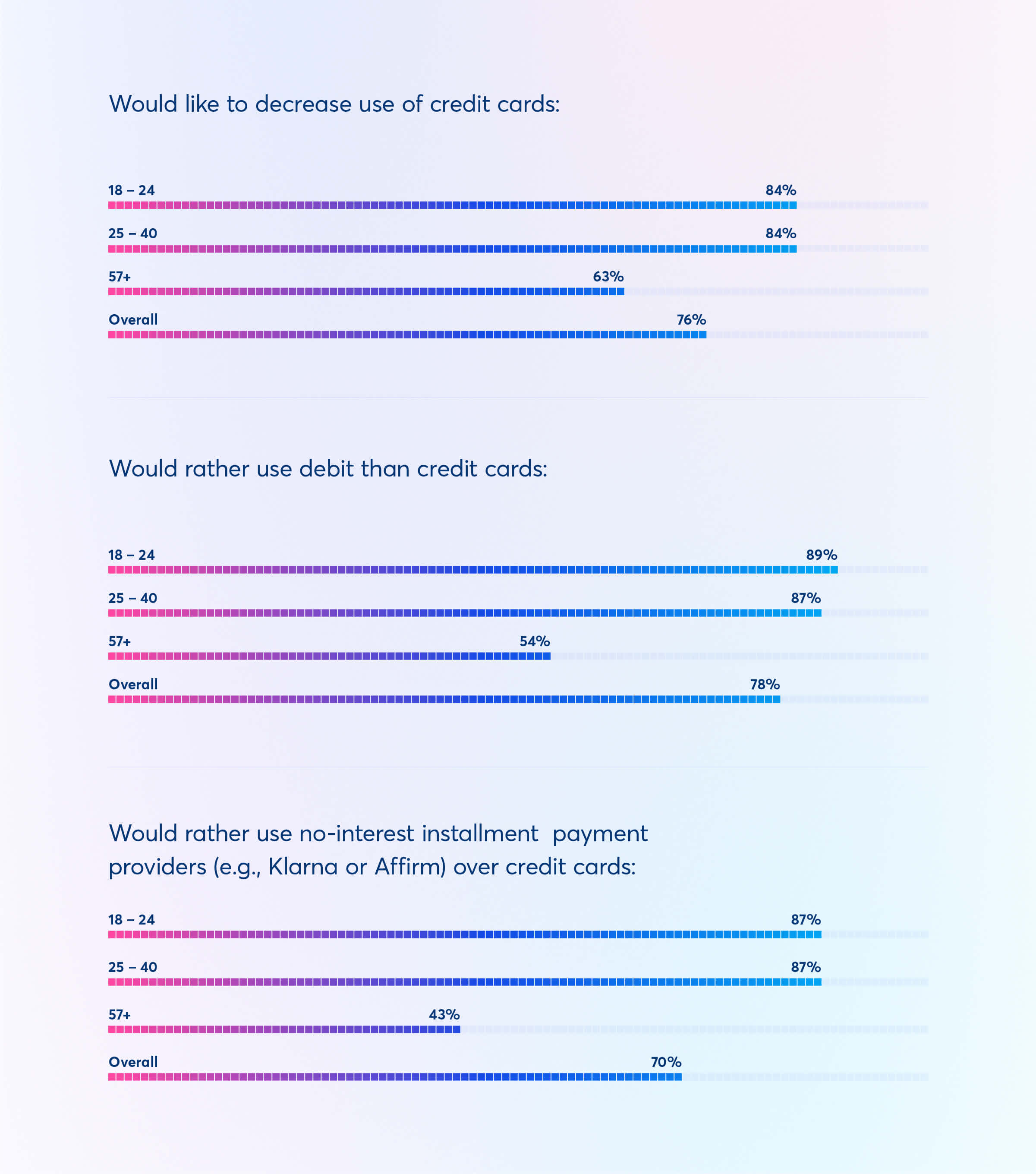

Younger Americans distinctly less interested in credit cards

In addition to harboring a distinct dislike for credit cards, the next generations of shoppers have a striking preference for other forms of payment, like Buy Now Pay Later (BNPL). Americans are also discovering the benefits of account-to-account payments like ACH debit, which have been popular in other parts of the world for years.

The data below helps illustrate that credit cards are on their way out, with preference for them declining sharply and significantly. This indicates that a permanent shift in consumer preferences will be under way as Gen Z and Millennials increase their purchasing power in the coming years.

Credit cards have significant downsides. Debt is the biggest one, but others include high interest rates, yearly fees, and a greater fraud risk—disadvantages that other forms of payment simply don’t have.

What Americans want in a payment experience

In addition to the payment method itself, shoppers also have strong preferences about the checkout process: the survey found that 85% of online shoppers would abandon their purchase entirely if the checkout process took too long. Boomers were the most patient—21% said they wouldn’t abandon a lengthy checkout. Gen Z and Millennials were least patient—about half as many (12%) said they’d stick around.

