Suffering in silence: Britain’s 'money muteness' holds back SMEs, with females at biggest disadvantage

Last editedOct 20213 min read

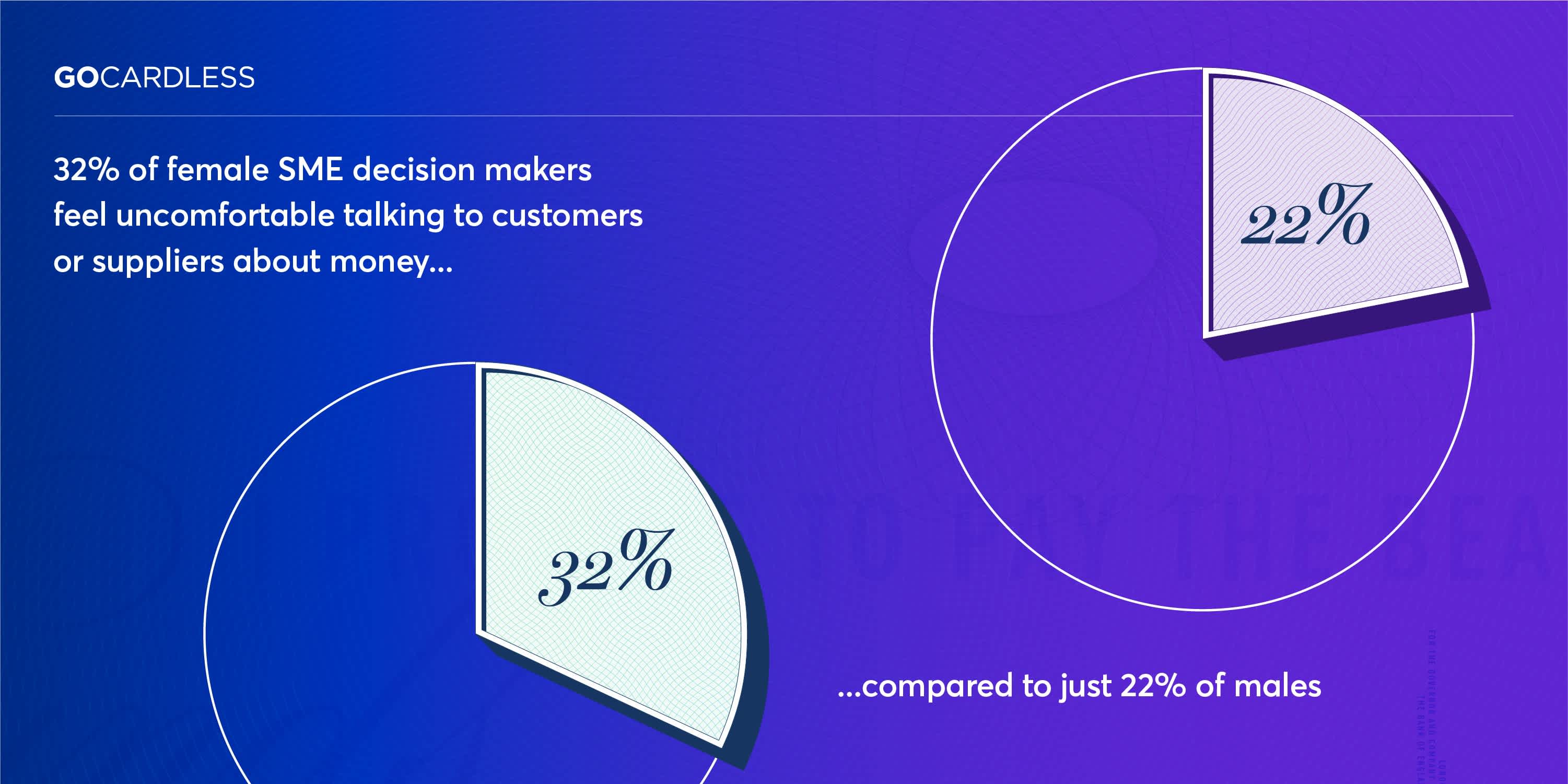

London, 13 October 2021 - New research from GoCardless, the fintech taking the pain out of getting paid for businesses, reveals that the very British trait of leaving things unsaid has created a nation of SMEs that are vastly under- and unpaid. According to the findings, a quarter (25%) of British small business owners feel uncomfortable talking to their customers and suppliers about money in a business context, rising to 32% for women. Almost four in ten (38%) SME decision makers say they feel awkward chasing customers for late payments and one in ten (10%) believe it’s more difficult to talk about ‘the M word’ with their clients now than before the pandemic.

