Global payments

Connect

Add-ons

More

Skip to content![Plend]()

![Funding circle]()

![Capital on Tap]()

![Fundtap]()

![Future Fulfilment]()

![plum]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![Connect to a GoCardless partner]()

![Connect to a GoCardless partner]()

Instant, secure payments for lenders

Create a seamless risk assessment and application journey with instant settlement with open banking

Instant and flexible recurring payments

Take a look at how Variable Recurring Payments can work for you

Yonder offer flexibility with VRPs

Find out how Yonder are using VRPs to offer customers flexibility

Leverage open banking across the lending journey

Improve risk assessment and offer greater flexibility with open banking

The perfect lender combination

Risk assessment and repayments made easy

Cut fees and payment admin

GoCardless automatically pulls payments from your customers so you reduce costs by 56% and admin by 59%.

Get paid faster

GoCardless is fully automated so receive funds in just 3 days. Save time and improve your cash flow.

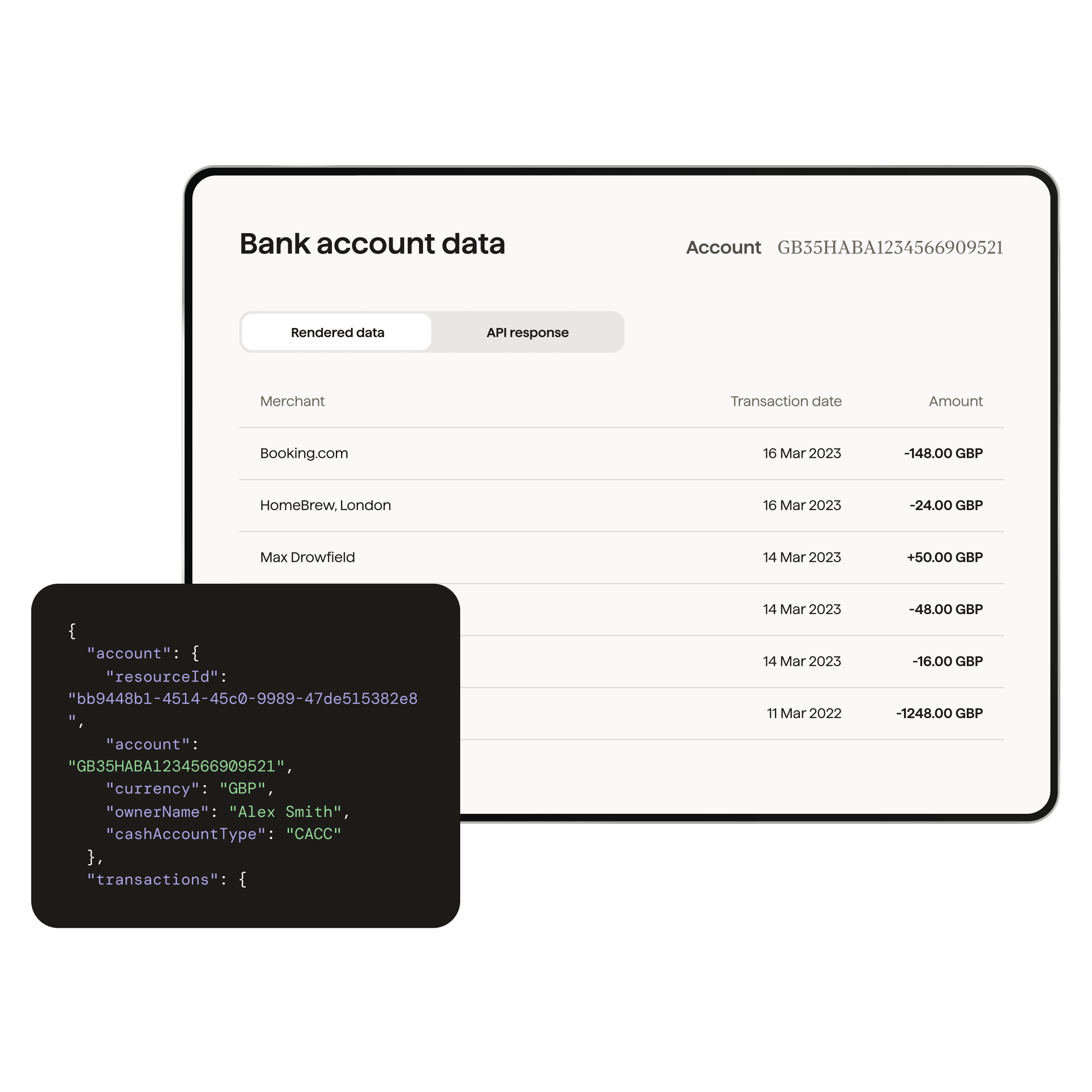

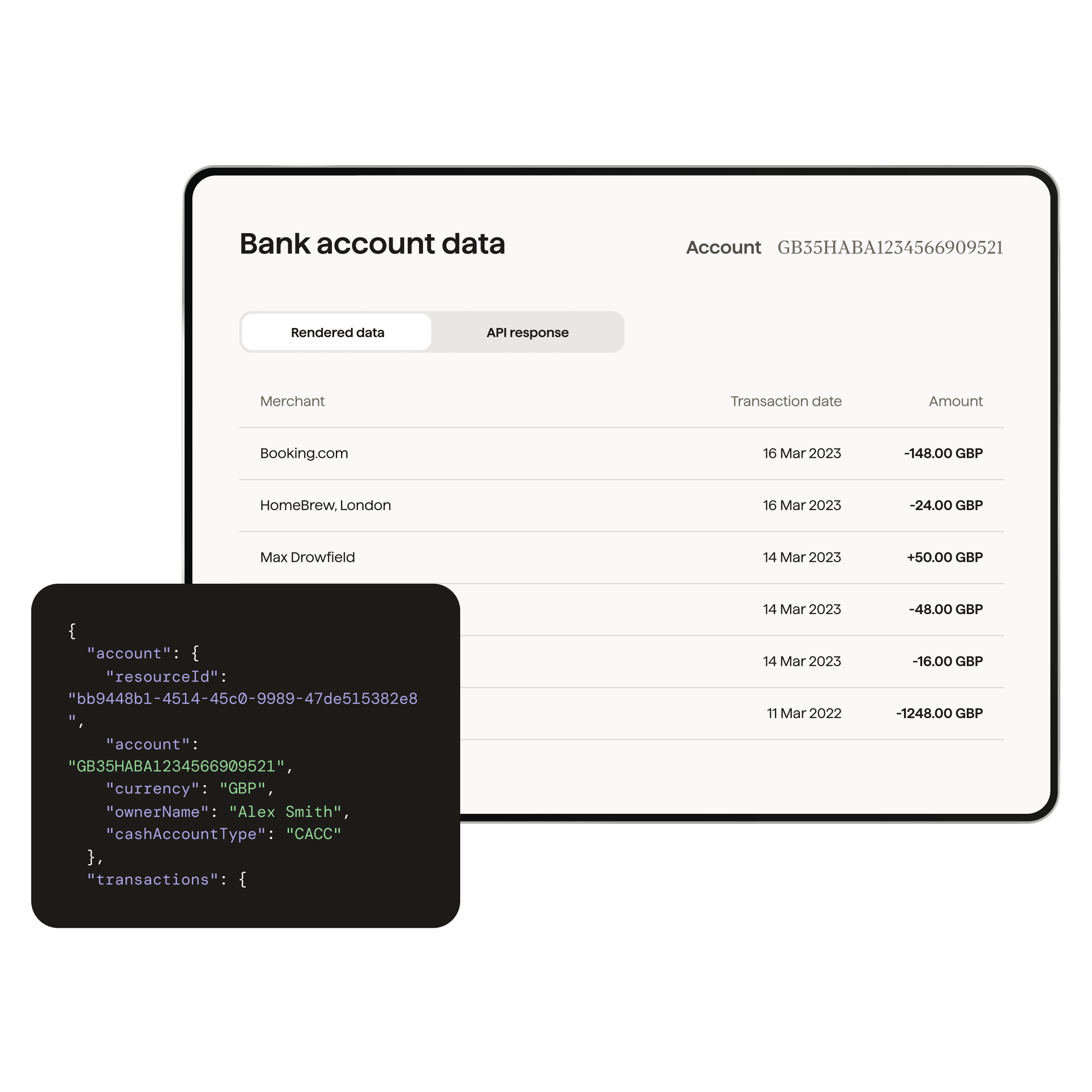

Real-time decision making

Automated access to the data you need to make fast, informed decisions with GoCardless Bank Account Data.

Improve the customer experience

Take a customer centric approach to risk assessment and payments with open banking and payment intelligence.

![]()

Plend

“Automatic direct debits, or one-off payments to catch-up or to pay off the loan, GoCardless provides that whole suite of services.”

![]()

Capital on Tap

“We're super excited to partner with GoCardless to offer Variable Recurring Payments so customers can pay us more quickly.”

![]()

Funding Circle

"Moving to GoCardless was the natural step in our payments evolution to allow us to scale, without payments being the limiting factor."

![]()

FundTap

“GoCardless from day one was an easy choice, they have a significant experience and they’re dedicated to driving automation and continuous improvement."

Make better decisions, faster

Quickly access customers bank account data to make a fast, informed decision and better manage risk with GoCardless Bank Account Data

Find the partner you need

Connect to a GoCardless partner

Want to start improving the way you collect loan repayments?

Speak to one of our payments experts about using GoCardless for your business.