Four things I didn’t know about open banking

Last editedMay 20243 min read

Open banking. Two words that sometimes raise more questions than answers. What does it mean? What are the benefits? And how can it help your business, right now?

Maybe you’ve heard about open banking’s promise to radically change the way we do payments, but you’re not sure what that means for you and your business. Or if you even need to know. For an initiative promising increased accessibility and transparency, it can sometimes seem inaccessible.

You’re in the right place. We recently heard from the UK’s most advanced payments innovators to answer the questions you have. Cuckoo, Nude, Plend and JustGiving joined us at our inaugural customer-powered event, Open banking - for everyone, to help us demystify the concept.

Here are four key takeaways from the day…

1. There are two types of open banking

Who knew? Open banking is split into two types: open banking transactions and open banking payments.

“Open banking transactions is what allows me, as the customer of my bank, at any point to tell my bank to share my financial transaction information,” said James Pursaill, Chief Technology Officer and Co-Founder at Plend. “The bank doesn’t own my information, I own my information, and I can share that with whoever I want as long as I give my permission.”

On the open banking payments side, it’s all about simplification, explained Oliver Shaw-Latimer, Senior Director of Fintech & Innovation at JustGiving: “I view open banking as really going back to basics and injecting some efficiency into payments.”

2. Open banking is a faster and simpler way to move money around

Open banking payments are really removing the complexity that is behind some other forms of payment. “Behind the buzz and the fintech sexiness of open banking, there are some extremely real use cases that it’s meeting for us,” said Oliver.

That includes getting your money quicker. Super important for cashflow to keep your operations going or if you want to reinvest in your growth.

The processing fees for open banking payments are also much cheaper than they are for other payment methods. “The cost that we pay for an open banking transaction is quite literally a fraction of what we pay for that very same transaction on a credit or debit card,” Oliver added.

There’s also less risk of chargebacks, refunds, and failed payments - typically making taking payments through open banking a far less bumpy road than cards.

3. Businesses of all shapes and sizes are using open banking

From broadband to lending, our four panellists showed us that open banking really is for everyone, and it has a wide breadth of use cases.

Nude, a savings app for first-time home buyers, has been using Instant Bank Pay from GoCardless (which is powered by open banking) to allow their customers to make one-off savings contributions, alongside their regular direct debit payments. Upon introducing Instant Bank Pay, they saw payment contributions from customers increase by 50%.

