Failure rates, Cancellation rates and Indemnity Claims at GoCardless

Last editedJun 20242 min read

Here at GoCardless, we’re keen to make sure that any potential customers are equipped with all the necessary information required to make the right choice when it comes to choosing a Payment Service Provider. Apart from excellent customer support and a simple, easy-to-use product, we understand that the bottom line is what you really care about and that, sometimes, numbers speak louder than words.

With this in mind, we’ve scoured our database of more than 3 million payments to bring to you some cold, hard facts about Direct Debit. This should help you decide whether or not Direct Debit is right for you.

What failure rate can you expect from using Direct Debit through GoCardless?

We get asked this a lot. Direct Debit uses bank account details which don’t expire, and it is therefore well suited to recurring payments. Our overall failure rate at GoCardless is 2.2%.

Failure rates vary depending on whether you have successfully taken a payment from a particular customer in the past, by business type and your customer base. Recurring payments for webhosting companies and membership organisations fail just 1.5% of the time while over 64% of our merchants actually have a 100% success rate.

How does this compare to our competitors? To put it bluntly, we sit head and shoulders above the rest (see here for a direct comparison). The GoCardless system is fully automated and optimized for payment timings, leaving less room for manual error and ensuring that banks have sufficient time to process Direct Debit instructions. Moreover, failed payments can be re-tried at the click of a button via GoCardless, with a success rate of over 75%!

Bulk changes and cancellation rates

If you're already using another Payment Service Provider, you may be concerned that a switchover to GoCardless will prompt some of your existing customers to switch off. To help put your mind at ease we've pulled out the statistics on bulk changes:

We process a lot of bulk changes for customers wanting to switch from their current Direct Debit Provider. The bulk change process typically takes between 6-8 weeks from start to finish. Once you send us an initial list of your customers, we require that you notify everyone on the list of the imminent move to GoCardless (to help you with this we’ve put together some handy email templates). A week before the switch, we will remove any customers who have cancelled their Direct Debit and move the rest onto our system.

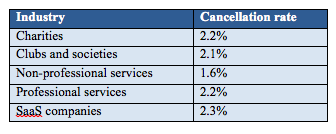

Based on our history of performing bulk changes, the average cancellation rate during switchover is 2.1%, with slight variations between industries. Importantly, this number does not distinguish between switchover-related churn and normal churn, and therefore overestimates the number of customers who are likely to switch off as a direct result of a change to your Payment Service Provider.

What percentage of payments are subject to indemnity claims and over what time scale?

The Direct Debit Guarantee protects customers against payments made in error or fraudulently. This entitles customers to full and immediate refund of any payment they claim has been taken in error.

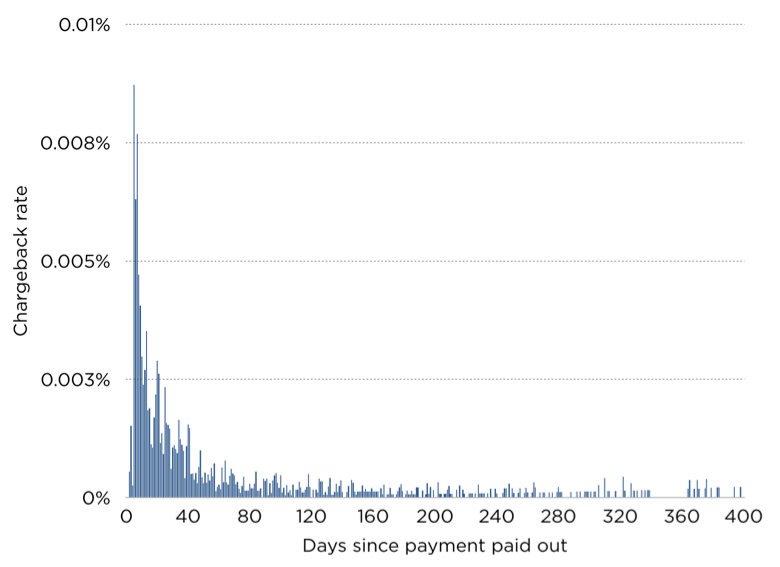

In practice, significantly less than 0.1% of GoCardless payments are charged back, of which 80% occur within 100 days of the original payment submission. Less than 0.005% of payments are charged back more than a year after payment submission and over 1/3 of indemnity claim requests occur before the money has been transferred to you by GoCardless. Moreover, GoCardless helps you manage indemnity claims by working with you and your customer to understand the reason, and retake the payment if appropriate.

If you would like more information on how to reduce your Direct Debit failure rates, please get in touch with our experts on 020 8338 9537. You can also send us a message through the following form: