The hidden costs of managing multiple payment systems: How to avoid them

Last editedJul 20252 min read

It’s a common scenario: A business starts with one payment system for collecting customer payments, then adds another for making payouts to suppliers, employees, or customers. Soon, you’re juggling multiple platforms, each with its own login, interface, and reconciliation process. What might seem like a straightforward solution can quickly become a significant drain on time and resources. This is the reality for many, as 60% of businesses surveyed by GoCardless believe late payments are holding them back from reaching their full potential. This is where the hidden costs of managing multiple payment systems truly emerge.

The problem: A fragmented payment landscape

Many businesses unknowingly adopt a fragmented approach to payments. Perhaps you're using one provider for recurring customer payments and manually paying suppliers through bank transfers. While each system might be good for its specific function, the act of using them separately introduces a host of inefficiencies and risks.

The hidden costs

Manual processes and slow payment times When you're dealing with separate systems, manual data entry becomes almost inevitable. Exporting data from one platform and importing it into another, or even worse, manually initiating bank transfers, is not only time-consuming but also prone to human error. These manual processes can significantly slow down payment runs, taking days instead of minutes. This delay can impact everything from supplier relationships to customer satisfaction, particularly when waiting for a refund or loan disbursement.

Lack of automation Without a unified system, automating payment processes becomes a monumental challenge. You can't easily schedule payments in advance or trigger client communications based on payment statuses across different platforms. This forces businesses to rely on time-consuming manual checks and interventions.

Exposure to fraud and security risks Manual data entry increases the risk of errors, which can lead to incorrect payments. Furthermore, a lack of integrated verification checks exposes businesses to potential fraudulent payment claims. Storing and handling bank account details separately across different systems also heightens security risks.

Reconciliation headaches Tracking transactions across multiple platforms is a nightmare for reconciliation. Your finance team spends countless hours trying to match inbound collections with outbound payments, making reporting processes unnecessarily complex. This fragmented view of your finances can obscure your true cash flow position.

Unnecessary costs and administrative burden Beyond direct transaction fees, maintaining multiple payment systems incurs additional costs related to setup, maintenance, and complex contractual processes. The administrative burden of managing these disparate systems, including training staff on different interfaces and troubleshooting issues across various providers, also adds up.

The solution: A unified payment approach

Imagine a world where all your payment activity, both inbound and outbound, is managed within a single system. By consolidating your collections and payouts, you can:

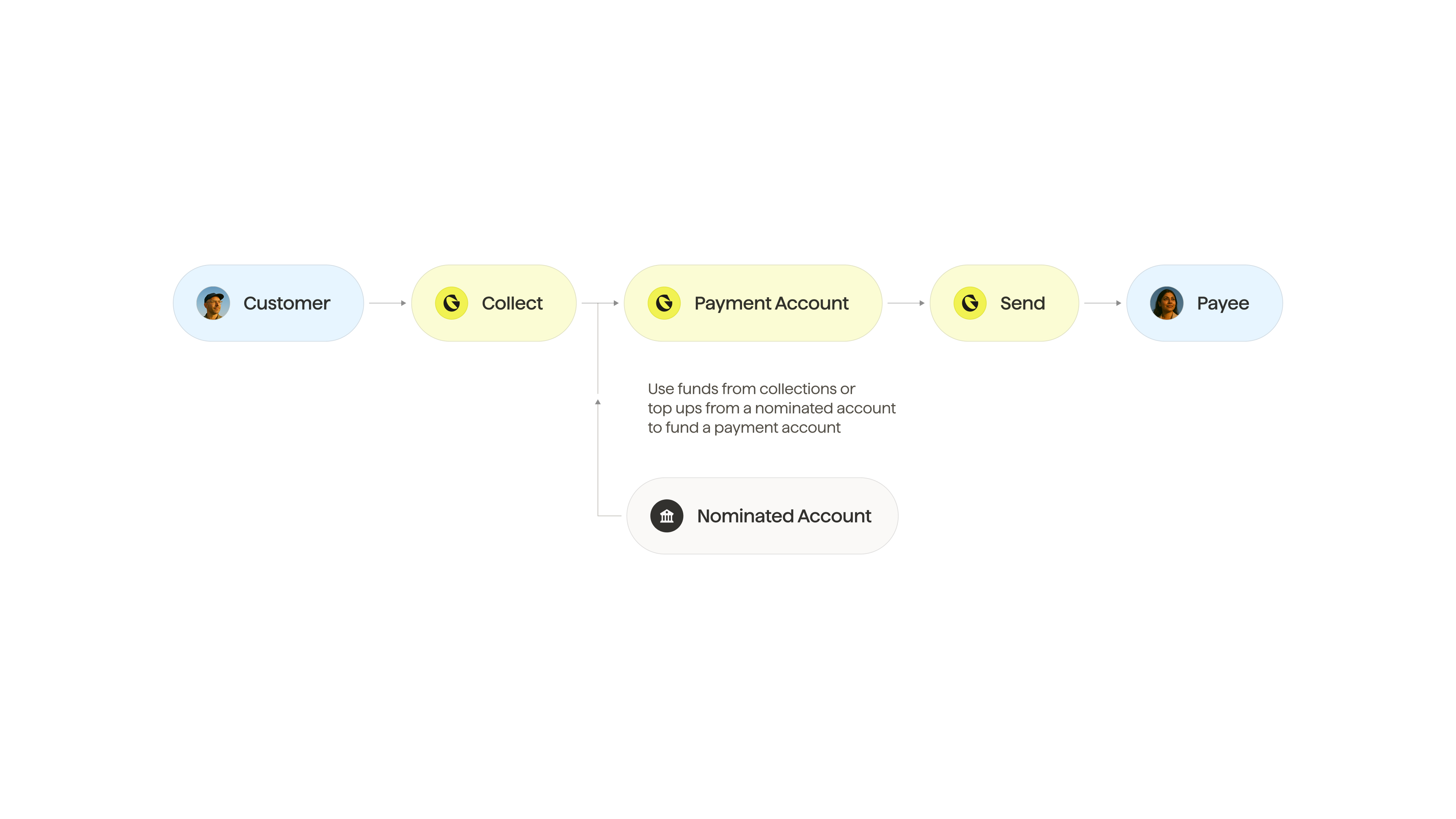

Automate processes: Send payments directly from your payment account, whether funded by existing collections or a verified business bank account. This eliminates manual steps and allows for seamless automation.

Improve security and reduce fraud: Reusing stored bank details from collections reduces manual errors and enhances security. Confirmation of Payee checks ensure that details match the recipient account, mitigating fraud risks.

Simplify reconciliation and gain visibility: Track all your transactions on a single platform, simplifying reporting and providing a clear, comprehensive view of your payment status.

Reduce costs: Say goodbye to the need for multiple pricey systems and contracts by keeping all your payments in one place.

By embracing a single payment solution, businesses can eliminate the hidden costs associated with managing multiple systems, boosting efficiency, enhancing security, and gaining unparalleled visibility into their financial operations.

Find out more about exactly how Outbound Payments can help your business collect and send payments today.