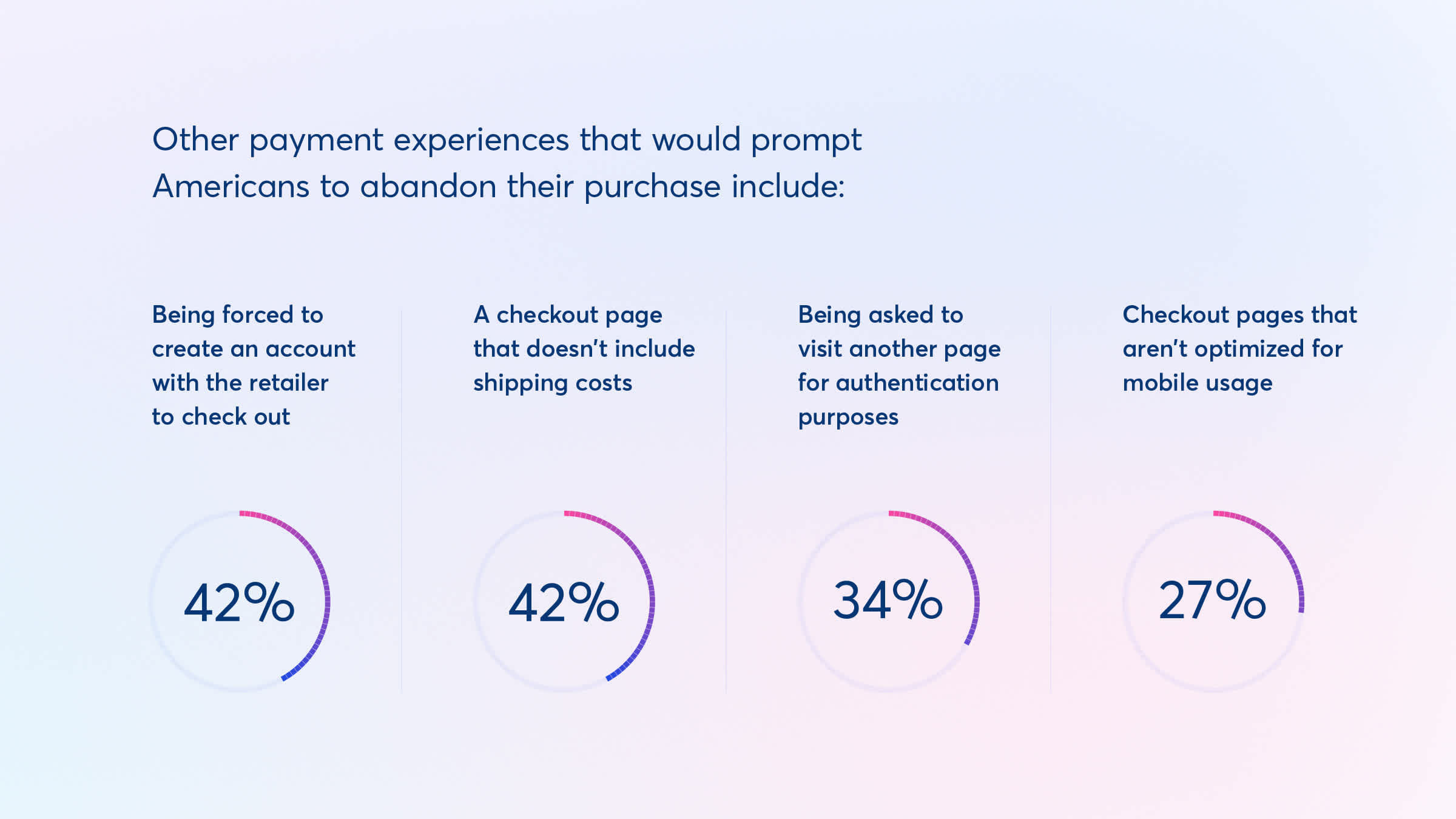

Other payment experiences that would prompt Americans to abandon their purchase include:

Being forced to create an account with the retailer to check out (42%)

A checkout page that doesn’t include shipping costs (42%)

Being asked to visit another page for authentication purposes (34%)

Checkout pages that aren’t optimized for mobile usage (27%)

Compared to Zoomers, there were two things that Boomers found particularly intolerable:

A checkout page that doesn’t include shipping costs (61% vs. 29%)

Being forced to create an account with the retailer to check out (59% vs. 33%)

About twice as many Zoomers (16%) as Boomers (9%) said they couldn’t tolerate wasting more than 30 seconds of their time that they could spend doing anything else.

There is a big takeaway here for online merchants. If you want to build trust with young American shoppers, make sure your checkout experience is fast and easy and that credit cards aren’t the only payment option. Cards dominated in the U.S. for decades, but it’s clear that a seismic shift has started and that they’ll be obsolete in a generation or two.