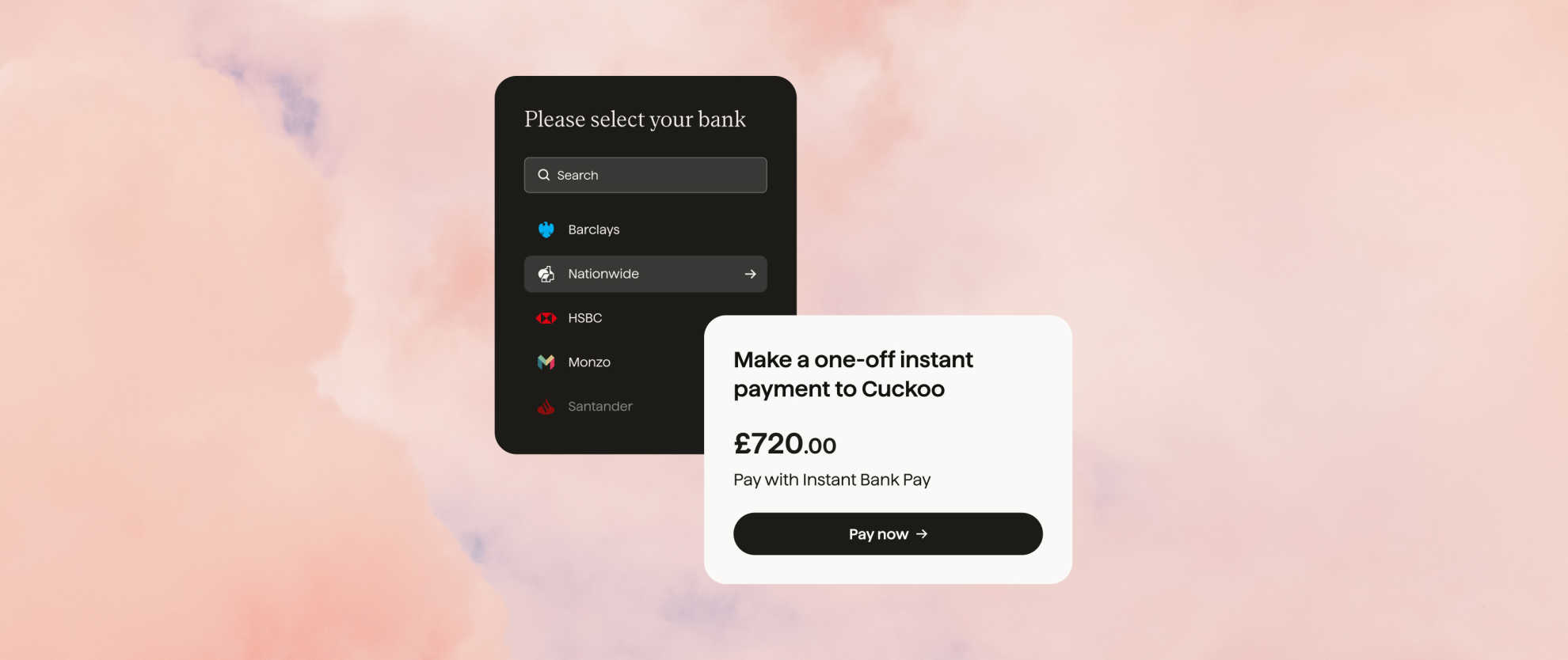

Nude is not the only one reaping the benefits of open banking payments. Innovative broadband provider, Cuckoo, discovered the benefits of Instant Bank Pay for its setup fees. “As a very young business, we needed the confidence that we could ship out a piece of hardware, like a router or dongle, and our costs were covered,” said Alex Fenton, Principal Engineer at Cuckoo.

For affordable loans startup Plend, open banking transactions really are the bread and butter of their business. They’re using open banking data to better understand their customers’ financial position, instead of just looking at credit scores. This is fairer and more accurate, as credit scores don’t necessarily show the whole picture, whilst a low credit score can completely cut you off from traditional lending.

For JustGiving, the pressure of keeping costs down is where open banking payments are key. When donors don’t make a voluntary contribution to JustGiving along with their charity donation, it’s a loss-making transaction for the platform. Open banking means JustGiving can get donor money to charities quicker, as well as avoiding expensive processing costs.

4. Open banking provides new paths for business innovation

Open banking is still so new and opportunities for innovation are being discovered all the time.

Nude is making use of better data to enable new product features. “We already do a little of this - suggesting ways of saving based on your habits,” said Yoann Pavy, Chief Marketing Officer at Nude. “Ideally what we’d like is for all our customers to have the most insights and suggestions possible to help them get to their goal of buying a house faster.”

With the help of Instant Bank Pay, Nude has also recently launched a new ‘Gift Time’ feature, which allows friends and family to make one off contributions into savers’ accounts - at Christmas or on birthdays, for example.

JustGiving is also interested in using the capabilities of open banking transactions to implement a new ‘round ups’ feature, where donors will be able to give consent to have their fractional transactions rounded up and donated to charity.

And the upcoming Variable Recurring Payments feature from GoCardless will bring new possibilities for Cuckoo and Plend to provide a better service for their customers. During difficult times, the new payment capability will reduce disruption to customers’ broadband service, and will allow for more flexibility around loan payment plans.

Hear more about open banking from JustGiving’s Oliver Shaw-Latimer in his guest blog.