Latest articles

The hidden costs of managing multiple payment systems: How to avoid them

How to avoid the hidden costs of managing multiple payment systems

2 min readCash flow

![[Webinar] Introduction to GoCardless for football clubs](https://images.ctfassets.net/40w0m41bmydz/30QbyKnbYqGXQEY83kanYL/bd2e666886beca63c3e7b2ccf9700f1a/image__4_.png?w=680&h=446&q=50&fm=png)

Get paid faster: Strategies for collecting money from customers

Master collecting money from customers for healthy cash flow and growth.

3 min readSmall Business

Energy : Five payment considerations for energy suppliers

Read our guide to learn how to navigate current energy sector challenges

2 min read

The cVRP Potential: Redefining Recurring Payments

Commercial Variable Recurring Payments are coming later this year but what will they mean for the way you collect payments?

Webinar

The open banking roadmap: What’s next for VRPs?

Understand what's next in the roadmap for Variable Recurring Payments

2 min read

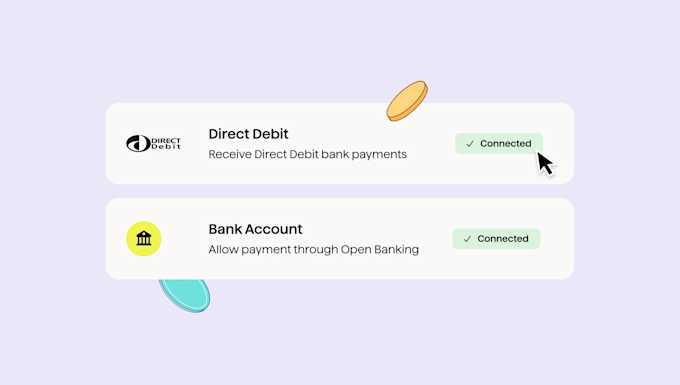

Open banking providers explained: What to look out for

Are you looking at open banking payments? Take a look at what to look out for.

2 min read

Payments explained: Your 101 guide to taking payments

This guide explains the foundations of taking payments

5 min readRecurring Payments

Calculate how long it takes to get paid

Find out how long it takes you to get paid and the impact on your business

1 min read

Scale your payments to scale your business

Use our guide to understand your payments process and how best to scale it

5 min read