We Need to Talk About Lending

Last editedOct 20253 min read

As a lender your payments function is set to get busier: do you have the resources to cope?

With interest rates continuing to rise as fast as prices and growth beginning to stall, both consumers and businesses are feeling the pinch. For lenders, that’s going to mean more payment delays, more payment failures, more defaults, and more resources needed to deal with the issues. Is your payment function ready?

After years of near-zero rates, few could begrudge lending and finance businesses enjoying the short-term sugar rush of increased revenue from charging higher interest. But as the cost-of-living crisis starts to bite and growth starts to slow, payments functions are going to get busier. For many lending businesses, that presents two key problems.

Legacy payment infrastructure

Three-quarters of lenders see new entrants to the market as a top concern, according to Credit Connect, with competition forcing traditional lenders to re-examine their operating models.

Yet established financial services firms are hamstrung by legacy infrastructure, with 54% of UK lenders ranking it as the biggest challenge to delivering payments technology fit for purpose. In fact, an incredible 49% of financial professionals admitted to still using Excel spreadsheets to log information and updates on customer payments into their business.

According to Forrester, legacy and manual processes mean 86% of businesses have more than 20 full-time employees dedicated to managing recurring payments. And a manual process can lead to more payment failures.

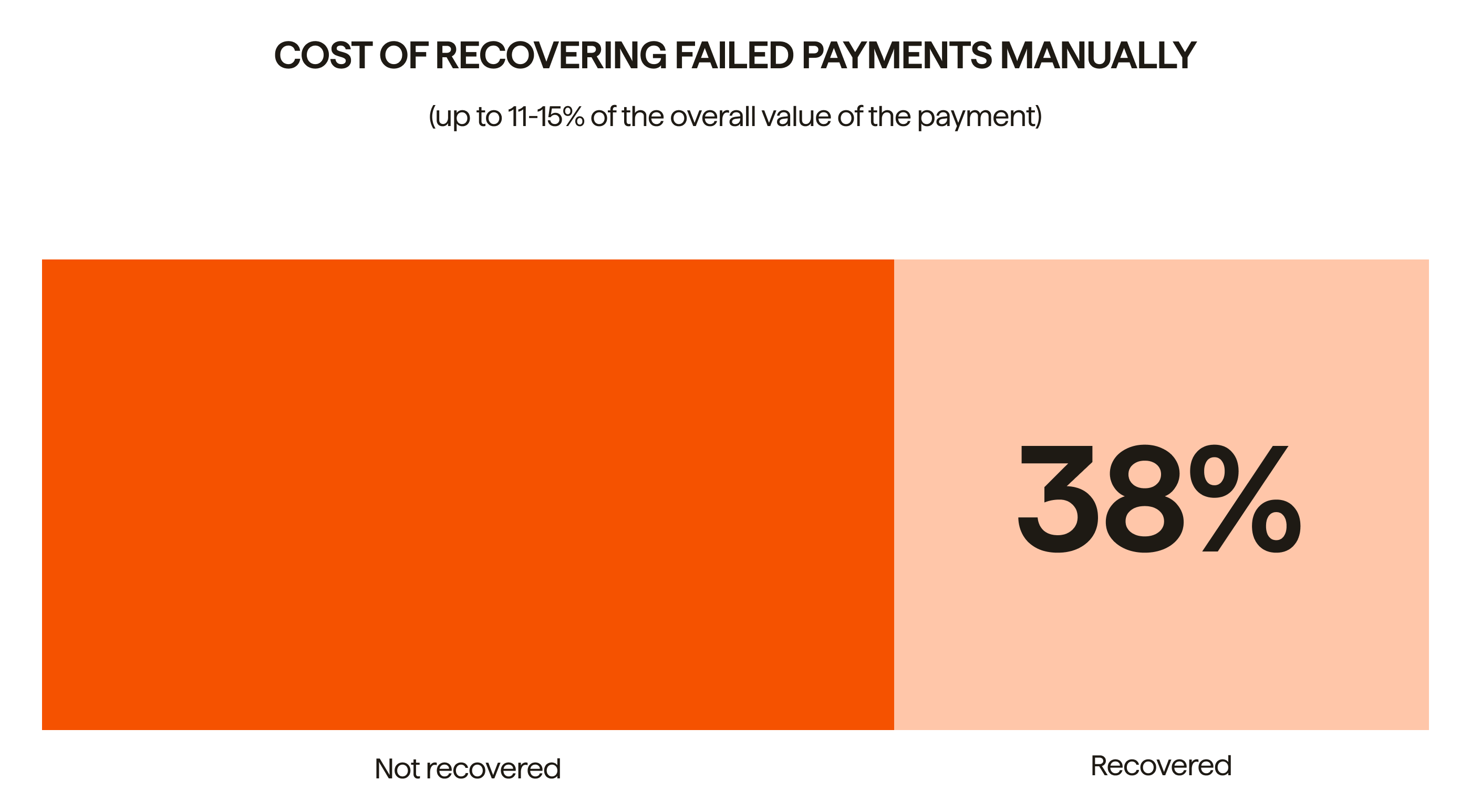

The cost of recovering failed payments manually can be up to 11-15% of the overall value of the payment and only 38% of them are recovered. Chasing payments manually can also lead to a negative experience for your customers and ultimately end customer churn, with 11% of all payment failures ending up in churn.

The straitjacket of legacy software and the reliance on manual processes are holding lenders back from adapting and are a significant drain on time and money.

Shortage of staff

Job vacancies in the financial services sector have grown steeply since 2020. Unfilled posts in the sector hit 54,000 in the second quarter of 2022, a 50% increase on the same period last year (ONS). According to the Finance and Leasing Association, members report significant difficulties in hiring staff across a wide range of expertise, including compliance, credit risk and collections. Segments worst affected include mortgage lenders and car loan providers, as well as in-house roles for consumer discretionary businesses such as car dealerships, tech sellers and high-end furniture stores.

With a heavy reliance on man power, lenders operating with a legacy payments infrastructure will see significant challenges in trying to hire the right people to sufficiently support payment processes.

Go digital, get ahead

