Global payments

Connect

Add-ons

More

Skip to content![]()

![]()

![]()

![]()

![]()

GoCardless for Sage

End late payments

GoCardless puts you in control of collecting payments directly from your customers’ bank accounts.

Collect invoice payments. Automatically.

1

Predictable cash flow

Take control of unpaid bills. When your invoice is due, GoCardless automatically collects payment from your customer’s bank account.

2

Lower-cost alternative to cards

Bank payments are on average 56%* lower cost per transaction than cards.

3

Save time

Spend 90% less hours on managing payments. GoCardless payments are automatically reconciled in Sage.

4

Popular with your payers

When it comes to paying invoices, bank debit is the preferred alternative to manual bank transfers and more popular than card payment.

How it works

Get paid faster with Direct Debit via GoCardless

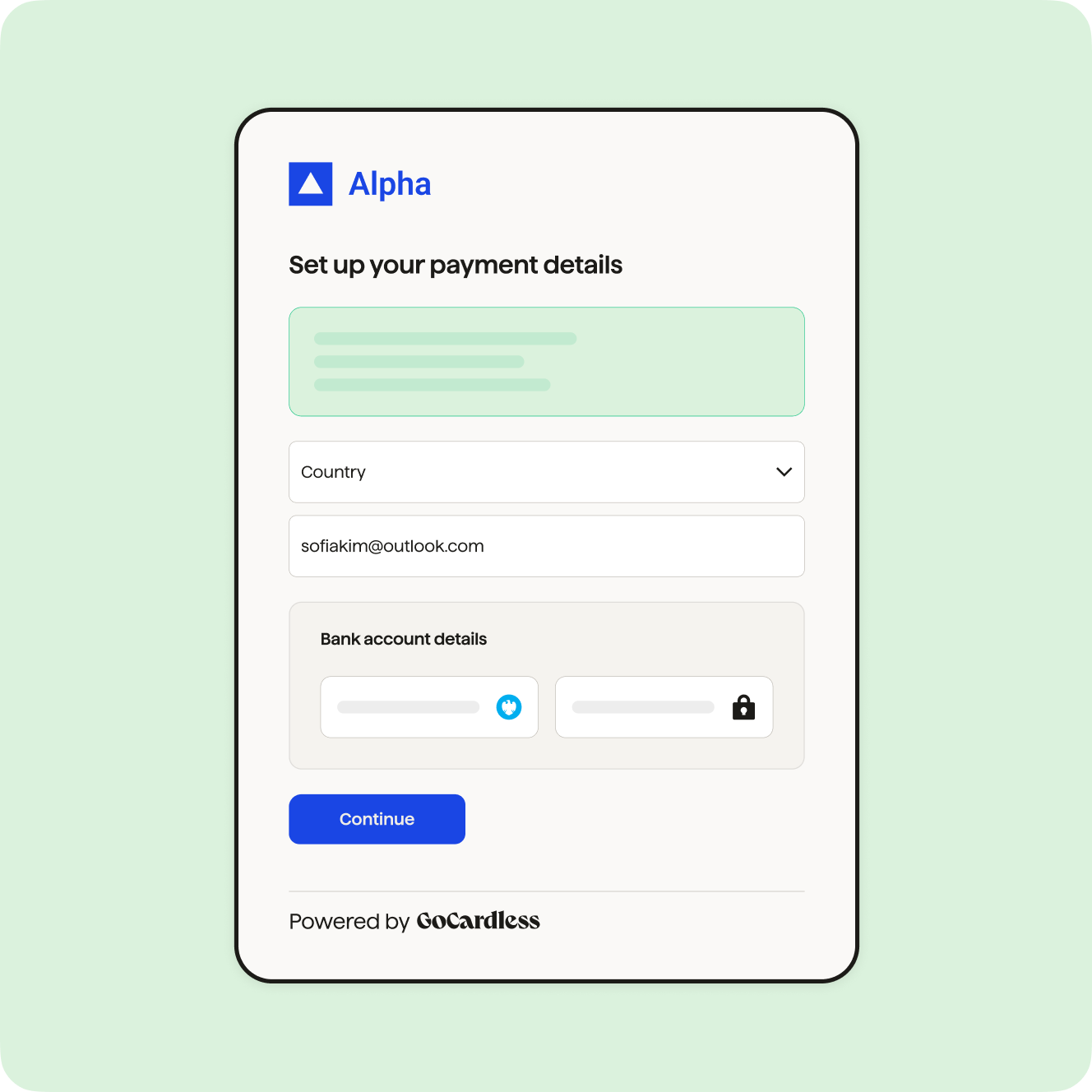

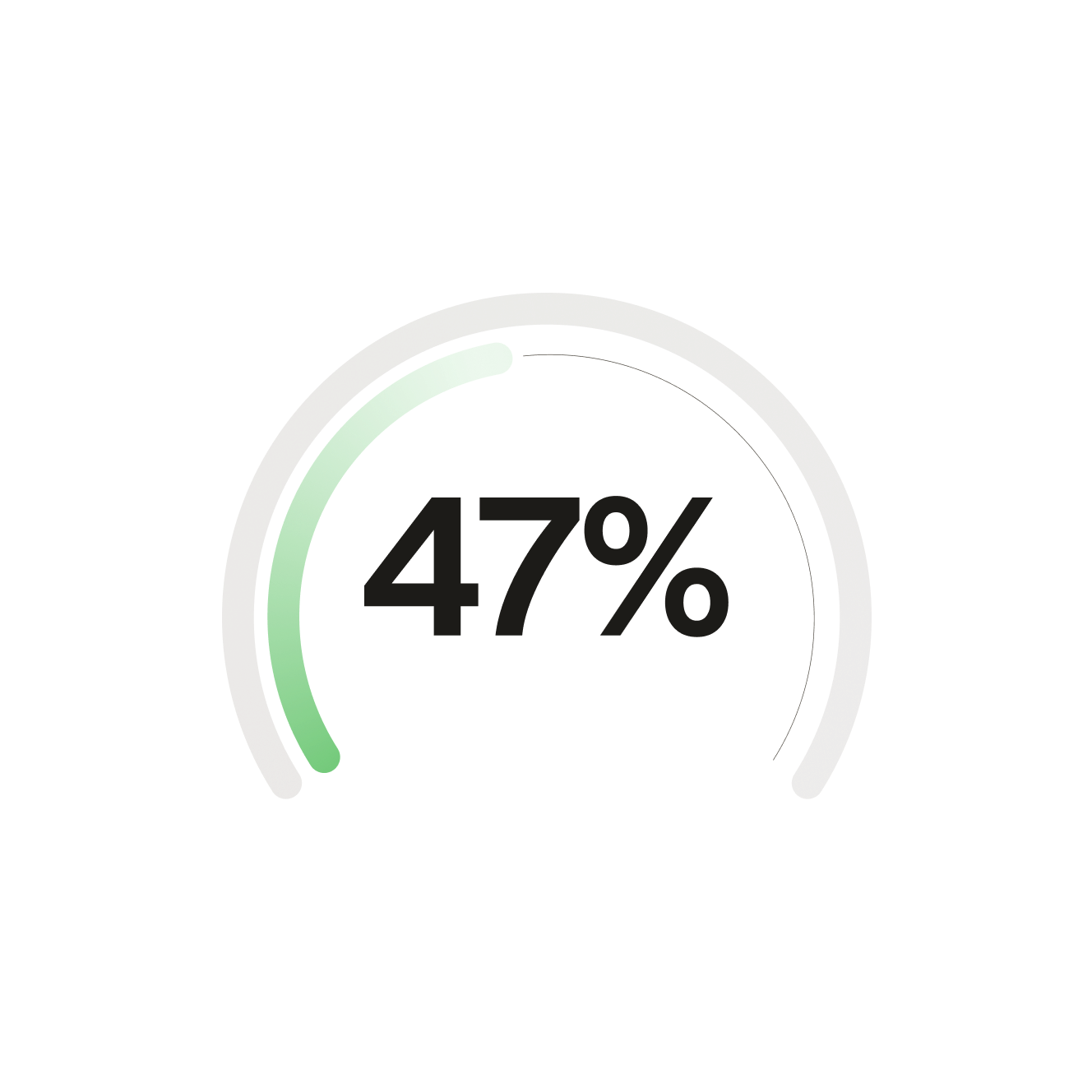

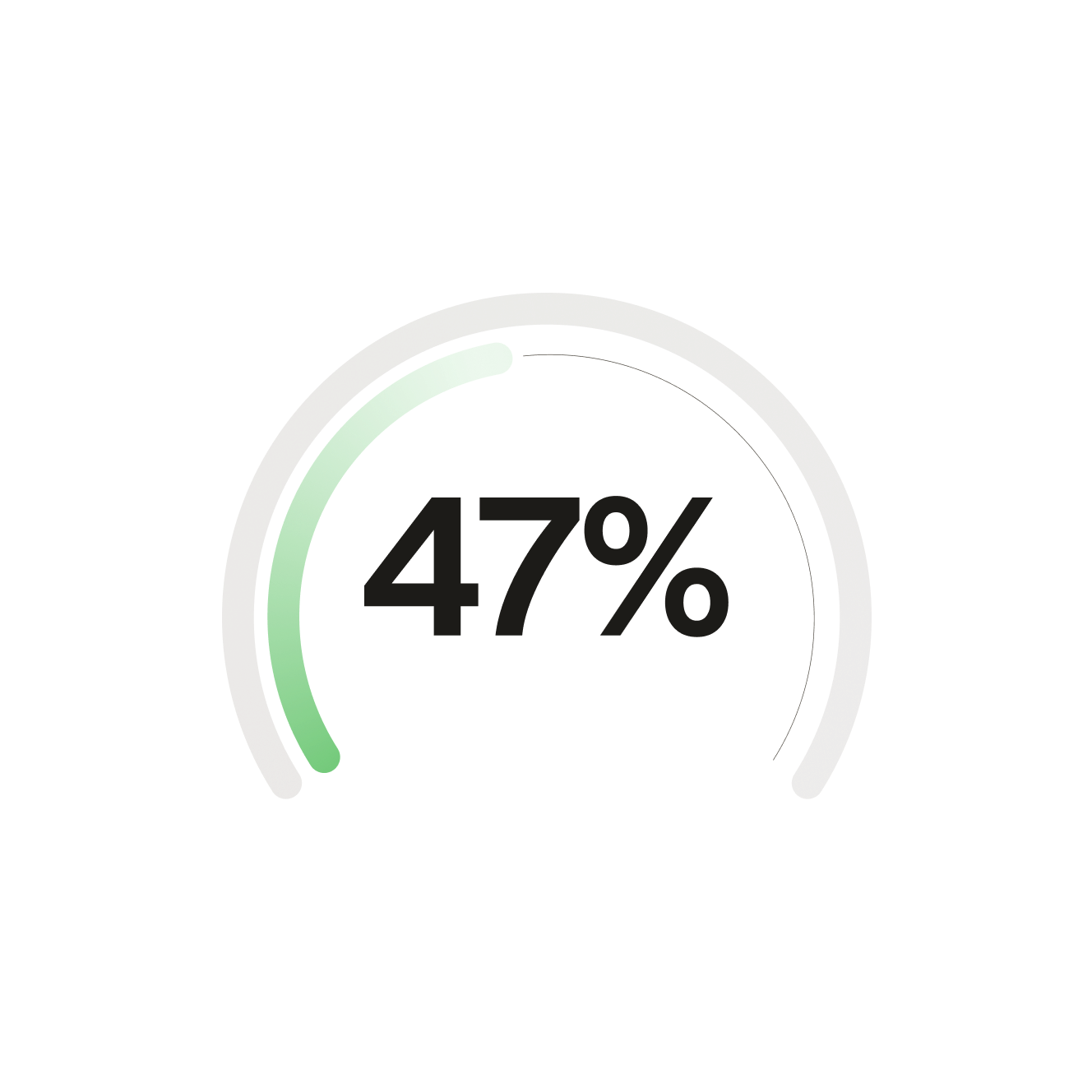

Set up more customers to pay via GoCardless in Sage to take the stress out of invoice admin, and get paid up to 47% faster.

56% lower average cost per transaction*

Core features

Standard

1% + £/€0.20 per transaction

Get startedMax. price cap £/€4 per transaction

