Instant Bank Pay

Collect instant bank transfers

GoCardless makes it easy to collect instant payments from your customers.

Welcome to the era of 'pay by bank'

The current options for payments are limited. Cards have expensive transaction fees; bank transfers offer a poor customer experience; bank debit is not optimised for one-off payments.

Instant Bank Pay is the GoCardless feature that makes it easy for your customers to pay by bank, using Faster Payments. These instant transfers mean better visibility for both you and your customers, save you time chasing one-off payments, and creating a smoother customer experience.

Benefits of instant payments

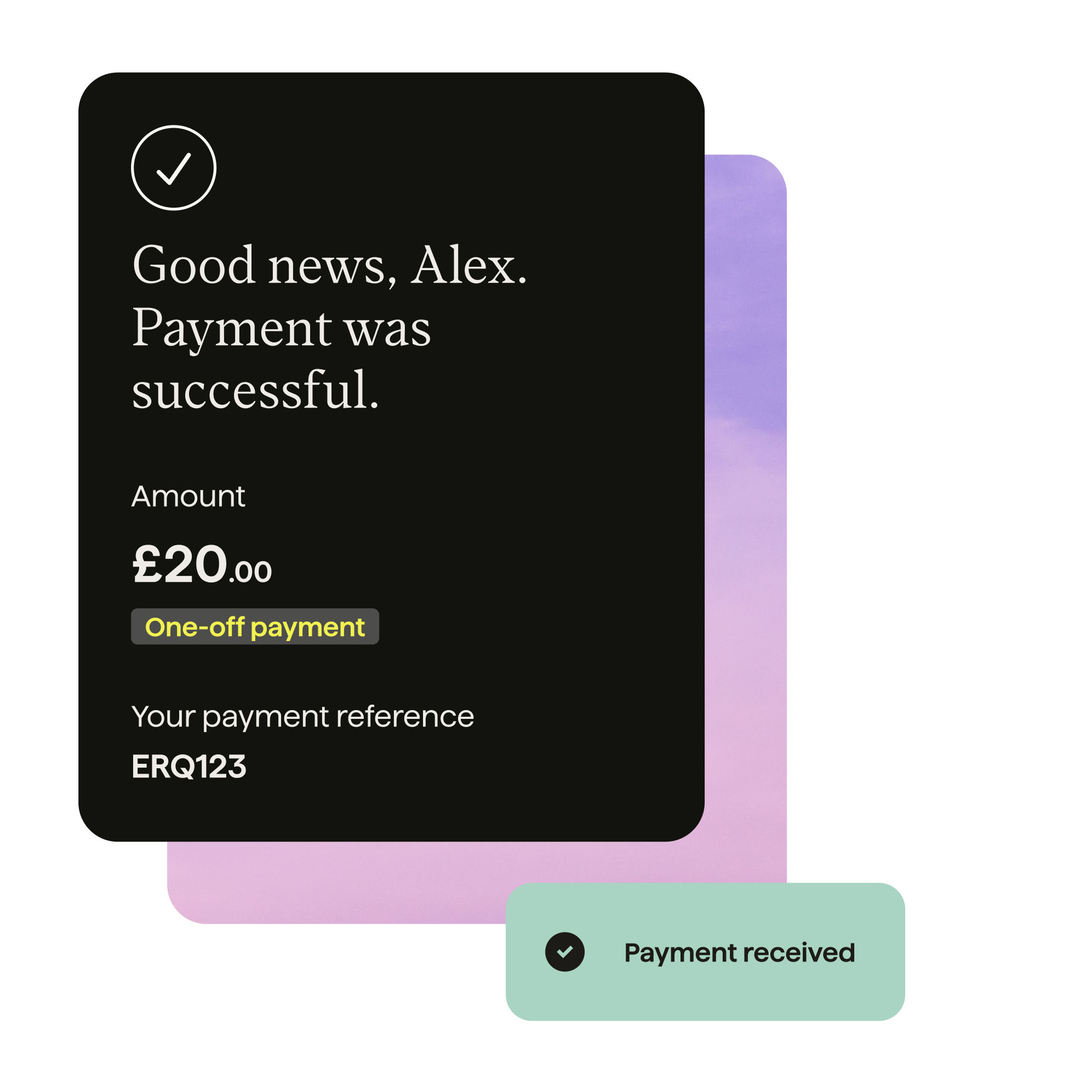

Instant confirmation

Instant transfers means real-time confirmation for you and your payers.

Reduce fees

Typically 54% cheaper than online card transactions.

Less stress

Spend less time chasing down late or failed payments.

Try instant bank payments yourself

Curious what the one-off donation experience is like with GoCardless? Make a donation to The Trussell Trust – a charity supporting 1,200+ food banks in the UK – below.

100% of your donation will go to charity.

How instant payments work

In our first month using the ['pay by bank'] feature, two-thirds of customers who experienced a failed payment were reached by Instant Bank Pay.

Oliver Nelson, Head of Service, Cuckoo Broadband

Instant payments are perfect for:

Taking a first-time payment

When a new customer signs up, take their first payment instantly before bank debit collections begin.

