How to tackle 3 major payment conversion killers

Last editedMay 20223 min read

A bad payment experience can be the difference between winning or losing a customer. Don’t let your checkout process cause friction for your customers.

This article tackles three of the key challenges of customer acquisition and how to avoid some important factors that could be killing your conversion.

Strong Customer Authentication (SCA)

Strong Customer Authentication is a current regulatory requirement applicable to the UK, designed to make paying online more secure and, consequently, reduce payment fraud.

This means customers have to complete a form of two-factor authentication designed to prove they are who they say they are. There are specific rules around what constitutes ‘authentication’, you can find out more here.

This addition to the checkout process means another opportunity for customers to abandon checkout when paying with a method that requires two-factor authentication, like credit cards.

The checkout experience really does have an impact on conversion and customer acquisition. In fact, 17% of US shoppers in 2022 claimed to abandon checkout because the process was ‘too long or complicated'.

While certain types of transactions are eligible to be exempt from SCA, SCA has a real impact on conversion rates for businesses unable to balance the new security measures with a convenient and optimised checkout experience for customers.

At GoCardless, in November 2020 we surveyed 300 anonymous UK businesses about their experience with SCA, of which, 73% of respondents had implemented SCA. When asked whether they had seen a decrease in conversion as a result of the implementation of SCA, 53.3% said yes, of which:

31% said that decrease was between 1%-20%

33% said that decrease was between 20%-40%

But there is a solution.

By offering payment methods that are not subject to two-factor authentication, you can still provide a smooth, secure and frictionless payment experience to your customers.

Direct Debit, in particular, is out of the scope for SCA. Meaning it is not subject to the two-factor authentication measures that payments like cards are subject to. This includes any initial payment collected with a paperless direct debit mandate. By choosing to offer direct debit to your customers you take the pain out of making a payment for them.

Payment page optimisation

A complicated or long checkout process isn’t the only reason customers might abandon their purchase. Baymard 2022 research identified that 24% of US adults abandoned their shopping carts because the site wanted them to create an account and 18% don’t trust it with credit card info.

Creating a trusted and optimised checkout experience helps create a better customer experience and drive better conversion rates for businesses.

Fewer steps to checkout, the better

Including a lot of steps in the checkout process offers customers more opportunities to drop out of your checkout flow. When examining drop-in payment pages, which don’t require a redirect from a business’ website to GoCardless, have a ~33% higher conversion rate.

Hide unnecessary form fields

Lengthy and complicated checkouts are a major conversion killer. By reducing the input needed from customers, you increase the likelihood of them completing the payment process.

If you offer several different payment methods to your customers, the requirements from customers to use those methods also differ. For example, direct debits require customers to complete a mandate meanwhile, credit/debit card CPA (Continuous Payment Authority) requires various snippets of information taken from a physical card.

There is no benefit in showing all of these requirements to every customer, regardless of how they choose to pay, it would lengthen and complicate the checkout experience.

Present a clearer more straightforward experience by offering only the relevant fields dependent on which payment method your customer chooses.

Include site seals

A site seal (or trust logo) is an icon used to show you value data security and can indicate that your website is encrypted. These logos indicate that your checkout is trusted and can be displayed on your site if you’re authorised to have certain processes in place to handle sensitive customer data securely.

Some site seals include:

Branded payment authorisation - e.g. PayPal Verified

Security verification - e.g. SSL Secure Site Seal

Virus/malware protection badges - e.g. Norton Secured

Remove mandatory registration

Another conversion killer is the requirement to create an account.

As many as 24% of US adults said they abandoned the checkout process because a site wanted them to create an account.

Although you might want people to register in order to manage say an online subscription. Ask them to register once the initial subscription process is complete to reduce friction.

Offering payment methods that convert

Finally, as many as 9% of customers abandon the checkout process because there aren’t enough payment options. Customers want to pay in a way most preferred and convenient to them, but there are other benefits to offering multiple payment methods.

Joint research from Zuora Subscribed Insitute and GoCardless identified that businesses offering 5 or more payment methods benefitted from 5% less customer churn than those accepting 1-3 payment methods.

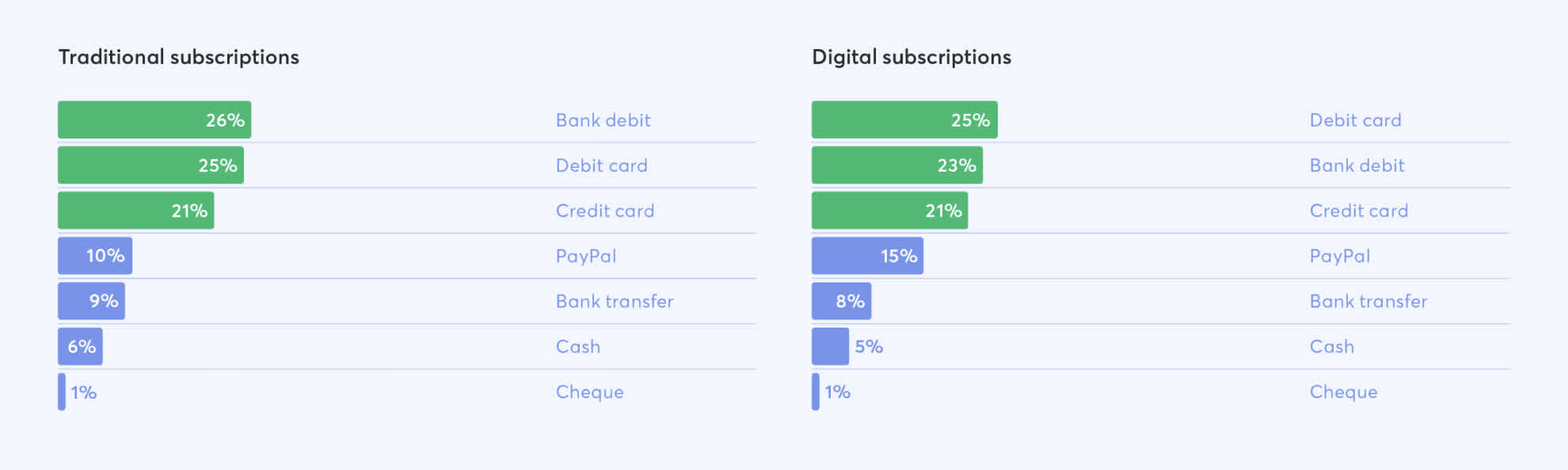

In fact, GoCardless research with YouGov identified, that overwhelmingly more consumers in the UK preferred to pay both traditional and digital subscriptions with direct debit than with other payment methods such as credit cards or bank transfers.

Data from the ‘Consumer payment preferences in 2021 report’

Ignoring your customers’ payment preferences can introduce friction into their buying journey and make your competitors a more welcoming alternative. Addressing their preferences, however, can increase conversion, improve customer loyalty, and reduce churn. Benefitting both you and your customers.