While the thought of money chat might make some faces flush, their businesses are becoming less so: one in six (17%) SMEs confess they follow up with less than a quarter of late customer payments and over seven in ten (73%) reveal they would actually be willing to forgo up to 10% of their annual revenue in order to dodge the discussion.

Money muteness causes more than just cash flow woes. Over a quarter (28%) of small business decision makers report that leaving money issues unaddressed leads to anxiety. With 21% worrying about how they might pay their bills or even their own staff (13%), it’s no surprise one in six (18%) suffer through sleepless nights. Staying silent also limits their future success: 73% of small business leaders agree that failing to talk openly about money would prevent their company from reaching its full potential.

Women lose out most The findings indicate that females feel more flustered when it comes to money talk: 44% of female SME decision makers indicate it’s too awkward to chase customers for late payments, compared to only 35% of men. When it comes to why, over half (54%) who have avoided talking about money say they don’t want to be seen as rude, in contrast to 40% of their male counterparts.

Regional disparities The research also revealed regional disparities across Britain, with Welsh business leaders feeling the stigma most. Almost half (47%) said they felt uncomfortable discussing money in a business context, compared to 25% nationwide. However, Welsh customers are also the UK’s most apologetic: 32% admit to feeling sorry when they find out about outstanding bills.

On the other end of the scale, only 16% of small business decision makers in the East Midlands feel uncomfortable talking to customers or suppliers about money. And payers in London are the least apologetic, with just 24% in the capital reporting remorse compared to 28% across Britain.

But it's not all bad news Although many small business leaders dodge discussions about ‘the m-word’, it is often the consumer who is left red-faced: When informed about a late or failed payment, 42% of people feel embarrassed, 28% feel apologetic and 22% are grateful to have the opportunity to resolve it.

Technology has the potential to minimise awkwardness on both sides. 62% of consumers agree they would feel more comfortable getting chased for a late or failed payment by an automated message, for instance on email or text, rather than a call or notice from a human being.

As for SMEs, 41% of business owners report they are interested in technologies such as machine learning or artificial intelligence to reduce the rate of failed payments. Almost half (45%) say they would be open to introducing technology which increases the speed of getting paid, including those that pull payments when they’re due, such as Bacs direct debit.

GoCardless has partnered with Emma Gannon, award-winning author of The Multi-Hyphen Method and host of careers podcast, Ctrl Alt Delete, to raise awareness of the issue and get small businesses talking more openly about money.

Gannon said: "Money is an emotional topic as it is, but add in the problem of late payments and it's even more stressful. Chasing payments causes a huge expenditure of emotional and mental energy and has affected almost every single freelancer I know. Research tells us women worry more about being seen as rude or could sometimes feel intimidated, which means they’re at a greater disadvantage. Small business owners and solopreneurs deserve more respect, and they deserve to be able to do their work without having another job on top. Late payments are a massive problem, and it is a scandal how normalised they’ve become. I'm really excited to be working with GoCardless to raise awareness of this problem, but more importantly, to offer solutions."

Pranav Sood, VP Small Business at GoCardless, said: “Talking about money has long been a taboo in the UK, so it’s no surprise that small business leaders find it uncomfortable to chase their customers for cash. However, with 91% of people now saying that they would never knowingly pay a business late, there couldn’t be a better time to break the stigma around this topic. If small business leaders can couple frank conversations with changes to their payment processes that allow them to get paid on time every time, they can end the awkward money moments once and for all.”

Top tips to help small businesses avoid awkward money conversations

State your payment terms, including when and how payments should be made, as early as possible in your discussions with customers and suppliers. This helps to ensure everyone is on the same page and there are no surprises.

Once you’ve agreed your terms, be confident in holding your customers and suppliers to them. Cashflow is as important to vendors as it is to buyers and you are entitled to ask for what you’re owed.

Make it as easy as possible to pay you. Offer a range of payment options to suit the preferences of any customer or accounts payable department.

Invest in technology to automatically collect your payments. This will help you avoid awkward conversations in the first place and free up valuable time: you can allocate the hours previously dedicated to chasing payments to growing your business.

For more information, contact: Linda Yang, Head of PR, GoCardless lyang@gocardless.com