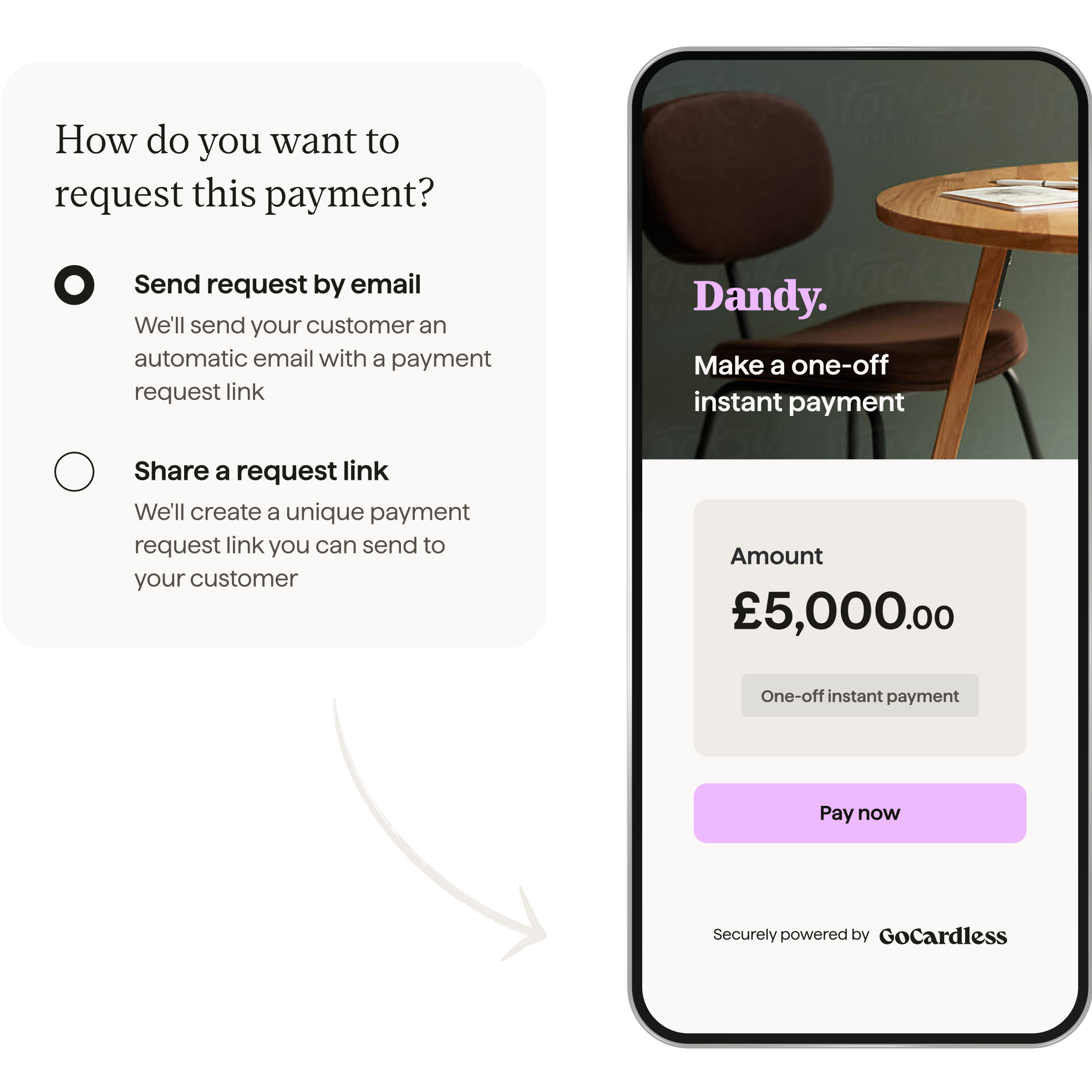

Easy invoicing

Collect one-off payments quickly by sending customers an invoice with an instant bank payment link.

![]()

Taking a first-time payment

When a new customer signs up, take their first payment instantly before bank debit collections begin.

![]()

Easy invoicing

Collect one-off payments quickly by sending customers an invoice with an instant bank payment link.

One-off payments for goods or services

Let your customers make upfront payments, purchase extras outside of their recurring payment, or follow-up on a failed payment.

Account top-up

Prompt your customers to instantly top-up their accounts with an instant bank transfer, and continue to use your services.

![]()

One-off payments for goods or services

Let your customers make upfront payments, purchase extras outside of their recurring payment, or follow-up on a failed payment.

![]()

Account top-up

Prompt your customers to instantly top-up their accounts with an instant bank transfer, and continue to use your services.

Cuckoo Broadband reduces costs

“We’re excited to continue using Instant Bank Pay for one-off payments. Not only will it prevent our customers from losing access to our services, it’ll also help reduce the time we spend chasing late payments and the risk of costs outstanding.” - Alexander Fitzgerald, Founder and CEO at, Cuckoo Broadband

Getting started with instant bank payments

For developers

Have a look through our API documentation here

Using GoCardless through a partner?

If you connect to GoCardless through a partner application, Instant Bank Pay is coming soon. Register your interest.

Do you have more questions?

We've put all the frequently asked questions about Instant Bank Pay on a dedicated FAQs page.

Are you a GoCardless partner?

Give your users Instant Bank Pay – a better way to collect instant bank transfers. Here's everything you need to know.