There’s a lot of debate around whether to outsource or build your own internal business processes, especially when it comes to your payments strategy. But with simple APIs, more secure and direct payments available and the potential cost savings, it’s easier and more beneficial than ever before.

Here are 4 key reasons why digitisation of your payments strategy can dramatically reduce costs, improve cash flow and reduce admin time spent on payments.

Reduce payment costs

Cost per transaction

With lower and transparent transaction fees, customers using GoCardless can reduce the cost of collecting payments per transaction by 56%.

“Since moving to GoCardless, we have reduced the cost if processing by 90%” - Damian Brychcy, COO,

Capital on Tap

Cost of managing payments

By automating payments and automating the way you retry failed payments, lenders can reduce staff time spent managing payments by 59%, therefore reducing the cost of managing your payments.

“We have significantly reduced the time we spend managing payments,” reports Chris Latchford, Global Head of Payments at Funding Circle. “Our team are freed up from some activities and have been able to shift their focus. We have also reduced risk, since we no longer need to manually manipulate this data to be able to upload it into our systems."

Read their story

Get paid faster

Through the faster payment rails of bank payments, businesses working with GoCardless reduce their payments timings by 86%. This frees up working capital and means you get paid faster.

“We’re also down to 30 days DSO,” Sam Coulton, CFO of ReLeased, the property management business said, “which, as we have 30-day payment terms, means most invoices are being paid on time.”

Reduce payment failure

As a more secure payment method, without intermediaries, direct bank payments only fail 2.9% of the time. Card payments, due to card expiry or or loss, fail 4 times as much at 8% of the time. Payment failures mean you’ve got revenue left uncollected, and, if you’re chasing payers manually, that costs time and money and creates a negative experience for your customers.

Then by using payment intelligence to automatically retry payments, you can reduce the impact of payment failures on your business. Success+ from GoCardless uses a wealth of payment data and machine learning to retry payment failures when they’re most likely to be successful. Businesses using Success+ recover, up to 70% of failed payments.

Integrate with ease

Overhauling your internal processes might seem daunting, but with GoCardless’s simple REST API you can optimise your entire collection through one simple integration.

“GoCardless’ API user documents are really clear, which allowed our engineers to build out the integration efficiently,” - Chris Latchford, Global Head of Payments Strategy, Funding Circle

Two-thirds of lenders say they would consider partnering with a third-party platform provider to deliver services to consumers. Why not become one of them?