+0.3% added to transactions over £2,000

2% +£0.20 for international

Prices exclude VAT

Benefits

Collect one-off and recurring payments seamlessly

Collect international payments from 30+ countries with the real exchange rate (powered by Wise)

Use GoCardless with an API, our dashboard or integrate with 350+ partner softwares, such as Xero, Sage or QuickBooks

Include your branding on the customer sign-up form

Enhanced payment protection

Advanced

Popular1.25% + £/€0.20 per transaction

Get startedMax. price cap £/€5 per transaction

+0.3% added to transactions over £2,000

2.25% +£0.20 for international

Prices exclude VAT

Benefits

All Standard benefits plus

Reduce failed payments through intelligent retries

Verify new customers' bank account details instantly at checkout

Design a tailored customer experience, from your own payment pages to email notifications (additional fees apply)

End-to-end fraud protection

Pro

1.4% + £/€0.20 per transaction

Get startedMax. price cap £/€5.60 per transaction

+0.3% added to transactions over £2,000

2.4% +£0.20 for international

Prices exclude VAT

Benefits

All Standard and Advanced benefits plus

Prevent fraud by intelligently identifying and verifying risky payers

Resolve fraud by monitoring and challenging chargebacks

Fully customised package

Custom

For businesses with large payment volumes or requiring a bespoke solution with dedicated support

Volume discounts

Contact SalesPremium white labelling

Benefits

All Standard, Advanced and Pro benefits plus:

Dedicated end-to-end customer success

Unlock discounts as you scale transaction volume

Option to commit volume or pay as you go

Collect one-off and recurring payments seamlessly

Collect international payments from 30+ countries with the real exchange rate (powered by Wise)

Use GoCardless with an API, our dashboard or integrate with 350+ partner softwares, such as Xero, Sage or QuickBooks

Include your branding on the customer sign-up form

How much GoCardless will save you

Calculate your fees

What is the monthly cost?

Calculate your fees

What is the monthly cost?

=

Estimated monthly saving compared to card payment fees

--

Estimated time saving per month not chasing late payments

--

Moving clients to GoCardless is pain-free — and once everything is set up, cash collection takes care of itself.

Ben Nacca, Founder, Cone Accounting

Trusted by 100,000+ businesses

Ready to get started?

Connect your GoCardless account in the Sage Settings menu. Head to Company Preferences and in the GoCardless for Sage tab, click Let’s get started.